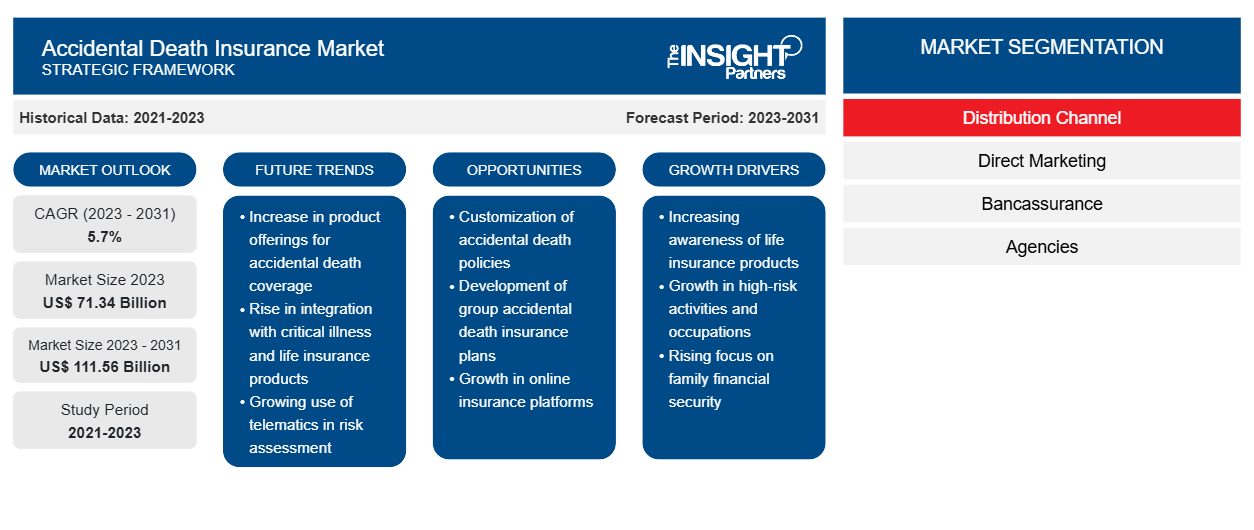

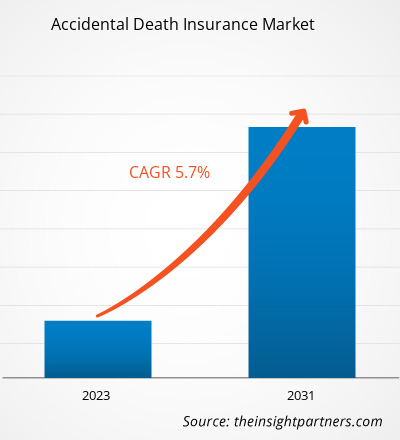

The accidental death insurance market size is expected to grow from US$ 71.34 billion in 2023 to US$ 111.56 billion by 2031; it is anticipated to expand at a CAGR of 5.7% from 2023 to 2031.

Accidental Death Insurance Market Analysis

As persons become more globally mobile, there is an increasing trend in the demand for accidental death insurance that provides coverage beyond nationwide borders. Frequent travelers, expatriates, and individuals engaged in worldwide business activities seek insurance solutions that bid seamless protection irrespective of their location. Insurers are acclimating to this trend by providing products with worldwide coverage or partnerships with global insurers to generate comprehensive solutions. The capability to deliver seamless coverage in numerous regions improves the application of accidental death insurance for individuals with varied geographical exposures.

Accidental Death Insurance

Industry Overview

- The insurance industry is undergoing a wave of modernization through the increase of insurance technology businesses. In the accidental death insurance market, insurance companies are leveraging digital platforms to restructure the purchase procedure, improve customer experiences, and provide innovative products.

- Digital distribution channels, such as mobile apps and online platforms, deliver consumers with efficient and convenient ways to purchase, explore, and manage their accidental death insurance policies.

