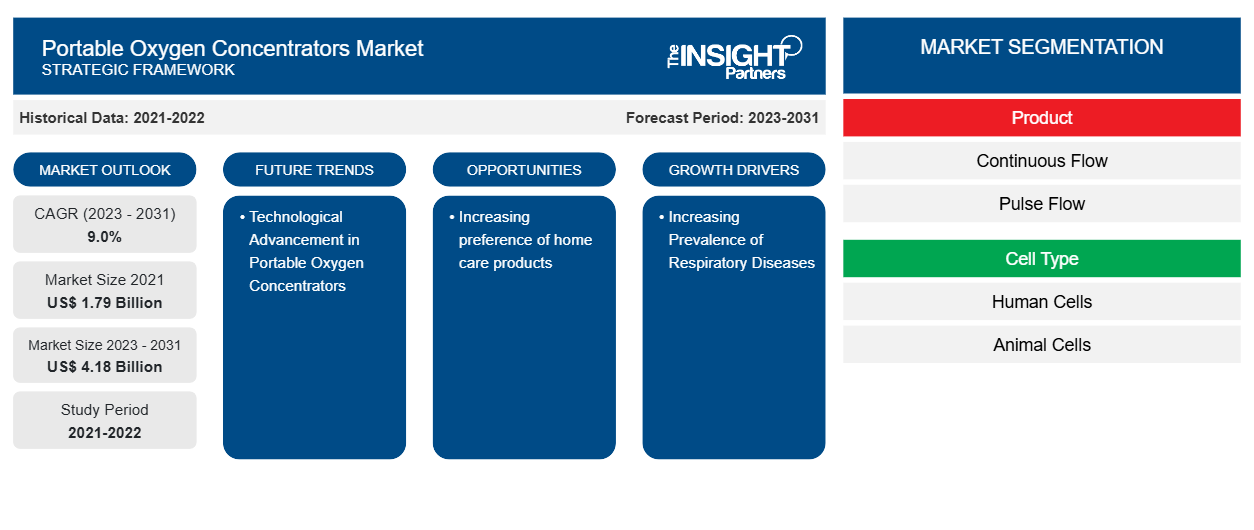

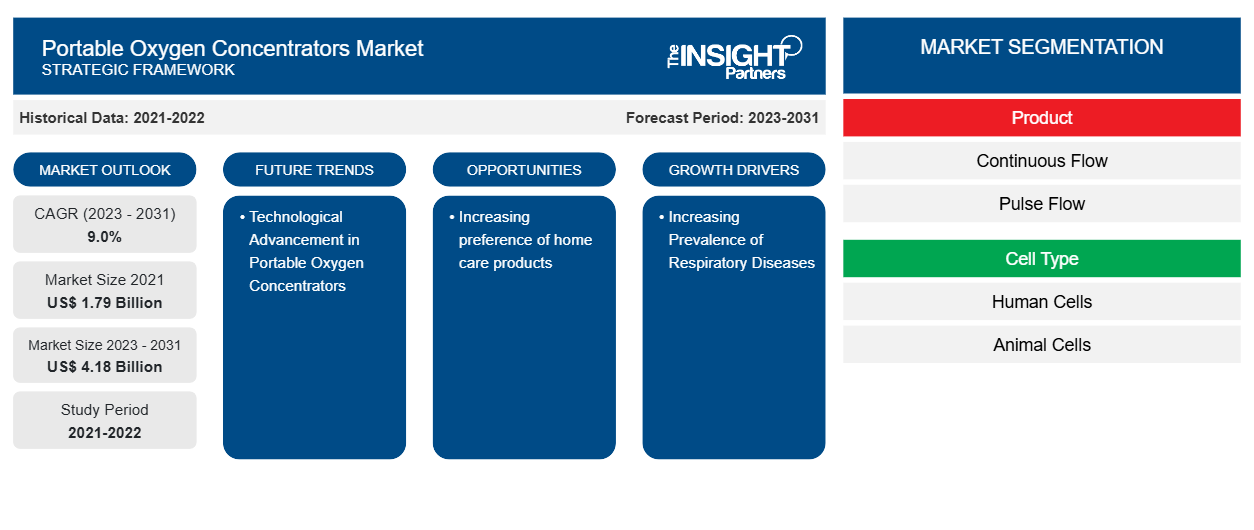

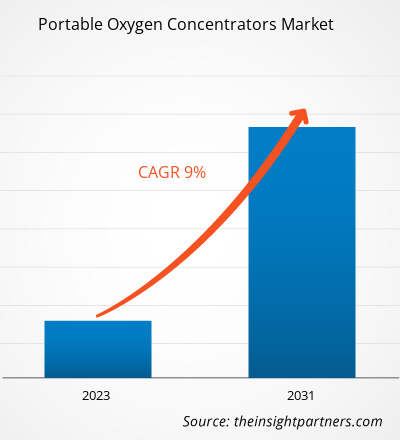

The portable oxygen concentrators market was valued at US$ 1.79 billion in 2021 and is expected to reach US$ 4.18 billion by 2031. The market is expected to register a CAGR of 9.0% in 2023–2031. Increasing preference of home care products will likely remain a key portable oxygen concentrators market trend.

