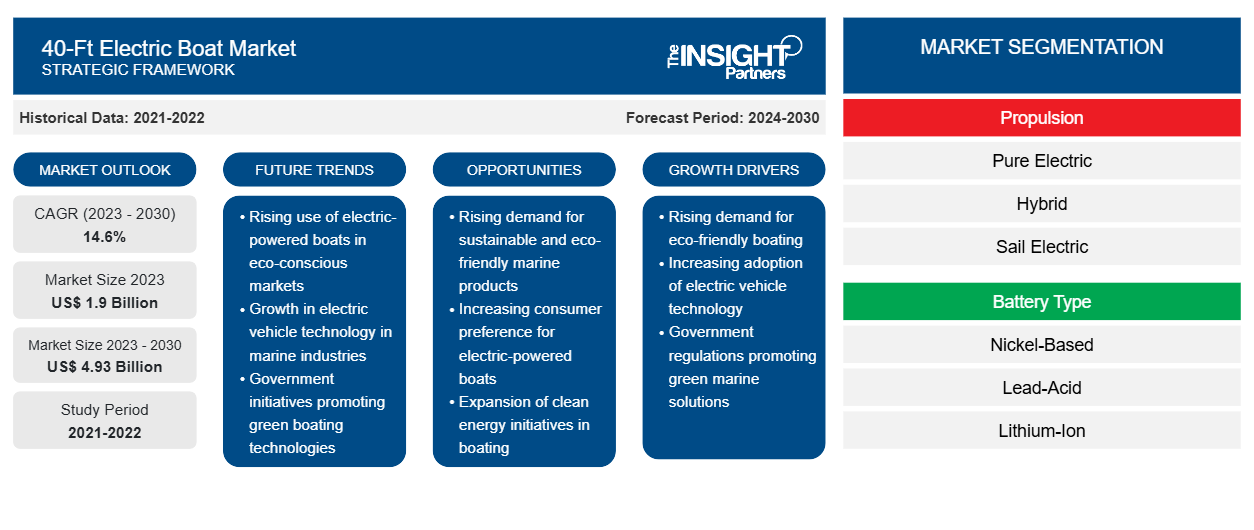

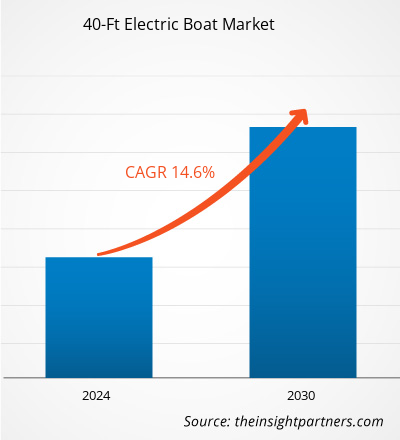

[Research Report] The 40-Ft Electric Boat Market expected to grow from US$ 1.90 billion in 2023 to US$ 4.93 billion by 2030; it is estimated to register a CAGR of 14.6% from 2023 to 2030.

Analyst Perspective

Growing concerns about greenhouse gas (GHG) emissions and rising inclination toward recreational boating in the tourism sector are expected to drive the demand for electric boats over the forecast period. In addition, supportive government initiatives for controlling GHG emissions are expected to boost the demand for electric boats. For instance, in Europe, the UK became the first G7 country to target net-zero greenhouse gas emissions by 2050, including adopting electric boats and vehicles. Research and developments to improve battery capacity and durability and customizations of hybrid boats to boost efficiency and operational capabilities are supporting market growth. In addition, the rising emphasis on eco-friendly or fully electric boats to reduce greenhouse gas emissions is contributing to the growth of the 40-Ft Electric Boat Market. For instance, in June 2021, South Korea’s first commercialized hydrogen-electric boat was launched at the 2021 Busan International Boat Show by Danfoss.