- Insurance companies are also integrating developing technologies, including smart contracts and blockchain, to enhance transparency, decrease fraud, and accelerate claims processing. The digitization of the insurance value chain subsidizes augmented accessibility and affordability, making accidental death insurance more appealing to a wider demographic.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Accidental Death Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Accidental Death Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Accidental Death Insurance Market Driver

Technological Integration and Data Analytics to Drive Market Growth

- In the digital stage of development, technology plays an essential role in restructuring the insurance business landscape, and the accidental death insurance market is no exception. Insurers are progressively leveraging innovative technologies such as data analytics and artificial intelligence (AI) to modernize underwriting procedures, improve risk assessment, and enhance overall operational efficiency.

- Data analytics allows insurers to evaluate enormous amounts of information, enabling more precise risk profiling and tailored pricing. Predictive modeling aids recognize evolving trends and enhance underwriting standards, contributing to improved risk management. Furthermore, technology enables seamless customer communications, allowing policyholders to access data, file claims information, and manage their policies through comprehensible mobile apps and online platforms.

- The incorporation of technology not only enhances the customer experience but also empowers insurers to acclimate to fluctuating risk landscapes more efficiently. As technology continues to develop, further innovations in customer engagement and risk assessment within the accidental death insurance market are expected to boost during the forecast period.

Accidental Death Insurance

Market Report Segmentation Analysis

- Based on application, the accidental death insurance market is segmented into enterprise and personal. The personal segment held a significant accidental death insurance market share in 2023.

- In the accidental death insurance market, the dominance between personal and enterprise segments is influenced by the exclusive requirements and primacies of each category. At present, the personal segment tends to dominate the market owing to its comprehensive consumer base and the extensive recognition of the importance of individual monetary protection. Consumers, driven by augmented awareness and a longing for personal security, actively seek out accidental death insurance to protect their families against unexpected tragedies.

- However, the enterprise segment is gaining importance, particularly as businesses identify the importance of delivering financial protection for their workforces. Corporate insurance policies, which often comprise accidental death insurance as part of employee benefits packages, subsidize the growth of the enterprise segment. The emphasis on employee welfare, combined with governing requirements in some industries, further drives the acceptance of accidental death insurance in the enterprise segment.

Accidental Death Insurance

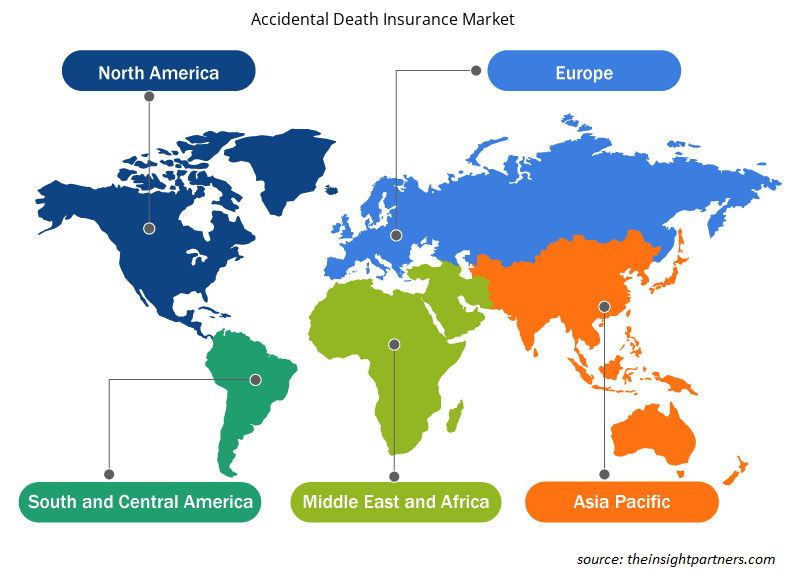

Market Regional Analysis

The scope of the accidental death insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is observing rapid growth and is expected to hold a noteworthy accidental death insurance market share in 2022. North America dominates the accidental death insurance market for numerous reasons, reflecting the region's financial, demographic, and governing characteristics. The US, in particular, plays a fundamental role in this supremacy. The region's mature and robust insurance business, coupled with a higher level of insurance awareness among individuals, contributes to a significant market share.

