US to Dominate North America Flatbread Market During 2023–2031

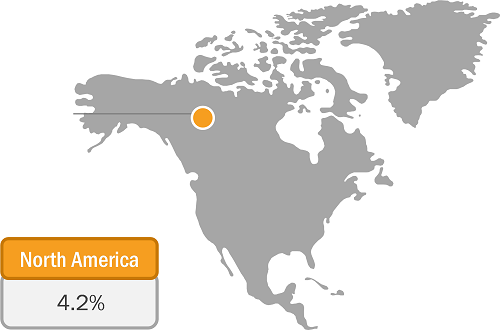

According to our new research study on “North America Flatbread Market Forecast to 2031 – by Type and Distribution Channel,” the market was valued at US$ 7.50 billion in 2023 and is projected to reach US$ 10.41 billion by 2031; it is expected to register a CAGR of 4.2% during 2023–2031. The report highlights key factors propelling the market growth and prominent players along with their developments in the market. Apart from growth drivers, the report covers the North America flatbread market trends and their foreseeable impact during the forecast period.

The scope of the North America flatbread market report focuses on the US, Canada, and Mexico. The US dominated the market in 2023. The demand for flatbreads in the US is attributed to changing consumer preference toward healthier alternatives and more versatile food options. With a growing emphasis on health and wellness, many consumers are shifting away from traditional bread in favor of lighter and more nutritious alternatives. Flatbreads, especially those made with whole grain, gluten-free options, or reduced carbohydrates, align with these dietary trends. Furthermore, flatbreads are highly adaptable and can be incorporated into various meal types, from wraps to pizzas and appetizers, making them appealing to consumers seeking convenient, easy-to-prepare meals that fit into a balanced diet. In addition, the rising popularity of ethnic and international cuisines has contributed to the growing demand for flatbreads. As more Americans explore diverse culinary experiences, there is a heightened interest in foods such as pita, naan, tortilla, and lavash, which are integral to Mediterranean, Middle Eastern, and Latin American dishes.

North America Flatbread Market Growth

North America Flatbread Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Tortilla, Pita, Naan, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Bakeries, Online Retail, and Others), and Country

North America Flatbread Market Drivers and Trends by 2031

Download Free Sample

Mexico accounted for a significant market share in 2023. The demand for flatbreads in Mexico is increasing due to a growing interest in healthier, artisanal, and premium bread options, particularly among middle and upper-class consumers. While tortillas have long been a staple in Mexican cuisine, there is rising interest in other flatbreads, such as pita, naan, and whole-grain wraps, as consumers explore new flavors and international cuisines. With the growth of health consciousness, many Mexicans are seeking flatbreads made with whole grains, organic ingredients, or gluten-free options, aligning with the global trends toward better nutrition. The expansion of urbanization and access to more diverse food products in major cities such as Mexico City and Monterrey also contribute to the elevated demand for flatbreads.

The increasing demand for flatbreads in North America from consumers has resulted in key players adopting strategic initiatives to strengthen their market position across the region. Flatbread manufacturers in the region are involved in mergers and acquisitions, collaborations, product launches, and other strategic developments to attract consumers and enhance their market position. For instance, in March 2023, Rise & Puff announced the launch of a new line of real tortillas that puffs. The launch was aimed to cater to the growing consumer demand for better-for-you tortilla products. Also, a few of the key players in the market engage in product launches and developments to cater to the growing consumer demand for healthy alternatives in flatbreads. For instance, in October 2023, Joseph's Bakery announced the launch of Heart Friendly pita bread, certified by the American Heart Association's Heart-Check Food Certification Program. The launch was aimed to cater to the growing demand for healthy and nutritional flatbreads. Such strategic initiatives adopted by key players have contributed to the North America flatbread market size.

North America Flatbread Market: Trends

The rising preference for gluten-free products is significantly contributing to the growth of the flatbreads market in North America. As more consumers adopt gluten-free diets due to an increase in gluten intolerance and celiac disease diagnoses, as well as lifestyle choices, there is a general trend toward gluten-free for perceived health benefits. According to the Beyond Celiac Organization, an estimated 1 in 133 Americans, or about 1% of the population in the US, has celiac disease. Manufacturers are expanding their gluten-free flatbread offerings to cater to this growing consumer demand. Gluten-free options such as tortilla wraps, naan, and other flatbreads made from alternative flours (e.g., almond, rice, or chickpea) are becoming more widely available in supermarkets, specialty stores, and online platforms, allowing consumers with dietary restrictions to consume flatbreads without compromising their health needs.

Moreover, the demand for gluten-free flatbreads is not limited to those with celiac disease but extends to health-conscious consumers who perceive gluten-free products as a healthier alternative. The gluten-free trend has encouraged innovation within the North America flatbread market growth, with manufacturers focusing on developing high-quality, tasty, and nutritious alternatives. Thus, the rising preference for gluten-free products is emerging as a trend in the North America flatbreads market.

North America Flatbread Market: Segmental Overview

The North America flatbread market analysis has been performed by considering the following segments: type and distribution channel. By type, the market is segmented into tortilla, pita, naan, and others. The tortilla segment accounted for the largest North America flatbread market share in 2023. Tortilla is a soft, round, thin, and unleavened flatbread. It is typically made from wheat and corn flours. Tortillas are baked on griddles called comal. The commercially available tortillas come in 6-, 8-, 10-, and 12-inch sizes. Tortillas can be eaten plain or used as food wraps. They are commonly used in Spanish and Mexican dishes such as fajitas, enchiladas, tacos, tostadas, burritos, and Tex-Mex cuisines. Tortillas complement most Mexican dishes. They are used in scooping sauced or stewed dishes. The round tortillas are also folded around fillings such as beans, piquant sauces, meat, fishes, cheese, onion rings, and tomato slices. Tortillas are considered a healthy flatbread option. They have replaced white sandwich breads in many parts of the world as they are considered more wholesome. The versatile application of tortillas as wraps is driving significant attention among consumers in US and Canada. This is anticipated to augment the sales of tortillas across North America.

In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest North America flatbread market share in 2023. Supermarkets & hypermarkets are large retail establishments that offer a wide range of products, including groceries, food and beverages, and other household goods. Also, products from different brands are available at reasonable prices in these stores, allowing consumers to quickly shop and find the right product. Manufacturers of flatbreads usually prefer to sell their products through supermarkets & hypermarkets owing to their heavy customer base. In addition, these stores offer attractive discounts, multiple payment options, and a pleasant customer experience.

Many supermarkets and hypermarkets have modern storage facilities to ensure ideal storage conditions for perishable items. Thus, flatbread manufacturers prefer selling their products through supermarkets & hypermarkets. Increasing urbanization, competitive pricing, and a rising working-class population boost the popularity of supermarkets & hypermarkets.

Kontos Foods, GRUMA SAB de CV, FGF Brands Inc, Joseph's Bakery, Olé Mexican Foods Inc., General Mills Inc, Goya Foods Inc, Mi Rancho, Leighton Foods AS, and Toufayan Bakeries are among the leading companies profiled in the North America flatbread market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com