The X-ray detectors market was valued at US$ 2,890.26 Million in 2021; registering at a CAGR of 5.8% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Flat-Panel Detectors Segment to Lead X-Ray Detectors Market During 2022–2028

The report highlights trends prevailing in the market and factors driving its growth. The market growth is mainly attributed to the increasing incidence and prevalence of chronic disorders along with new product launches and approvals. However, the high cost of digital X-rays detectors and health hazards associated with X-rays hamper market growth.

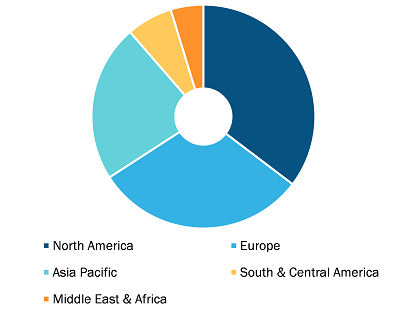

X-Ray Detectors Market, by region, 2021 (%)

X-Ray Detectors Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type [Flat-Panel Detectors, Computed Radiography (CR) Detectors, Charge Couple Device (CCD) Detectors, and Line-Scan Detectors], Application (Medical Applications, Dental Applications, Veterinary Applications, and Other Applications), and End User (Hospitals, Diagnostic Laboratories, Clinics, and Other End Users)

X-Ray Detectors Market Regional Overview by 2028

Download Free Sample

Source: The Insight Partners Analysis

Based on type, the X-ray detectors market is segmented into computed radiography (CR) detectors, flat-panel detectors, line-scan detectors, and charge couple device (CCD) detectors. The flat-panel detectors segment held the largest share of the market in 2021 and is anticipated to register the highest CAGR in the market during the forecast period. Flat-panel detectors are used in digital radiography to convert X-rays to charge (direct conversion), which is then interpreted using a thin film transistor array. There are various options for flat panel detectors of indirect types like amorphous silicon flat panel detectors and CMOS. Amorphous silicon flat-panel detectors are found to be the most suitable semiconductor for large-area devices. In addition, the introduction of Complementary Metal Oxide Semiconductor (CMOS) flat-panel detectors into the X-ray imaging industry is likely to favor the growth of the market. CMOS is a good substitute for other indirect detectors because of numerous benefits such as higher frame rates and decreased image lags. Moreover, flat-panel detectors are used for medical imaging, such as CT, X-ray, and mammography, as well as in some extraoral imaging devices. The high demand for these detectors and advantages, such as excellent image quality and the ability to retrofit into existing X-ray tables, propel the market's growth.

Impact of COVID-19 Pandemic on X-Ray Detectors Market

The COVID-19 pandemic hampered the harmony of manufacturing, healthcare, aerospace & defense, and construction industries in 2020. Initially, spike in COVID-19 cases affected the growth of X-ray detectors worldwide. Hospital visits of patients suffering from cardiovascular diseases, cancer, and dental problems decreased due to worldwide increase in the cases of COVID-19. As patients were skeptical of visiting hospitals due to fear of contracting COVID-19 infection, the number of surgeries and procedures carried out for treatment of these diseases drastically declined. For example, all appointments for routine dentist visits in the UK were suspended from March 2020. Liverpool University Dental Hospital (LUDH) stopped routine dental care from March 2020 following the advice from National Health Service (NHS) England. Face-to-face treatment within the general dental practice was restricted to urgent and emergency conditions. Due to restricted access to dental services, the number of dental treatments performed fell dramatically, which affected the demand for X-ray detectors.

However, the COVID-19 pandemic boosted the growth of the X-ray detectors market in response to the increasing demand for chest X-rays. Several research activities were conducted for helping the society recover from the chaotic situation. For instance, Louisiana State University Health Sciences Center New Orleans, in September 2020, conducted a study on ~400 people to study COVID-19 effects. They evaluated the RT-PCR and chest X-rays and experienced that chest X-rays are 96.6% accurate in detecting SARS-CoV-2. Also, digital X-ray devices provide digital images, which is a very important advantage amid the pandemic, as the maintenance of films could lead to a tedious workflow. In July 2022, KA Imaging launched Reveal, the world’s first dual-energy X-ray detector that can be used on the bedside. If a hospital wishes to use dual energy X-ray for COVID-19, it can simply replace any older computed radiography (CR) plate or digital fixed or portable detector with Reveal.

PerkinElmer Inc, Varian Medical Systems Inc, FUJIFILM Holdings Corp, Teledyne Technologies Inc, Analogic Corp, Konica Minolta Inc, Canon Inc, Varex Imaging Corp, Rigaku Corp, and Moxtek Inc. are among the leading companies operating in the X-ray detectors market.

The report segments the global X-ray detectors market as follows:

The X-ray detectors market is segmented based on type, application, and end users. Based on type, the market is subsegmented into computed radiography (CR) detectors, flat-panel detectors, line-scan detectors, and charge couple device (CCD) detectors. By application, the market is categorized into medical, dental, veterinary, and other applications. In terms of end user, the market is further segmented into hospitals, diagnostic laboratories, clinics, and other end users. Geographically, the market is been segmented into North America (US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), APAC (China, India, Japan, Australia, South Korea, and the Rest of APAC), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, and the Rest of MEA), and South & Central America (Brazil, Argentina, and the Rest of SCAM).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com