Live Attenuated Vaccines Segment to Bolster Veterinary Vaccines Market Growth During 2024–2031

According to our new research study on "Veterinary Vaccines Market Forecast to 2031 – Global Analysis – by Technology, Animal Type, Route Of Administration, End User", the market was valued at US$ 9.13 billion in 2024 and is projected to reach US$ 13.67 billion by 2031; it is estimated to register a CAGR of 6.0% during 2025–2031. The Veterinary Vaccines Market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The increasing pet ownership and companion animal population and rising awareness of animal health are contributing to the growing Veterinary Vaccines Market size. However, the high cost associated with vaccines hampers the growth of the market. Further, technological advancements in veterinary vaccine products are expected to bring new Veterinary Vaccines Market trends in the coming years.

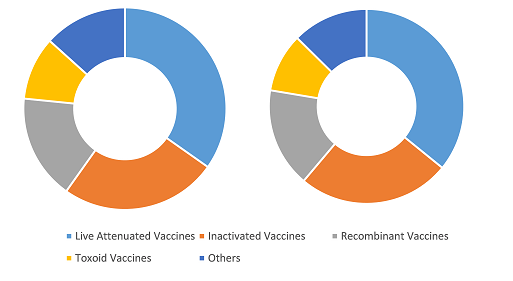

Veterinary Vaccines Market Share, by Technology, 2024 (%)

Veterinary Vaccines Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Live Attenuated Vaccines, Inactivated Vaccines, Recombinant Vaccines, Toxoid Vaccines, and Others), Animal Type (Companion {Dogs, Cat, Horses, and Others}, Livestock and Poultry {Chicken, Cattle, and Others}), Route of Administration (Intramuscular, Subcutaneous, and Others), End User (Veterinary Hospitals, Veterinary Clinics, and Others), and Geography

Veterinary Vaccines Market Report, Size, Opportunities by 2031

Download Free Sample

Source: The Insight Partners Analysis

Rising Pet Ownership and Companion Animal Population Bolsters Veterinary Vaccines Market Growth

The increasing ownership of companion animals has heightened awareness regarding pet health and preventive care, ultimately raising the demand for vaccines that protect them from infectious diseases. According to the American Pet Products Association (APPA), the percentage of US households reported owning a pet increased from 67% in 2019 to 70% in 2022. This trend prevails among developed countries and emerging economies such as India and China. These economies have seen a rise in pet adoption due to urbanization and higher disposable income. In September 2022, the World Health Organization (WHO) established vaccination campaigns for zoonoses, such as rabies, that can pass from animals to humans. The WHO promotes elimination campaigns for rabies, which include the vaccination of dogs on a mass scale as a preventive measure. Such initiatives encourage vaccine acceptance in developed and developing regions. In conclusion, the rising pet ownership and companion animal population are drive the growth of the veterinary vaccines market. This trend is fueled by changing societal attitudes toward pets, increasing disposable income, and global initiatives to control zoonotic diseases. As the pet healthcare industry continues to evolve, the demand for effective vaccines is expected to grow.

The veterinary vaccines market analysis has been carried out by considering the following segments: technology, animal type, route of administration, end user, and geography. The veterinary vaccines market, based on technology, is divided into live attenuated vaccines, inactivated vaccines, recombinant vaccines, toxoid vaccines, and others. The live attenuated vaccines segment held the largest share of the veterinary vaccines market in 2024, and it is expected to register the highest CAGR during 2024–2031. By animal type, the market is segmented into companion, livestock, and poultry.

As per the 2022 US Pet Ownership & Demographics, nearly 44.5% of the households in the US have dogs. According to the PDSA Animal Wellbeing (PAW) Report 2023, approximately 29% of people in the UK own a dog, which is estimated to be ~11 million pet dogs. As pet ownership is rising, pet health and wellness are becoming a priority for pet owners. This trend reflects the soaring demand for vaccines that prevent infectious diseases. Pet owners are seeking preventive measures, including vaccinations, to protect their pets from diseases such as rabies, distemper, and parvovirus in dogs or feline leukemia and calicivirus in cats. For instance, the Nobivac Canine Distemper Vaccine is widely administered to puppies to prevent distemper, a potentially fatal disease. The increasing number of dog owners opting for vaccinations is driving the demand for such vaccines. Vaccination requirements for pet travel have also contributed to this demand. Countries require proof of vaccination against diseases such as rabies for animals entering their borders. This regulatory requirement has fueled the need for companion animal vaccines, particularly those against infectious diseases. For example, the Rabies Vaccine for dogs and cats is required for international travel. In the US, rabies vaccination is mandated by law in many states, contributing to the demand for this vaccine. As international pet travel becomes more common, there is a growing demand for vaccines that comply with the importation regulations of countries. Advancements in veterinary medicine have led to the development of effective and safer vaccines, which has further fueled demand. Companies, including Zoetis, Merck Animal Health, and Boehringer Ingelheim have introduced vaccines for zoonotic diseases. Their increasing availability has contributed to the rising demand for immunization against respiratory infections in pets. In November 2024, Boehringer Ingelheim launched the EURICAN L4 vaccine, which offers protection against leptospirosis in dogs.

The geographic scope of the Veterinary Vaccines Market report includes the assessment of the market performance in North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America. The North America is expected to dominate the market in 2024.

The veterinary vaccines market in North America is segmented into the US, Canada, and Mexico. The US holds the largest market share, followed by Canada. Factors such as the growing launch of veterinary vaccines from market players, the increasing government support to provide cost-effective healthcare services, the rising strategic developments by the veterinary vaccine players to enhance services, and a growing healthcare industry that demands frameworks and guidelines based on real-world data for their business models contribute to the market growth. Livestock groups provide consumers with different products and services, including meat, milk, eggs, fiber, and draught power. Viral infection among livestock, companion animals, etc., is a critical aspect of animal health in the country. The viruses infecting animals spread at a faster rate. Thus, immunizations of the animal from such viruses are of prime importance in animal healthcare in the country. Foot-and-mouth disease is a highly contagious viral disease that affects cloven-hoofed animals, such as cattle, pigs, sheep, and goats. While the US has been free of FMD for decades, outbreaks in other parts of the world, particularly in regions with close international trade and animal transport, present an ongoing risk. The US government and agriculture industry are ready to respond quickly if an outbreak occurs, with vaccines being essential for managing and controlling the disease. According to the US Department of Agriculture, Animal and Plant Health Inspection Service (APHIS) invested ~US$ 42 million in foot-and-mouth disease vaccine antigen concentrate from private companies in 2022, with an additional US$ 30 million in 2023.

The increasing pet ownership is driving the demand for vaccinations for companion animals in the country. According to the 2023–2024 American Pet Products Association Survey, 66% of US households, which equates to 86.9 million households, own a pet. The rise in research and development activities is expected to further boost the growth of the veterinary vaccines market in the coming years.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com