Rising Demand for Packaged and Convenience Food Bolster Packaged Brownies Market Growth

According to our latest study on "Packaged Brownies Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – by Flavor, Category, and Distribution Channel," the market size is expected to grow from US$ 3.91 billion in 2024 to US$ 5.96 billion by 2031; it is estimated to register a CAGR of 6.2% during 2024–2031. The packaged brownies market report highlights key factors driving the packaged brownies market growth and prominent players along with their developments in the market.

Hectic work schedules are changing the lifestyle and eating habits of consumers, thereby increasing their dependency on convenience and packaged food products. Convenience foods, such as packaged brownies, allow consumers to save time and effort associated with ingredient shopping and baking preparations, as well as provide the convenience of storage. The food industry is witnessing a surge in the consumption of high-quality convenience food. According to a recent report by the Food Institute, convenience remains a key driver of prepared food sales, with 72% of consumers citing it as a major factor in their purchasing decisions. This shift toward convenient and packaged food options can be attributed to the busy lifestyles of consumers, who prioritize ease and speed in their daily lives. Growth in sales of prepared foods, such as ready-to-eat and ready-to-heat meals, is due to the expansion of meal kit delivery services, grocery store prepared food sections, and online ordering platforms. The rise of single-person households and the elderly population has also fueled this demand. Consumers are willing to pay a premium for convenience, with 40% of respondents willing to pay more for quick-prepared meals. Prominent market players provide a range of packaged brownie products featuring classic fudge brownies, nut-infused varieties, and decadent dessert bars. These brownies benefit from an extended shelf-life due to the efficient packaging and preservation methods used. According to the 2023 Food and Health Survey conducted by the International Food Information Council in 2023, out of 1,022 people in America (aged between 18 and 80 years), 61% of participants chose convenience as a major factor impacting food buying decisions in 2023, which was 56% in 2022. Preprocessed food allows consumers to save time and effort associated with food preparation and reduces baking time. Thus, the rising demand for packaged and convenience food drives the global packaged brownies market.

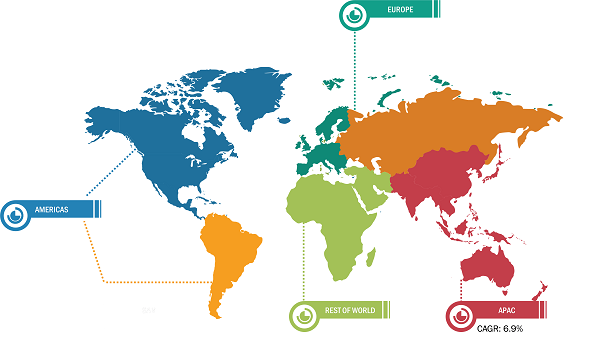

Packaged Brownies Market Breakdown – by Region

Packaged Brownies Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Flavor (Chocolate, Chocolate Chip, Hazelnut, Salted Caramel, Raspberry, and Others), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others), and Geography

Packaged Brownies Market | 2031 Insights | Updates

Download Free Sample

The packaged brownies market trends include the rising preference for gluten-free products. The incidence of celiac disease (gluten sensitivity) is rising globally. According to the Celiac Disease Foundation, as of 2022, 3 million population in America were affected by celiac disease, and ~60–70% of people in America remain undiagnosed. It is recommended to consume a 100% gluten-free diet for celiac disease patients. As per the study published in the National Library of Medicine in 2022, celiac disease is common in Saudi Arabia, with prevalences in normal populations of biopsy-proven celiac disease of 10.6% and seroprevalence of 15.6%. The rising number of people diagnosed with celiac disease and growing awareness for gluten-free diets are positively impacting innovations pertaining to gluten products. Manufacturers are focusing on developing innovative products to cater to the consumer demand for healthy and gluten-free packaged brownies. In February 2024, Rule Breaker Snacks introduced a line of vegan, gluten-free, and allergen-free BFY brownies and blondies designed to provide a healthier option. Consumers are increasingly seeking healthy, nutritious food products, which has surged the demand for healthy alternatives such as gluten-free, high-fiber, high-protein, or low-calorie packaged brownies over conventional packaged brownies. Gluten-free products are convenient and accessible and contain healthy ingredients. Therefore, the rising consumer preference for gluten-free products is expected to bring new trends in the global packaged brownies market in the coming years.

The packaged brownies market analysis has been performed by considering the following segments: flavor, category, and distribution channel. Based on flavor, the market is segmented into chocolate, chocolate chip, hazelnut, salted caramel, raspberry, and others. The chocolate segment is anticipated to hold a significant packaged brownies market share. Based on category, the market is bifurcated into gluten-free and conventional. The gluten-free segment is expected to register a significant CAGR during 2024–2031. Based on distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others.

In terms of revenue, Asia Pacific dominated the packaged brownies market share in 2024. The consumption of ready-to-eat and convenient food is rising due to hectic consumer work schedules and sedentary lifestyles. According to a survey released by the Japan Packaged Food Association, ~88% of women and 80% of men use packaged foods in Japan. Packaged foods have become a staple food item for many households in the country. Furthermore, the country's growing middle-class population, high per capita income, and rising number of working women boost the demand for convenience food products, including packaged brownies, driving the market growth.

The demand for packaged brownies is influenced by their increased availability across various retail channels, including traditional grocery stores, hypermarkets, convenience stores, and online retailing. Consumers seek convenience, and manufacturers continually innovate by introducing new product variants, flavor profiles, healthier alternatives, and gluten-free and plant-based options to cater to different culinary needs and preferences, attracting consumers seeking quick desserts or snacks. For instance, in March 2023, Green's introduced Vegemite Choc Chunk Brownies, a chocolate-flavored, mitey, gooey, chunky, and gooey brownie infused with the iconic Australian taste of VEGEMITE.

The packaged brownies market forecast can help stakeholders plan their growth strategies. General Mills Inc, McKee Foods Corp, Grupo Bimbo SAB de CV, Britannia Industries Ltd, Elite Foods Pvt Ltd, Rich Products Corp, Flax4Life, Dolci di Maria, Sweet Street Desserts Inc, St Michel Biscuits SAS, Mars Inc, nutrezybars, Dr. August Oetker Nahrungsmittel KG, Marks and Spencer Group Plc, and Pulsin Ltd are among the prominent players profiled in the packaged brownies market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive. For instance, in May 2023, McKee Foods announced the launch of a new Little Debbie snack, Big Pack Cookies & Creme Brownies. Each carton includes 12 large, individually wrapped brownies topped with white icing and chocolate cookie crumbles.

The packaged brownies market is segmented on the basis of flavor, category, distribution channel, and geography. Based on flavor, the market is segmented into chocolate, chocolate chip, hazelnut, salted caramel, raspberry, and others. Based on category, the market is bifurcated into gluten-free and conventional. Based on distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. By geography, the packaged brownies market is broadly segmented into the Americas, Europe, Asia Pacific, and the Rest of the World. The Americas market is further segmented into Argentina, Canada, and the Rest of Americas. The market in Europe is subsegmented into Germany, France, Italy, Spain, the United Kingdom, Poland, Austria, Sweden, Norway, Denmark, Belgium, the Netherlands, Luxembourg, Finland, and the Rest of Europe. The Asia Pacific market is further segmented into Australia, Japan, South Korea, Indonesia, Malaysia, Thailand, Philippines, Pakistan, and the Rest of Asia Pacific.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com