Market Overview

Electric boats are marine vessels that utilize electric propulsion systems for their operation. These boats rely on battery power to drive the rotor and achieve optimal speed. The key components of an electric boat include the electric charger, battery bank, controller, and electric motor. One of the major advantages of electric boats is their reliance on clean energy, resulting in zero emissions. The global 40-Ft Electric Boat Market is witnessing substantial growth due to the increasing popularity of seaborne activities and the thriving marine tourism industry. The key market players are engaged in developing technologically advanced electric boats. For instance, X Shore offers one model called Eelex 8000, equipped with a 120-kWh lithium-ion battery pack and an electrical inboard motor, with a top speed of 35 knots and a range of 35 nautical miles at 20–24 knots. The Eelex 8000 is eight meters long, has a conventional planning hull, and is designed for a functional boating life, with open spaces and a steering wheel with a sunroof in the middle. Electric boat companies are growingly focusing on improving battery efficiencies and range by enhancing charging infrastructure. The presence of large number of electric boat manufacturers are competing at large scale primarily based on charging technology (features) and availability of presence across the globe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

40-Ft Electric Boat Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

40-Ft Electric Boat Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver

Increasing Network for Charging Points in Marine Infrastructure for Small Boats to Drive Growth of 40-Ft Electric Boat Market

In Europe and North America, there has been a significant rise in the demand for electric boats, mainly due to the increasing number of leisure boats and watersport activities. Growing tourism and rising fishing activities are expected to boost the demand for electric boats. In addition, the development of speedboats is expected to fuel innovations in charging infrastructure. The average speed of an electric speedboat is around 60 mph (100 km/h). Major global speedboat manufacturers include Candela, X Shore, and Orust E-boats. Further, the increasing government support for the electrification of leisure boats is expected to boost the demand for a network of charging stations across marine lines or seaports. For instance,, the Swedish government plans to speed up the electrification of the transport sector to reach the climate goals with emission control, including projects for electricity roads, marine infrastructure for charging, and an electrification commission by 2030. The major focus on electrification of all transportation type is expected to contribute to the demand for electric boats.

In addition, the increasing collaboration between market players to build charging stations is a key factor contributing to the growth of the 40-Ft Electric Boat Market. To electrify leisure boats, cities, municipalities, and companies along the European coastline have taken many projects and initiatives. For instance, in 2021, Candela partnered with solar energy supplier Nordsol Energi to install and develop charging stations for electric leisure boats in different key areas in Stockholm, Sweden. Similarly, in June 2020, in Norway, under the initiative "The Green Tail," a network of charging points was established in marinas along the coast around Bergen and the surrounding municipalities in Norway. Further, the Norwegian Coastal Administration has created a web solution that provides an overview of all charging points, shore power plants, LNG plants, etc. Thus, an increasing number of investments in establishing charging stations at seaports is anticipated to fuel the demand for electric boats during the forecast period.

Segmental Analysis

Based on the battery type, the market is segmented into nickel based, lead acid, and lithium-ion. Lithium-ion battery segment held the largest share of the market in 2020 and is anticipated to register the highest CAGR in the market during the forecast period. Lithium-ion battery is most prominent and advanced solution for the electric boats, as it offer enhanced performance and storage capacity with limited space. A lithium-ion battery features smaller, lighter, long-lasting, and faster-charging features. Lithium-ion boat battery is gaining popularity because it excels significantly at high-performance battery tasks and is suitable for storing high-capacity power. In October 2021, Electric Fuel—a leading manufacturer of professional high-performance batteries—launched its new 48V high energy density lithium-ion marine battery at the METSTRADE 2021 show. These new marine-grade smart batteries offer four times more energy than traditional lead-acid batteries of a comparable size. Also, these batteries are largely used in commercial marine applications, supporting rigid-hulled inflatable boats, yachts, and racing sailboats. However, sensitivity to high temperatures and vulnerability to external factors are among the major factors limiting the adoption of lithium-ion batteries in electric boats. In October 2019, the Norwegian Maritime Authority published an alert concerning a small fire that erupted in a passenger ferry after a gas explosion on board in Norway. The authority warned operators, shipowners, and other stakeholders about the dangers associated with lithium-ion battery systems.

