Asia Pacific Dominated Petrochemicals Market in 2023

According to our latest market study on “Petrochemicals Market Forecast to 2031 – Global Analysis – by Membrane Type, Application, and End-Use Industry,” the market was valued at US$ 457.57 billion in 2023 and is projected to reach US$ 685.01 billion by 2031; it is anticipated to record a CAGR of 5.2% from 2023 to 2031. The report includes growth prospects owing to the current petrochemicals market trends and their foreseeable impact during the forecast period.

In 2023, North America had a significant petrochemicals market share. The growth of the petrochemicals market in North America is propelled by the region's robust economic development and industrialization. The North America petrochemicals market plays a pivotal role in the region's industrial landscape, as petrochemicals are used in various manufacturing sectors. Petrochemicals, derived primarily from oil and natural gas, are essential in the production of a wide array of products, including plastics, fertilizers, packaging, and automotive components, which are essential in numerous sectors such as automotive, construction, packaging, and consumer goods. With the automotive industry’s increasing emphasis on lightweight and durable materials, the industry heavily relies on petrochemical products for manufacturing parts and components. In the region, passenger vehicles are a majorly preferred mode of transportation, and their utilization is growing with the rise in per capita income. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in North America increased by 20%, from ~14.8 million in 2022 to 16.2 million vehicles in 2023. Similarly, as per the report by the Department for Promotion of Industry and Internal Trade (DPIIT), the Government of India has announced its plans to boost the country’s infrastructure and construction services through several policies such as large budget allocation to the infrastructure sector, open FDI norms, and smart cities mission.

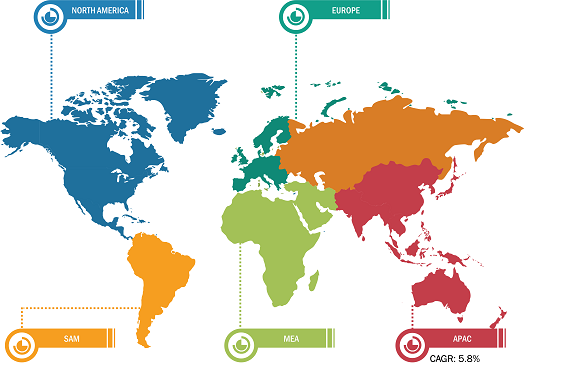

Global Petrochemicals Market Breakdown – by Region

Petrochemicals Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Ethylene, Benzene, Propylene, Xylene, and Others), Application (Polymers, Paints and Coatings, Solvent, Rubber, Adhesives, Surfactants, and Others), End-use Industry (Packaging, Automotive, Construction, Electrical & Electronics, Healthcare, Agriculture, Aerospace & Defense, and Others), and Geography

Petrochemicals Market Size, Share, Growth & Scope | Analysis 2031

Download Free Sample

The growth in the demand for petrochemicals from various industries is another significant factor fueling the petrochemicals market growth in Asia Pacific. Petrochemical-derived products are widely used in construction projects, including residential, commercial, and industrial projects across the region. Petrochemical-derived materials such as polyvinyl chloride (PVC), polyethylene, and polystyrene are widely used in building and construction applications, including piping, insulation, roofing, and flooring. These materials offer durability, cost-effectiveness, and ease of installation, making them indispensable for modern construction projects.

In terms of revenue, in Asia Pacific, China accounted for the largest petrochemicals market share. China is one of the fastest-growing economies across the globe. Manufacturing, automotive, and electronics are among the major industries in the country. China's significant industrial growth has led to an upsurge in the production of goods across these industries. Further, population growth and industrialization are the key factors that led to the growth in the demand for petrochemicals across China. Rapid industrialization and an expansive manufacturing base in China propel the demand for petrochemicals. The automotive sector stands out as a major consumer of petrochemical products in China. The government of China has taken several initiatives to stimulate the production capacities of automobiles to 35 million units by 2025. According to the OICA, in 2023, vehicle production in China was 30.2 million vehicles, ~33% higher than in 2021. With the world's largest automotive market, Chinese manufacturers and international automakers operating in the country require vast quantities of petrochemical-derived materials such as plastics, synthetic rubbers, and resins. All these properties of petrochemicalss play a major role in contributing to the petrochemicals market growth in the country.

India held the second-largest share of the market in 2023. According to the India Brand Equity Foundation, India holds a strong position in the heavy vehicles market across the globe. It is the largest tractor producer, the second-largest bus manufacturer, and the third-largest heavy truck manufacturer worldwide. In FY22, the country produced 22.93 million vehicles. In FY23, the total passenger vehicle sales reached 3.89 million units. In FY23, the total automobile exports from India increased to 4.7 million units.

According to a report published by the National Investment Promotion & Facilitation Agency in 2023, in terms of volume, the automotive market in India is likely to rank third among the world's largest automotive markets by 2030. The report also revealed that the automotive industry in the country manufactured 22.9 million vehicles during 2021–2022. Moreover, the Government of India declared a Production-Linked Incentive Scheme for the automobile and automotive component businesses by providing 18% of financial incentives to boost the domestic manufacturing of advanced automotive products. According to the India Brand Equity Foundation, the country marks the presence of 30,000 plastic processing units as of 2022, of which 85–90% comprise small and medium enterprises. The country produces various plastic products such as houseware, fishnets, flooring materials, medical products, packaging items, plastic films, and pipes. The government aims to develop 10 plastic parks in the country to boost plastic manufacturing output. Therefore, the petrochemicals market in India is extensively bolstered by the growth of the packaging and automotive industries. Furthermore, India is one of the largest manufacturers of generic drugs worldwide, known for its affordable vaccines and generic medications. The country has the largest number of pharmaceutical production facilities that are US Food and Drug Administration (USFDA)-compliant, with 500 active pharmaceutical ingredients (APIs) makers, accounting for ∼8% of the global API industry.

Global Petrochemicals Market: Trends

Government regulations and policies are key factors leading to the development and adoption of biodegradable petrochemical-based products. Governments of many countries implement bans or restrictions on single-use plastics, incentivizing businesses to switch to biodegradable alternatives. Policies such as extended producer responsibility and plastic taxes further encourage the transition toward making it economically advantageous to adopt sustainable materials. Rising consumer awareness about environmental issues significantly boosts the demand for biodegradable petroleum-derived products. The modification in the existing petrochemical building blocks can potentially make them susceptible to breakdown in certain environmental conditions. Polybutylene adipate terephthalate and polycaprolactone are a few examples of polymers containing both biodegradable monomers derived from petrochemicals and bio-based constituents. Many scientists are focused on research pertaining to achieving the optimal balance between biodegradability and desired material properties such as durability and strength. Thus, the development of biodegradable petrochemicals-based products is likely to promote the growth of the petrochemicals market size in the coming future.

Shell International BV, China Petroleum Corporation, LyondellBasell Industries Holdings BV, Chevron Phillips Chemical Company LLC, SABIC, BASF SE, BP Plc, INEOS, DOW Inc, and Mitsubishi Chemical Corporation among the key players profiled in the petrochemicals market report.

The petrochemicals market involves the segmentation of the market based on:

The petrochemicals market analysis is based on membrane type, application, end-use industry, and geography. Based on type, the petrochemicals market is segmented into ethylene, benzene, propylene, xylene, and others. Based on application, the market is segmented into polymers, paints and coatings, solvent, rubber, adhesives, surfactants, and others. Based on end-use industry, the market is segmented into packaging, automotive, construction, electrical & electronics, healthcare, agriculture, aerospace & defense, and others. The scope of the petrochemicals market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, the UK, Italy, Russia, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com