Rapid Industrialization and Enormous Developments in Construction Sector Propel Safety Helmets Market Growth

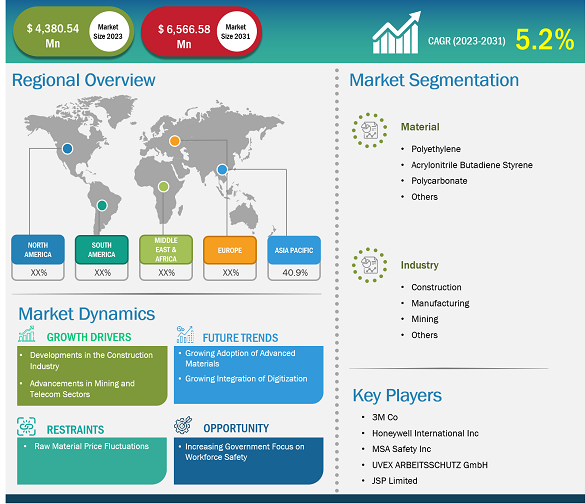

According to our latest market study on "Safety Helmets Market Forecast to 2031 – Global Analysis – by Material and Industry," the market is expected to grow from US$ 4,380.54 million in 2023 to US$ 6,566.58 million by 2031; it is likely to register a CAGR of 5.2% from 2023 to 2031. Apart from growth drivers, the report covers the safety helmets market trends and their foreseeable impact during the forecast period.

Growing Adoption of Advanced Materials

Safety measures are being revolutionized with the use of advanced materials to address challenges associated with workforce safety. By embracing advanced materials, safety helmet manufacturers and providers can offer solutions that address industry challenges and meet evolving workforce demands. Polyamide, polyethylene, nylon, and acrylonitrile butadiene styrene are among the advanced lightweight materials that have proven to improve the strength-to-weight ratios of safety helmets in order to ensure long-term performance and resistance to wear and tear. These materials not only improve safety but also position companies at the forefront of innovation. Thus, the use of advanced materials in the manufacturing of safety helmets is expected to provide significant growth opportunities for the market.

Safety Helmets Market

Safety Helmets Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Polyethylene, Acrylonitrile Butadiene Styrene, Polycarbonate, and Others), Industry (Construction, Manufacturing, Mining, and Others), and Geography

Safety Helmets Market Analysis by 2031

Download Free Sample

Source: The Insight Partners Analysis

Key Strategic Initiatives by Market Players Accelerate Safety Helmets Market Growth

The safety market analysis is carried out by identifying and evaluating key players in the market across different regions. Below are a few strategic developments announced by the key market players.

- In March 2024, STUDSON, a safety helmet developer that recently launched the first-of-its-kind Full Brim ANSI Type II Safety Helmet, announced the completion of a US$ 2.48 million funding round and a strategic collaboration with Blaklader, one of Europe’s largest producers of workwear.

- In April 2024, MSA Safety launched Cairns Fire Helmets. Model number 1836 fire helmet is a lightweight traditional-style fire helmet that meets the National Fire Protection Association (NFPA) standards.

The scope of the global safety helmets market report entails North America, Europe, Asia Pacific, Middle East and Africa, and South America. The construction industry in the US is growing with the increasing number of commercial, residential, and civil engineering projects. The demand for various construction equipment, including safety helmets, is stimulated by the progressive construction sector in the US. Population growth, increasing urbanization, and numerous ongoing infrastructure projects are among the factors boosting the demand for safety helmets in the country. According to the Associated General Contractors, the construction sector is one of the prime contributors to the US economy, generating ~US$ 2.1 trillion worth of structures each year. Burgeoning construction activities owing to government initiatives toward improving roads and building bridges in remote and rural parts also benefit the market in the US; thus, the construction industry held a significant safety helmets market share in 2023.

The safety helmets market report presents information regarding the major stakeholders in the ecosystem—i.e., raw material providers, safety helmet manufacturers and distributors, and end users.

