Increasing Pet Ownership and Humanization of Pets Bolster Pet Food Market Growth

According to our latest study on “Pet Food Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – by Product Type, Pet Type, Category, and Distribution Channel,” the market size is expected to grow from US$ 183.39 billion in 2024 to US$ 268.59 billion by 2031; it is estimated to register a CAGR of 5.6% from 2024 to 2031. The pet food market report highlights key factors driving the market growth and prominent players along with their developments in the market.

As pets provide comfort and emotional support, with dogs being particularly effective in this role, they often play a crucial role in many households, contributing to the overall physical and mental well-being. Owing to the growing awareness of the benefits of pet companionship, the humanization of pets is steadily increasing across the globe, including in emerging economies. Pet ownership skyrocketed during the COVID-19 pandemic, as most working officials were urged to work remotely to reduce contact with people amidst the outbreak. In India, there is an increasing popularity of pets. India's dog ownership surged from 16.9 million households in 2018 to 23.9 million households in 2023, while the number of households owning cats also increased during the same period. According to the Government of Canada, the pet population of the country increased from 22.1 million in 2018 to 38.5 million in 2023. Likewise, the percentage of US households that own dogs and cats has also increased steadily from 1991 to 2024. According to the data from the American Veterinary Medical Association, about 59.8 million US households owned dogs, and 42.1 million US households owned cats as of 2024.

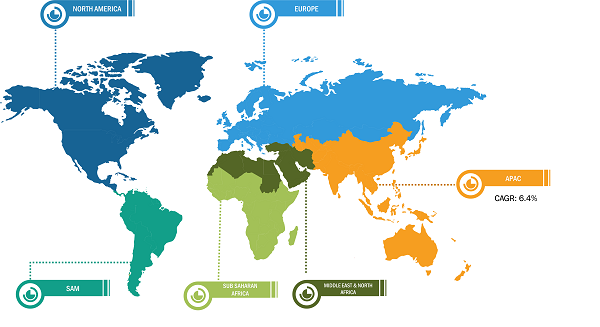

Pet Food Market Breakdown – by Region

Pet Food Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Dry Food, Wet Food, and Snacks & Treats), Pet Type (Dogs and Cats), Category (Animal-based and Plant-based), Distribution Channel (Supermarkets and Hypermarkets, Pet Specialty Stores, Vet Clinic, Convenience Stores, Online Retail, and Others), and Geography

Pet Food Market Research Report by 2031

Download Free Sample

The pet food market analysis has been performed by considering the following segments: product type, pet type, category, and distribution channel. Based on product type, the market is segmented into dry food, wet food, and snacks and treats. The dry food segment is anticipated to hold a significant pet food market share. Based on pet type, the market is bifurcated into dogs and cats. Cats is expected to register a significant CAGR from 2024 to 2031. Based on category, the market is bifurcated into animal-based and plant-based. The animal-based segment is anticipated to hold a significant market share. Based on distribution channel, the market is segmented into supermarkets and hypermarkets, pet specialty stores, vet clinic, convenience stores, online retail, and others.

In terms of revenue, North America dominated the pet food market share in 2024. The UK is a major market for pet food in North America. The pet adoption rate in the UK is rising. According to the Pet Food Manufacturers' Association (PFMA), in 2022, 17.4 million households (constituting 62% of the total the UK population) own a pet. Furthermore, dogs accounted for 34% of the whole household owned, while cats accounted for 28% of household pets. The total pet population in the UK reached 34 million, including 13 million dogs and 12 million cats. Further, 4.7 million households (accounting for nearly 17%) adopted a new pet since the pandemic, with around 45% of the owners aged above 40. Thus, the rising pet ownership depicts the care and affection toward the pet, favoring the purchasing decision of the consumers to get the appropriate pet food to ensure the pets' health.

