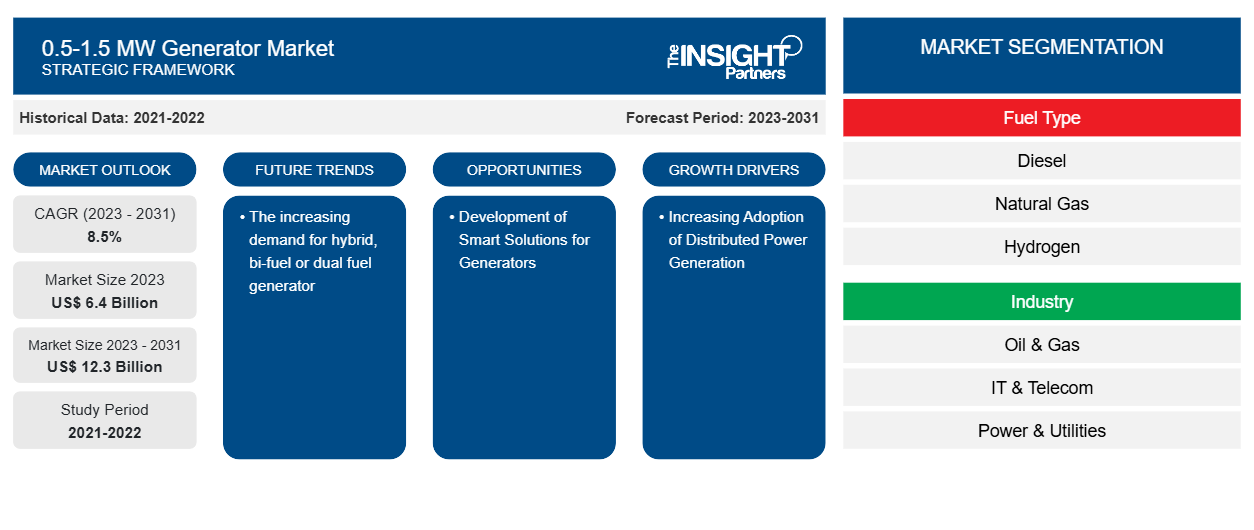

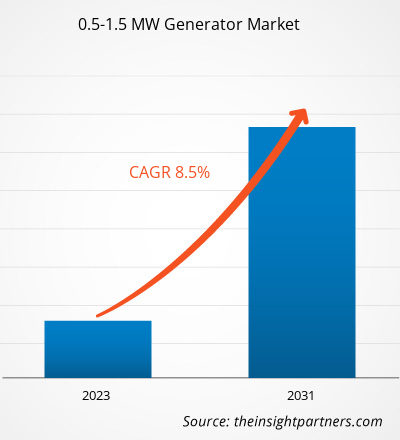

The 0.5-1.5 MW generator market size is projected to reach US$ 12.3 billion by 2031 from US$ 6.4 billion in 2023. The market is expected to register a CAGR of 8.5% during 2023–2031. The increasing demand for hybrid, bi-fuel or dual-fuel generators is likely to remain a key trend in the market.

0.5-1.5 MW Generator Market Analysis

Increasing demand for uninterrupted power supply is projected to drive the 0.5-1.5 MW generator market market growth during the forecast period. In addition, the rising demand for distributed power generation is projected to boost the 0.5-1.5 MW generator market growth in the coming years. Moreover, a rise in investment towards research and development of smart generator solutions is expected to create opportunities for the key players operating in the market from 2023 to 2031. Furthermore, the increase in demand for portable generators with a capacity of less than 1.5 MW is expected to fuel the market growth in the coming years.

0.5-1.5 MW Generator Market Overview

The key players in the global 0.5-1.5 MW generator market ecosystem include component manufacturers, 0.5-1.5 MW generator manufacturers and end users. The component manufacturers operating in the global 0.5-1.5 MW generator market offer numerous parts and components for manufacturing 0.5-1.5 MW generators. Various types of components are used to manufacture these generators: engines, alternators, fuel systems, voltage regulators, cooling and exhaust systems, control panels, and others. Timely delivery of all of these components is critical to the efficient operation of all generator manufacturing facilities. Thus, any operational impact on these component suppliers will directly impact the 0.5-1.5 MW generator market. The manufacturers of 0.5-1.5 MW generators are engaged in various processes involving design, assembly and production to convert the raw material into a finished good.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

