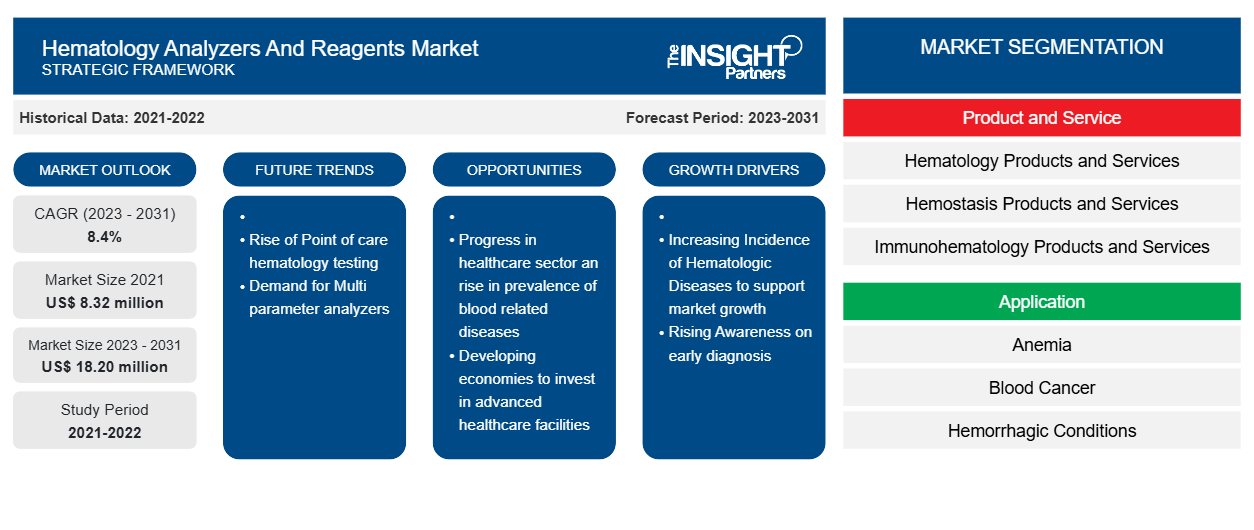

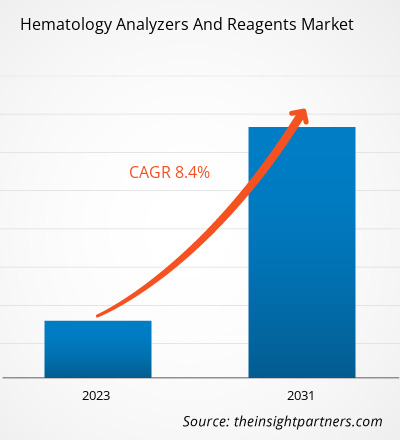

The hematology analyzers and reagents market size was estimated to be US$ 8.32 million in 2021 and US$ XX million in 2023 and is expected to reach US$ 18.20 million by 2031; it is estimated to record a CAGR of 8.4% in till 2031. Escalating adoption of smart point-of-care devices is likely to remain key hematology analyzers and reagents market trends.

HEMATOLOGY ANALYZERS AND REAGENTS Market Analysis

The players operating in the hematology analyzers and reagents market are highly competitive and have been introducing novel products and reagents. For instance, in January 2024, HORIBA Medical launched the latest HELO 2.0 high throughput automated hematology platform. The platform is CE- European In Vitro Diagnostic Devices Regulation (IVDR) approved and is currently awaiting the US Food and Drug Administration (FDA) approval. The HELO 2.0 is the next generation of high-end hematology range and has been developed in consultation with customers to cater to all high throughput fully automated hematology needs. The HELO 2.0 offers a highly flexible and efficient modular hematology solution, which can be fully scaled and configured to suit the varying needs of mid to large-scale laboratories. Similarly, In May 2023, Siemens Healthineers launched two solutions for high-volume hematology testing: the Atellica HEMA 570 Analyzer and the Atellica HEMA 580 Analyzer. The lab's ability to review and release patients' test results quickly is hindered by the broad use of CBC testing and increasing staff shortages. The Atellica HEMA 570 and Atellica HEMA 580 Analyzers offer integrated automation and intelligence to improve workflow efficiency and produce faster patient results. The launches of such new products are fuelling the growth of the hematology analyzers and reagents market.

HEMATOLOGY ANALYZERS AND REAGENTS Market Overview

The growth of the hematology analyzers and reagents market is attributed to increasing number of hematologic diseases and technological advancements in hematology analyzers. However, steep prices of high-tier systems are likely hampering the growth of the market.

