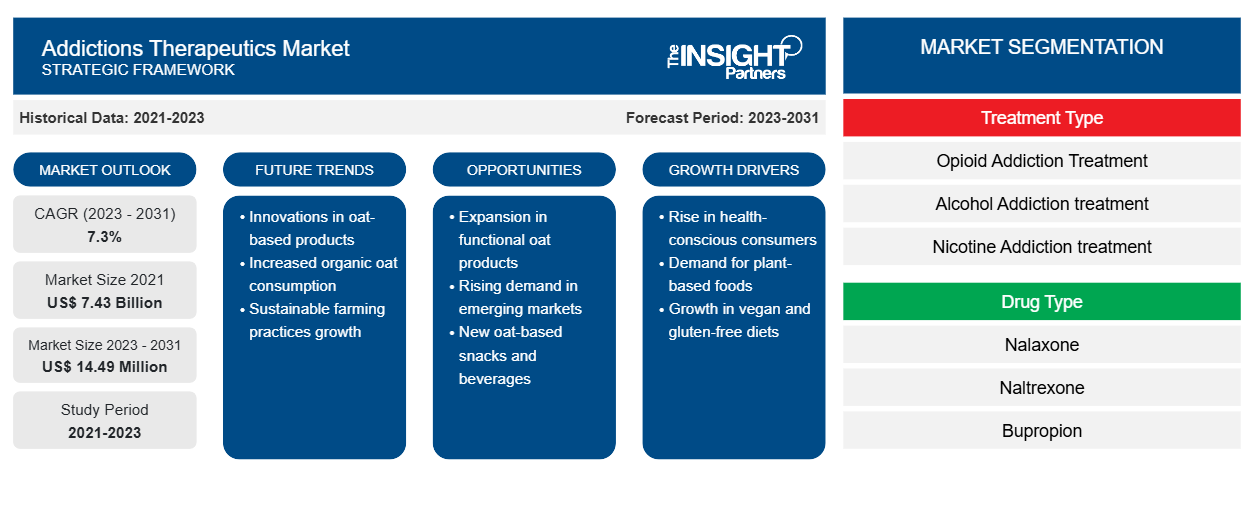

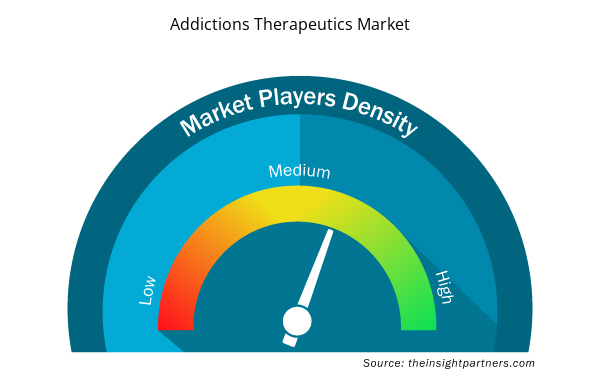

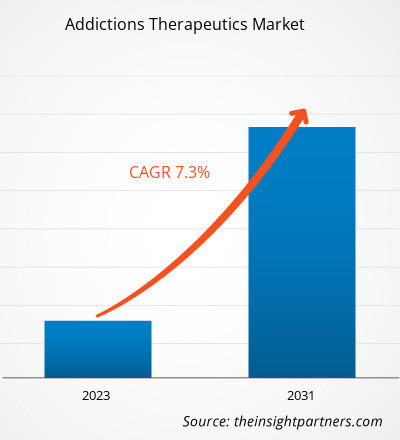

The Addictions Therapeutics Market size was estimated to be US$ 7.43 billion in 2021 and US$ XX million in 2023 and is expected to reach US$ 14.49 million by 2031; it is estimated to record a CAGR of 7.3% till 2031. Consistent launch of various therapeutics are likely to remain key Addictions Therapeutics Market trends.

Addictions Therapeutics Market Analysis

The leaders, governing powers, and Non-governmental organization (NGOs) are looking for new ways to create awareness and fight the epidemic of growing substance addiction. For instance, the Council on Chemical Abuse participates in various state and national campaigns to raise awareness regarding substance misuse, recovery, and prevention.

The United Nations Office of Drugs and Crime (UNODC) lead a worldwide campaign that creates awareness about the major challenge caused by the illicit drugs on society and the young population. The UNODC undertakes various awareness-raising activities worldwide and invites individuals, private sector, non-profit organizations, and member states to organize institutional outreach programs against illicit trafficking and drug abuse.

Further, in August 2023, a campaign was launched in India to discourage vaping among adolescents. The campaign aimed to recommend effective solutions and sought the help of experts to create impactful communication highlighting the adverse effects of vaping. Additionally, the campaign aimed to raise awareness about the ban on vaping in India and other countries, explaining the reasons behind such measures.

Similar awareness campaigns and government efforts to counteract drug abuse and promote medication to get rid of all sorts of addictions is likely to fuel the market growth during the forecast period.

