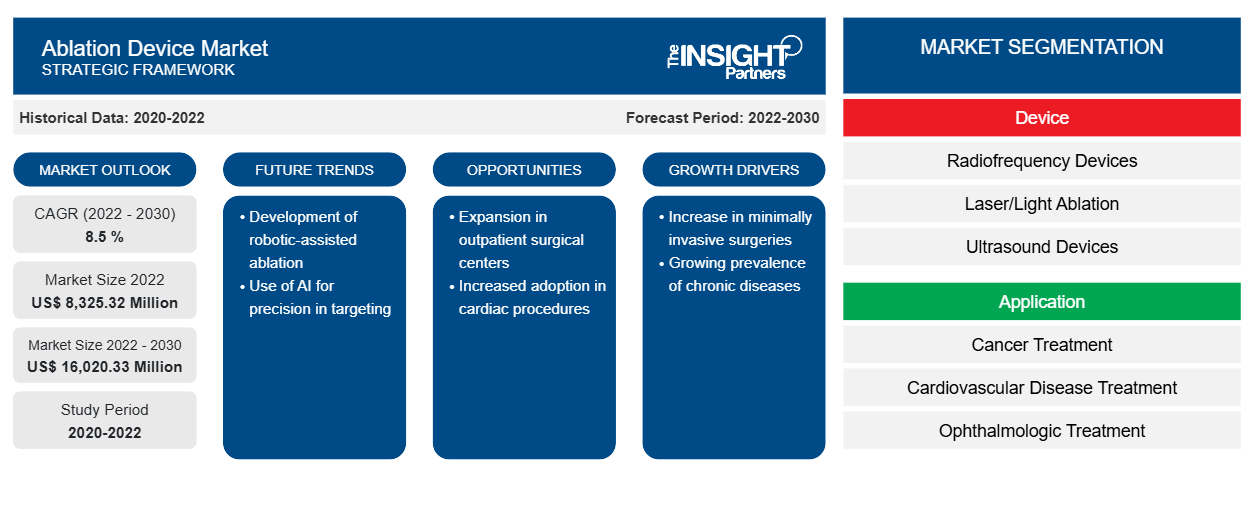

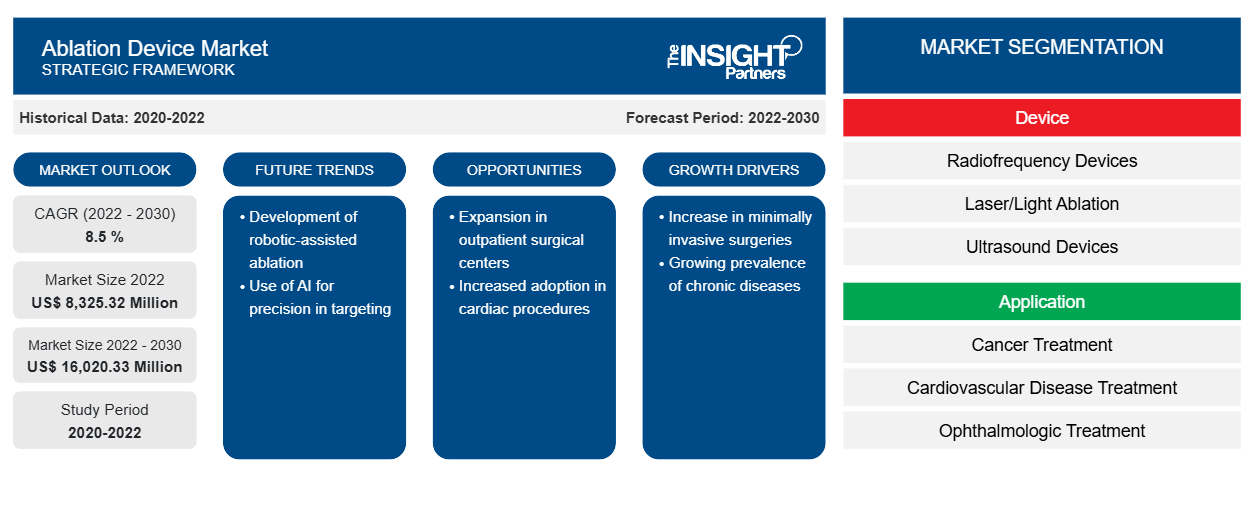

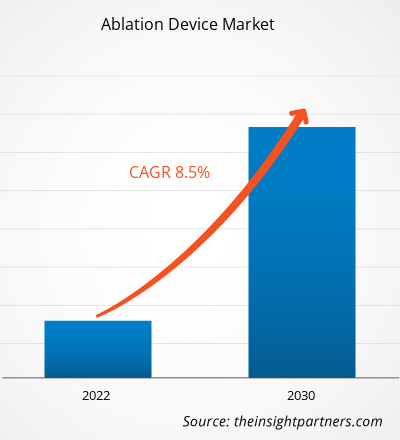

[Research Report] The ablation device market was valued at US$ 8,325.32 million in 2022 and is projected to reach US$ 16,020.33 million by 2030; it is estimated to register a CAGR of 8.5 % from 2022 to 2030.