Regional Analysis

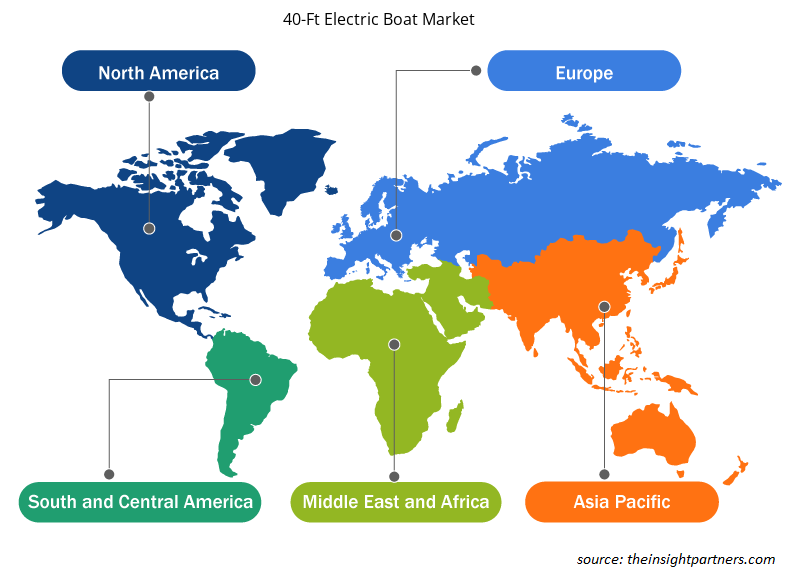

The electric boat in North America was valued at US$ 2.1 billion in 2021 and is projected to reach US$ 5.4 billion by 2028; it is expected to grow at a CAGR of 14.5% from 2022 to 2028. The US, Canada, and Mexico are among the major countries in North America. Increasing water sports activities and favorable government policies to promote water sport and develop boating infrastructure are among the major factors driving the 40-Ft Electric Boat Market growth in North America. During the COVID-19 pandemic, the imposition of restrictions on trade activities and shutdown of manufacturing facilities hampered the market growth in North America. However, from the second half of 2020, the market is witnessing growth due to the reliving of travel bans.

Furthermore, key players in North America are improving the production processes of electric boats and taking several strategic initiatives to increase the penetration of electric boats. For instance, In May 2021, Limestone Boat Company and Vision Marine Technologies, which produces outboard engines, entered a strategic partnership to develop electric outboard motors. Also, the partnership aims to increase production from 400 to 510 powerboats by the end of 2022. In March 2022, Aqua superPower and X Shore, a Swedish climate technology company and electric boat manufacturer, announced a strategic alliance to expedite electric boat adoption across the region and provide an accessible app to 150 kW superchargers specifically engineered and rated to use in marine environments. Such initiatives fuel the 40-Ft Electric Boat Market growth in North America.

With providing higher speeds that helps lift the boat hull, as well as available in a longer range; demand for electric boats is growing tremendously. Also, companies in the market innovate, design, manufacture, and sell handcrafted and environmentally friendly electric recreational power boats. Cruising, water-sports, and fishing are some of the most popular and preferable activities among citizens. The market caters to several opportunities for the vendors toward expanding 40-Ft Electric Boat Market in the country. In November 2021, Arc Boat Company, which has a team of former SpaceX engineers invested US$ 30 million in venture capital financing and built a luxury power boats in Los Angeles, US. However, switching to an all-electric boat model across several individual boat owners or ferry operators has become a challenging factor and higher expenses stopping most prospective buyers, even with the lower maintenance and energy costs. In February 2021, National Marine Electronics Association (NMEA) has announced NMEA 2000 certification for its new CANverter gateway device provided by VETUS, which is a complete boat systems supplier. In addition, the launch of the CANverter enables connection of the proprietary VETUS Controller Area Network (V-CAN) into the NMEA 2000 network. These growing number of initiatives and investment thereby propels the market growth in the country.

Key Player Analysis

The 40-Ft Electric Boat Market analysis consists of the players such as Frauscher, Duffy Electric Boat Company, Rand Boats APS, Vision Marine Technologies, Quadrofoil D.O.O, Ruban Bleu, Aquawatt Mechatronik and Yachtbau, Candela, and Budsin Wood Craft. Among the players in the electric boat Duffy Electric Boat Company and Budsin Wood Craft are the top two players owing to the diversified product portfolio offered.

