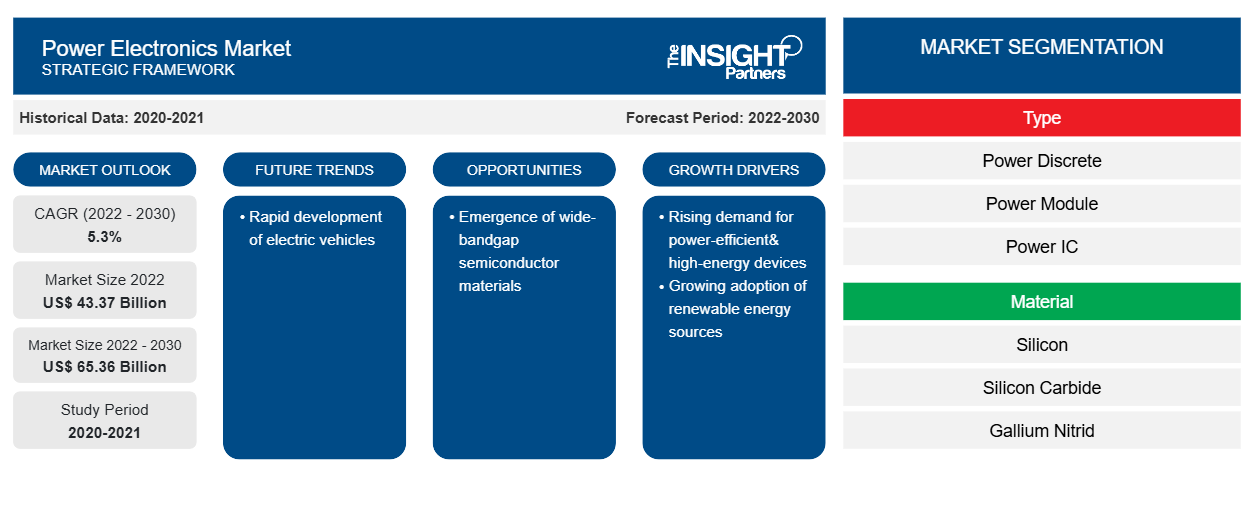

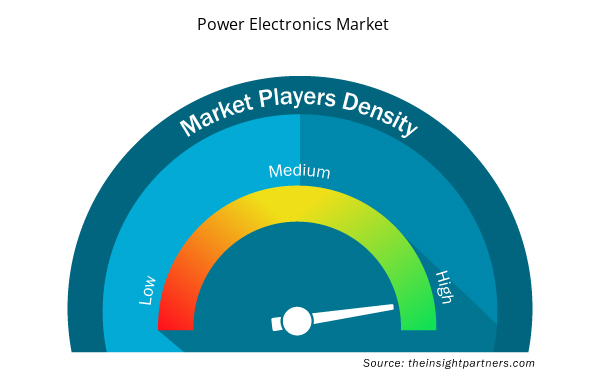

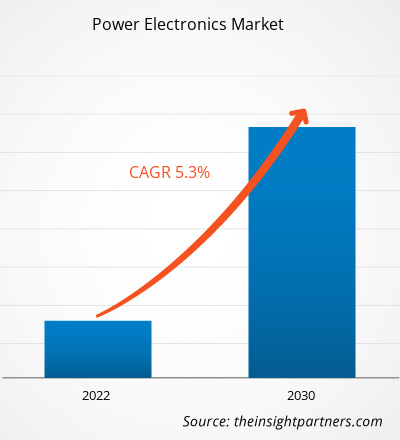

The power electronics market is projected to grow from US$ 43.37 billion in 2022 to US$ 65.36 billion by 2030; it is expected to expand at a CAGR of 5.30% from 2022 to 2030. Rapid development of electric vehicles is expected to be a key trend in the market.

Power Electronics Market Analysis

Rising electrical energy consumption across the globe is driving the power electronics market. More than 50% of total energy consumption is predicted to be transformed into electricity, which must be produced, distributed, and used as effectively as feasible. Furthermore, rising climate change encourages manufacturers to develop sustainable solutions is fueling the power electronics market. Under such changing conditions, two major technologies that are likely to play critical roles in resolving future problems include a shift in electrical power production from conventional, fossil (and short-term) based energy sources to renewable energy sources, as well as the use of highly efficient power electronics in power transmission/distribution, power generation, and end-user application, which is driving the power electronics market.

Power Electronics Market Industry Overview

Power electronics is a device with a circuit that distributes power from a source to a load in a sturdy, efficient, compact, and substantial manner for easy use. Power electronics play a major part in electrified vehicle applications by supplying small and high-efficiency power conversion systems.

