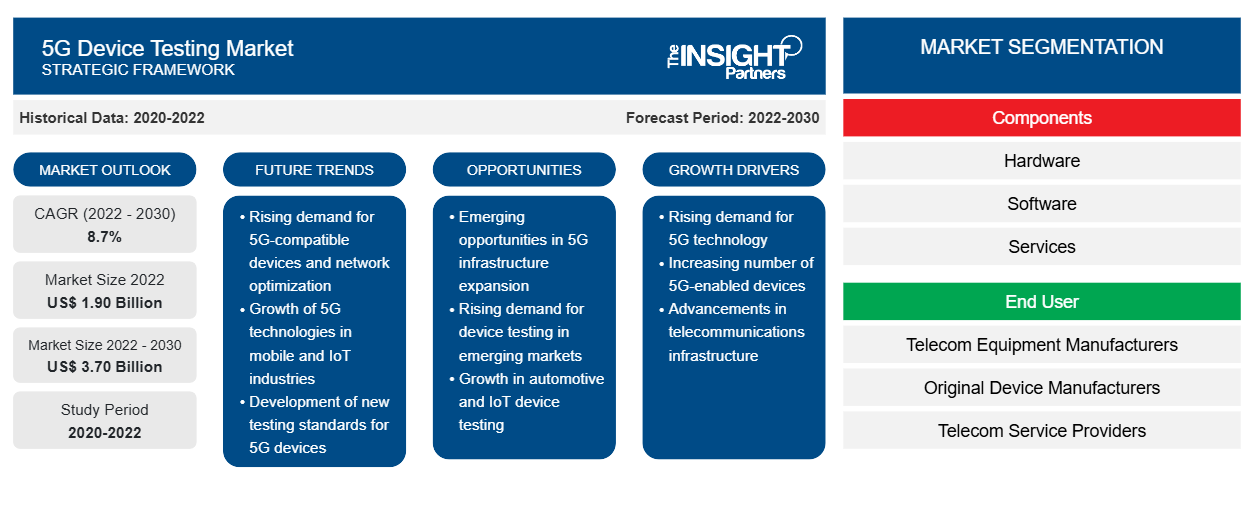

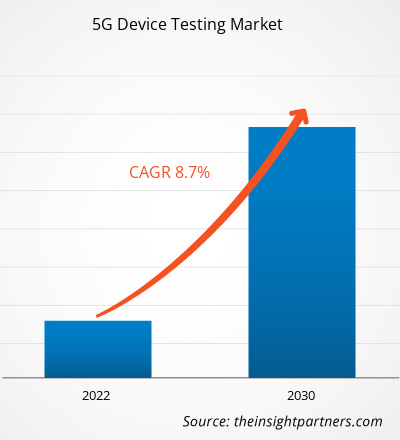

[Research Report] The 5G device testing market size is expected to grow from US$ 1.90 billion in 2022 to US$ 3.70 billion by 2030; it is anticipated to expand at a CAGR of 8.7% from 2022 to 2030.

Analyst Perspective:

The 5G device testing market offers several opportunities and trends, such as the rising demand for 5G testing equipment to validate virtualized network functions, the growing adoption of 5G testing equipment for smart cities and IoT applications, and the innovation and development of new 5G testing equipment and solutions. These factors may create new market segments and enhance market competitiveness and differentiation. The market is also driven by factors such as the increasing usage of IoT and connected devices, the need for high-speed and low-latency connectivity, the emergence of new use cases, and the increasing adoption of 5G technology across various industries.

Market Overview:

5G device testing is the process of evaluating, validating, and optimizing the performance, functionality, and compatibility of devices that operate on 5G wireless networks and technologies. 5G device testing involves various types of tests, such as radio frequency (RF) tests, protocol tests, application tests, and conformance tests, that cover different aspects of the device's behavior and interaction with the network. 5G device testing requires specialized testing and measurement tools, devices, and solutions that can simulate and emulate 5G networks and scenarios, as well as measure and analyze the device's parameters and performance. 5G device testing is essential for ensuring that devices and networks meet the necessary standards and regulatory requirements, as well as the quality of service, reliability, and security expectations of the end users. 5G device testing is applicable to various end users, such as telecom equipment manufacturers, original device manufacturers, and telecom service providers.