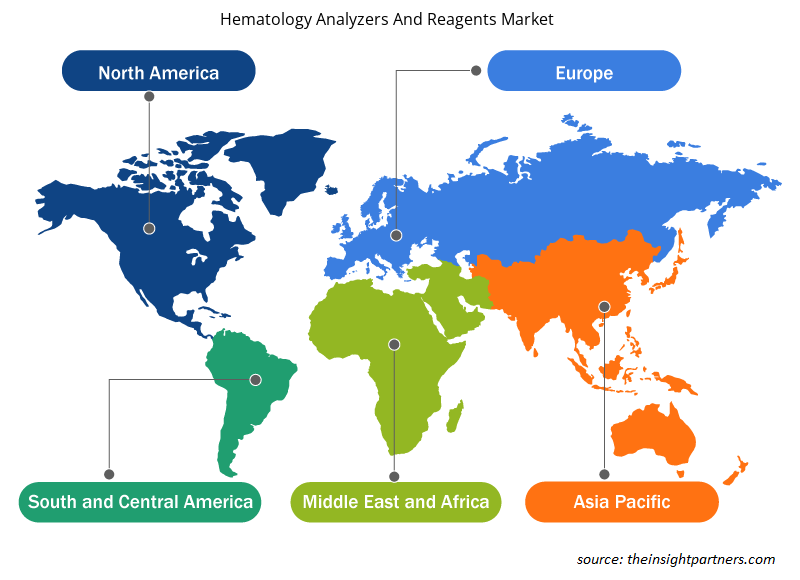

Global hematology analyzers and reagents market is segmented by region into North America, Europe, Asia Pacific, Middle East &Africa, and South & Central America. The North American region is the largest shareholder and the Asia Pacific is the fastest growing market for hematology analyzers and reagents. The growth of the hematology analyzers and reagents market is estimated to have a largest share in the US. The growth of the market in the US is expected to grow due to a rising number of blood testing procedures, high prevalence of hematology diseases, rising numbers of diagnostic and blood testing centers, and access to well-developed infrastructure and others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hematology Analyzers And Reagents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hematology Analyzers And Reagents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

HEMATOLOGY ANALYZERS AND REAGENTS Market Drivers and Opportunities

Increasing Incidence of Hematologic Diseases to Favor Market

According to the Centers for Disease Control and Prevention (CDC), approximately 12 out of every 100,000 males in the US and 400 boys are born with hemophilia A each year. Further, the Leukemia & Lymphoma Society (LLS) reports that in the US, one person is diagnosed with lymphoma, leukemia, or myeloma every 3 minutes. In 2023, an estimated total of 184,720 people in the US are expected to be diagnosed with leukemia, lymphoma, or myeloma. Furthermore, new cases of lymphoma, leukemia, and myeloma are expected to make up 9.4% of the 1,958,310 new cancer cases that will be diagnosed in the US in 2023. The rising prevalence of hematologic diseases boosts demands for blood transfusion as well as blood cell counting for monitoring normalcy, which is further escalating the demand for hematology analyzers and reagents. The increasing incidence of blood-related diseases is augmenting the growth of the hematology analyzers and reagents market.

Progress in Healthcare Sectors and Rise in Prevalence of Blood-Related Diseases in Emerging Economies – An Opportunity in hematology analyzers and reagents Market

The incidence of hematologic diseases is rising significantly in developing countries due to the shift in the lifestyle of populations. Moreover, the surging prevalence of other health conditions due to lowered physical activities and increasing stress levels is also contributing to the rise in cases of hematologic disorders in these countries. Developing nations are striving to bring significant advancements in their healthcare facilities and services. For instance, the Hemophilia Federation India (HFI) is a nonprofit organization that has worked closely with the World Federation of Hemophilia (WFH) to increase awareness regarding hemophilia and affordable treatments available for the same as well as to enhance the diagnosis of the disease. Moreover, The RED LAPI professional team strives to contribute and improve the diagnosis and treatment of hemophilia in Latin America. Such developments in the hematology analyzers and reagents market in developing nations in Asia Pacific, the Middle East and Africa, and Latin America are providing opportunities for the future growth of market players.

HEMATOLOGY ANALYZERS AND REAGENTS Market Report Segmentation Analysis

Key segments that contributed to the derivation of the hematology analyzers and reagents Market analysis are product and service, cause, application, and end user.

- Based on Product and Service, the hematology analyzers and reagents market is segmented into hematology products & services, hemostasis products & services, and immunohematology products & services. Hematology products & services are further subsegmented as instruments, reagents and consumables, and services. Similarly, the hemostasis products & services segment is further segmented into instruments, reagents & consumables, and services. The immunohematology products & services segment of the hematology analyzers & reagents market is also further segmented into instruments, reagents & consumables, and services. The hematology products & services segment held a larger market share in 2023.