The device uses diodes, transistors, and thyristors to control the transfer of electric power from one form to another. Power electronics devices, which have a faster switching rate and higher efficiency, can be utilized to execute operations efficiently at high current or high voltage. Furthermore, depending on the application, power electronics can regulate both unidirectional and bidirectional energy flow, and regenerated energy can be returned for utility. Power electronics devices are projected to be significant technologies in the future, helping to improve system efficiency and performance in automotive and energy-saving applications. These factors are anticipated to fuel the power electronics market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Power Electronics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Power Electronics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Power Electronics Market Driver and Opportunities

Rising Demand for Power-efficient and High-energy Devices to Favor Market Growth

Industrial appliances such as motor drives, power converters, UPSs, and server power supplies consume a large amount of power. Consequently, any improvement in industrial power supply efficiency will result in a significant drop in operating expenses for a business. The demand for high-efficiency power supplies is increasing across the globe due to their improved thermal performance and higher power density. Currently, uninterruptible power supplies are one of the most widely used applications for power semiconductors. Numerous hardware such as computers, communications equipment, data centers, and other electrical equipment are integrated with power semiconductors that protect them against unplanned power outages. The system used for uninterruptible power supplies typically consists of batteries and an IGBT (insulated-gate bipolar transistor) inverter, which have high voltage capabilities. This increases its adoption in high-current-density applications.

High-efficiency power sources are becoming increasingly necessary worldwide. Growing awareness related to efficient energy usage is creating demand for power semiconductors among consumers. Power semiconductors are also becoming an essential component to reduce the carbon footprint of society worldwide. Power semiconductors such as diodes, thyristors, and transistors are highly used for regulating electricity in automotive, consumer electronics, power, energy, ICT, and other industries. Thus, the rising demand for power-efficient and high-energy devices drives the power electronics market.

Emergence of Wide-Bandgap Semiconductor Materials

Technologies based on wide-bandgap semiconductors meet all of the industry's current requirements. As the name implies, they have a bigger bandgap, which allows various electrical devices to operate at high voltages, temperature, and frequency. Wide-bandgap semiconductors have the advantages of increased power efficiency and cheaper cost. For instance, GaN and SiC can improve the performance of power electronics and produce more efficient outputs than typical silicon devices. Further, wide-bandgap materials have a 3eV+ wide-bandgap, which is a critical feature for carrying out high-voltage activities. Thus, the emergence of wide-bandwidth semiconductor materials is expected to supplement the growth of the power electronics market during the forecast period.

Power Electronics Market Report Segmentation Analysis

The key segments that contributed to the derivation of the power electronics market analysis are installation and end user.

- By Type, the market is divided into power discrete, power module, and power IC.

- By material, the market is divided into Silicon (SI), Silicon Carbide (SIC), Gallium Nitride (GAN), and Others.

- By industry vertical, the market is divided into ICT, automotive & transportation, consumer electronics, industrial, energy & power, and others.

- Based on type, the power electronics market is segmented into power discrete, power module, and power IC. The power module segment held the largest power electronics market share in 2022 and is anticipated to grow during the forecast period.

