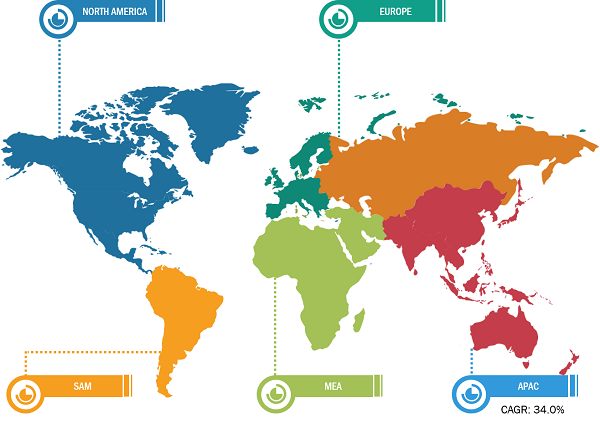

Asia Pacific Dominated Nonwovens for Energy Applications Market in 2023

According to our latest market study on "Nonwovens for Energy Applications Market Forecast to 2031 – Global Analysis – by Type and Application," the market was valued at US$ 10.92 million in 2023 and is projected to reach US$ 104.73 million by 2031; it is anticipated to record a CAGR of 32.7% from 2023 to 2031. The report highlights key factors driving the nonwovens for energy applications market growth and prominent players along with their developments in the market.

In 2023, Asia Pacific accounted for the largest nonwovens for energy applications market share. The pharmaceutical industry generates a huge demand for nonwovens for energy applications in this region. As battery technology continues to improve, Asia Pacific is expected to become a key hub for new energy vehicle production. China has emerged as one of the largest electric vehicle markets worldwide, supported by government policies promoting electric vehicles. According to the China Association of Automobile Manufacturers, ~6,000 fuel-cell electric vehicles were sold in China in 2023, a year-on-year rise of 72%. Several economies in Asia Pacific plan to expand the new energy vehicle industry in accordance with the government to support fuel cell electric vehicle growth in the region over the coming years. According to the hydrogen development plan released in 2022, China has set a goal to put 50,000 fuel cell vehicles on its roads by the end of 2025. Asia Pacific has been the world's largest and fastest-growing producer of renewable energy for more than ten years. The government of Japan has set the target of 10 GW of offshore wind energy installation by 2030 and 30–45 GW by 2040. Nonwovens play a major role in battery and fuel cell applications, as these materials offer superior insulation and separation properties, thereby enhancing battery performance. China, Japan, and South Korea emerged as a hub for electric vehicle production, thereby fueling the demand for high-quality nonwovens. Thus, the development in the battery, wind energy, and new energy vehicles industries is expected to boost the nonwovens for energy applications market in Asia Pacific over the coming years.

Nonwovens for Energy Applications Market Breakdown – by Region

Nonwovens for Energy Applications Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Carbon Fiber, Titanium Fiber, and Others), Application [Battery, Fuel Cell Gas Diffusion Layer (GDL), PTL, and Wind Energy], and Geography

Nonwovens for Energy Applications Market Growth by 2031

Download Free Sample

China accounts for the largest nonwovens for energy applications market share in Asia Pacific. China is one of the global leaders in the adoption and development of new energy vehicles, including fuel cell vehicles. The Government of China invests in hydrogen fuel cell technology as a part of its strategy to reduce pollution and dependence on nonrenewable resources. Manufacturers in China offer nonwoven portfolios for domestic applications and are also major exporters of these materials. According to the China Hydrogen Alliance, the country's hydrogen output will reach US$ 139 billion by 2025. As per the hydrogen development plan published in 2022, China has set a goal to sell 50,000 fuel cell vehicles by 2025. Thus, China's strong manufacturing base for the automotive industry and developed wind energy industry have positioned the country as a strong market for nonwovens for energy applications. Thus, the hydrogen fuel cell technology is a key enabler of the nonwovens for energy applications market growth in China.

The energy sector in India is undergoing a major transition with a strong emphasis on renewable energy and clean energy technologies, coupled with government support and incentives. The Government of India has launched several initiatives to promote hydrogen fuel cell technology, including the National Hydrogen Mission. In January 2024, the Indian Space Research Organisation (ISRO) generated power from a hydrogen fuel cell in space as part of a test that might help transform manned space missions. In February 2024, the Chidambaranar Port was inaugurated as the first Green Hydrogen Hub Port in the country, including several projects such as a desalination plant, hydrogen production, and bunkering facility.

According to the India Brand Equity Foundation, India has established a strong global position in the heavy vehicles market. In FY23, the total automobile exports from India increased to 4.7 million units. According to a report published by the National Investment Promotion & Facilitation Agency in 2023, the automotive market in India is likely to rank third among the world's largest country markets in terms of volume by 2030. The report also revealed that the automotive industry in the country manufactured 22.9 million vehicles during 2021–2022. Nonwovens are a major component of proton exchange membrane fuel cells and other components used in energy storage and conversion systems. Thus, the proliferating energy industry contributes to the growing nonwovens for energy applications market size in India.

Nonwovens for Energy Applications Market: Trends

The research and development in high-performance nonwovens are crucial in advancing the capabilities of these materials, leading to innovations that cater to demanding applications across various industries. High-performance nonwovens are characterized by their enhanced mechanical properties, durability, and functionality, making them an integral component in several sectors, such as aerospace, clean energy, and automotive. The development of advanced materials such as nanofiber nonwovens has gained traction due to their exceptional strength, flexibility, and large surface area. Electrospinning and other advanced manufacturing techniques are used to produce nanofibers for several energy storage applications. Companies such as Tapyrus, Mitsui Chemicals, Asahi Kasei, and Kuraray produce meltblown nanofiber nonwoven fabrics in Japan. In April 2024, the team of engineers from the Virtua Health College of Medicine & Life Sciences and the Henry M. Rowan College of Engineering received a US$ 511,931 Partnerships for Innovation grant from the US National Science Foundation to improve the efficiency of the manufacturing technology as well as determine the optimal path to commercialize the technology. The team has developed novel technology for fabricating aligned nanofibers in continuous rolls of material. Therefore, the research and development on high-performance nonwovens are expected to bring significant new nonwovens for energy applications market trends in the coming years.

Technical Fibers Products, Tex Tech Industries Inc, Freudenberg Group, SGL Carbon SE, Lydall Inc, AstenJohnson Inc, Hoftex Group AG, DeatexGroup S.r.l., Sandler AG, and Glatfelter Corporation Sontara. are among the key players profiled in the nonwovens for energy applications market report.

Nonwovens for Energy Applications Market Segmentation:

The nonwovens for energy applications market analysis is based on type, application, and geography. By type, the market is segmented into carbon fiber, titanium fiber, and others. In terms of application, the market is categorized into battery, fuel cell gas diffusion layer (GDL), PTL, and wind energy. The geographic scope of the nonwovens for energy applications market report encompasses North America (US, Canada, and Mexico), Europe (Germany, France, UK, Italy, Russia, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com