Portable Oxygen Concentrators Market Analysis

A portable oxygen concentrator (POC) is a tool used to administer oxygen treatment to patients who need greater doses of oxygen than that in normal air. It's comparable to a concentrator with home oxygen (OC), but is more mobile and reduced in size. These devices enable patients to carry their oxygen and help them continue their usual activities, allowing them the freedom to continue a normal lifestyle.

Portable Oxygen Concentrators Market Overview

The rising prevalence of chronic respiratory diseases and the demand for external oxygen to manage these diseases are boosting the market's growth. Additionally, many manufacturers engaged in manufacturing advanced portable oxygen concentrators are further driving the growth of the country's market. Moreover, increasing awareness among consumers regarding healthcare spending have led to the demand for health supplemental oxygen in North America.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Portable Oxygen Concentrators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Portable Oxygen Concentrators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Portable Oxygen Concentrators Market Drivers and Opportunities

Increasing Prevalence of Respiratory Diseases

Chronic obstructive pulmonary disease (COPD), asthma, pneumonia, and other respiratory diseases are creating a huge burden on the public healthcare system in several countries across the world. Infections, Smoking, and genetic factors can cause serious respiratory complications. In 2021, The American Lung Association reported that COPD is the third leading cause of death in the US, and over 16.4 million people are diagnosed with the condition. Data published by the Asthma and Allergy Foundation of America, ∼ 26 million people in the US had asthma in 2022, which is one of the most common respiratory diseases in the world. As per the World Health Organization (WHO), pneumonia accounted for 14% of the total deaths (i.e., 740,180 deaths) of children below the age of 5 years across the world in 2019. Patients suffering from respiratory disorders usually experience breathing issues and oxygen shortages. The patients suffering from these respiratory disorders commonly experience difficulty in breathing and face oxygen shortage. Thus, the availability of supplemental oxygen through portable oxygen concentrators has helped to improve the survival rates of the patients suffering with the above-mentioned medical conditions. The rising demand for portable oxygen concentrators among patients with respiratory disorders are thus driving growth of the market over the forecast years.

Technological Advancement in Portable Oxygen Concentrators– An Opportunity in the Portable Oxygen Concentrators Market

The launch of portable oxygen concentrator devices is creating dynamic competition among players to keep up their position in the market. The players are developing multiple advanced products for buyers, including various alternatives for treating sleep apnea and respiratory disorders. For instance, in February 2018, GCE Healthcare introduced a remote monitoring platform named Clarity for oxygen concentrators in the US. The company launched the same product in the European Union in February 2020. Furthermore, The OMRON medical molecular sieve oxygen concentrator, the newest oxygen delivery technology from Japanese electronics manufacturer OMRON, was introduced in July 2022 by OMRON Healthcare, the company's healthcare division. Recently, in November 2020, CAIRE, a Georgia-based oxygen supply manufacturer, launched FreeStyle Comfort, a portable oxygen cylinder equipped with autoSAT technology that has a self-adjusting, proprietary clinical feature ensuring consistent delivery of oxygen bolus to patients who have trouble in regular breathing due to various respiratory conditions.

Portable Oxygen Concentrators Market Report Segmentation Analysis

Key segments that contributed to the derivation of the portable oxygen concentrators market analysis are disorder and service providers.

- Based on products, the portable oxygen concentrators market is segmented into continuous flow, pulse flow. The continuous flow segment held a larger market share in 2023.

- By application, the portable oxygen concentrators market is segmented into COPD, asthma, respiratory distress syndrome, others. The COPD segment held the largest share of the market in 2023.

- By end users, the portable oxygen concentrators market is segmented into hospitals, homecare settings, others. The homecare settings segment held the largest share of the market in 2023.

