Table-Top Spirometers Segment to Lead Market from 2022 to 2028

According to our new research study on "Spirometer Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Type, Technology, and Application," the market is expected to grow from US$ 893.71 million in 2021 to US$ 1,907.36 million by 2028. It is estimated to grow at a CAGR of 11.5% during 2022–2028.

Factors driving the growth of the spirometer market are the growing preference for home care products and the rising prevalence of respiratory diseases. The unfavorable reimbursement scenario hinders the market growth. Increasing government initiatives in developing economies are expected to provide lucrative opportunities for the spirometer market in the coming years.

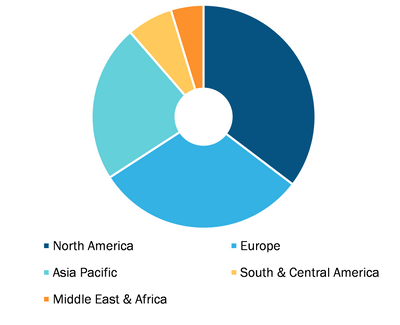

Spirometer Market, by Region, 2022 (%)

Spirometer Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type (Handheld Spirometers, Table-Top Spirometers, and Desktop Spirometers), Technology (Volume, Flow, and Peak Flow), and Application (Asthma, Chronic Obstructive Pulmonary Disease, Cystic Fibrosis, and Others)

Spirometer Market Trends and Scope by 2028

Download Free Sample

Based on type, the spirometer market is segmented into handheld spirometers, table-top spirometers, and desktop spirometers. The table-top spirometers segment accounted for the largest share of the market in 2022. However, the handheld spirometers segment is anticipated to register the highest CAGR in the market during the forecast period. The handheld spirometer is used to test the lungs at home without the hassle of a doctor's visit. Some portable spirometry devices function independently, while others pair with a smartphone app to provide extra information. With the onset of the COVID-19 pandemic, the demand for home spirometers with portable devices is growing rapidly in the global market. With a portable spirometer, children can also monitor their lung function at home, and it empowers them to take control of their health. Handheld spirometers are small, lightweight, and easily portable. Therefore, they are becoming ubiquitous in the industry.

Moreover, market players are focusing on the advancements of these devices. For instance, in November 2021, Cipla launched Spirofy, India's first portable wireless spirometer, for early diagnosis of COPD and asthma. Also, in March 2021, Vyaire Medical launched AioCare mobile spirometry system in more than 15 countries across Europe, Middle East, and Australia. AioCare has a portable spirometer linked to a dedicated smartphone app and an online panel that enables doctors and patients to share and communicate results through remote tracking and secure communication. Thus, advantages offered by these products along with product launches by companies would propel the growth of the spirometer market for the handheld spirometers segment during the forecast period.

Impact of COVID-19 Pandemic on Spirometer Market

The COVID-19 pandemic has significantly affected the global healthcare system. Governments imposed stringent policies between 2020 and 2021 to prevent and reduce the infection spread of SAR-CoV-2 and mortality rates. Many companies offering spirometer have their business operations in the US, and their business was adversely affected by the outbreak. The pandemic has disrupted the supply chain of the healthcare industry mainly due to strict lockdown in several regions. Businesses of various companies were impacted due to a lack of locally sourced raw materials and parts. For instance, Vitalograph, one of the spirometry device manufacturers based in Ireland, faced production issues as some of the material parts were procured from China, and in China, there were strict restrictive measures taken to reduce infection transmission. Such conditions restricted the ability of enterprises to manufacture and distribute their products and compelled them to temporarily shut down their facilities.

The COVID-19 pandemic has had a positive impact on the spirometer market owing to the rising need for methods that could be used to provide relief from breathing problems faced by COVID-19 patients. Patients with COPD, pneumonia, acute chest syndrome, and other similar respiratory disorders often use incentive spirometry. Researchers at the University of Illinois at Chicago suggested the use of incentive spirometer for the treatment of COVID-19 patients suffering from mild to moderate respiratory symptoms, according to a research report published by the American Journal of Emergency Medicine in January 2021. Therefore, the adoption of spirometers is increasing during the COVID-19 pandemic.

Jones Medical Instrument Company; Benson Medical Instruments Co.; NUVOAIR U.S, INC. (NUVOAIR AB); Teleflex Incorporated; Vyaire Medical, Inc.; COSMED srl; Depisteo LLC; Henry Schein, Inc; Baxter International Inc.; and ICU Medical Inc. are among the leading companies operating in the spirometer market.

The spirometer market is segmented on the basis of type, technology, application, and geography. Based on type, the market is segmented into handheld spirometers, table-top spirometers, and desktop spirometers. By technology, the spirometer market is segmented into volume, flow, and peak flow. Based on application, the market is segmented into asthma, chronic obstructive pulmonary disease, cystic fibrosis, and others. Geographically, the spirometer market is segmented into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and the Rest of APAC), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, and the Rest of MEA), and South & Central America (Brazil, Argentina, and the Rest of SAM).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com