Mobile Wallet and Payment Market Forecast to 2031: Key Insights

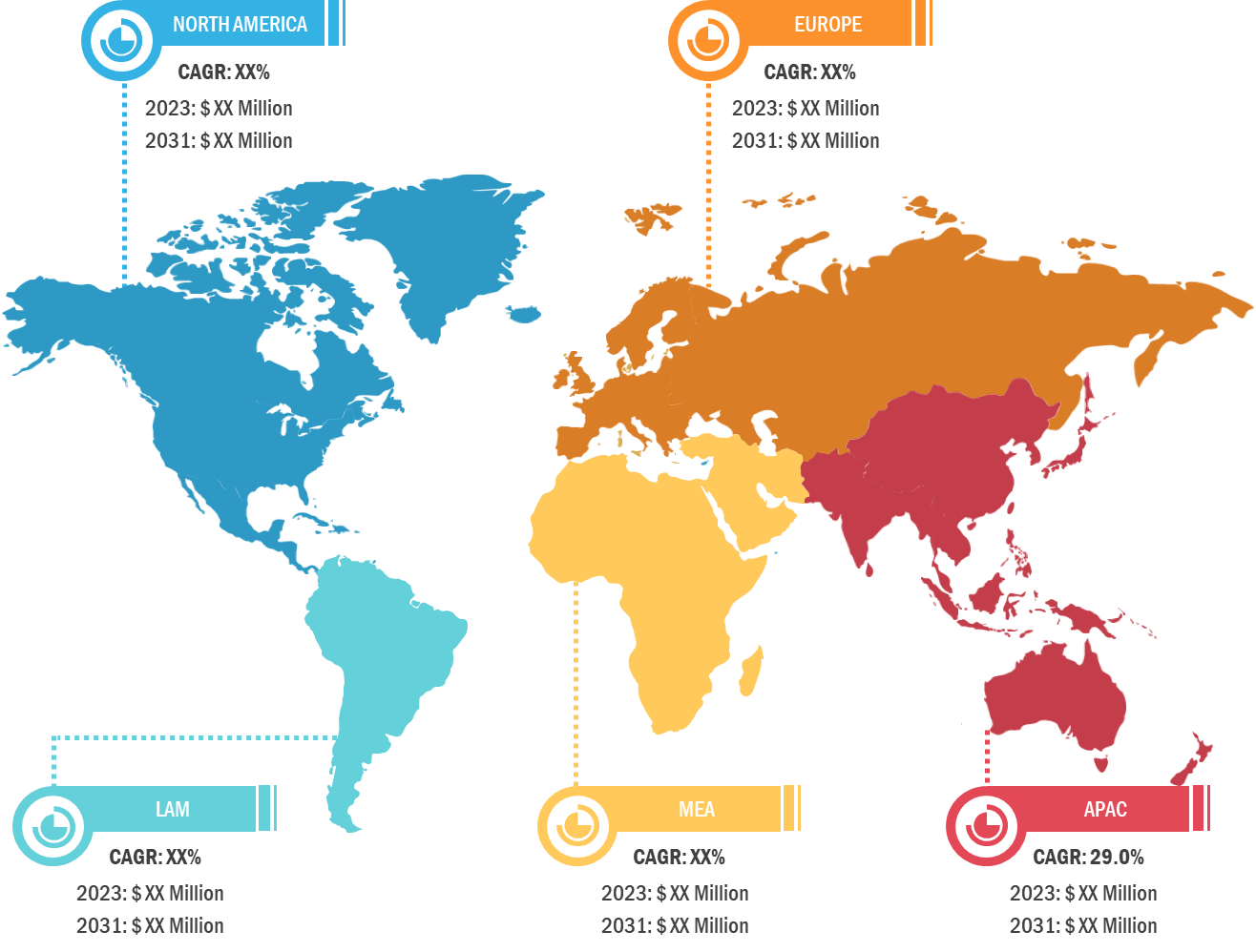

According to our latest study on "Mobile Wallet and Payment Market – Global and Regional Share, Trend, and Growth Opportunity Analysis – by Type, Technology, End User, and Geography," the market size was valued at US$ 10.28 billion in 2023 and is expected to reach US$ 71.28 billion by 2031. The market is estimated to record a CAGR of 27.4% from 2023 to 2031. The emergence of real-time payments in developing nations is one of the major mobile wallet and payment market trends.

The mobile wallet and payment industry in North America is expanding due to the benefits it offers customers, financial institutions, organizations, and government bodies. Increasing online shopping is propelling mobile payments as the most preferred payment option. Further, the carrier billing ecosystem is undergoing a complete revolution in response to the changes in the economy, social conditions, regulatory environment, and technological developments in the region. Owing to the growing popularity of mobile payment applications, software businesses, payment technology brands, banks, merchants, and others are seeking ways to capitalize their gains by getting into this growing industry. The growth of e-commerce business is primarily responsible for the widespread use of mobile payment systems in North America. Near-field communication (NFC) is a mobile payment method that allows users to construct digital wallets. Moreover, mobile payment is a preferred option over other payment solutions due to the key players of the IT industry, such as Apple and Google, launching excellent mobile payment platforms.

