Increasing Demand for Carpool and Bike Pool Services to Create Growth Opportunities for Smart Commute Market during 2021–2028

According to our latest market study on “Smart Commute Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Type, Solution, and End User,” the market is expected to grow from US$ 30,469.49 million in 2021 to US$ 86,568.73 million by 2028; it is estimated to grow at a CAGR of 16.1% from 2021 to 2028.

The key element driving the growth of smart commutes is a rapid increase in the adoption of carpool and bike pool services among regular office commuters. Prominent market players such as Uber and Ola offer convenient pick-up and drop-off services, attracting consumers to use ride-sharing services. Furthermore, services, including short-distance travel, intercity ride-sharing, bus-sharing, bike-sharing, and auto-sharing, are available, stimulating the rise in the demand for smart commutes.

Many prominent Indian corporations proactively push employees to use carpool and bike pool services. Organizations with large workforces, such as Infosys, Capgemini, Cognizant, HCL, Amazon, Flipkart, Siemens, L&T, Biocon, and HDFC Bank, and several smaller businesses, are launching awareness campaigns and digital platforms to help employees better plan their commutes. Moreover, organizations are rewarding top carpoolers to keep employees engaged and motivated to reduce carbon emissions and traffic jams across cities. New York, Seoul, and Shanghai are among the top ten cities with the highest carbon footprint. Governments and businesses are encouraging carpooling to commute in cities to reduce emissions. Many countries have established specific targets for reducing carbon footprints by 2030 as part of the Paris climate agreement. In Delhi, the Indian government implemented an odd-even number plate strategy to control traffic density and reduce carbon emissions in the city.

Carpooling and bike pooling services offer advantages such as affordable pick-up and drop-off, co-passenger information, affordable rides, and greater convenience than traditional transportation services. Moreover, several service providers offer incentives and discounts, including a monthly pass on shared transport, to help daily commuters save money. As a result, the rise in demand for carpool and bike pool services is propelling the smart commute market.

In North America, the need for smart commutes is fuelled by an increasing preference for carpool services among office commuters, which will alleviate traffic congestion and prevent environmental damage. Furthermore, a rise in the tourism industry, technological advancements, and favorable government policies are other factors driving the growth of the North America smart commute market. In Europe, the rise in the trend of mobility-as-a-service and the increase in the user base of ride-sharing services are expected to create lucrative opportunities for the smart commute market players. Further, in Europe, due to growing concerns about global warming, road congestion, and reliance on foreign energy, smart commutes are becoming more popular. The practice of levying toll rates on automobiles with a single occupant, which was imposed in 2012, has resulted in a huge increase in the use of smart commutes by European consumers.

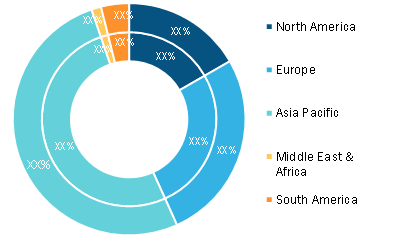

The smart commute market is segmented on the basis of type, solution, end user, and geography. Based on type, the smart commute market is segmented into carpooling, van pooling, bike pooling, metro, and others. Based on solution, the smart commute market is segmented into mobile apps, parking management, traffic management, and others. Based on end user, the smart commute market is bifurcated into personal and enterprises. By geography, the smart commute market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). In 2021, North America accounted for a significant share of the global smart commute market.

Impact of COVID-19 Pandemic on Smart Commute Market

The COVID-19 outbreak had a significant impact on the transportation sector. The demand for carpooling and vanpooling services reduced globally in 2020 due to the COVID-19 pandemic. The global smart commute market witnessed a considerable decline in revenue generation in 2020 compared to 2019, partly due to the lockdowns and customers' reluctance to use ride-sharing services even after the regulations were lifted. Ride-sharing firms are always attempting to maintain driver and passenger confidence in terms of safety and sanitation. However, post COVID-19 the market is again gaining momentum owing to the government initiatives towards sustainblity development.

A few key players operating in the global smart commute market are BlaBlaCar, CommuteSmart, Enterprise Holdings Inc, ePoolers Technologies Pvt. Ltd, Golden Concord Holdings Limited, Oakland Smart Commute, Quick Ride, Transhelp Technologies Pvt Ltd, Uber Technologies Inc., and Smart Commute. Several other market players were analyzed to understand the market.

Smart Commute Market — by Geography, 2021 and 2028 (%)

Smart Commute Market Regional Overview by 2028

Download Free Sample

Smart Commute Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type (Carpooling, Van Pooling, Bike Pooling, Metro, and Others), Solution (Mobile Apps, Parking Management, Traffic Management, and Others), and End User (Personal and Enterprises)

Contact UsSmart Commute Market Regional Overview by 2028

Download Free SampleSmart Commute Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type (Carpooling, Van Pooling, Bike Pooling, Metro, and Others), Solution (Mobile Apps, Parking Management, Traffic Management, and Others), and End User (Personal and Enterprises)

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com