Plastic Injection Molding Segment to Lead Medical Injection Molding Market Based on Type During 2024–2031

According to our new research study on “Medical Injection Molding Market Forecast to 2031 – Global Analysis – by Material, Type, End User, Product Type, And System,” the Medical Injection Molding market size was valued at US$ 7,525.22 million in 2024 and is projected to reach US$ 10,801.10 million by 2031; it is expected to register a CAGR of 5.3% from 2024 to 2031. Major factors driving the medical injection molding market growth include the increasing demand for medical devices and equipment, and advancements in molding technologies.

Medical injection molding is a manufacturing process used to produce precision plastic components for medical applications. It involves injecting molten plastic into a mold cavity under high pressure, where it cools down and solidifies into the desired shape.

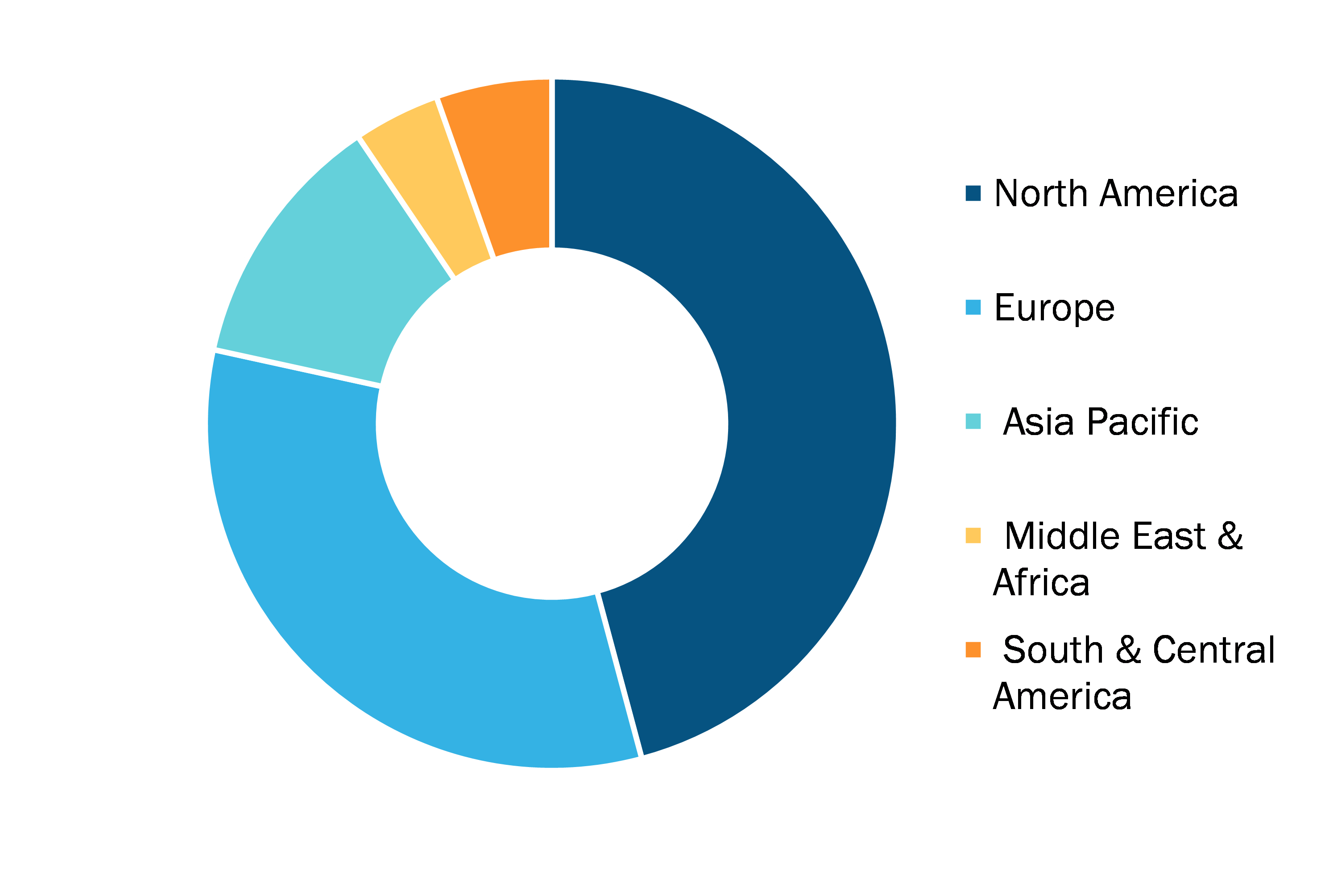

Medical Injection Molding Market, by Region, 2024(%)

Medical Injection Molding Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material [Polyvinyl Chloride (PVC), Poly(Methyl Methacrylate) (PMMA), Polyether Ether Ketone (PEEK), Metals, and Others], Type (Plastic Injection Molding, Overmolding, Liquid Silicone Molding, and Others), End User (Medical Device Companies, Pharmaceutical Drug Packaging Companies, Surgical Instruments Companies, and Others), Product Type (Medical Equipment Components, Consumables, Patient Aids, Orthopedic Instruments, Dental Products, and Others), System (Hot Runner and Cold Runner), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Medical Injection Molding Market Growth Report by 2031

