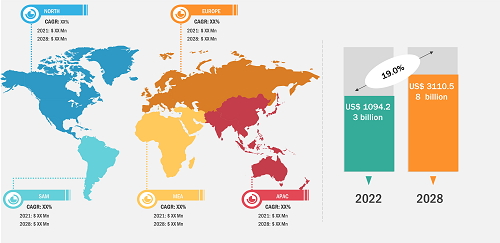

The smart city market size is expected to reach USD 3110.58 Billion by 2028; registering at a CAGR of 19% from 2022 to 2028, according to a new research study conducted by The Insight Partners

Increasing Government Initiatives to Develop Smart Cities to Provide Growth Opportunities for Smart City Market Growth During 2022–2028

Government bodies across developed and developing countries are actively taking initiatives to integrate smart city solutions. The government bodies are focused on modernizing infrastructures and reducing the cost of distribution of utilities. The integration of smart city solutions is enhancing the efficiency of utility distribution, thereby promoting the adoption of the same. Moreover, the governing bodies across countries such as China, India, Singapore, Dubai, and Japan have experienced a rise in smart city initiatives over the years. For instance, the UAE aims to make the country paperless under its Smart Dubai Plan 2021, influencing the adoption of smart digital services, thereby contributing to the market's growth.

More than 50 cities in France have partially implemented the smart city concept, with developments in some aspects such as parking, education, and healthcare. Rise in urban population and climate change have given rise to some of the key issues related to water management, waste management, energy management, transportation, and services. Smart energy is the most significant aspect of the smart city project implementation by the French government in 2013. The country is also focusing on the rapid adoption of smart transportation by integrating smart ticketing and parking solutions across the country. These factors are further contributing to the France smart city market growth.

The pandemic adversely impacted the growth of the smart city market size. The stringent lockdown regulations imposed by the local government bodies across the globe led to severe supply chain disruptions and a shortage of laborers, thereby impacting the growth of industries, especially the manufacturing industry. The virus spread also impacted the plans for smart cities undertaken by the government. However, with the shortage of laborers across industries, the demand for advanced technologies and automated and connected equipment experienced a rise from Q3 of 2020. This factor aided the revival of the smart city market size across the globe.

Smart City Market – by Region, 2022

Smart City Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Report Coverage: by Industry Vertical [Smart Infrastructure, Smart Energy, Smart Governance, Smart Transportation, Smart Healthcare, Smart Education]

Smart City Market Growth Report by 2031

Download Free Sample

Source: The Insight Partners Analysis

Based on industry vertical, the smart city market is segmented into smart infrastructure, smart energy, smart governance, smart transportation, smart healthcare, and smart education. In 2021, the smart education segment accounted for a significant share of the global smart city market. For smart cities to be effective, they need to engage a broad range of people, from businesses to public services, school children to higher education students, and the wider community. As technology is changing, how we deliver education is also altering. Migration from textbooks to dynamic learning content delivered through computers and mobile smart devices allows more student-focused education delivery at their pace, with relevant content and learning approaches. It also allows schools to stay updated with current and timely information and leverage teaching resources across schools, campuses, districts, and the world.

Thus, the growing demand from consumers, students, parents, employers, or employees to become digitally educated is highly impacting the growth of smart education in smart cities. Moreover, the escalating number of mobile learning applications and learners’ expertise with technology and affinity toward digital learning; along with enhanced collaboration between the hardware providers, software providers, and educational material providers; has resulted in improved educational technology, leading to exceptional growth in smart education.

The key players operating in the smart city market include ABB Ltd; Cisco Systems, Inc.; Oracle Corporation; Microsoft Corporation; IBM Corporation; Accenture; General Electric Company; Schneider Electric SE; Siemens AG; and Ericsson AB.

- In March 2021, Huawei Technologies Co., Ltd. announced the launch of its new smart classroom solutions based on the HUAWEI IdeaHub Board and the education cloud platform. The solution is designed to promote interactive teaching across schools and universities through digital platforms.

- In September 2022, SenseTime launched its new smart hospital solutions to empower medical care centers with AI and other technologies.