Growing Automobile Sector to Bolster Lubricants Market Growth

According to our latest market study on "Lubricants Market Size and Forecast to 2031 – Global Analysis – by Base Oil, Type, and End-Use Industry," the market accounted for a revenue of US$ 175.73 billion in 2024 and is projected to reach US$ 236.71 billion by 2031; it is anticipated to record a CAGR of 4.6% from 2025 to 2031. The report includes growth prospects along with the lubricants market trends and their foreseeable impact during the forecast period.

Lubricants are highly used in various end-use industries such as automotive, marine, industrial, chemical, and oil & gas. End-use industries also drive innovation within the lubricants market. This collaborative effort for innovation by end-use industries helps support the product development strategies of lubricant manufacturers. In the automotive industry, lubricants are essential for maintaining engine efficiency and reducing friction, contributing to enhanced fuel economy and prolonged engine life. Similarly, manufacturing industries heavily depend on lubricants to optimize the performance of diverse machinery, from gears and bearings to hydraulic systems. The choice of lubricants is tailored to specific applications, with manufacturers seeking products that meet stringent performance requirements. Manufacturers are investing in research and development to meet evolving consumer needs as they demand lubricants that can withstand higher temperatures, offer better fuel efficiency, or align with environmental regulations. Thus, the growing manufacturing industry fuels the lubricants market growth.

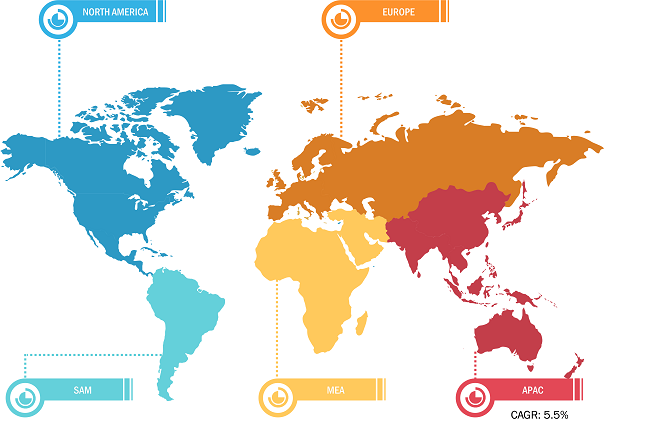

Global Lubricants Market Breakdown – by Region

Lubricants Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Base Oil (Mineral Oil, Synthetic Oil, and Bio-based Oil), Type (Hydraulic Fluid, Engine Oil, Driveline Lubricants, Metalworking Fluids, Grease, Process Oils, Coolants, and Others), End-Use Industry [Automotive (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others), Building and Construction, Power Generation, Mining and Metallurgy, Food Processing, Oil and Gas, Marine, Aviation, and Others], and Geography

Lubricants Market Growth Report by 2031

Download Free Sample

The rise of EVs has introduced a new dynamic to the lubricants market. Electric vehicles rely on lubricants in several components, such as transmissions, motors, and other drivetrain parts. These vehicles often require specialized lubricants to ensure efficient power transfer, cooling, and long-term durability of electric motor components. As EVs typically use different mechanical structures than ICE vehicles, the demand for high-performance lubricants has expanded to meet the unique needs of these systems. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 14 million electric cars were sold worldwide in 2023. Thus, the overall growth of the automobile industry accelerates the demand for lubricants, which contribute to better vehicle performance and longevity.

Asia Pacific dominated the global lubricants market share in 2024. India, China, and Australia are the leading countries in global mine production and reserves for garnets. Mining, quarrying, and perforating operations utilize lubricants to increase the lifespan and performance of the machinery. Asia Pacific has been the world's largest and fastest-growing producer of renewable energy for more than 10 years. The government of Japan has set the target of ~10 GW of offshore wind energy installation by 2030 and 30–45 GW by 2040. Thus, the high number of metal and nonmetal reserves, a rise in regional mining operations, and the growth of the wind energy market in the region propels the demand for lubricants.