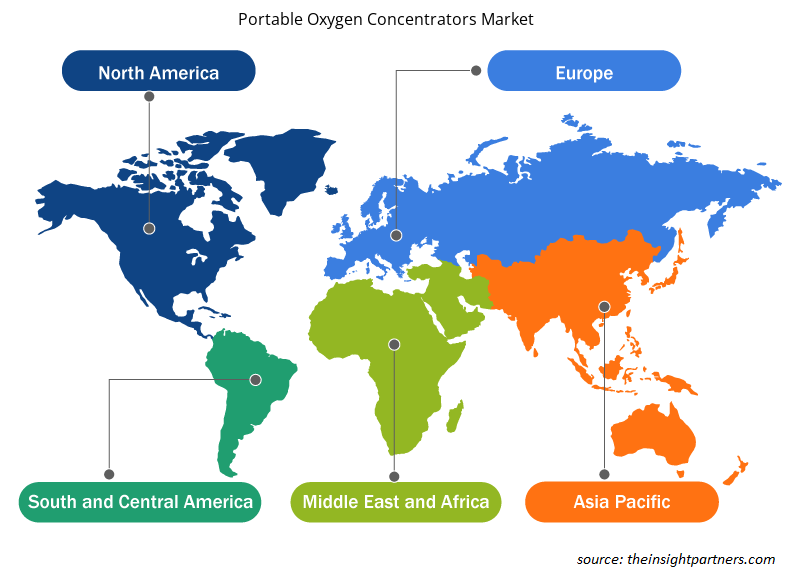

Portable Oxygen Concentrators Market Share Analysis by Geography

The geographic scope of the portable oxygen concentrators market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The US Food and Drug Administration in the midst of coronavirus pandemic undertook significant actions to increase the availability of respiratory equipment including ventilators, accessories and its alternate solutions. In March 2020, as a wide-ranging emergency policy, U.S. Food and Drug Administration (FDA) has committed to providing enforcement policy and guidelines for ventilators and other respiratory accessories. During the pandemic, the FDA has planned to expand the availability and production of these devices during this pandemic. The Emergency Use Authorization issued by the FDA enables use of these machines for treating COVID-19 patients following a manufacturer’s official request. In order for these devices to work seamlessly as an alternate solution, the American Society of Anesthesiologists ruled out a guidance document in March 2020 recommending the healthcare professionals to undertake extra precautions with the use of non-invasive respiratory devices including the portable oxygen concentrators.

Portable Oxygen Concentrators Market Regional Insights

Portable Oxygen Concentrators Market Regional Insights

The regional trends and factors influencing the Portable Oxygen Concentrators Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Portable Oxygen Concentrators Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Portable Oxygen Concentrators Market

Portable Oxygen Concentrators Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.79 Billion |

| Market Size by 2031 | US$ 4.18 Billion |

| Global CAGR (2023 - 2031) | 9.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

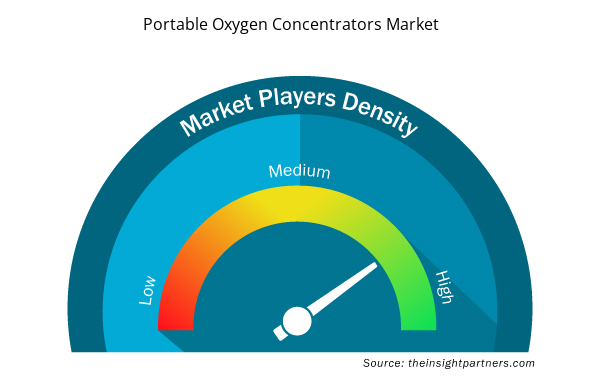

Portable Oxygen Concentrators Market Players Density: Understanding Its Impact on Business Dynamics

The Portable Oxygen Concentrators Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Portable Oxygen Concentrators Market are:

- AirSep Corporation

- Besco Medical Co., LTD

- CAIRE Inc.

- Chart Industries, Inc.

- Drive DeVilbiss Healthcare

- Foshan Keyhub Electronic Industries Co. Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Portable Oxygen Concentrators Market top key players overview

Portable Oxygen Concentrators Market News and Recent Developments

The portable oxygen concentrators market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for portable oxygen concentrators:

- With the introduction of the LifeStyle portable oxygen concentrator in the US, Carire significantly raised the standard of living for oxygen users everywhere. (Source: Carire, 2022).

- The ARYA Portable Oxygen Concentrator was introduced in the US by ARYA BioMed Corp. The powerful battery-powered system of ARYA's portable oxygen concentrator charges fast, and it is remarkably light. (Source: ARYA BioMed Corp, Press Release, 2022).

Portable Oxygen Concentrators Market Report Coverage and Deliverables

The “Portable Oxygen Concentrators Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product , Application , End User , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Middle East and Africa, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For