According to our new research study on “US Digital Pharmacy Market Forecast to 2030 –Country Analysis – by Drug Type, Product, Platform, and Gender” the US digital pharmacy market size is expected to grow from US$ 67,242.93 million in 2022 to US$ 2,40,216.87 million by 2030; it is estimated to register a CAGR of 17.25% during 2022–2030.

Key factors driving the US digital pharmacy market growth include owing to upsurge in online purchase of prescription medicines during COVID-19 pandemic and increasing inclination towards online platform. However, illicit practices in online pharmacy operations’ hinders the market growth.

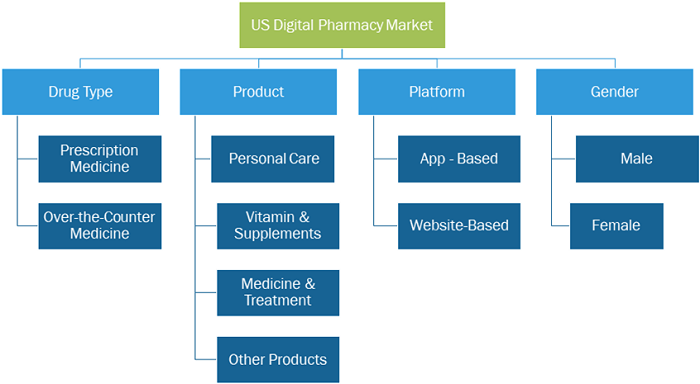

US Digital Pharmacy Market Size and Forecast (2020-2030), Regional Share, Trends, and Growth Opportunity Analysis Coverage: by Drug Type (Prescription Medicine and Over-the-Counter Medicine), Product [Personal Care, Vitamins and Supplements, Medicine and Treatment (Sexual Health, Neurological Disorders, Heartcare, Diabetes, and Weight Loss Drugs), and Others], Platform [App-Based (Telehealth Pharmacy Apps, Medication Management Apps, Health and Wellness Apps, and Compounding Pharmacy Apps, and Others) and Website Based], and Gender (Male and Female)

US Digital Pharmacy Market Growth Report by 2030

Download Free Sample

Based on drug type, the US digital pharmacy market is segmented into prescription medicine and over-the-counter medicine. The prescription medicine segment held a larger market share in 2022 and the same segment is anticipated to register a higher CAGR of 17.83% during the forecast period. A doctor fills out a digital prescription online and sends it directly to prescription centers over the internet. Prescription centers are electronic databases that issue and process medicines, baby food, and medical devices. Prescriptions are by default public, but they can be changed by the doctor. In the private prescription, only patients are allowed to purchase prescribed medicines, while in the authorized prescription, prescription medicines can be purchased at a pharmacy by the patient or by people authorized by the patient on the online portal. Individuals purchasing the prescribed medicines need to show the pharmacist their identity documents, including a photograph and an identification number. If the medicine is purchased for another person, the buyer must also know their personal identification number. Post buyers’ verification, pharmacists would locate the correct prescription in the prescription center based on the buyer's identification code (mentioned in the prescription).

Amazon.com Inc, GoodRx Holdings Inc, The Cigna Group, CVS Health Corp, Walmart Inc, Hims & Hers Health Inc, Roman Health Pharmacy LLC, Apex Pharmacy Inc, Llodys Pharmacy Ltd, Pharmacy2 U Ltd, Docmorris NV, and Truepill are among the leading companies operating in the US digital pharmacy market.

Based on product, the US digital pharmacy market is segmented into personal care, vitamins & supplements, medicines & treatments, and other products. The medicine and treatment segment held a larger market share in 2022 and the segment is anticipated to register a higher CAGR of 17.87% during the forecast period. The medicines and treatments segment is further classified into sexual health, neurological disorders, heart care, diabetes, and weight loss drugs. According to the Heart Failure Society of America, the US reported an increase in the number of heart failure patients who were admitted twice or multiple times due to the lack of care coordination in 2020. This is due to the lack of a consistent provider, follow-up care, and the ability to track blood pressure and weight at home. The Heart Failure Society of America also revealed that medications were the main cause of readmissions. Health issues, including cardiovascular diseases, can be effectively evaluated, diagnosed, monitored, and followed through digital pharmacy. The use of patient data generated through wearables, and blood pressure and pulse monitoring devices; electrocardiograms; sleep parameters; pulse oximetry; etc., is instrumental for the understanding of health. Digital pharmacies enables the valid interpretation of diagnostic data in a timely manner, enabling the adoption of optimal treatment. To identify risk factors correctly and develop practical approaches to improve preventive measures, remote monitoring tools and an optimized prevention scheme will be used along with precision medicine data. Telepharmacy has an adequately proven clinical efficacy and cost-effectiveness in online pharmacy platforms, but the inclusion of telepharmacy services in healthcare models may offer a unique opportunity to improve cardiovascular screening and care.

A number of major adverse cardiovascular events, including mortality, are reduced by statins. With COVID-19, care delivery was dramatically changed, including rapid adoption of telemedicine in primary care and hyperlipidemia treatment. According to an article published in National Library of Medicine in 2021, as a result of COVID-19, in-person visits decreased, but telemedicine visits increased. It was found that statin prescribing rates were higher during telemedicine visits than in-person visits during April and May 2020. As hyperlipidemia does not always require a physical examination for management, telemedical care delivery may be an effective use case for hyperlipidemia management. Additionally, telemedicine visits may have allowed clinicians to spend more time addressing chronic conditions like hyperlipidemia than in-person meetings.

In terms of platform, the US digital pharmacy market is segmented into app-based and website-based. The app-based is further segmented into telehealth pharmacy apps, medication management apps, health and wellness apps, compounding pharmacy apps, and others. The app-based segment held a larger market share in 2022 and the same segment is anticipated to register a higher CAGR of 17.60% during the forecast period. The app-based segment is further segregated into telehealth pharmacy apps, medication management apps, health and wellness apps, compounding pharmacy apps, and others. The growth of the segment is driven by growing technological advancements in telehealth pharmacy, proper medicine management, and growing usage of app-based healthcare devices. Virtual healthcare can be accessed through telehealth apps from anywhere. According to CDC data published in 2021, 37.0% of adults used telemedicine in 2020, including provider visits, online prescriptions, and mental health services. The best telehealth apps are free to download and easy to use, and they often completely cover insurance services. A few examples of telehealth pharmacy apps are Hims & Hers, GoodRx, K Health, and Doctor on Demand. GoodRx offers services such as low-cost visits, easy prescription refills via mail, and visits without health insurance.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com