Mobile Wallet and Payment Market

Mobile Wallet and Payment Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Proximity and Remote), Technology (NFC, QR-Based, Text-Based, and Digital-Only), End User (Personal and Business), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Mobile Wallet and Payment Market Overview and Forecast - 2031

Download Free Sample

Digital wallets are a quick and easy payment solution that is highly preferred in America. For instance, in August 2023, according to Forbes data, more than half (53%) of individuals preferred to pay with digital wallets over traditional ways. 47% of Americans spend more money using digital wallets than traditional payment methods. PayPal was the most popular option, with 69% of the total population using it. According to the findings, the other popular mobile wallet payment options are Google Pay (56%), Apple Pay (53%), and Samsung Pay (52%). Peer-to-peer apps are also popular, with 52% of respondents using Cash App and 49% using Venmo to make digital payments. Users generally access digital wallets using smartphones (68%) and smartwatches (41%). The study results are consistent with broader economic trends toward more digitalization. The majority of respondents (64%) stated that digital wallets are used as frequently as traditional payment methods, thereby demonstrating the immense popularity of these contactless payment methods among customers.

Expansion of E-Commerce Industry to Drive Mobile Wallet and Payment Market Growth

The rise in the e-commerce business and consumers' preference for online shopping has increased the adoption of mobile wallets and payment solutions for making quick payments. In May 2024, the Census Bureau of the Department of Commerce revealed that the estimate of the US retail e-commerce sales for the first quarter of 2024 was US$ 289.2 billion due to seasonal variation adjustments and not price change. This represents a 2.1% (±0.7%) rise from the fourth quarter of 2023. Retail sales in the first quarter of 2024 stood at US$ 1,820.0 billion, with a fall of 0.1 % (±0.4%) from the fourth quarter of 2023. In the first quarter of 2024, e-commerce expanded by 8.6% (±1.1%) compared with the first quarter of 2023. Total retail sales were increased by 1.5% (±0.5%). In the first quarter of 2024, e-commerce sales made 15.9% of the total sales.

Mobile Wallet and Payment Market: Segmental Overview

Based on type, the market is categorized into remote and proximity. The proximity segment held a larger mobile wallet and payment market share in 2023. By technology, the market is divided into NFC, QR code, text-based, and others. The QR code segment dominated the market in 2023. In terms of end user, the market is segmented into personal and business. The personal segment held a larger mobile wallet and payment market share in 2023. Mobile wallets are used for transferring money online to other individuals by using their personal bank, credit union accounts, or mobile applications. Mobile wallets and payment solutions have become popular as a "contactless" payment mechanism. Mobile wallets and payment solutions can also help users avoid in-person risks linked with carrying cash and credit cards, and these options also safeguard them from the ever-increasing risk of card skimming. People of all ages own mobile phones and use them whenever feasible. As a result, application or software development companies are developing mobile wallet and payment solutions as well as mobile apps with bank account integration to streamline and simplify monetary transactions. The most popular mobile wallet and payment solutions used for personal purposes include PayPal, Apple Pay, Cash App, Google Pay, and Square Cash. According to Wallet Factory LLC, all payments made with PayPal or Square Cash are almost instant and take no longer than 5 minutes.

Mobile Wallet and Payment Market Analysis: Competitive Landscape and Key Developments

The mobile wallet and payment market report emphasizes key factors driving the market and prominent players' strategic developments. Paytm E-Commerce Pvt Ltd, Telefonaktiebolaget LM Ericsson, Early Warning Services, LLC, PayU, One MobiKwik Systems Limited, Apple Inc, Alphabet Inc, AT&T Inc, Paypal Holdings Inc, Samsung Electronics Co Ltd, Mastercard Inc, Fitbit LLC, American Express, Visa Inc, FIS Global, Alipay, Bharti Airtel, SoftwareGroup, PhonePe, and ACI Worldwide Inc are among the prominent players profiled in the mobile wallet and payment market report. The market players focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

- In June 2023, PayPal Holdings Inc and KKR signed an exclusive multi-year agreement for a US$ 3.15 billion replenishing loan commitment under which private credit funds and accounts managed by KKR will purchase up to US$ 42.06 billion of buy now, pay later (BNPL) loan receivables originated by PayPal in France, Germany, Italy, Spain, and the UK.

- In December 2023, Samsung Electronics Co Ltd announced the launch of Mastercard programme: Wallet Express. The service provides banks and card issuers with a swift and cost-effective means of expanding their digital wallet offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com