The increasing adoption of 5G network deployment and the implementation of software-defined testing are also driving the growth of the 5G device testing market. Furthermore, the emergence of a hyper-connected world is expected to increase the demand for 5G test equipment. Countries such as India and China, as well as other developing countries, are accompanying an increase in the use of connected devices, resulting in increased data traffic within networks. This necessitates the construction of secure, dependable, and efficient networks. For instance, Cavli, an IoT hardware solution provider platform, launched a significant 5G test network in India in February 2020, demonstrating the transformative impact of 5G technology, particularly in the domains of smart cities and industries globally.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

5G Device Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

5G Device Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Usage of IoT and Connected Devices Drives Market Growth

5G applications are expanding at a significant rate due to the mounting usage of IoT and linked devices. The demand for 5G device testing is expected to increase as 5G becomes more widely available in various industries such as construction, security, entertainment, and automobiles. The rise of new applications and business models, combined with lower device costs, has facilitated Internet of Things (IoT) adoption and, as a result, a proliferation of connected devices. This includes connected automobiles, wearables, machinery, meters, and consumer electronics, all of which have contributed significantly to market growth. The introduction of IoT and machine-to-machine connections, which have been instrumental in driving the market, aligns with the ongoing Industrial Revolution 4.0, fostering cellular connectivity advancements across various industries. As a result, the growing telecommunications user base and global R&D activities are expected to drive the demand for 5G device testing, thereby propelling the 5G device testing market throughout the forecast period.

Segmentation and Scope:

The "5G Device Testing Market" is segmented on the basis of component, end user, and geography. In terms of component, the market is segmented into hardware, software, and services. Based on end user, the market is segmented into telecom equipment manufacturers, original device manufacturers, telecom service providers, and others. Based on geography, it is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Segmental Analysis:

Based on components, the market is segmented into hardware, software, and services. The hardware segment is expected to grow at a significant CAGR during the forecast period. This is due to the increasing complexity of 5G networks, which require sophisticated testing equipment. Hardware is further divided into network analyzers, signal generators, spectrum analyzers, oscilloscopes, and others. Network analyzers are useful for evaluating the signal and data transmission quality in 5G devices. They aid in the detection and resolution of signal distortions, interference, and anomalies, ensuring that devices meet stringent quality standards. The signal generators segment is expected to grow at the fastest CAGR during the forecast period. This is due to the increasing demand for 5G devices and the need to test them for performance and compliance with standards. A spectrum analyzer assesses the magnitude of an input signal versus frequency over the instrument's entire frequency range. The primary application is to determine the strength of the spectrum of known and unknown signals. An oscilloscope, also known as an oscillograph, is a device that graphically displays electrical signals and shows how they change over time. Engineers use oscilloscopes to test, verify, and debug their circuit designs by measuring electrical phenomena. Its primary function is to measure voltage waves. These waves are displayed on a graph, which can disclose a lot about a signal.

Regional Analysis:

The Europe 5G Device Testing Market holds the second-largest market share. Europe is poised to see a surge in demand for 5G services, driven by the increasing need for faster data speeds in both commercial and residential applications. As part of the Europe 2020 strategy, a concerted effort is being made to ensure that high-speed broadband of more than 100 Mbps is made available to a substantial number of European countries. The strategy also sets an ambitious goal of achieving ultra-fast broadband adoption by 50% of European households by 2020. According to European Commission estimates, substantial investments totaling US$ 64.5 billion in 5G technology are expected to yield substantial economic benefits totaling US$ 129.0 billion per year.

This investment is likely to provide enormous job prospects, with an estimated 2.3 billion jobs being created in Europe by 2025. This increased demand is likely to generate a sizable market for 5G testing equipment. Furthermore, the German 5G Device Testing Market held the biggest market share, while the UK 5G Device Testing Market was the fastest-growing market in Europe.

Key Player Analysis:

Anritsu, Artiza Networks Inc., Emite, Exfo Inc., GL Communications Inc., Intertek Group plc, Keysight Technologies, LitePoint, MACOM Technology Solutions, National Instruments Corp, Rohde & Schwarz, Spirent Communications, Tektronix Inc., Teradyne Inc, Trex Enterprise Corporation, and Viavi Solutions Inc. are among the key 5G device testing market players profiled in the report.

