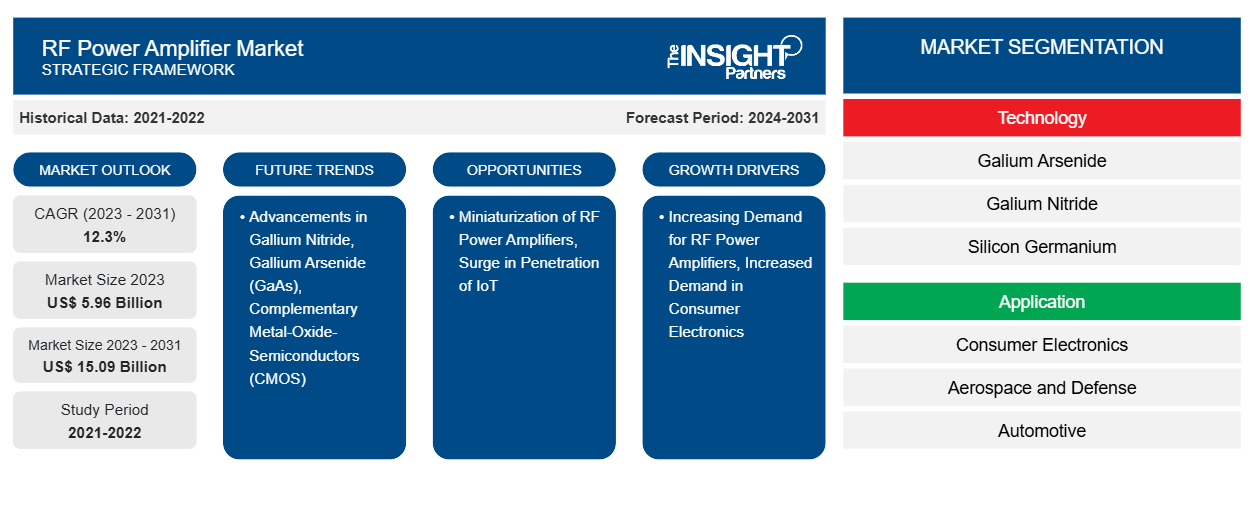

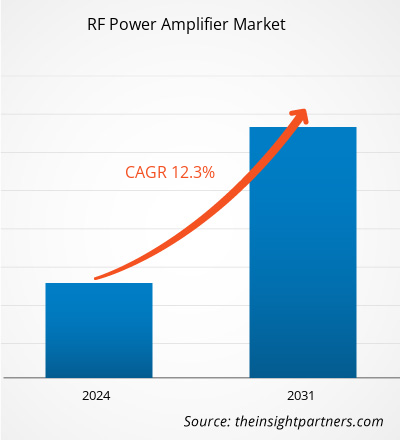

The RF Power Amplifier Market size is projected to reach US$ 15.09 billion by 2031 from US$ 5.96 billion in 2023. The market is expected to register a CAGR of 12.3% in 2023–2031. Increasing demand for RF power amplifiers and increasing demand for consumer electronics is likely to remain key RF Power Amplifier market trends.

RF Power Amplifier Market Analysis

An RF power amplifier is an electrical device used to boost the power of radio frequency signals. It amplifies a weak input signal to a greater power level suited for long-distance transmission or driving high-power loads, most commonly antennas. RF power amplifiers are distinguished by their ability to efficiently handle high power levels while preserving linearity, signal quality, and low distortion. The RF power amplifier market size is likely to surge in the coming years owing to the rapid installation of 5G infrastructure. The RF power amplifier market report emphasizes the key factors driving the market and prominent company developments.

RF Power Amplifier Market Overview

A radio-frequency power amplifier, or RF power amplifier, is an electronic device that strengthens a weak radio-frequency signal and enhances it to a higher power level. It is usually employed in the last stage of a radio transmitter, where it boosts the signal before it is transmitted through the antenna. RF power amplifiers are designed with specific objectives, such as enhancing signal strength, increasing power output, expanding bandwidth, improving power efficiency, maintaining linearity, achieving input and output impedance matching, and effectively dissipating heat.

The increasing use of consumer electronics, such as tablets, laptops, smartphones, and other personal electronic devices, has led to an increased demand for RF power amplifiers. These amplifiers play a vital role in improving the performance of these devices by converting low-power radio-frequency signals into higher-power signals. As consumer spending on electronic devices continues to rise, the demand for RF power amplifiers is also expected to grow. Further, the development of innovative RF technologies has contributed to the increased demand for RF power amplifiers in consumer electronics. These technologies offer products with a dynamic power range, higher frequencies, and lower noise parameters, enabling the design of next-generation electronic components. Additionally, the popularity and adoption of high-speed networks such as 4G and 5G have significantly impacted the demand for RF power amplifiers in consumer electronics. The growing demand for RF power amplifiers in industries such as consumer electronics, and telecommunication contributes significantly to the overall RF power amplifier market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

