Polyvinyl Chloride (PVC) Segment to Bolster Medical tubing Market Growth During 2023–2031

According to our new research study on "Medical Tubing Market Forecast to 2031 – Global Analysis – by Type, Structure, Application, and End User," the market is expected to grow from US$ 23.55 billion by 2031 from US$ 13.27 billion in 2023; it is estimated to grow at a CAGR of 7.4% during 2023–2031. The medical tubing market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

Increase in medical applications of tubing, and expanding applications in biopharmaceutical processing are contributing to the medical tubing market growth. However, recalls due to product failure hamper the market growth. Nevertheless, tubing with smart technology integration are expected to bring new medical tubing market trends in the coming years.

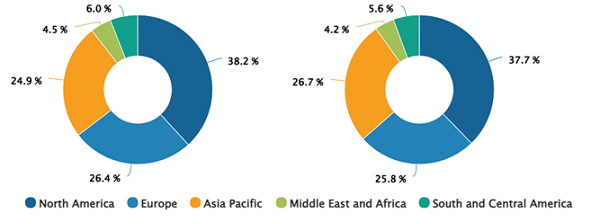

Medical tubing Market Share, by Region, 2023 (%)

Medical Tubing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Polyvinyl Chloride (PVC), Polyimide or Nylons, PTFE or Thermoplastic Elastomers (TPES), Thermoplastic Polyurethanes (TPUS), Polyvinylidene Fluoride (PVDF), Polypropylene and Polyethylene, Silicone, and Others], Structure (Single-Lumen, Multi-Lumen, Multi-Layer Extruded Tubing, Tapered or Bump Tubing, Braided Tubing, Balloon Tubing, Corrugated Tubing, Heat Shrink Tubing, and Others), Application (Bulk Disposable Tubing, Catheters and Cannula, Drug Delivery Systems, and Others), End Users (Hospital and Clinics, Ambulatory Care Centers, Medical Labs, and Others), and Geography

Medical Tubing Market Drivers and Trends by 2031

Download Free Sample

Source: The Insight Partners Analysis

Expanding Applications in Biopharmaceutical Processing Bolsters Medical Tubing Market

The utilization of medical tubing is on the rise in the pharmaceutical and biopharmaceutical industries. Bioprocessing involves utilizing living cells or their components to produce desired products. This process requires specialized tubing solutions to ensure efficiency, safety, and adherence to strict regulatory standards. The purity of materials used is crucial in bioprocessing applications. Medical-grade tubing made from biocompatible materials such as silicone and thermoplastic elastomers (TPE) is essential to prevent the leaching of harmful substances into biopharmaceutical products. The increasing regulatory emphasis on product safety and efficacy drives the demand for medical tubing solutions that guarantee high levels of purity and biocompatibility during bioprocessing.

Various market players are launching medical-grade tubing with applications in biopharmaceutical fluid processing. In October 2023, RAUMEDIC expanded its range of biopharmaceutical fluid processing products by introducing a new brand of biocompatible tubing. Its portfolio includes a diverse selection of biocompatible fluid processing tubing systems—SILMOTION (silicone tubing), BRAIDMOTION (braided silicone tubing), THERMMOTION (thermoplastic elastomer tubing), PVC tubing, and FEP tubing.

Such developments by the market players coupled with the growing demand of medical tubing in the bioprocessing industries is expanding the medical tubing market size during 2023–2031.

The medical tubing market analysis has been carried out by considering the following segments: type, structure, application, end user, and geography. The medical tubing market, based on type, is segmented into polyvinyl chloride (PVC), polyimide/nylons, polytetrafluoroethylene (PTFE)/thermoplastic elastomers (TPES), thermoplastic polyurethanes (TPUS), polyvinylidene fluoride (PVDF), polypropylene and polyethylene, silicon, and others. The Polyvinyl Chloride (PVC) segment held the largest share of the medical tubing market in 2023, and it is expected to register the highest CAGR during 2023–2031. Medical and surgical tubes made from PVC are more widely used due to their strength, stability, flexibility, and safety. PVC is naturally free of latex protein allergens. The material also exhibits very high recyclability as it can be reused numerous times without showing any tendency of degradation. PVC tubes are also commonly used in IV lines and drainage systems, which is a cornerstone of patient care in medical facilities.

The market, based on structure, is segmented into single-lumen tubing, multi-lumen tubing, multilayer extruded tubing, tapered or bump tubing, braided tubing, balloon tubing, corrugated tubing, heat shrink tubing, and others. The single-lumen segment held the largest medical tubing market share in 2023. Single-lumen catheters are employed in clinical procedures such as intravenous therapy, blood transfusions, and diagnostic tests. These tubing types are usually designed with biocompatible materials such as silicon or polyurethane to aid in their safe insertion inside the human body. Moreover, single-lumen medical tubes are widely employed in inducing general anesthesia by administering anesthetic gases. In addition, these tubes can be designed to meet the specific needs of patients in various sizes and lengths.

Based on application, the market is segmented into bulk disposable tubing, catheter and cannula, drug delivery systems, and others. The bulk disposable tubing segment held the largest share of the medical tubing market in 2023. Bulk disposable medical tubing enables the safe transfer of fluids and gases in the place of applications such as IV lines and ventilators. The materials used for its production may include PVC and silicon. This type of tubing is also made for single-use applications to avoid cross-contamination among patients. Healthcare institutions can maintain adequate stock levels to support emergencies and routine procedures with the assistance of bulk supply. Bulk disposable tubing is of great importance in contemporary medical practices as it supports patient care and complements surgical outcomes within healthcare facilities.

In terms of end user, the medical tubing market is segmented into hospitals, clinics, ambulatory care centers, medical device companies, laboratories, etc. The hospital and clinics segment held the largest share in the medical tubing market in 2023.

The geographic scope of the medical tubing market report includes the assessment of the market performance in the North America, Europe, Asia Pacific, Middle East and Africa, South and Central America. North America accounted for the largest medical tubing market size in 2023. The presence of key market players, early adoption of technologically advanced products, and well-established healthcare infrastructure are the key factors anticipated to drive the market growth. The early adoption of emerging medical technologies, coupled with the rising prevalence of chronic diseases, is likely to increase the demand for medical tubing solutions in the future. As healthcare service providers continue to focus on efficiency and patient safety, investing in this area is expected to reap good returns and form an attractive area of investment for growth-driven investors across the US. The medical tubing market is likely to grow in the coming years with other advancements in medical technology and patient care. This scenario reemphasizes the need for even more research and development to cater to the changing needs of the healthcare sector in Canada.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com