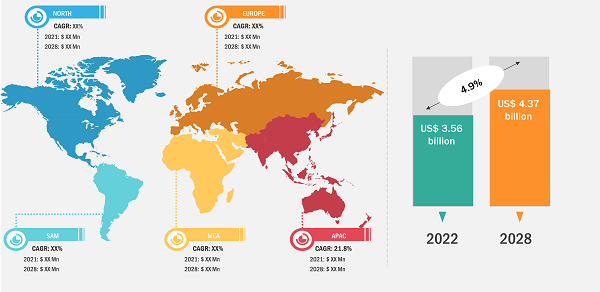

The Scissor Lift Market size is expected to reach USD 4.37 Billion; registering at a CAGR of 4.9% from 2022 to 2028, according to a new research study conducted by The Insight Partners

Proliferation in Manufacturing Industries is Projected to Offer Potential Growth Opportunities for Scissor Lift Market

The outburst in the urban population has led to increased demand for commodities, generating pressure on the manufacturing industries to cope with the increasing end-user demand. This demand pressure is applicable to both commodities and manufacturing plants including automobiles, food & beverages, and machinery. To balance the stringent government safety norms and environmental concerns, many manufacturers are installing scissor lifts for most of their operations. Common applications include infeed and outfeeds, variable height workbenches, variable height welding benches, mezzanine floor lifts, packing and stacking, work platforms, loading docks, and production lines and machines.

Scissor Lift Market – by Region

Scissor Lift Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: by Product Type (Hydraulic, Mechanical, and Pneumatic); Movement Type (Mobile and Fixed); Industry (Construction, Manufacturing and Warehouse, and Others), and Geography (North America, Europe, Asia Pacific, and South and Central America)

Scissor Lift Market | 2031 Strategic Insights | Recent updates

Download Free Sample

Source: The Insight Partners Analysis

Scissor lift enhances process ergonomics and decreases the risk of repetitive strain-type injuries, which is fueling the scissor lift market growth. Scissor lifts or lift tables are ideal ergonomic solutions for vertical lifting and material work positioning tasks. Technological advancements surrounding mobile elevating work platforms (MEWPs) depict that maintenance managers and engineers must stay up to speed on the new industry standards. The new ANSI A92.20 standards for the aerial equipment industry have modified design requirements for MEWPs, like scissor lifts, portable personnel lifts, and boom lifts produced after June 1, 2020. Continuous development in standards will make the creation and use of scissor lifts in a more appropriate manner across end-user industries. Moreover, development of mandates will have a positive impact on the use of scissor lifts as well, which in turn will create a positive impact on the overall scissor lift market growth.

Based on geography, Europe held the largest scissor lift market share in 2022. The region is home to some of the largest automakers, and the automotive industry accounts for 4% of the total European Union’s gross domestic product (GDP). The automotive industry, which includes manufacturing units and service centers, is the largest end user of scissor lifts. Countries such as Germany and Italy, with robust automotive markets, have noticed a significant adoption of these equipment. European countries are witnessing high adoption of material handling equipment in various industries. Countries in Central and Eastern Europe, including Romania, Slovakia, Lithuania, Portugal, and Estonia, are witnessing high adoption of these equipment in varied industries. The biggest climbers are the Czech Republic and Poland. Presence of such gigantic end user countries in Europe will act as a key attributing factor towards the European scissor lift market size.

COVID Impact on APAC Scissor Lift Market

Asia Pacific is characterized by the presence of a large number of developing countries, a positive economic outlook, a high industrial presence, and a huge population. The high rate of industrialization in developing countries of Asia Pacific is offering plenty of growth opportunities to the market players operating in the global scissor lift market. Logistics is among the prominent industries in the Asian economy due to the rising e-commerce. However, the COVID-19 pandemic impacted the supply chain of many industries. The government measures to reduce the effects of the outbreak by announcing lockdowns and travel and trade bans disturbed the performance of the supply chain to some extent. The disturbed logistics industry witnessed minimal adoption of technologies and equipment during the time of lockdown. Since the businesses resumed in mid-2021, the adoption of autonomous technologies and systems such as scissor lifts increased.

Based on product type, the scissor lift market size is categorized into hydraulic lift, pneumatic lift, and mechanical lift. The hydraulic lift segment held the dominating scissor lift market share in 2022. Hydraulic scissor lifts are the most widely used scissor lifts. Many standard designs of hydraulic scissor lifts are available, and they can also be used in integration with equipment such as turntables or conveyors. The adoption of hydraulic scissor lifts is increasing across industries, including automotive. For instance, in September 2022, MG Motor announced their new service program called “MG Service on Wheels,” providing customers with basic repairs and maintenance services for MG cars at their respective houses. The new service will utilize a mobile workshop equipped with basic machinery needed by the service personnel. This mobile workshop would come with a hydraulic scissor lift attached to a hydraulic power pack, waste oil collection tank digital oil dispenser, air compressor, and pneumatic line with a filter-regulator-lubricator (FRL) unit.

The key scissor lift market players include Terex Corporation; JLG Industries; Aichi Corporation; Haulotte Group; Linamar Corporation; MEC Aerial Work Platforms; GALMON (S) Pte Ltd.; Wese USA; Edmolift AB; and Advance Lifts, Inc.

- In December 2022, JLG Industries, Inc. received 12 industry awards for depicting their latest products. RER magazine has honored JLG company with two Innovative Product Awards—a Miscellaneous award for the “Access Your World” virtual experience and Technology Enhancements award for JLG’s suite of telehandler accessory offerings.

- In June 2022, Haulotte upgraded its Compact range of electric scissor lifts. The new five rugged models are redesigned to ensure increased safety, easy maintenance, and better utilization. The new models integrate high-quality standards and fulfill all requirements needed for performing tasks at heights from 20 to 39 feet on every stabilized ground.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com