5G Device Testing Market Regional Insights

The regional trends and factors influencing the 5G Device Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses 5G Device Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for 5G Device Testing Market

5G Device Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.90 Billion |

| Market Size by 2030 | US$ 3.70 Billion |

| Global CAGR (2022 - 2030) | 8.7% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Components

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

5G Device Testing Market Players Density: Understanding Its Impact on Business Dynamics

The 5G Device Testing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the 5G Device Testing Market are:

- Anritsu

- Artiza Networks Inc.

- Emite

- Exfo Inc.

- GL Communications Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the 5G Device Testing Market top key players overview

Recent Developments:

Companies in the market highly adopt inorganic and organic strategies such as mergers and acquisitions. A few recent key 5G device testing market developments are listed below:

- In July 2023, with three transmit antennas, Samsung Electronics and MediaTek achieved an innovative 5G uplink breakthrough. Samsung Electronics and MediaTek have successfully tested 5G Standalone Uplink (UL) 2CC Carrier Aggregation (CA) with C-Band UL MIMO to achieve top uplink speeds, marking a breakthrough in wireless mobile capabilities. This method used three transmit (3Tx) antennas to improve upload experiences, ushering in a new era of global connectivity for consumers. With the rise of live streaming, multi-player gaming, and video conferences, the demands on uplink performance are increasing. Upload speeds govern how quickly your device can send data to gaming servers or send high-resolution videos to the cloud. As more customers seek to film and share their real-time experiences with the world, expanded uplink experiences allow them to use the network to improve how they map out their route home, check player stats online, and upload movies and pictures to share with friends and followers.

- In June 2023, Fibocom introduced the industry-first SC151-GL, which accelerates global 5G AIoT commercialization with a single highly integrated smart module. Fibocom, a global leader in IoT (Internet of Things) wireless solutions and wireless communication modules, will have SC151-GL available at MWC Shanghai 2023. Fibocom SC151-GL, based on the Qualcomm® QCM4490 Processor, is the industry's first 5G smart module that supports mainstream frequency bands under 5G network architecture globally, which is critical for customers who require global roaming on their devices to deploy the smart wireless solution faster and more efficiently than regional versions.

- In June 2023, HCLTech, a global technology company, announced the opening of a cutting-edge test lab in Chennai, India. This cutting-edge facility aims to empower global telecom infrastructure original equipment manufacturers (OEMs) by providing resources for testing and validating 5G solutions. The lab is the first of its kind in India due to its unique capabilities. Its advanced high-end scanners enable global OEMs to test large cellular base stations as well as small form factor antennas used in a variety of devices such as mobile phones, smart gadgets, health monitoring systems, and remote surveillance systems.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Architecture Software Market

- Intraoperative Neuromonitoring Market

- Visualization and 3D Rendering Software Market

- Space Situational Awareness (SSA) Market

- Artificial Intelligence in Defense Market

- Point of Care Diagnostics Market

- Workwear Market

- Non-Emergency Medical Transportation Market

- Ceramic Injection Molding Market

- Skin Graft Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Components, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rise in the adoption of 5G technologies is expected to drive the growth of the 5G device testing market in the coming years.

The key players holding majority shares in the 5G device testing market include Anritsu, Intertek Group plc, Keysight Technologies, Rohde & Schwarz, and Spirent Communications.

The hardware segment led the 5G device testing market with a significant share in 2022.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

Increasing demand for 5G networks across various sectors and increasing adoption of smartphones and mobile devices are driving factors in the 5G device testing market.

The 5G device testing market was estimated to be valued at US$ 1.90 billion in 2022 and is projected to reach US$ 3.70 billion by 2030; it is anticipated to grow at a CAGR of 8.7% over the forecast period.

The 5G device testing market is expected to reach US$ 3.70 billion by 2030.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - 5G Device Testing Market

- Anritsu

- Artiza Networks Inc.

- Emite

- Exfo Inc.

- GL Communications Inc.

- Intertek Group plc

- Keysight Technologies

- LitePoint

- MACOM Technology Solutions

- National Instruments Corp

- Rohde & Schwarz

- Spirent Communications

- Tektronix Inc.

- Teradyne Inc

- Trex Enterprise Corporation

- Viavi Solutions Inc.

Get Free Sample For

Get Free Sample For