Market Insights and Analyst View:

Ablation refers to the surgical removal of an organ, structure, or part. Ablation devices use heat (usually generated by radio frequency, RF, energy, or a laser) or extreme cold to cause minor burns. Key factors driving the ablation device market growth include the growing prevalence of chronic diseases, an increase in the geriatric population, and increasing demand for minimally invasive procedures. However, the strong position of alternative treatment methods and therapies hinders market growth.

Growth Drivers and Restraints:

The increasing prevalence of chronic diseases, such as cancer, cardiovascular diseases, and respiratory conditions, drives the global ablation devices market. Ablation procedures offer effective treatment options for various conditions, including tumor ablation, cardiac arrhythmias, and pulmonary disorders. According to the World Health Organization (WHO), each year, noncommunicable diseases (NCDs) are the primary reason for 41 million deaths globally. Furthermore, cardiovascular diseases account for most NCD deaths, or 17.9 million people annually, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, including kidney disease deaths caused by diabetes). Similarly, according to the National Cancer Institute (NCI), cancer is increasingly becoming a global health issue. In 2020, more than 19.3 million new cancer cases resulted in approximately 10 million cancer-related deaths worldwide. The World Health Organization estimated that, by 2040, there could be 28.9 million new cancer cases globally and ∼16.2 million cancer-related deaths yearly. The rising burden of chronic diseases and the need for treatment approaches drive the demand for ablation devices.

Furthermore, aging is a significant risk factor for chronic diseases, particularly cardiovascular conditions and cancer. According to the Union for International Cancer Control (UICC), aging is a significant risk factor for cancer, with a higher incidence of the disease observed in older adults. According to the World Health Organization (WHO), the proportion of the world's population over 60 years will nearly double from 12% to 22% Between 2015 and 2050. Per a study published in January 2023 by NCBI, in the U.S., the number of people aged 50 years and older will reach 221.13 million by 2050, a rapid increase from 137.25 million in 2020. People aged 50 and above are expected to suffer from at least one chronic disease, and the figure is projected to rise by 99.5% from 71.52 million in 2020 to 142.66 million by 2050. Also, it is projected that ~14 million people are likely to suffer from multimorbidity by 2050. Ablation procedures provide minimally invasive treatment options for the elderly population, who may have higher surgical risks. Thus, the increasing geriatric demographic, coupled with a growing prevalence of chronic diseases, fuels the growth of the ablation devices market.

However, ablation techniques face competition from alternative treatment methods, including surgical interventions, radiation therapy, systemic drug therapies, and other minimally invasive procedures. Depending on the specific condition being treated, healthcare providers may opt for alternative treatment modalities based on factors such as efficacy, safety profile, patient eligibility, cost-effectiveness, or availability of resources. The availability and preference for alternative treatment options can limit the adoption and utilization of ablation devices. For example, treatment methods such as surgery, chemotherapy, and radiation therapy are preferred in cancer treatment due to high public awareness of traditional cancer treatments, low adoption of advanced treatment options in developing countries, and surgeons' reluctance to abandon traditional treatment options. Thus, the factors mentioned hamper the growth of the ablation device market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ablation Device Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ablation Device Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