Download Free Sample

Source: The Insight Partners Analysis

Medical Injection Molding Market Analysis Based on Segmental Evaluation:

Based on type, the medical injection molding market is categorized into plastic injection molding, overmolding, liquid silicone molding, and others. In 2024, the plastic injection molding segment held a significant medical injection molding market share. Plastic (regular) injection molding is mostly used due to its cost-effectiveness, versatility, and the high demand for disposable medical devices. Regular plastics such as polyethylene (PE), polypropylene (PP), and polystyrene (PS) are widely used in the production of essential medical components, including syringes, IV bags, catheters, and diagnostic tools. These materials are valued for their biocompatibility, ease of sterilization, and ability to be molded into complex shapes with high precision. Additionally, plastics such as PP are commonly used in medical containers, while PE is often selected for making flexible tubing and bottles for pharmaceutical applications. The increasing use of single-use medical devices, driven by both cost considerations and infection control measures, further strengthens the demand for regular plastic injection molding. The surging focus of healthcare providers on affordability, quality, and precision makes regular plastics a crucial material choice in the production of a wide range of medical products.

The scope of the medical injection molding market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the medical injection molding market share in 2024. The region's robust healthcare infrastructure and increasing demand for high-quality medical devices, such as syringes, catheters, and diagnostic tools, are several key factors driving the market's growth. Additionally, advancements in medical technologies and the rise in chronic diseases require precise, cost-effective manufacturing processes like injection molding. The growing adoption of minimally invasive surgeries and personalized medicine further fuels the need for innovative, high-performance medical products in the North American market.

In North America, the US contributes significantly to the medical injection molding market growth followed by Canada and Mexico. The Canadian medical injection molding market growth is largely attributed to the soaring prevalence of chronic diseases, which necessitate advanced medical interventions. As per the Canadian Institute for Health Information, heart disease and diabetes are the prominent causes of death and disability in the country. Statistics Canada data states over 14.6 million Canadians (45.1%) reported having one or more chronic diseases in 2021. Additionally, the aging population is contributing to an increased demand for medical devices in the country, as older adults often experience multiple health issues and urge medical attention. According to the Government of Canada’s data from April 2022, over 861,000 people were aged 85 or above as per the 2021 census. Injection molding is employed to produce a broad range of medical products that are meant to improve the quality of life in older adults. Through this process, manufacturers can create lightweight, biocompatible, and highly functional products that cater to the specific needs of the aging population, enhancing their health management and offering them independence. In addition, advancements in molding technologies have enabled the production of more complex and precise components, enhancing the functionality and safety of medical devices. For example, continuous developments in biocompatible medical-grade plastics have improved the performance of implantable devices, reducing the risk of infection and enhancing patient outcomes.

Mexico has experienced a significant rise in chronic disease cases, notably cardiovascular conditions, diabetes, and various cancer types. CVDs are a prominent cause of mortality in Mexico; according to the article titled “ACC’s Advancing CV Health in Mexico Roundtable Outcomes Report,” published in December 2022, the Mexican government confirmed that CVD was the cause of ~226,000 deaths in the country in 2021. The increasing prevalence of chronic diseases in Mexico has further bolstered the demand for medical devices. These health challenges have spurred the demand for medical devices and components, many of which are produced through injection molding. This manufacturing process is essential for creating precise and complex medical devices, including syringes, catheters, and implantable devices. The ability to produce sophisticated designs with high accuracy and efficiency makes injection molding a preferred method in the medical device industry.

The surging demand for single-use and disposable medical devices, particularly following the COVID-19 pandemic, further contributes to the medical injection molding market in Mexico. The pandemic emphasized the importance of infection control, leading to elevated production of IV connectors, testing kits, and personal protective equipment (PPE), among others, which rely on precision molding processes. Additionally, robust manufacturing infrastructure and skilled workforce availability provide a boost to the medical injection molding market in Mexico.

Aberdeen Technologies, Inc; Husky Technologies; The Rodon Group; UPG International; Proto Labs; C&J Industries; Ensinger; Sanner GmbH; Feronyl; Biomerics LLC; HTI Plastics; Tessy Plastics; and Kaysun Corporation are among the leading companies profiled in the medical injection molding market report.

Based on material, the medical injection molding market is segmented into polyvinyl chloride (PVC), poly(methyl methacrylate) (PMMA), polyether ether ketone (PEEK), metals, and others. By type, the market is segmented into plastic injection molding, overmolding, liquid silicone molding, and others. In terms of end user, the medical injection molding market is segmented into medical device companies, pharmaceutical drug packaging, surgical instruments companies, and others. Based on product type, the market is segmented into medical equipment components, consumables, patient aids, orthopedic instruments, dental products, and others. In terms of system, the medical injection molding market is bifurcated into hot runner and cold runner. On the basis of geography, the market is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com