40-Ft Electric Boat Market Regional Insights

40-Ft Electric Boat Market Regional Insights

The regional trends and factors influencing the 40-Ft Electric Boat Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses 40-Ft Electric Boat Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for 40-Ft Electric Boat Market

40-Ft Electric Boat Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.9 Billion |

| Market Size by 2030 | US$ 4.93 Billion |

| Global CAGR (2023 - 2030) | 14.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Propulsion

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

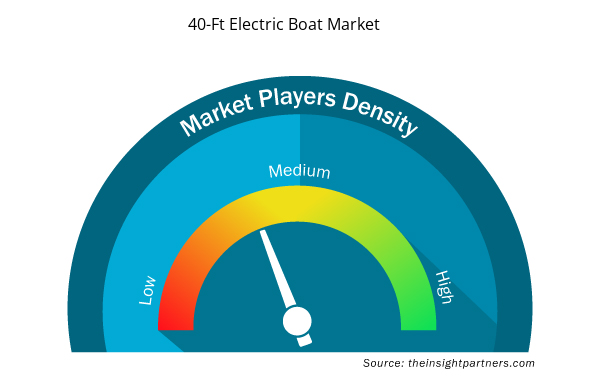

40-Ft Electric Boat Market Players Density: Understanding Its Impact on Business Dynamics

The 40-Ft Electric Boat Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the 40-Ft Electric Boat Market are:

- Frauscher Bootswerft GmbH & Co KG

- Duffy Electric Boat Co

- RAND Boats Aps

- Vision Marine Technologies Inc

- Quadrofoil DOO

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the 40-Ft Electric Boat Market top key players overview

Recent Developments

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the 40-Ft Electric Boat Market. A few recent key market developments are listed below:

- In August 2022, Polestar Automotive Holding—an electric car maker—agreed to share battery technology with Candela Speed Boat AB, a startup trying to electrify leisure boats and water taxis. In addition to those listed previously, several other important companies have been studied and analyzed during this research study to get a holistic view of the ecosystem.

- In 2022, Canadian tech firm vision marine technologies are testing the traditional boating world with its powerful electric motor.

- In 2022, The Electric-car maker company Polestar Automotive Holding has agreed to share battery technology with Candela Speed Boat AB, a startup trying to electrify leisure boats and water taxis.

- In 2022, Danish boat builder Rand Boats has introduced a new electric runabout boat called the Spirit 25, also available in a gas-powered version.

- In 2021, The company has raised $24 million to accelerate production of its existing small craft and a larger commercial one in pursuit of a cleaner and generally more future-proof waters.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Propulsion, Battery Type, Application, Voltage Architecture, and Boat Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The US is expected to hold a major market share of 40-Ft Electric Boat market in 2023.

UK, US, and Canada are expected to register high growth rate during the forecast period.

The global market size of 40-Ft Electric Boat market by 2030 will be around US$ 4.93 billion

Pure electric segment is expected to hold a major market share of 40-Ft Electric Boat market in 2023.

Frauscher Bootswerft GmbH & Co KG, Natural Yachts BV, ESMARIN LTD, Cockwells Modern & Classic Boatbuilding Ltd, and Navalt Inc are the key market players expected to hold a major market share of 40-Ft Electric Boat market in 2023.

The estimated global market size for the 40-Ft Electric Boat market in 2023 is expected to be around US$ 1.90 billion

1. Growing Tourism Industry

2. Rising Installation of Charging Infrastructure

The 40-Ft Electric Boat market is expected to register an incremental growth value of US$ 3,029.22 million during the forecast period.

North America is expected to register highest CAGR in the 40-Ft Electric Boat market during the forecast period (2023-2030).

Increasing Demand for Solar-Powered Electric Boat

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Electric Boat Market

- Frauscher Bootswerft GmbH & Co KG

- Duffy Electric Boat Co

- RAND Boats Aps

- Vision Marine Technologies Inc

- Quadrofoil DOO

- LTS MARINE

- RUBAN BLEU SAS

- aquawatt Mechatronik und Yachtbau

- Wellington Electric Boat Building Co

- Cockwells Modern & Classic Boatbuilding Ltd

Get Free Sample For

Get Free Sample For