RF Power Amplifier Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

RF Power Amplifier Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

RF Power Amplifier Market Drivers and Opportunities

Increased Demand for RF Power Amplifiers in the Consumer Electronics Industry to Favor Market

The surge in consumer electronics usage, including smartphones, tablets, laptops, and other personal devices, has contributed to the rising demand for RF power amplifiers. These devices rely on RF power amplifiers to enhance their performance by converting low-power radio-frequency signals into higher-power signals as the consumer electronics market continues to expand, driven by various factors such as rising disposable incomes, digitization, and the increasing prevalence of personal electronic devices. According to GSMA's annual State of Mobile Internet Connectivity Report 2023 (SOMIC), in October 2023, over half (54%) of the global population—approximately 4.3 billion people—owned a smartphone. The number of smartphones is increasing significantly across the globe; for example, according to Ericsson & The Radicati Group, in 2020, the number of smartphones was recorded to be 5.75 billion. In 2024, the number of smartphones has grown to 6.93 billion, and by 2025, it is expected to reach 7.15 billion.

Miniaturization of RF Power Amplifiers – An Opportunity in RF Power Amplifier

The demand for compact and energy-efficient devices in wireless technology applications, advancements in communication engineering such as 5G, and the need for high-quality transmission with enhanced parameters such as efficiency, linearity, and bandwidth have led to the adoption of miniaturized RF power amplifiers. The miniaturization of RF power amplifiers enables their integration into wireless transceivers. This integration is crucial for the development of smaller and more portable devices without affecting the overall performance. By integrating miniaturized RF power amplifiers into transceivers, multiple RF power amplifiers can be equipped with the wireless sensors of each cell, contributing to increased efficiency and performance of wireless communication systems. Miniaturized RF power amplifiers help reduce power consumption and enable the design of compact devices without compromising performance. By reducing the size and improving the design of RF power amplifiers, power consumption can be minimized while maintaining stable output and high efficiency. With the increasing adoption of IoT, wireless sensors, and connected devices, there is a growing requirement for RF power amplifiers that can operate efficiently as well as extend battery life. The miniaturization of RF power amplifiers finds applications in various industries, including telecommunications, broadcasting, aerospace, defense, and healthcare. Thus, the miniaturization of RF power amplifiers is anticipated to present new opportunities for the market players during the forecast period.

RF Power Amplifier Market Report Segmentation Analysis

Key segments that contributed to the derivation of the RF Power Amplifier market analysis are type, cause, disorder type, category, and end user.

- Based on frequency, the RF Power Amplifier market is bifurcated into less than 10 GHz, 11–20 GHz, 21–30 GHz, and above 30 GHz. The less than 10 GHz segment held a larger market share in 2023.

- By technology, the market is segmented into galium arsenide (GaAs), galium nitride (GaN), silicon germanium (SiGe), and others. The galium arsenide (GaAs) segment held the largest share of the market in 2023.

- By application, the market is segmented into consumer electronics, aerospace and defense, automotive, medical, and others. The consumer electronics segment held the largest share of the market in 2023.

RF Power Amplifier Market Share Analysis by Geography

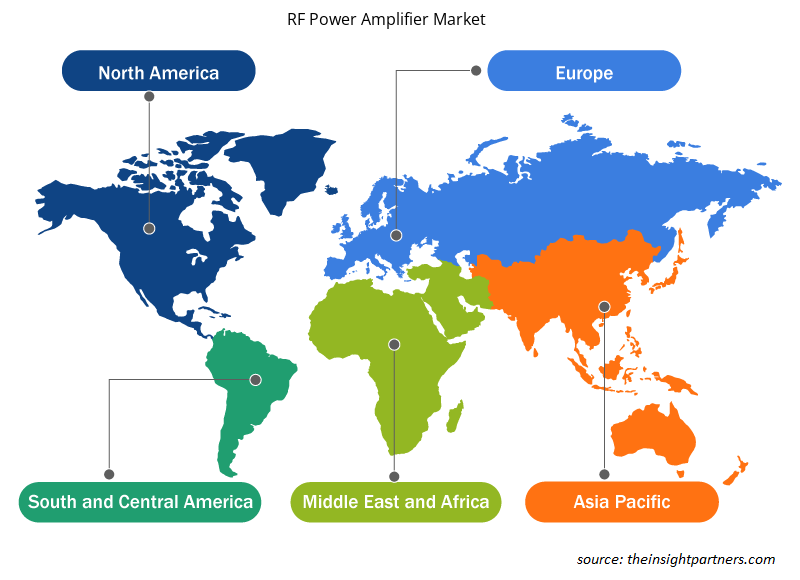

The geographic scope of the RF Power Amplifier market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, Asia Pacific accounted for the largest RF power amplifier market share. The market in this region is segmented into China, Japan, South Korea, India, Australia, and the Rest of Asia Pacific. China has a highly lucrative RF power amplifier market, and the country accounts for a significant share of the total global production and consumption of RF power amplifiers. Increasing research and development in RF power amplifier technologies, advancements in wireless technologies, and the rapid acceptance of high-tech products and solutions in industries such as healthcare and pharmaceuticals boost the demand for RF power amplifiers in China. China has a significant number of mobile subscribers. According to GSMA, ~1.3 billion people in the country had subscribed to mobile services at the end of 2022. Such a large consumer base contributes to the demand for RF power amplifiers in the country. Further, high-quality infrastructure and low labor costs have attracted huge investments and business development opportunities in the country, positioning China as a global hub for large investments and business expansions in the RF power amplifier market.

