Increasing Government Regulations on Wastewater Treatment Fuels Water Treatment System Market Growth

According to our latest market study on "Water Treatment System Market to 2031 – Global Analysis – by Type, Connection Type, Size, and Application," the water treatment system market is expected to grow from US$ 60.17 billion in 2023 to US$ 97.55 billion by 2031. It is expected to register a CAGR of 6.2% from 2023 to 2031.

The volume of wastewater is growing with the increase in population. Households and industries produce the majority of wastewater. Every year, ~380 billion cubic meters of municipal wastewater is produced worldwide. As a result, the requirement for proper infrastructure development in the wastewater management sector is growing, led by the growing population and rising urbanization. Governments of numerous countries are focusing on installing proper wastewater treatment facilities to protect the environment from pollution. For instance, in 2023, Cambi signed an agreement for the development of the Woodman Point Water Resource Recovery Facility in Perth and Western Australia. In 2022, there were more than 16,000 public wastewater management facilities in the US. Over 80% of the US population consumes drinking water from these facilities after proper treatment, and ~75% of the US population has sanitary treatment in these facilities. Thus, key factors bolstering the water treatment system market size include the growing importance of proper water treatment infrastructure.

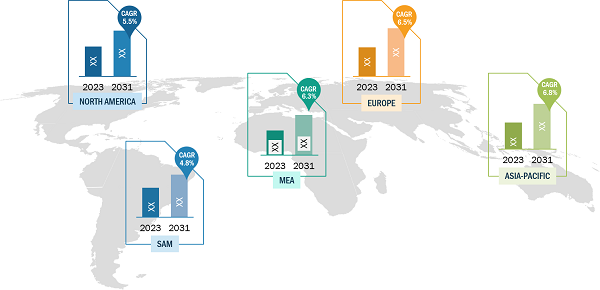

Water Treatment System Market Share — by Region, 2023

Water Treatment System Market Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Filtration Process (Distillation, Ultra-violet Sterilization, Reverse Osmosis, Filtration, Ion-exchange, Others), Type (Drinking Water Treatment System, Industrial Water Treatment Systems, Wastewater Treatment Systems, Portable Water Treatment Systems, Well Water Treatment Systems), Application (Ground Water, Brackish and Sea Water Desalination, Rainwater Harvesting, Drinking Water, Others), End User (Residential, Municipal, Agriculture, Food and Beverage, Commercial, Mining and Metal, Oil and Gas, Pharmaceuticals, Others), and Geography

Water Treatment System Market Forecast and Size by 2031

Download Free Sample

Source: The Insight Partners Analysis

Governments of various countries across the globe are focusing on building wastewater treatment facilities. For instance, in August 2022, the United States Department of Agriculture announced a US$ 75 million investment in an infrastructure development project that involves offering clean drinking water and sanitary wastewater systems to Greenbrier County residents in the rural area. Additionally, in December 2022, the US government announced to invest US$ 84.7 million from President Biden's Bipartisan Infrastructure Act to help 36 communities that experienced drought in the Western part of the US. These projects have brought clean, dependable drinking water to communities across these areas by funding groundwater storage, rainwater harvesting, water reuse, ion exchange treatment, aquifer recharge, and other methods for encompassing the utilization of existing water supplies. In March 2022, the US Department of the Interior stated that the Bureau of Reclamation invested US$ 420 million in rural water-building efforts in fiscal year 2022. This investment in rural water systems includes operations associated with the building of water treatment facilities and pipeline connections. Thus, the water treatment system market size is likely to surge by 2030 owing to rising investments in wastewater treatment facilities. However, high maintenance and installation costs of water treatment systems are a few of the factors hampering the market growth.

