Rising Demand for Wood Products is Boosting Sawmill Machinery Market Growth

According to our latest study on "Sawmill Machinery Market Analysis and Forecast to 2031 – by Type and Application," the market is expected to grow from US$ 1,419.42 million in 2023 to US$ 2,018.73 million by 2031; it is anticipated to record a CAGR of 4.5% from 2023 to 2031. The report includes growth prospects owing to the current sawmill machinery market trends and their foreseeable impact during the forecast period.

The trade-in forest products range from raw wood products, such as wood logs and wood chips, to highly processed wood products, including furniture and fine paper. Some countries specialize in the production of raw wood, while other produce both raw wood and processed value-added wood. Lumber is the most widely used product produced in the solid wood industry of the forestry sector, and it is also the most intensively traded product worldwide. It is typically used for structural purposes in construction as well as furniture, flooring, and woodwork. Wood panels such as plywood are the second most traded wood products.

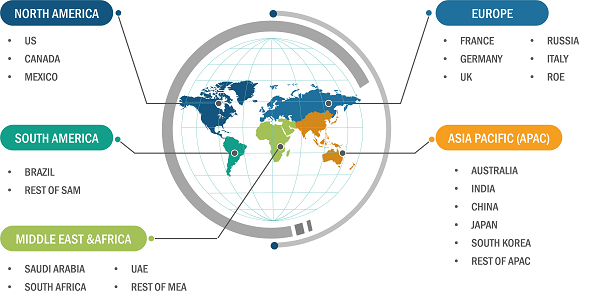

Sawmill Machinery Market Share - by Region, 2023

Sawmill Machinery Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fixed Sawmills and Portable Sawmills), Application (Woodworking Industry and Forestry), and Geography

Sawmill Machinery Market Growth Report and Size by 2031

Download Free Sample

Source: The Insight Partners Analysis

Rising wood product demand from industries such as manufacturing, construction, paper, and packaging fuels the requirement for sawmill machinery to convert wood logs into lumber. According to the World Bank, the demand for timber wood is expected to quadruple by 2050, which is anticipated to fuel the demand for sawmill machinery in the coming years. In addition, the government initiatives toward promoting the use of timber in the construction sector drive the wood products trade worldwide. For example, the Net Zero Strategy by the UK government, launched in October 2021, propelled the demand for timber to meet the net zero target by 2050. The UK imported more than 80% of all its timber in 2021, resulting in the second-largest importer of wood in the world. As per the UK government data, the demand for timber products is expected to peak by late 2030. Such a rise in demand for wood products and trade growth across the world propels sawmill machinery market size.

The report includes the sawmill machinery market forecast by type and application. The sawmill machinery market, based on type, is bifurcated into fixed sawmills and portable sawmills. Fixed sawmill, also known as a stationary sawmill, can be used indoors in varying weather conditions. On the basis of cutting requirements, these types of sawmills are used at base sites or at remote locations. The fixed sawmills segment held a larger sawmill machinery market share in 2023. Fixed sawmills are large structures at fixed locations mounted on a foundation. Fixed sawmill machinery is the stationary sawmill, which is a large band saw or a circular saw. The sawmill allows production in almost all weather conditions since it is usually under one roof. Fixed sawmills are generally larger than portable sawmills. Some businesses need a fixed mill to process large logs. With portable and fixed sawmills, operator load the log themselves unless they have a feeding system. These types of sawmills are increasingly used in commercial sites for cutting or building various products.

The rise in demand for sawmill machinery from large commercial sites, forestry, and industrial woodworking applications fuels the requirement for fixed sawmill machinery. In addition, an upsurge in the demand for furniture products for residential and commercial interiors drives the sawmill machinery market for the fixed sawmill segment.

The scope of the sawmill machinery market report focuses on North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). Europe held the largest sawmill machinery market share in 2023 and is projected to maintain its dominance during the forecast period. North America is the second-largest contributor to the global sawmill machinery market, followed by APAC.

Governments of North American countries focus on infrastructure development. Rising infrastructure developments fuel the usage of wood-based products and furniture for home renovation and decoration, which favors the sawmill machinery market growth in North America. The demand for US-made softwood lumber in Mexico is growing at a high rate due to several factors, including the positive impacts of the US-Mexico Canada Agreement (USMCA), the limited domestic supply of quality lumber, and the logistical advantages of a shared border. Thus, the sawmill machinery market is witnessing growth in both countries, and it is anticipated to remain the same over the forecast period. The high presence of sawmill machine manufacturers such as Baxley Equipment; Brewco, Inc.; Corley MFG; and McDonough Manufacturing Company are contributing to the growth of the sawmill machinery market in North America. Brewco, Inc. launched the Brewco 4-inch Resaw System that can saw Hard Maple efficiently. Marks Lumber is a lumber mill that primarily offers quality lumber products. The company performed retooling of its sawmill in 2023 and doubled its production capacity. Such upgrades in sawmills also fuel growth of the sawmill machinery market size.

The forest industry is a key contributor to the US economy by offering jobs in various fields, from forests to showrooms. Employment in each region in the country depends on different components of the industry, e.g., people in east depend on jobs in hardwood manufacturing, while population in the west finds softwood lumber and plywood production jobs more convenient. Additionally, the forest industry comprises many occupations, from natural resource professionals working in the field and production workers in mills and factories to statistics and financial experts working in office settings. The growing government focus on developing the forestry sector is one of the prime driving factors propelling the sawmill machinery market growth. In May 2024, the Deputy Secretary of Agriculture stated that the Department of Agriculture's Forest Service has plans to invest ∼US$ 74 million to stimulate innovation and generate new markets for wood products as well as renewable wood energy derived from sustainably obtained wood; the investment is also expected to increase the capability of wood processing facilities as part of President’s Investing in America agenda. Eliminating dead trees and overgrown vegetation decreases wildfire risk, enhances forest health, and establishes wildlife habitat, all while supporting the forest products economy, which is directly impacting the demand for sawmill machinery in the US. In addition, the development of the construction industry in the US is growing with the surging number of commercial, residential, and civil engineering projects, which also fuels the demand for wood-related artifacts and furniture and boosts the demand for sawmill machinery in the US.

HewSaw, BID Group Technologies Ltd., Esterer WD GmbH, Mendes Maquinas, SAB Sagewerksanlagen GmbH, Real Performance Machine, and Linck are among the key players profiled in the sawmill machinery market report. Companies in the sawmill machinery market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com