Microfiltration segment to Lead Pharmaceutical Membrane Filters Market Based on Technology During 2025–2031

According to our new research study on “Pharmaceutical Membrane Filters Forecast to 2031 – Global Analysis – by Technology, Design, Material, End User,” the market was valued at US$ 8,470.0 million in 2024 and is projected to reach US$ 20,053.1 million by 2031; it is expected to register a CAGR of 13.1% from 2025 to 2031. Major factors driving the market growth include the increasing demand for biopharmaceuticals and stringent regulatory requirements and quality.

A membrane filter is a selectively permeable barrier used in the pharmaceutical industry to separate, purify, and sterilize liquids and gases by removing microorganisms, particulates, and contaminants. These filters are typically made from materials such as polyethersulfone (PES), polytetrafluoroethylene (PTFE), or polyvinylidene fluoride (PVDF) and are available in various pore sizes (e.g., 0.22 µm for sterilization). They are critical in aseptic processing, ensuring product safety, purity, and compliance with regulatory standards such as the US Pharmacopeia (USP) and Good Manufacturing Practices (GMP).

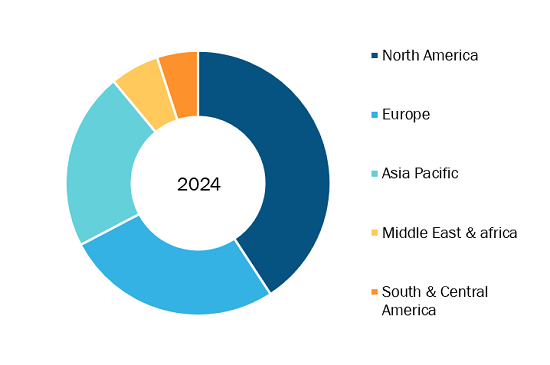

Pharmaceutical Membrane Filters Market, by region, 2025 (%)

Pharmaceutical Membrane Filters Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Pharmaceutical Membrane Filters Market Dynamics by 2031

Download Free Sample

Source: The Insight Partners Analysis

Pharmaceutical Membrane Filters Analysis Based on Segmental Evaluation:

Based on technology, the pharmaceutical membrane filters market is categorized into microfiltration, ultrafiltration, reverse osmosis, and nanofiltration. In 2024, the microfiltration segment held a significant pharmaceutical membrane filters market share. Microfiltration membranes play a crucial role in pharmaceutical manufacturing by removing bacteria, particulate matter, and yeast from process fluids. With pore sizes typically ranging from 0.1–10 microns, these membranes are widely employed in sterilization, protein separation, and fermentation broth clarification. The rising adoption of single-use filtration systems, driven by their ability to reduce cross-contamination and enhance process flexibility, is fueling the demand for microfiltration membranes. The increasing production of biopharmaceuticals, including vaccines and monoclonal antibodies, necessitates the use of high-performance filtration solutions to ensure sterility and compliance with stringent regulatory standards. Ongoing advancements in membrane materials, such as polyethersulfone (PES) and polytetrafluoroethylene (PTFE), have enhanced filtration efficiency, longevity, and chemical compatibility, making microfiltration more effective. Additionally, growing regulatory emphasis on contamination control and product safety is pushing pharmaceutical companies to adopt advanced filtration technologies. Industry leaders such as Merck KGaA, Danaher Corporation, and Sartorius AG are developing innovative microfiltration solutions to address these evolving demands, ensuring high product purity and manufacturing efficiency.

The scope of the pharmaceutical membrane filters market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the pharmaceutical membrane filters market share in 2024. North America, comprising the US, Canada, and Mexico, is witnessing significant growth in the pharmaceutical membrane filters market due to stringent regulations, rising biologics demand, and expanding manufacturing. The US leads with biotech advancements, Canada sees increased R&D investments, and Mexico benefits from growing pharmaceutical outsourcing, collectively driving market expansion.

