Mounting Energy Demand Bolsters US Battery Energy Storage System Market Growth

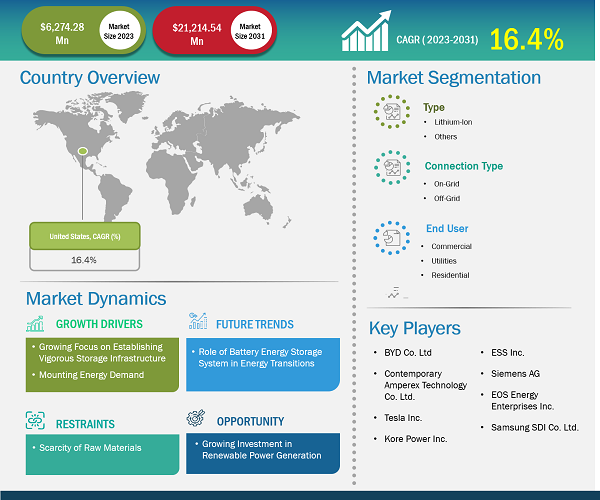

According to our latest study on "US Battery Energy Storage System Market Analysis to 2031 – Country Analysis – by Type, Connection Type, and End User," the market is expected to grow from US$ 6,274.28 million in 2023 to US$ 21,214.54 million by 2031; it is anticipated to record a CAGR of 16.4% from 2023 to 2031. The US battery energy storage system market report emphasizes the key factors driving the market and showcases the developments of prominent players.

Apart from growth drivers, the report covers the US battery energy storage system market trends and their foreseeable impact during the forecast period. Rising population and growing urbanization are a few factors steering the use of energy in the US. As per the US Energy Information Administration (EIA), energy consumption in the US is anticipated to grow through 2050 owing to economic and population growth. EIA also mentioned that US electricity end-use consumption was about 3.2% higher in 2022 than in 2021. Battery energy storage has the potential application as energy storage to be used in times of crisis or in remote or distant locations where power networks are not available. Furthermore, due to the increasing energy uncertainties worldwide, the US government is boosting the application of battery energy storage. For instance, in May 2024, Plus Power secured a US$ 82 million tax equity investment from bank Morgan Stanley for the Arizona-based 90 MW/360 MWh Superstition BESS project, which is anticipated to be operational in June 2024. In February 2024, RWE completed the construction of three new battery energy storage systems totaling 190 MW (361 MWh) in Texas and Arizona. Thus, the increase in energy demand contributes to the growing US battery energy storage system market size.

US Battery Energy Storage System Market Share, 2023

US Battery Energy Storage System Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Lithium-Ion and Others), Connection Type (On-Grid and Off-Grid), End User (Commercial, Utilities, and Residential), and Country

US Battery Energy Storage System Market Forecast by 2031

Download Free Sample

Source: The Insight Partners Analysis

By type, the US battery energy storage system market is bifurcated into lithium-ion and others. Lithium-ion battery energy storage systems include lithium-iron-phosphate and lithium-nickel-manganese-cobalt batteries. The lithium-ion segment accounted for a significant US battery energy storage system market share in 2023 and is anticipated to maintain its dominance during the forecast period. The market, in terms of connection type, is bifurcated into on-grid and off-grid. Based on end user, the market is segmented into utilities, residential, and commercial.

Lithium-ion batteries are rechargeable energy storage solutions that are paired with a solar or wind energy system to store excess power generated in these power plants. Lithium-ion battery energy storage systems are commonly used in energy storage applications in solar, wind, and other renewable-based energy storage. The lithium-ion battery energy storage system has characteristics such as higher depth of discharge, higher energy density, long lifespan, high efficiency, and less maintenance. The lithium-ion battery energy storage is lightweight; it lasts longer; it has few self-charges; and it takes up less area than other battery energy storage solutions. It is most widely used in EV charging stations, grid modernization, and other energy storage applications. Moreover, the increasing adoption in the utility grid and energy storage systems is contributing to the demand for lithium-ion battery energy storage systems. In addition, the cost of lithium-ion batteries reduced rapidly from 2012 to 2022 and is expected to decline by 25–50% by 2030 with the rise in improved manufacturing techniques.

Battery energy storage system capacity in the US has been increasing rapidly since 2021, owing to the rise in government initiatives and investment in renewable power generation, along with the expansion of microgrids and BESS capacity across the country. In addition, the US has been facing unpredictable or bad weather conditions for the last 4 to 5 years, which has affected power grid reliability and resulted in power outages in the country. This has increased the demand for battery energy storage systems, which will benefit the utility grid in maintaining reliable and stable power in case of peak demand and power outages while maintaining the power charges to its consumers.

The growing number of trusted suppliers is one of the key factors for increasing the production of lithium-ion battery energy storage systems, contributing to the growth of the overall US battery energy storage system market size. At present, the expansion of the US battery energy storage system market is highly dependent on the supply chain. BESS projects are slated for deployment in the next 2–5 years, and utilities, independent power producers (IPPs), and storage project developers primarily depend on supply chain resources. Major components of supply chain management include supply chain planning, demand forecasting, production planning, supplier collaboration, and risk management.

Many crucial BESS components, ranging from battery cells to semiconductors in inverters and control systems, depend on supply chains, which are vulnerable to supply shudders from various sources, regulation changes, and raw material shortages. Planned and strategic business partnerships, multi-sourcing, and local sourcing are significant factors considered in defining a supply chain strategy, along with the potential technology shifts. In addition to BESS components, other concerning factors in the sector are engineering, procurement, and construction (EPC) capabilities. Strategic business partnerships with large EPC players ready for large-scale battery energy storage system installations are critical to ensure the effective execution of battery energy storage system projects.

Vehicle electrification plays an important role in the carbon emission reduction goals set by the US. In general, vehicle electrification focuses on the electrically powered powertrain and its auxiliary systems, such as onboard and offboard charging systems and wireless power transmission. Vehicle electrification also includes many aspects of vehicle functions present in a traditional nonelectric vehicle, including electronic power steering, electronic stability program, electronic traction control, intelligent lighting system, intelligent electromagnetic suspension, four-wheel drive, and airbag delivery system. The rise in demand and deployment of electric vehicles (EVs) across the US propels the requirement for vehicle charging infrastructure or electric vehicle charging stations. Hence, the power and transport sectors are expected to boost the US battery energy storage system market growth in the coming years.

The EV charging stations and solar photovoltaic (PV) plant coupling resulted in reducing the peak charging demand, power loss mitigation, increased self-consumption of locally produced PV energy, and demand charges at fast EV charging stations. Integration of BESS in EV charging stations reduces the dependence of fast charging stations on the grid and minimizes grid connection size. The rapidly growing electric vehicle industry is projected to fuel the demand for fast charging stations with suitable energy storage. The demand for battery electric storage systems is on the rise to avoid the power curtailment of the charging vehicles. In addition, a rise in investment and integration of solar power facilities in EV charging infrastructure is expected to propel the requirement for battery energy storage systems during the forecast period.

BYD Co. Ltd; Saft America Inc; CATL; Tesla Inc; Samsung SDI Co Ltd; Panasonic Holdings Corp; AES Corp; NextEra Energy, Inc.; Ameresco Inc.; ESS, Inc.; Siemens AG; EOS Energy Enterprises Inc; KORE Power Inc; General Electric Co; LG Chem Ltd.; SAFT Groupe SA; and ESS Inc. are among the key players profiled in the US battery energy storage system market report. Companies in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com