The US has a diverse and large population with a higher standard of living, driving the need for financial protection. The culture of financial planning and risk mitigation has led to extensive adoption of insurance products, including accidental death insurance, as individuals seek complete coverage for themselves and their families. Furthermore, the governing environment in North America, particularly in the US, delivers a conducive and stable framework for insurance processes. Stringent regulatory oversight ensures consumer protection and boosts trust in the insurance business, attracting both consumers and insurers to participate vigorously in the market. The dominance of North America in the accidental death insurance market is further powered by technological developments, a strong economy, and a practice of risk management, making it a booming hub for the accidental death insurance market.

Accidental Death Insurance

Accidental Death Insurance Market Regional Insights

The regional trends and factors influencing the Accidental Death Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Accidental Death Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Accidental Death Insurance Market

Accidental Death Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 71.34 Billion |

| Market Size by 2031 | US$ 111.56 Billion |

| Global CAGR (2023 - 2031) | 5.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Distribution Channel

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

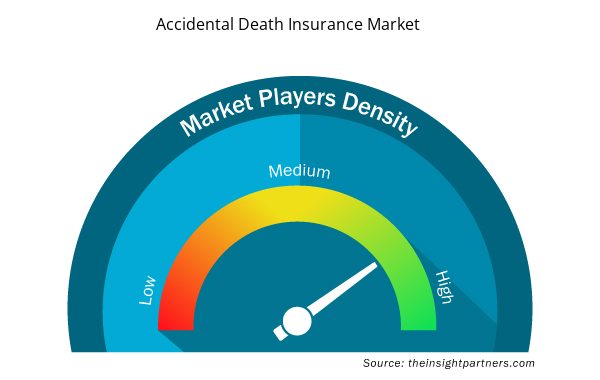

Accidental Death Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Accidental Death Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Accidental Death Insurance Market are:

- Allianz SE

- Assicurazioni Generali SpA

- China Life Insurance Company Limited

- MetLife Inc.

- Ping An Insurance Company of China Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Accidental Death Insurance Market top key players overview

The "Accidental Death Insurance Market Analysis" was carried out based on type, application, distribution channel, and geography. In terms of type, the market is segmented into personal injury claims, road traffic accidents, workplace accidents, and general-purpose reloadable cards. In terms of application, the market is segmented into enterprise and personal. By distribution channel, the market is distributed into direct marketing, bancassurance, agencies, e-commerce, and brokers. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Accidental Death Insurance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the accidental death insurance market. A few recent key market developments are listed below:

- In January 2024, MSIG Insurance introduced a new comprehensive personal accident plan, PA Recovery Plus, crafted to safeguard individuals at numerous life stages. In the event of permanent disability or accidental death, PA RecoveryPlus ensures financial security through payouts. The coverage extends to vital benefits, including daily hospital income and reimbursement for medical expenses, as well as alternative treatments.

(Source: MSIG Insurance, Company Website)

Accidental Death Insurance

Market Report Coverage & Deliverables

The market report "Accidental Death Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Machine Condition Monitoring Market

- Hair Extensions Market

- Emergency Department Information System (EDIS) Market

- Educational Furniture Market

- Identity Verification Market

- Saudi Arabia Drywall Panels Market

- Microcatheters Market

- Ceramic Injection Molding Market

- Non-Emergency Medical Transportation Market

- Dairy Flavors Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Distribution Channel, Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increasing investments in the accidental insurance market and high adoption in the personal segment are the major factors that propel the global accidental death insurance market.

The global accidental death insurance market was estimated to be US$ 71.34 billion in 2023 and is expected to grow at a CAGR of 5.7% during the forecast period 2023 - 2031.

Digital advancements in the accidental death insurance market to play a significant role in the global accidental death insurance market in the coming years.

The key players holding majority shares in the global accidental death insurance market are Aviva PLC, Allianz SE, MetLife Inc. , AXA SA, Aegon Life Insurance Company Limited

The global accidental death insurance market is expected to reach US$ 111.56 billion by 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Allianz SE

- Assicurazioni Generali SpA

- China Life Insurance Company Limited

- MetLife Inc.

- Ping An Insurance Company of China Ltd.

- AXA SA

- Sumitomo Life Insurance Company

- Aegon Life Insurance Company Limited

- Dai-ichi Life Insurance Company Limited

- Aviva plc

Get Free Sample For

Get Free Sample For