In North America, the US holds the highest share of the pharmaceutical membrane filters market. As per Ibis World, in 2024, the US was home to approximately 2,432 biotechnology companies; likewise, in the contract research organization (CRO) sector, about 4,321 businesses are operating in the US. The US pharmaceutical membrane filters market is witnessing robust growth driven by increasing pharmaceutical and biopharmaceutical production, stringent regulatory guidelines for sterile filtration, and rising demand for high-purity filtration solutions.

Membrane filters play a critical role in ensuring sterility, removing particulates, and improving the drug quality of biologics and biosimilars. Technological advancements, including the development of advanced polymeric membranes and innovations in nanofiltration and ultrafiltration, are fueling the adoption of these filters. Stringent FDA regulations and USP standards necessitate the adoption of high-performance filtration technologies in drug manufacturing, thereby boosting demand for membrane filters in applications such as sterilization, microfiltration, and virus removal. The growing emphasis on single-use technologies in bioprocessing is driving the adoption of disposable filtration systems, reducing the risk of cross-contamination and enhancing operational efficiency. The rising prevalence of chronic diseases and the subsequent surge in drug development activities, particularly in monoclonal antibodies, vaccines, and recombinant proteins, are contributing to increased consumption of membrane filters. For instance, according to the CDC's Quarterly Provisional Mortality Estimates, heart disease and cancer remain the leading causes of death. For the 12-month period ending in the second quarter of 2024, the age-adjusted death rate for heart disease was 168.5 per 100,000 population, while cancer had a rate of 146.2 per 100,000.

Key players such as Merck Millipore, Sartorius AG, and Danaher Corporation are investing in research and development to enhance filter performance, increase throughput, and comply with evolving industry standards. Strategic collaborations between pharmaceutical manufacturers and filtration technology providers are fostering innovation, enabling the development of customized filtration solutions tailored to specific drug formulations. The COVID-19 pandemic has underscored the critical role of pharmaceutical membrane filters in vaccine production and therapeutic drug manufacturing. The rising adoption of continuous manufacturing processes in the pharmaceutical sector is also fueling demand for high-efficiency membrane filtration systems that ensure consistent product quality and scalability.

The increasing government and private investments in the pharmaceutical and biotechnology industries are supporting the adoption of high-performance filtration technologies. For instance, in fiscal year 2023, the National Institutes of Health (NIH) received a budget of approximately US$ 47.7 billion, which included US$ 1.412 billion from Public Health Service (PHS) Evaluation financing, US$ 141.5 million in mandatory funding for the Special Type 1 Diabetes account, and US$ 1.085 billion allocated from the 21st Century Cures Act.

The expansion of biopharmaceutical research and increasing clinical trials in the US are expected to sustain the demand for membrane filters, particularly in sterile filtration and cell culture applications. Additionally, the growing focus on sustainability and eco-friendly filtration technologies is encouraging manufacturers to develop energy-efficient and recyclable membrane filtration products.

Thermo Fisher Scientific Inc, Merck KGaA, Danaher Corporation, 3M, Sartorius AG, Repligen Corporation, Parker Hannifin Corporation, Asahi Kasei Corporation, GEA Group, Alfa Laval, TAMI Industries, Membrane Solutions, Koch Industries, W L Gore and Associates Inc, and Meissner Filtration Products, Inc are among the leading companies profiled in the pharmaceutical membrane filters market report.

Based on material, the pharmaceutical membrane filters market is segmented into Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN), and Others. By design, the pharmaceutical membrane filters market is segmented into Spiral Wound, Tubular System, Hollow Fiber, Plate & Frame. In terms of end user, the pharmaceutical membrane filters market is segmented into Pharmaceutical and Biotech Industries, CROs, and CDMOs. Based on technology, the pharmaceutical membrane filters market is segmented into reverse osmosis, microfiltration, ultrafiltration, and nanofiltration. Based on end user, the pharmaceutical membrane filters market is segmented into pharmaceutical and biotech industries, CROs, and CDMOs. Geographically, the market is categorized into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com