Addictions Therapeutics Market Overview

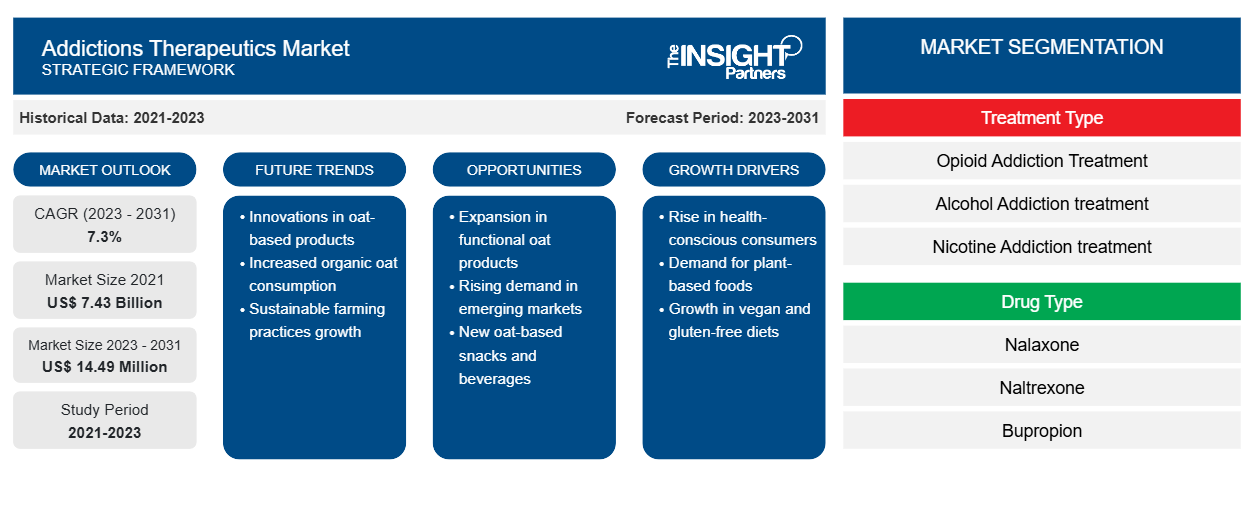

Global addictions therapeutics market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North American region holds the largest market share of the market, whereas the Asia Pacific region is the fastest-growing region. The growth of market in North America is majorly due to entry of new market players, various product launches and rising number of people having one or more addiction of substances. Moreover, Asia Pacific is the fastest growing market for addiction therapeutics in a global scenario. China, India and Japan are three major contributors to the growth of the market, which is driven by high amount of narcotic consumption, bulk development of generic drugs for addiction treatment as well as emergence of local players in the region. Additionally, research & development (R&D) investments by multinational pharmaceutical companies also fuel the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Addictions Therapeutics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Addictions Therapeutics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Addictions Therapeutics Market Drivers and Opportunities

Growing Partnerships Between Organizations to Favor Market

There are several organizations in the addictions therapeutics market partnering that are boosting the growth of the market. For instance, in September of 2023, Click Therapeutics collaborated with Indivior. The collaboration aims to develop and commercialize prescription digital therapeutics to treat substance use disorders, starting with Opioid Use Disorder (OUD). The collaboration will be facilitated through a mobile application called CT-102, which aims to address the major gaps in OUD, such as access to high-quality, personalized psychosocial treatment.

Similarly, in January of 2023, Pear Therapeutics expanded its partnership with outpatient addiction treatment clinics. Spero Health can now use Pear's reSET and reSET-O prescription digital therapeutics in 99 locations across five states, after previously using them in just 14 clinics in Kentucky. Thus, growing partnerships between organizations driving the growth of addictions therapeutics market.

Rising Demand for R&D from Contract Organizations – An Opportunity

In the last few years, the pharmaceutical industry has witnessed a rapid growth in outsourcing services; driven by many factors, such as the growth of demand for pain medications, increase in API complexities, and growing need to reduce development costs. Large pharmaceutical companies are outsourcing R&D activities to increase the speed of the drug development process, along with reducing their development and manufacturing costs.

Various pharmaceutical firms, including the one that manufactures addiction therapeutics, rely on contract research organizations (CROs) to minimize the high fixed costs of in-house development, manufacturing capabilities, and expertise. Increasing complexity in the development of new molecular entities (NMEs) has created a need for niche capabilities that pharmaceutical companies prefer outsourcing instead of in-house. With the increasing drug approvals (the FDA approved 55 NMEs in 2023); there is a rise in robust clinical development and demand for outsourcing. Various biotechnology companies are taking advantage of CROs to expand their potential drug candidate’s pipeline. The reduction in costs of drug manufacturing through outsourcing is likely to offer significant growth opportunities to market players in order to maximize the profit margins and sustain in the dynamic addiction therapeutics market.

Addictions Therapeutics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the addictions therapeutics market analysis are treatment type, drug type, treatment center, and distribution channel.