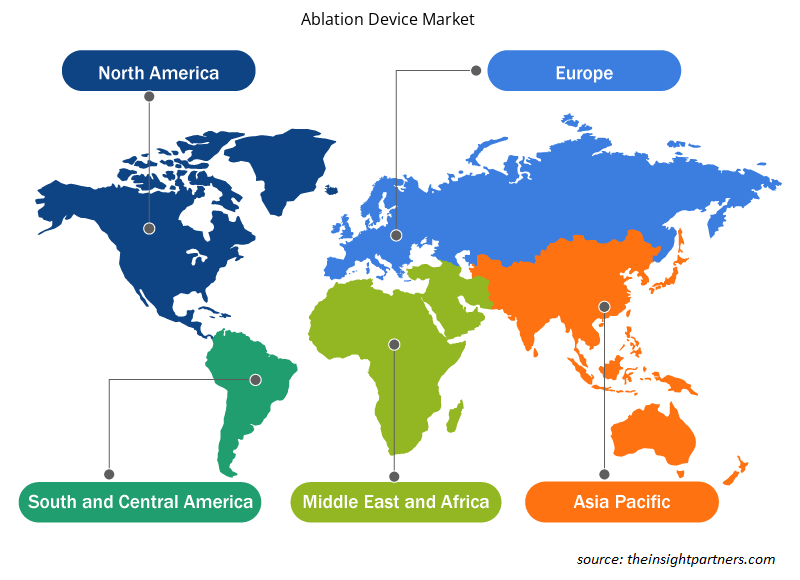

The global ablation device market is categorized on the basis of device, application, and end user. Based on the device, the ablation device market is segmented into radiofrequency devices, laser/light ablation, ultrasound devices, cryoablation devices, and others. Based on application, the ablation device is divided into cancer treatment, cardiovascular disease treatment, ophthalmologic treatment, gynecological treatment, urological treatment, cosmetic surgery, and others. In terms of end user, the market is categorized into hospitals and clinics, ambulatory surgical centers, and others. The ablation device market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The ablation device market, by device, is segmented into radiofrequency devices, laser/light ablation, ultrasound devices, cryoablation devices, and others. The radiofrequency devices segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR during 2022-2030. Radiofrequency ablation is a minimally invasive procedure used in the treatment of myomas, bones, tissues, thyroid, endometrium, varicose veins, and others. It is an alternative to the traditional surgical operation.

The ablation device market, by application, is segmented into cancer treatment, cardiovascular disease treatment, ophthalmologic treatment, gynecological treatment, urological treatment, cosmetic surgery, and others. The cardiovascular disease treatment segment held a larger market share in 2022; also, the same segment is anticipated to register a higher CAGR during 2022-2030.

The ablation device market, by end users, is segmented into hospitals and clinics, ambulatory surgical centers, and others. In 2022, the hospitals and clinics segment held the largest market share, and the same segment is anticipated to register the highest CAGR during 2022–2030. Hospitals and clinics are the primary end users of ablation devices as they offer a wide range of medical services, including non-invasive procedures that require ablation.

Regional Analysis:

Based on geography, the global ablation device market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. Asia Pacific is estimated to register the highest CAGR during 2022–2030. Countries in Asia Pacific, such as India and China, hold significant potential for the growth of the ablation devices market. Developing countries in the region with improving healthcare infrastructure, increasing healthcare expenditure, and a rising focus on adopting advanced medical technologies offer opportunities for market expansion. As emerging markets invest in healthcare infrastructure and as more physicians gain exposure to advanced ablation techniques, the demand for ablation devices will increase, boosting the market growth in Asia Pacific.

North America accounted for the largest share of the ablation device market in 2022. The US accounted for the largest share of the largest ablation device market in 2022, and it is likely to continue this trend during 2022–2030. As per the American Cancer Society estimates, more than 1.9 million people were diagnosed with cancer in 2021, and 608,570 people died due to the disease. Moreover, 1 in 2 men and 1 in 3 women are likely to be diagnosed with cancer in their lifetime in the US. Thus, the high prevalence of cancer among people fuels the ablation device market growth in the US.

According to the US Centers for Medicare & Medicaid Services, the national healthcare expenditure in the US increased by 2.7% in 2021, reaching US$ 4.3 trillion or US$ 12,914 per person. Also, health spending accounted for 18.3% of the national Gross Domestic Product (GDP). As per the US Department of Health & Human Services, national health spending is estimated to grow at an annual rate of 5.4% during 2019–2028, reaching US$ 6.2 trillion by 2028. A rise in healthcare expenditure can potentially lead to increased funding in research and development studies related to drugs, fueling the demand for ablation devices in academics.

Ablation Device Market Regional Insights

Ablation Device Market Regional Insights

The regional trends and factors influencing the Ablation Device Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ablation Device Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ablation Device Market

Ablation Device Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8,325.32 Million |

| Market Size by 2030 | US$ 16,020.33 Million |

| Global CAGR (2022 - 2030) | 8.5 % |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Device

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

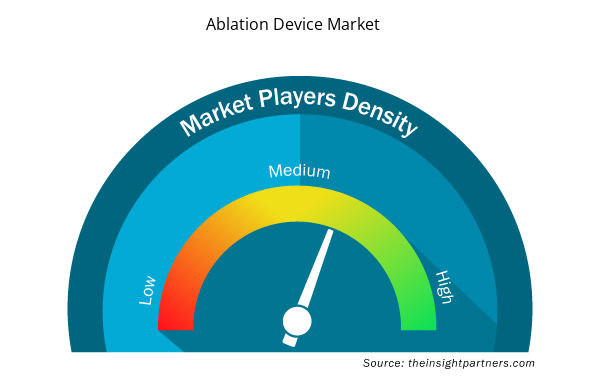

Ablation Device Market Players Density: Understanding Its Impact on Business Dynamics

The Ablation Device Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ablation Device Market are:

- Abbott Laboratories

- AngioDynamics, Inc.

- AtriCure, Inc.