- By application, the market is segmented into anemia, blood cancer, hemorrhagic conditions, infection related conditions, immune system related conditions, and other applications. The anemia segment held the largest share of the market in 2023.

- In terms of end user, the market is segmented into hospital laboratories, commercial service providers, government reference laboratories, and research and academic institutes. The hospital laboratories segment dominated the market in 2023.

Hematology Analyzers And Reagents Market Share Analysis by Geography

The geographic scope of the hematology analyzers and reagents market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In North America, the US is the largest market for hematology analyzers and reagents manufacturing. The US market's growth is primarily driven by favorable research scenarios, rising demand for blood and blood components, and high adoption of automated hematology instruments.

Growing prevalence of hematological disorders such as leukemia, hemophilia, and anemia in the US. The American Cancer Society’s estimates for leukemia in the US for 2024 are:

- About 62,770 new cases of leukemia (all kinds) and 23,670 deaths from leukemia (all kinds)

- About 20,800 new cases of acute myeloid leukemia (AML). Most will be in adults.

- About 11,220 deaths from AML. Almost all will be in adults.

Rising awareness about early diagnosis among patients is expected to be one of the key driving forces for the hematology analyzers and reagents market. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Hematology Analyzers And Reagents Market Regional Insights

The regional trends and factors influencing the Hematology Analyzers And Reagents Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hematology Analyzers And Reagents Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hematology Analyzers And Reagents Market

Hematology Analyzers And Reagents Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 8.32 million |

| Market Size by 2031 | US$ 18.20 million |

| Global CAGR (2023 - 2031) | 8.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product and Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

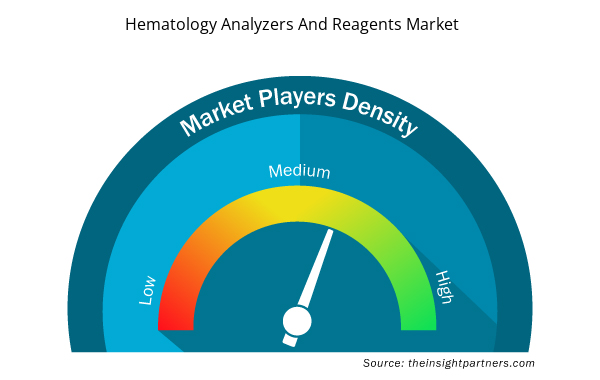

Hematology Analyzers And Reagents Market Players Density: Understanding Its Impact on Business Dynamics

The Hematology Analyzers And Reagents Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hematology Analyzers And Reagents Market are:

- Clinical Diagnostic Solutions, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Danaher

- BIO-RAD LABORATORIES INC.

- Abbott

- Diatron

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hematology Analyzers And Reagents Market top key players overview

Hematology Analyzers And Reagents Market News and Recent Developments

The hematology analyzers and reagents market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for hematology analyzers and reagents and strategies:

- HORIBA Medical launched new products in its Yumizen hematology product family. The company introduced two compact benchtop hematology analyzers, Yumizen H500 and Yumizen H550, which offer enhanced performance, new features, and increased benefits. These analyzers have been designed to deliver a rapid and comprehensive hematology report with a high throughput of 60 tests per hour, 40 tubes autonomy with continuous loading, urgent manual mode, and multi-analysis modes and sampling for running samples. (Source: HORIBA Medical, 2022)

- Mindray launched a revolutionary hematology analyzer series, the BC-700 Series, which incorporates both complete blood count (CBC) and erythrocyte sedimentation rate (ESR) tests. The series includes two open vial models, BC-700/BC-720, and two autoloader models, BC-760/BC-780. This series is designed to empower medium-volume laboratories with advanced diagnostics technologies applied in premium products. (Source: Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Press Release, 2022)

Hematology Analyzers And Reagents Market Report Coverage and Deliverables

The “Hematology Analyzers And Reagents Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Procedure Trays Market

- Virtual Pipeline Systems Market

- Ceiling Fans Market

- Hydrogen Compressors Market

- Electronic Toll Collection System Market

- Artificial Intelligence in Defense Market

- Underwater Connector Market

- Energy Recovery Ventilator Market

- Electronic Signature Software Market

- Electronic Shelf Label Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product and Service, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Clinical Diagnostic Solutions, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Danaher

- BIO-RAD LABORATORIES INC.

- Abbott

- Diatron

- ERBA Diagnostics Inc.

- EKF Diagnostics

- HORIBA Medical

- Biosystems S.A.

Get Free Sample For

Get Free Sample For