- Based on treatment type, the addictions therapeutics market is segmented into nicotine addiction treatment, alcohol addiction treatment, opioid addiction treatment, other substance addiction treatment. The nicotine addiction treatment segment held a largest market share in 2023.

- By drug type, the market is segmented into varenicline, bupropion, nicotine replacement products, buprenorphine, naltrexone, disulfiram, others. The varenicline segment held the largest share of the market in 2023.

- In terms of treatment center, the market is segmented into outpatient treatment center, residential treatment center, inpatient treatment center. The outpatient treatment center segment dominated the market in 2023.

Addictions Therapeutics Market Share Analysis by Geography

The geographic scope of the addictions therapeutics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America is the largest market for addiction therapeutics, with the US holding the largest market share, followed by Canada. The growth in North America is characterized by entry of new market player, various product launches and rising number of people having one or more addiction of substances. Market players in the US raising funds for addiction treatment. For instance, in July 2023, Affect Therapeutics, a company that is revolutionizing addiction treatment using digital technology, announced that it has raised US$16 million in a Series A funding round led by ARTIS Ventures, a TechBio-focused investment firm. The funds raised will be used to expand the company's programs to a national level, as well as to improve the Affect app through engineering innovation.

Addictions Therapeutics Market Regional Insights

Addictions Therapeutics Market Regional Insights

The regional trends and factors influencing the Addictions Therapeutics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Addictions Therapeutics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Addictions Therapeutics Market

Addictions Therapeutics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.43 Billion |

| Market Size by 2031 | US$ 14.49 Million |

| Global CAGR (2023 - 2031) | 7.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Treatment Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

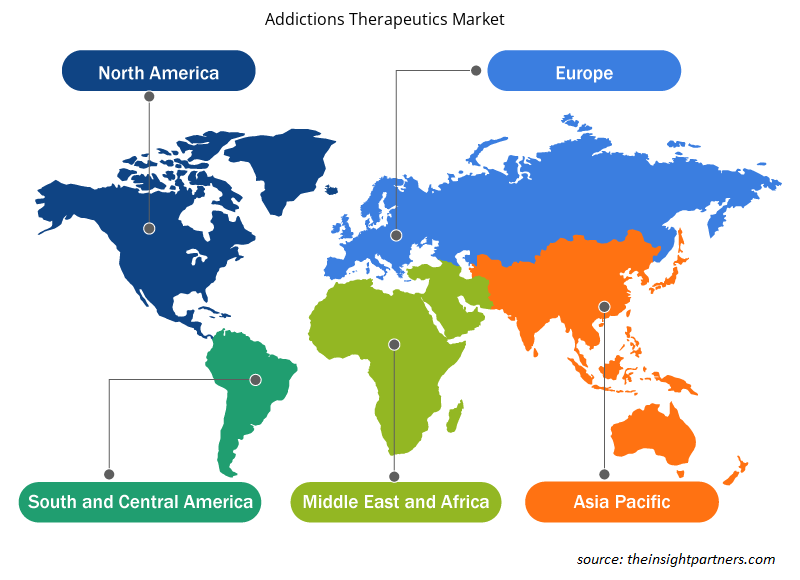

Addictions Therapeutics Market Players Density: Understanding Its Impact on Business Dynamics

The Addictions Therapeutics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Addictions Therapeutics Market are:

- Indivior PLC

- Pfizer, Inc.

- GlaxoSmithKline Plc

- Bausch Health Companies

- Cipla, Inc.

- Orexo AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Addictions Therapeutics Market top key players overview

Addictions Therapeutics Market News and Recent Developments

The addictions therapeutics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for addictions therapeutics:

- In January 2023, Hikma Pharmaceuticals PLC launched Naloxone Hydrochloride Injection, USP, 2mg/2mL, in prefilled syringe (PFS) form. This drug is used for emergency treatment of a known or suspected opioid overdose and is the third PFS product launched. The injection is currently available in the US. (Source: Hikma Pharmaceuticals PLC, 2023)

- In January 2022, Pfizer partnered with Swedish start-up Alex Therapeutics to venture into the digital therapeutics space. Alex Therapeutics' AI-based platform integrates both cognitive behavioral therapy (CBT) and Acceptance and Commitment Therapy (ACT) with AI to personalize care. The initial focus of their partnership is to create digital therapeutics for nicotine addiction treatment and will begin their efforts in the German market. (Source: Pfizer, 2022)

Addictions Therapeutics Market Report Coverage and Deliverables

The “Addictions Therapeutics Market Size and Forecast (2022–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Treatment Type ; Drug Type ; Treatment Center ; Distribution Channel and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoAPAC, RoEU, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Indivior PLC

- Pfizer, Inc.

- GlaxoSmithKline Plc

- Bausch Health Companies

- Cipla, Inc.

- Orexo AB

- Purdue Pharma L.P.

- Alvogen

- Camurus AB

- Hikma Pharmaceuticals Plc

Get Free Sample For

Get Free Sample For