Adequate water supply, proper sanitation, including wastewater management, and assured clean drinking water availability are a few of the requirements of a smart city. Developing new infrastructures such as universities, schools, housing, and IT data centers requires high-quality water and wastewater treatment facilities. For instance, in 2023, Kerala Water Authority and the city corporation initiated a project on utilizing Japanese decentralized wastewater treatment plants known as "Johkasou" in the city. In 2023, the governments of Canada and British Columbia invested US$ 24.3 million in the construction of a water treatment plant. The construction of metro facilities, new airports, and commercial spaces is also anticipated to fuel the demand for clean water facilities. Thus, the development of smart cities in emerging countries is expected to bring new water treatment system market trends in the coming years.

The reverse osmosis segment accounted for 24.9% of the water treatment system market share in 2023, and it is anticipated to maintain its dominance during the forecast period. Reverse osmosis is used to remove pollutants, such as fluoride, pharmaceuticals, arsenic, lead, and pesticides, from water. Also, it reduces the odor of the water and removes chlorine for improved taste. The system is highly preferred in municipal water purification, desalination of seawater, industrial boiler feed water, and wastewater treatment, among others. Due to the wider scope of the technology and its utilization in residential and commercial applications, the market for the segment is anticipated to grow at a significant pace. Stringent government regulations regarding water quality, an increase in water pollution levels, a rise in demand for pure water, and an increase in awareness about the importance of pure and safe drinking water are projected to boost the demand for water treatment systems that use reverse osmosis. This is likely to fuel the water treatment system market growth during the forecast period.

Geographically, the scope of the water treatment system market report is divided into North America (US, Canada, and Mexico), Europe (France, Italy, Germany, UK, Russia, and Rest of Europe), Asia Pacific (Australia, India, China, Japan, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, South Africa, Egypt, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

In terms of revenue, North America is the second-largest contributor to the water treatment systems market. The water treatment system market in North America is segmented into the US, Canada, and Mexico. The growing focus on environmental pollution and sustainability is driving the demand for water treatment facilities in the region. For instance, in July 2023, the US Department of Interior invested ~US$ 152 million as a part of the Bipartisan Infrastructure Law to bring clean and reliable drinking water to communities across the Western US. The projects were initiated in California, Colorado, and Washington in an area of 1.7-million-acre feet for the additional water storage capacity. The funding was also made available to advance water storage capacities in that area.

The water treatment system market analysis is carried out by identifying and evaluating key players in the market across different regions. Pentair plc, Xylem Inc, GE Water & Process Technologies, MPW Industrial Services, Suez Environment, Pall, and Veolia Water Technologies are among the key players offering water treatment systems and services in North America. Companies operating in the water treatment systems market are taking strategic initiatives and utilizing technologies for water treatment facilities. For instance, in May 2020, Veolia launched SIRION Pro, which is a skid-mounted reverse osmosis system for high-purity water production. Similarly, in 2022, Pentair announced the expansion of its residential water treatment offerings with its Pentair water solutions segment. Thus, such developments and growing investment in water management infrastructure are propelling the growth of the water treatment systems market in North America.

In the US, the demand for water treatment systems is widely generated by agricultural, commercial, municipal, industrial, and institutional end users. Additionally, stern government policies and regulations in terms of proper application of onsite wastewater treatment systems, growing occurrences of aquatic diseases, and development in portable water treatment technology are the major factors boosting the growth of the water treatment systems market in the US. Moreover, the demand for water treatment continues to retain its importance in the country with rapid industrialization. The US government is concentrating on installing proper wastewater treatment amenities to protect the environment from pollution. For instance, in 2023, Cambi signed an agreement for the development of the Woodman Point Water Resource Recovery Facility in Perth and Western Australia.

Hitachi Zosen Corporation; Pentair PLC; Thermax Limited; Xylem Inc; Veolia Environnement SA; Pall Corp; Culligan International Co; Dupont De Nemours Inc; Thermo Fisher Scientific Inc; 3M Co.; Aqua Filsep Inc; Pure Aqua, Inc.; RITE Water Solutions (India) Pvt. Ltd.; Aquatec International LLC; and Filtra-Systems Company LLC are among the prominent players profiled in the water treatment system market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com