Raw Material Providers: ExxonMobil; Boedeker Plastics, Inc.; Dow; BD Custom Manufacturing, Inc.; Chevron Phillips Chemical; and Westlake Corporation are a few leading raw material suppliers operating in the safety helmets market. Raw materials used in the manufacturing of safety helmets include polyethylene, acrylonitrile butadiene styrene, polycarbonate, and polyamide. The cost of raw materials fluctuates depending on production capacity, government policies, availability of raw materials, global economic circumstances, tariff rates, and supply and demand. For instance, the cost of high-density polyethylene fluctuated significantly from 2020 to 2022 globally. It was nearly US$ 837 per metric ton in 2020 and reached US$ 1,106 per metric ton in 2022. Variations in the cost of these raw materials have a high impact on the production expenses of safety helmets. The cost of raw materials is subjected to factors such as demand for raw materials in different end-user industries, trade agreements between nations, and policies related to international agreements.

Safety Helmet Manufacturers and Distributors: 3M, Centurion Safety Products Ltd., Concord Helmet & Safety Product Private Limited, Polison Corporation, Honeywell International Inc., JSP Limited, Pyramex, and Schuberth are among the major manufacturers of safety helmets. Most companies focus on developing IoT-driven smart safety helmets to remain competitive in the market. These manufacturers also distribute safety helmets to the end-use industries; however, in a few instances, local suppliers and distributors play a crucial role in the ecosystem of safety helmets.

Mining, construction, manufacturing, and oil & gas are among the end users of safety helmets. The growing number of construction activities and exploration of crude oil and gas are among the major factors driving the safety helmets market. The telecom sector is also one of the major end-use industries that has potential applications for safety helmets. For instance, in 2023, AT&T aimed at expanding 5G and fiber networks to connect urban, rural, and tribal communities nationwide. In Lawrence County (Indiana), AT&T plans to build AT&T Fiber for more than 1,200 customer locations in a project worth more than US$ 4.3 million. Thus, the growing developments in various sectors are fueling the safety helmets market share globally.

Advancements in Mining and Telecom Sectors

As mineral exploration requires the workforce to operate in a challenging environment, the use of safety helmets is mandatory. Governments of several countries are working on mineral exploration projects as one of the major parts of their economic advancement. Also, they are emphasizing the discovery of new mining sites, along with the upgradation and maintenance of already existing mining sites. For instance, in 2023, Irving Resources Inc. started diamond drilling at its East Yamagano high-grade epithermal gold-silver vein project in Kyushu, Japan.

In 2023, Metal Tiger plc announced that Southern Gold Limited had initiated drilling at its Deokon Au-Ag project in South Korea. Southern Gold is anticipated to commence the drilling of the first two diamond drill holes of 500 meters at the untested extensions of the Deokon Main Mine in the Deokon Project. The rapid urbanization and growing government emphasis on infrastructure development that involves telecom network expansion in rural areas are a few factors increasing the infrastructure development work. In 2023, Grid Telecom and Exa Infrastructure collaborated to boost digital connectivity and offer infrastructure services anchored in Europe. The partnership focuses on offering their wholesale and corporate customers diverse open-access interconnection and international reach across Europe. Similarly, in 2024, Bharat Sanchar Nigam Limited declared a US$ 7.8 billion tender to commence the third phase of the BharatNet project in India, which is among the crucial rural telecom projects. Therefore, the advancements in mining and telecom sectors drive the safety helmets market size.

Building Information Modeling (BIM) allows for the digital representation of a construction project, including safety measures for the workforce. The integration of advanced designs into BIM models enables accurate planning, clash detection, and seamless coordination with other project elements. IoT enables smart safety helmets to reduce risks and neutralize the chances of hazardous situations by offering real-time data from the work location. IoT-enabled safety helmets primarily ensure safe access to intricate details about the project by leveraging infrared sensors.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com