- Biotronik

- Boston Scientific Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ablation Device Market top key players overview

Industry Developments and Future Opportunities:

Technological advancements in the field of ablation have significantly improved the effectiveness and safety of procedures. Newer ablation devices incorporate advanced technologies such as radiofrequency, microwave, cryoablation, and laser, enabling precise tissue destruction while minimizing damage to surrounding healthy tissues. These advancements have increased the success rates and expanded the scope of ablation procedures, driving market growth. Various initiatives taken by key players operating in the global ablation device market are listed below:

A few of the recent developments in the global ablation device market are mentioned below:

- In May 2023, Abbott received US Food and Drug Administration (FDA) approval for its TactiFlex Ablation Catheter (Sensor Enabled), which became the world's first ablation catheter featuring a flexible tip and contact force technology.

- In February 2023, the NovaSure V5 global endometrial ablation (GEA) device of Hologic Inc. was approved for medical usage in Canada and Europe. This innovative version incorporates enhanced features for the treatment of a broad range of cervical and uterine anatomies.

- In November 2021, Medtronic India launched the Arctic Front Cardiac Cryoablation Catheter System for atrial fibrillation (AF) treatment in the country. The system is used to perform minimally invasive cryoballoon catheter ablation, one of the therapeutic modalities used to manage AF.

- In January 2021, Medtronic plc received FDA approval for the DiamondTemp Ablation (DTA) system, which is indicated for treating patients with recurrent, symptomatic paroxysmal AF, particularly for those who have been unresponsive to conventional drugs. The DTA is the first FDA-approved, temperature-controlled, irrigated radiofrequency (RF) ablation system with diamonds, which is currently available to deliver ablations.

- In December 2020, Acutus Medical launched the AcQBlate Force Sensing Ablation System in Europe. The product was launched after securing the CE Mark for the AcQBlate Force ablation catheter and the Qubic Force Sensing Module. AcQBlate Force incorporated by this ablation system is the only commercially available gold-tipped, irrigated, force-sensing radiofrequency ablation catheter on the market. The system also integrates two state-of-the-art components made available through Acutus Medical’s international alliance with BIOTRONIK—the Qubic RF and the Qiona Irrigation Pump.

- In November 2020, Abbott announced the launch of the IonicRF Generator, a device cleared by the FDA to deliver a nonsurgical, minimally invasive treatment for the management of pain in the nervous system. This RF ablation device uses heat to target specific nerves and block pain signals from reaching the brain. The device is currently approved for sale in the US and Europe.

Competitive Landscape and Key Companies:

Abbott Laboratories, AngioDynamics Inc, AtriCure Inc, Biotronik, Boston Scientific Corporation, Conmed Corporation, Johnson and Johnson, Medtronic PLC, Olympus Corporation, and Smith & Nephew PLC are among the prominent players operating in the ablation device market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Vision Guided Robotics Software Market

- Smart Parking Market

- Thermal Energy Storage Market

- Biopharmaceutical Contract Manufacturing Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Oxy-fuel Combustion Technology Market

- Europe Surety Market

- Small Satellite Market

- Organoids Market

- Aesthetic Medical Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Device, Application, End-User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The ablation device market, by device, is segmented into radiofrequency devices, laser/light ablation, ultrasound devices, cryoablation devices, and others. The radiofrequency devices segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR during 2022-2030.

The ablation device market, by application, is segmented into cancer treatment, cardiovascular disease treatment, ophthalmologic treatment, gynecological treatment, urological treatment, cosmetic surgery, and others. The cardiovascular disease treatment segment held a larger market share in 2022; also, the same segment is anticipated to register a higher CAGR during 2022-2030.

Key factors driving the ablation device market growth include the growing prevalence of chronic diseases, an increase in the geriatric population, and increasing demand for minimally invasive procedures.

The ablation device market majorly consists of the players, including Abbott Laboratories, AngioDynamics Inc, AtriCure Inc, Biotronik, Boston Scientific Corporation, Conmed Corporation, Johnson and Johnson, Medtronic PLC, Olympus Corporation, and Smith & Nephew PLC.

Ablation refers to the surgical removal of an organ, structure, or part. Ablation devices use heat (usually generated by radio frequency, RF, energy, or a laser) or extreme cold to cause minor burns.

The ablation device market was valued at US$ XX.XX million in 2022.

The ablation device market is expected to be valued at US$ XX.XX million in 2030.

The ablation device market, by end users, is segmented into hospitals and clinics, ambulatory surgical centers, and others. In 2022, the hospitals and clinics segment held the largest market share, and the same segment is anticipated to register the highest CAGR during 2022–2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Ablation Device Market

- Abbott Laboratories

- AngioDynamics, Inc.

- AtriCure, Inc.

- Biotronik

- Boston Scientific Corporation

- Conmed Corporation

- Johnson and Johnson

- Medtronic PLC

- Olympus Corporation

- Smith & Nephew PLC

Get Free Sample For

Get Free Sample For