0.5-1.5 MW Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

0.5-1.5 MW Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

0.5-1.5 MW Generator Market Drivers and Opportunities

Increasing Adoption of Distributed Power Generation to Favor Market

The increasing demand for power is leading to various forms of decentralized power generation. Although solar PV and other renewable technologies receive the majority of coverage, they represent only a small portion of the distributed market. In order to meet the increasing demand for power, diesel generators were used for decentralized power generation. However, due to factors such as cheap natural gas and increasingly stringent environmental regulations, demand for distributed natural gas generation (DNGG) technologies is increasing. Due to the increasing demand for compact, resilient, and switchable power supply, the demand for DNGG in the market is also increasing. Various companies use technology to provide continuous power to their facilities. Therefore, the demand for DNGG is increasing as it is a reliable power source, which further promotes the growth of the 0.5-1.5 MW generator market.

Development of Smart Solutions for Generators

Nowadays, even the basic generators have a control panel that helps the operator check the functional status of the generator during operation. To further develop the control panel, intelligent functions are integrated that provide information about power, remaining fuel, and other functions. Some smart generators also help to check performance and status using an app on the mobile phone. In addition, various large standalone generators used in hospitals, hotels, industrial plants, and other companies have a remote monitoring solution. These generators provide a complete analysis of how much fuel the generator uses at quarter, half, or full load. This fuel consumption rate allows customers to calculate how much fuel they need for a given time.

Additionally, some generators send telephone alerts when verification is required. This helps operators keep the health of their generators under control even when they are not around. Additionally, technologies such as solder are increasingly being integrated into 0.5-1.5 MW generators to make them smarter. For example, in March 2021, Trinetra announced that it had partnered with the diesel generator manufacturer to digitally improve generator activities using IoT. The generator's centralized solution is supported by GPS, allowing remote assets to be monitored and tracked 24/7. Additionally, the company has deployed an IoT solution to automate its process and reduce manual interventions. Therefore, developing such smart solutions for the 0.5-1.5 MW generator will further increase the demand in the market.

0.5-1.5 MW Generator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the 0.5-1.5 MW generator market analysis are fuel type and industry.

- Based on fuel type, the 0.5-1.5 MW generator market is divided into diesel, natural gas, hydrogen, and others. The diesel segment held a larger market share in 2023.

- Based on industry, the market is classified into oil & gas, IT & telecom, power & utilities, and others. The IT & telecom segment held the largest share of the market in 2023.