RF POWER AMPLIFIER Market News and Recent Developments

The RF Power Amplifier market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- Broadcom Inc introduced FiFEM with filter integration optimized for Wi-Fi 7 access points. FiFEM is the world’s first Wi-Fi RF FEM used in Wi-Fi routers, residential gateways, and enterprise Aps. The FiFEM devices incorporate best-in-class FBAR filter technology to provide superior 5 GHz and 6 GHz band coexistence and low in-band insertion loss while significantly reducing the bill of materials (BOM) at the RF front end. (Source: Broadcom Inc, Press Release, 2023)

- Qualcomm Inc announced its next generation of RF Front End (RFFE) solutions, such as Snapdragon X65 and X62 5G Modem-RF Systems for high-performance 5G mobile devices. The solutions are designed to support advanced performance and power-efficiency capabilities for bringing together modem, RF transceiver, RF front-end components with artificial intelligence (AI) assistance, and mmWave antenna modules. These solutions enable OEMs to design premium 5G devices. (Source: Qualcomm Inc, Press Release, 2021)

RF Power Amplifier Market Regional Insights

The regional trends and factors influencing the RF Power Amplifier Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses RF Power Amplifier Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for RF Power Amplifier Market

RF Power Amplifier Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.96 Billion |

| Market Size by 2031 | US$ 15.09 Billion |

| Global CAGR (2023 - 2031) | 12.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

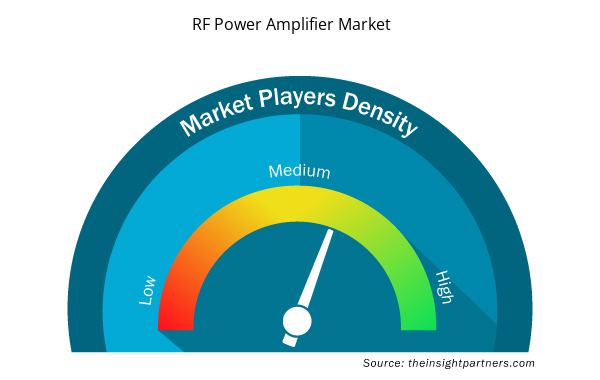

RF Power Amplifier Market Players Density: Understanding Its Impact on Business Dynamics

The RF Power Amplifier Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the RF Power Amplifier Market are:

- Qorvo Inc

- NXP Semiconductors NV

- Qualcomm Inc

- Infineon Technologies AG

- Broadcom Inc

- Mitsubishi Electric Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the RF Power Amplifier Market top key players overview

RF POWER AMPLIFIER Market Report Coverage and Deliverables

The “RF POWER AMPLIFIER Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Virtual Pipeline Systems Market

- Artificial Intelligence in Defense Market

- Wind Turbine Composites Market

- Smart Locks Market

- Rare Neurological Disease Treatment Market

- Environmental Consulting Service Market

- Molecular Diagnostics Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Data Annotation Tools Market

- Mail Order Pharmacy Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Frequency, Technology, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increasing demand for RF power amplifiers and increased demand in consumer electronics are the major factors that propel the global RF power amplifier market.

The global RF power amplifier market is expected to reach US$ 15.09 billion by 2031.

The incremental growth expected to be recorded for the global RF power amplifier market during the forecast period is US$ 9.13 billion.

The global RF power amplifier market was estimated to be US$ 5.96 billion in 2023 and is expected to grow at a CAGR of 12.3% during the forecast period 2023 - 2031.

Advancements in gallium nitride, gallium arsenide (GaAs), complementary metal-oxide-semiconductors (CMOS) is anticipated to play a significant role in the global RF power amplifier market in the coming years.

The key players holding majority shares in the global RF power amplifier market are Broadcom, Qualcomm Technologies, Inc., Analog Devices, Inc., Qorvo, Inc, and Skywork Solutions Inc.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - RF Power Amplifier Market

- Qorvo Inc

- NXP Semiconductors NV

- Qualcomm Inc

- Infineon Technologies AG

- Broadcom Inc

- Mitsubishi Electric Corp

- STMicroelectronics NV

- Skyworks Solutions Inc

- Texas Instruments Inc

- Analog Devices Inc

Get Free Sample For

Get Free Sample For