Italy is expected to register a significant CAGR in the pet food market from 2024 to 2031. The pet food market in Italy is expected to boost during the forecast period owing to the increasing pet adoption rate in the country. According to the National Association of Manufacturers for Food and Care of Companion Animals (ASSALCO), roughly half of households in Italy had dogs or cats. Pet owners in Italy increasingly consider their pets as a part of their families. Italy holds a large pet population, thus driving the demand for pet food products. Moreover, the number of pet stores and veterinary clinics is rising in the country. Also, major market players are diversifying product portfolios by introducing a variety of pet foods with different forms and health benefits. For instance, in February 2024, Italian cooperative and retailer Coop planned to launch 200 new pet food SKUs across four lines, catering to dogs and cats. Products such as dental chews, treats, and raw ham bones for pets developed with the University of Milan use quality ingredients, are free from preservatives and artificial colors, and feature insect flour-based protein in snacks and superfood ingredients such as spirulina and blueberries.

The pet food market trends include rising demand for natural and vegan pet food products. Natural pet food options are gaining significant traction as they are free from artificial additives, preservatives, and fillers. These products are formulated to provide essential nutrients while avoiding harmful substances. The growing clean-label trend is also driving demand for natural pet food products that support holistic health and increase life quality. Many people are extending their vegan food lifestyle to their pets owing to increased concerns about animal cruelty and its negative impact on the environment. Further, there is an emergence of specialized pet food brands that cater to the specific needs and preferences of pet owners. Pet food manufacturers are increasingly focusing on using sustainably sourced ingredients to develop and market natural and vegan pet food products that meet consumer preferences. For instance, in 2021, Lily’s Kitchen launched the Plant Power vegan range for dogs. The Plant Power range directly taps into key trends around reducing meat consumption for health and environmental reasons. The range includes two new treats (Tropical Mango Jerky and Succulent Sweet Potato Jerky with Jackfruit) and two wet products (Mighty Burrito Bowl with Jackfruit and Vibrant Rainbow Stew). Thus, the rising demand for natural and vegan pet food products is likely to trend in the pet food market growth.

The pet food market forecast can help stakeholders plan their growth strategies. Mars Inc; Nestle SA; J M Smucker Co; General Mills Inc; United Petfood Group BV; Colgate Palmolive Co; Monge & C SpA; Butcher’s Pet Care Limited; VAFO Group AS; Inspired Pet Nutrition Ltd; First Class Pet Co Ltd (Little BigPaw); Symply Pet Food Ltd; MPM Products Ltd; Burns Pet Nutrition Ltd; Forthglade Foods Ltd; Furchild Nutrition LLC; Wunderdog Animal Feed Manufacturing LLC; Cagatay Pet Food; Schell & Kampeter, Inc; and Burgess Group PLC are among the prominent players profiled in the pet food market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market. For instance, in March 2024, PrimaCat launched a special "Presidential Cat Food" batch to honor Finland's new President Milo and Nala, the feline companions of the recently inaugurated Finnish president, available at K-Supermarket Munkki.

- The pet food market is segmented on the basis of product type, pet type, category, distribution channel, and geography. Based on product type, the market is segmented into dry food, wet food, and snacks & treats. By on pet type, the market is bifurcated into dogs and cats. In terms of category, the market is bifurcated into animal-based and plant-based. Based on distribution channel, the market is segmented into supermarkets and hypermarkets, pet specialty stores, vet clinic, convenience stores, online retail, and others. By geography, the pet food market is broadly segmented into North America, Europe, Asia Pacific, South and Central America, Sub Saharan Africa, and Middle East and North Africa. The North America market is further segmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, the UK, Italy, Spain, and the Rest of Europe. The market in Asia Pacific is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The pet food market in South and Central America is segmented into Brazil, Argentina, the UAE, and the Rest of South and Central America. The Sub Saharan Africa market is further segmented into South Africa, Nigeria, Kenya, and the Rest of Sub Saharan Africa. The market in the Middle East and North Africa is further segmented into Egypt, Saudi Arabia, the UAE, Nigeria, Morocco, Turkey, Oman, Iran, Kuwait, Qatar, Bahrain, Iraq, and the Rest of Middle East and North Africa.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com