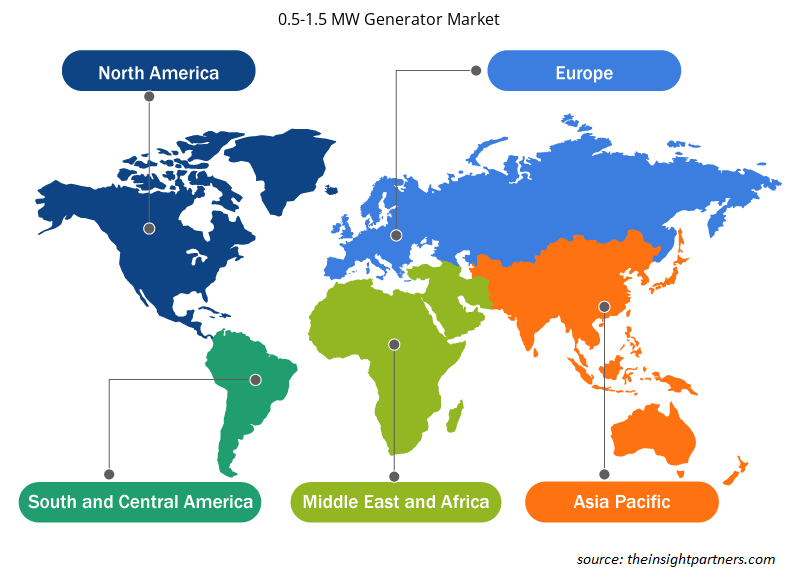

0.5-1.5 MW Generator Market Share Analysis by Geography

The geographic scope of the 0.5-1.5 MW generator market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Based on geography, the global 0.5-1.5MW Generator market is segmented into North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM). Asia Pacific registered the largest 0.5-1.5 MW generator market market share in 2023, followed by North America and Europe. China is one of the prominent countries in the 0.5-1.5 MW generator market in the Asia Pacific. Rising industrialization in countries such as China, Japan, Taiwan, Indonesia, and Singapore and growing manufacturing industry in these countries are a few factors that are creating the demand for the installation of 0.5-1.5MW Generators for uninterrupted power supply. Asia Pacific countries including as China, Japan, South Korea, and India observed a significant paradigm shift in respective industrial sectors with digitization and automation, which requires nonstop functioning of machines in industries, which increased the demand for 0.5-1.5MW Generators to ensure the continued functioning of these machinery, which is contributing to the APAC 0.5-1.5MW Generators market growth.

0.5-1.5 MW Generator Market Regional Insights

The regional trends and factors influencing the 0.5-1.5 MW Generator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses 0.5-1.5 MW Generator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for 0.5-1.5 MW Generator Market

0.5-1.5 MW Generator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.4 Billion |

| Market Size by 2031 | US$ 12.3 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

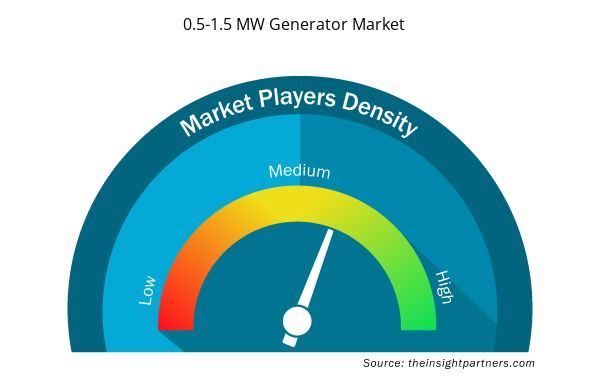

0.5-1.5 MW Generator Market Players Density: Understanding Its Impact on Business Dynamics

The 0.5-1.5 MW Generator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the 0.5-1.5 MW Generator Market are:

- Siemens Energy

- Atlas Copco AB

- ABB Ltd

- Caterpillar Inc.

- Cummins Inc

- Yanmar Holdings

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the 0.5-1.5 MW Generator Market top key players overview

0.5-1.5 MW Generator Market News and Recent Developments

The 0.5-1.5 MW generator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the 0.5-1.5 MW generator market are listed below:

- Cummins introduces CENTUM Series generators which provide the flexibility to deliver precise power in a smaller footprint while meeting evolving sustainability standards. These generators are made to meet the precise power needs of the customers with high-efficiency engines that fit in smaller footprints. (Source: Cummins, Inc., Press Release, July 2022)

- Cummins launches new 1MW twin pack rental power diesel generator. The C1000D6RE offers a competitive rental power solution for a diverse range of applications throughout North America by Cummins. (Source: Cummins, Inc., Press Release, June 2022)

0.5-1.5 MW Generator Market Report Coverage and Deliverables

The “0.5-1.5 MW Generator Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- 0.5-1.5 MW generator market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- 0.5-1.5 MW generator market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- 0.5-1.5 MW generator market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the 0.5-1.5 MW generator market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sterilization Services Market

- Underwater Connector Market

- Pharmacovigilance and Drug Safety Software Market

- Analog-to-Digital Converter Market

- Artificial Intelligence in Defense Market

- Environmental Consulting Service Market

- Customer Care BPO Market

- Ketogenic Diet Market

- Medical Devices Market

- Europe Industrial Chillers Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Fuel Type, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

8.5% is the expected CAGR of the 0.5-1.5 MW generator market.

US$ 12.3 billion estimated value of the 0.5-1.5 MW generator market by 2031.

Siemens Energy, Atlas Copco AB, ABB Ltd, Caterpillar Inc., Cummins Inc, Yanmar Holdings, Generac Power Systems, Kohler Co., Mitsubishi Heavy Industries, and Rolls Royce Holdings are some of the leading players in the 0.5-1.5 MW generator market.

The increasing demand for hybrid, bi-fuel or dual fuel generators is the future trend of the 0.5-1.5 MW generator market

Asia Pacific dominated the 0.5-1.5 MW generator market in 2023.

Get Free Sample For

Get Free Sample For