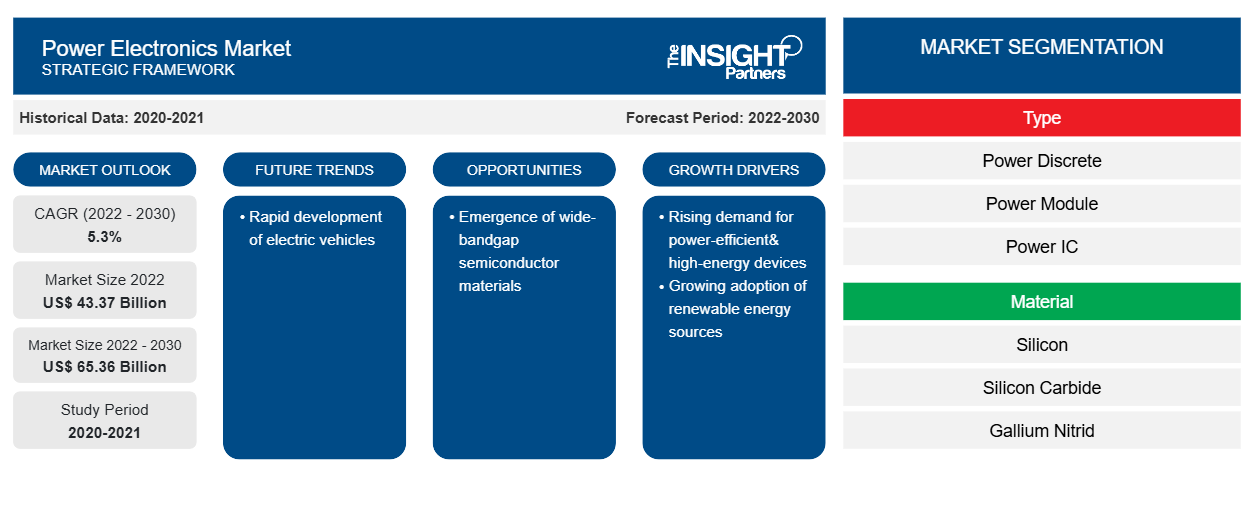

Power Electronics Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Asia Pacific held the largest power electronics market share in 2022. The significant presence of consumer electronics can be linked to the market's expansion in Asia Pacific. The rising demand for power generation, as well as government attempts to support power generation in several Asia Pacific countries, are boosting the cost of power generation. Renewable energy infrastructure development is a critical factor driving the power electronics market. Moreover, the expanding population in developing countries, particularly China and India, which is increasing the deployment of communication infrastructure, is expected to fuel the market expansion for power electronics in the region during the forecast period. The presence of well-established power electronics market players such as Renesas Electronics Corporation, Mitsubishi Electric Corporation, Fuji Electric Co., and Toshiba Corporation in Asia Pacific boosts the market growth. Furthermore, the development of Chinese firms such as BYO, Huawei, CRRC, and Sungrow is strengthening the domestic power electronics sector in the country. All these factors are driving the growth of the Asia Pacific power electronics market.

China remains the world's largest automobile sector in terms of yearly sales as well as manufacturing output, with domestic output estimated to exceed 35 million vehicles by 2025. According to Ministry of Industry and Information Technology figures, over 26 million vehicles were sold in 2021, including 21.48 million passenger vehicles—representing a 7.1% increase over 2020. Commercial vehicle sales totaled 4.79 million units, a 6.6% decrease from 2020. Moreover, China is witnessing increased demand for EVs. For instance, in 2022, more than 5.92 million new passenger plug-in electric cars were recorded in China (83% more than in 2021), registering a new record. Thus, there is an increased need to control automobile engines in the field of automotive electronics for proper control and conversion, thereby increasing the importance of power electronics. The growth of the power electronics market in China is expected to create several opportunities for businesses and individuals that develop and manufacture power electronics products and services.

Power Electronics Market Regional Insights

Power Electronics Market Regional Insights

The regional trends and factors influencing the Power Electronics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Power Electronics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Power Electronics Market

Power Electronics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 43.37 Billion |

| Market Size by 2030 | US$ 65.36 Billion |

| Global CAGR (2022 - 2030) | 5.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Power Electronics Market Players Density: Understanding Its Impact on Business Dynamics

The Power Electronics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Power Electronics Market are:

- Infineon Technologies AG

- Semiconductor Components Industries, L.L.C. (On Semiconductor)

- STMicroelectronics NV

- Mitsubishi Electric Corp

- Fuji Electric Co Ltd

- ROHM Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Power Electronics Market top key players overview

Power Electronics Market News and Recent Developments

The power electronics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Power Electronics Market are listed below:

- In August 2023, Vishay Intertechnology introduced a new 650V E Series power MOSFET of the fourth generation that provides high efficiency and power density for telecom, industrial, and computing applications. The Vishay Siliconix n-channel SiHP054N65E reduces on-resistance by 48.2%. It offers a 59% reduction in resistance times gate charge, a key figure of merit (FOM) for 650V MOSFETs used in power conversion applications. (Source: Vishay Intertechnology, Press Release, August 2023)

Power Electronics Market Report Coverage & Deliverables

The power electronics market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Power Electronics Market Size and Forecast (2020–2030)" provides a detailed analysis of the market covering below areas-

- Power electronics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Power electronics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Power electronics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Power Electronics Market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The power electronics market size is projected to reach US$ 65.36 billion by 2030.

Asia Pacific is expected to dominate the power electronics market with the highest market share in 2022.

The global power electronics market was estimated to grow at a CAGR of 5.3% during 2022 - 2030.

Rising demand for power-efficient& high-energy devices and growing adoption of renewable energy sources are the major factors that drive the global power electronics market.

Rapid development of electric vehicles is a major trend in the market.

Infineon Technologies AG, Semiconductor Components Industries, L.L.C. (On Semiconductor), STMicroelectronics NV, Mitsubishi Electric Corp, Fuji Electric Co Ltd, ROHM Co Ltd, Renesas Electronics Corp, Littelfuse, Inc., and Toshiba Electronic Devices & Storage Corp are the major market players.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Power Electronics Market

- Infineon Technologies AG

- Semiconductor Components Industries, L.L.C. (On Semiconductor)

- STMicroelectronics NV

- Mitsubishi Electric Corp

- Fuji Electric Co Ltd

- ROHM Co Ltd

- Renesas Electronics Corp

- Littelfuse, Inc

- Toshiba Electronic Devices & Storage Corp

- Vishay Intertechnology Inc

Get Free Sample For

Get Free Sample For