According to the International Trade Administration, China is the world's largest construction market. Overall investment in new infrastructure during the 14th Five-Year Plan period (2021–2025) will reach approximately US$ 4.2 trillion (27 trillion yuan). According to a report released by the US Geological Survey in 2022, China held the leading position in mine production of critical minerals such as antimony, barite, germanium, graphite, magnesium, rare-earth elements, titanium, and tellurium. As per the British Geological Survey released in 2023, China accounted for over 50% of global aluminum mining in 2021. Further, the coal mining production in the country increased from ~4,130.54 million metric tons in 2020 to nearly 4,368.13 million metric tons in 2021. Construction and mining operations involve large-scale machinery such as drag-line excavators and bucket excavators, tracked bulldozers and front loaders, the diamond wire saw, and chain-cutting machines undergoing rigorous operating conditions. Lubricants are largely used in improving the shelf life of such machinery. Thus, the strong presence of the construction and mining industry in the country drives the demand for lubricants.

Global Lubricants Market: Trends

Unlike conventional lubricants derived from petroleum, bio-based lubricants are made from renewable, plant-based sources such as vegetable oils. This shift toward bio-based alternatives is fueled by their reduced environmental impact, as they are biodegradable, non-toxic, and emit fewer greenhouse gases during production and use. The preference for environmental compatibility, longer product life, and high performance has driven the shift from traditional mineral oil lubricants to synthetic and quasi-synthetic oils and biolubricants. Industries such as automotive, manufacturing, agriculture, and marine are at the forefront of adopting bio-based lubricants. In the automotive sector, these lubricants are gaining traction due to their potential to reduce engine wear and improve fuel efficiency while meeting eco-friendly standards. In agriculture and forestry, bio-based lubricants are preferred for equipment that operates in sensitive environments, where soil contamination from petroleum-based lubricants can be harmful. The marine industry is also witnessing a rise in the use of bio-based lubricants, particularly for vessels that operate in ecologically sensitive areas. These lubricants help minimize the risk of pollution. Additionally, bio-based lubricants help improve thermal stability and oxidative resistance, enhancing machinery longevity and performance. Governments and regulatory bodies are encouraging the shift to bio-based products through incentives, promoting sustainability in the industrial sector. As technological advancements continue to improve the performance of bio-based lubricants, their increasing adoption is expected to contribute to a more sustainable future for industries worldwide.

The key players in the lubricants market report include BP Plc, Chevron Corporation, Exxon Mobil Corporation, TotalEnergies, FUCHS, Shell plc, China National Petroleum Corporation, Petro‐Canada Lubricants Inc, Valvoline Inc, LUKOIL, Repsol, ENEOS Corporation, Gulf Oil International Ltd, CEPSA COMERCIAL PETRÓLEO, S.A.U, and Petrofer. The lubricants market forecast can help stakeholders plan their growth strategies and learn about innovative products that are made available at affordable prices to attract consumers.

The lubricants market analysis is based on base oil, type and end-use industry. Based on base oil, the lubricants market is segmented into mineral oil, synthetic oil, and bio-based oil. The mineral oil segment held the largest global lubricants market share in 2024. By type, the market is segmented into hydraulic fluid, engine oil, driveline lubricants, metalworking fluids, grease, process oils, coolants, and others. The engine oil segment dominated the lubricants market in 2024. By end-use industry, the market is segmented into automotive, building and construction, power generation, mining and metallurgy, food processing, oil and gas, marine, aviation, and others. The automotive segment is further segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, and others. The automotive segment held the largest share of the global lubricants market in 2024. The scope of the lubricants market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, the UK, Italy, Russia, Spain, Poland, Czech Republic, Turkey, and the Rest of Europe), Asia Pacific (Australia, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, Egypt, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com