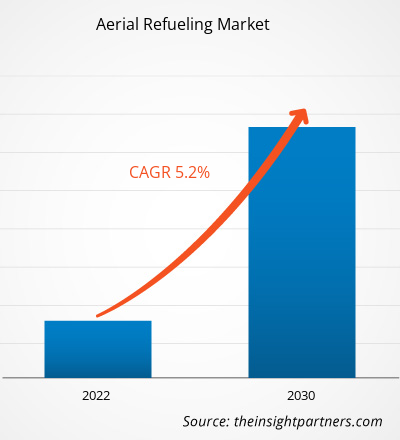

[Research Report] The aerial refueling market was valued at US$ 640.75 million in 2022, and it is expected to reach US$ 960.94 million by 2030; it is anticipated to register a CAGR of 5.2% from 2022 to 2030.

Analyst Perspective:

The aerial refueling market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. The aerial refueling market has witnessed tremendous growth in the past few years. One of the major factors driving the market is the rising global military aircraft fleet and the replacement or refurbishment of older military tanker aircraft fleets. Another major factor driving the market includes the rising development of unmanned refueling tankers that are currently being tested for their first-ever actual operations among different armed forces. Manufacturers operating in the market are majorly focusing on the development of innovative products to remain competitive. However, a few of the factors hindering the aerial refueling market growth include the rise in environmental concerns caused by aircraft operations and higher installation costs for refueling system components. The report includes growth prospects in light of current aerial refueling market trends and driving factors influencing the market growth.

Market Overview:

The aerial refueling market is moderately consolidated, with the presence of a limited number of players operating across different regions. Moreover, a few countries have been pushing their military investments in terms of procuring newer tanker aircraft models to replace their older tanker aircraft fleet, which is outdated and requires huge monetary sources for successful operation. Furthermore, the constant tensions among countries such as Russia-Ukraine, China-Taiwan, Israel-Palestine, US-China, India-Pakistan, and India-China is also pushing the awareness for the procurement of new military aircraft and tanker models to strengthen their respective armed forces. Further, such tensions are also due to the rising geopolitical competition among different countries for strengthening their respective armed forces. Hence, they are procuring advanced technologies and adding value to their respective armed forces. Such factors are supporting the deployment of tankers and combat aircraft, which is further generating the need for aerial refueling systems across different regions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerial Refueling Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerial Refueling Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Growing Procurement of Military Aircraft & Helicopters Generates Demand for Aerial Refueling Systems

The growing demand for advanced technologies to neutralize missile attacks, along with enhancing the process of identification or locating the target area and surveillance and detection of possible airborne threats, is boosting the application of advanced aerial refueling in military aircraft, jets, and helicopters. The government bodies of different countries are investing substantially in procuring high-end military aircraft, combat jets, and helicopters to tackle the growing airborne threats, which is also expanding the application scope of aerial refueling and refueling tanker aircraft globally. There is a growing number of contracts and deals to procure advanced defense aircraft and helicopters to combat the rise in advanced airborne attacks. A few of the major investments, contracts, and deals are mentioned below:

- In 2023, the Boeing company secured a contract worth US$ 12 billion for the supply of Apache attack helicopters to Poland. Poland is expected to receive 96 units of AH-64E Apache attack helicopters.

- In 2022, the US government and Lockheed Martin finalized the contract for the production and delivery of 398 F-35s for ~US$ 30 billion.

- In 2022, the Indian Air Force announced its plan to acquire 114 fighter jets, out of which 96 are expected to be developed in the country.

- In 2022, Switzerland signed a deal to procure three dozen F-35A fighter jets.

- In 2022, L3Harris Technologies Inc. secured a contract worth US$ 3 billion to supply military aircraft to the US Special Operations Command.

Thus, the increasing procurement of military aircraft and helicopters for combating the growing instances of airborne attacks drives the aerial refueling market.

Segmental Analysis:

Based on component, the market is segmented into refueling pods, refueling probes, drogues, hoses, boom, and others. In 2022, the boom segment dominated the aerial refueling market share, and it is also expected to retain its dominance during the forecast period. Further, the hoses and refueling pods are two of the main segments that are anticipated to register the healthy CAGRs in the aerial refueling market from 2022 to 2030. The main factors fueling the boom segment’s growth are its higher price, technology integration, and the fact that it allows the operator to conduct smooth refueling operations during any aerial flight. However, the boom segment is likely to register sluggish growth during the forecast period due to the higher demand for probe & drogue systems in the present scenario across different regions. The demand for probe & drogue systems is increasing because of their reasonable prices, flexibility, ease of installation, and other parameters. Such factors are likely to boost the aerial refueling market size during the forecast period.

Regional Analysis:

In terms of revenue, North America dominated the aerial refueling market share in 2022 which is also expected to retain its dominance during the forecast period as well. The North America aerial refueling market was valued at US$ 275.01 million in 2022 and is projected to reach US$ 413.21 million by 2030; it is expected to register a CAGR of 5.2% from 2022 to 2030. North America is home to a few of the major aircraft OEMs such as Boeing, Bombardier, Lockheed Martin, and Airbus, which have their respective production facilities across different parts of the region and keep generating new demand for aerial refueling systems from their respective facilities. Such factors have been boosting the demand for aerial refueling products across the region. Further, another major factor catalyzing the growth of the North America aerial refueling market includes the presence of aerial refueling system manufacturers across countries such as the US and Canada. Such companies include vendors such as Eaton, GE Aviation, Marshall Aerospace & Defense Group, Parker Hannifin Corporation, Boeing, and Raytheon Technologies Corporation.

Aerial Refueling Market Regional Insights

Aerial Refueling Market Regional Insights

The regional trends and factors influencing the Aerial Refueling Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aerial Refueling Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aerial Refueling Market

Aerial Refueling Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 640.75 Million |

| Market Size by 2030 | US$ 960.94 Million |

| Global CAGR (2022 - 2030) | 5.2% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

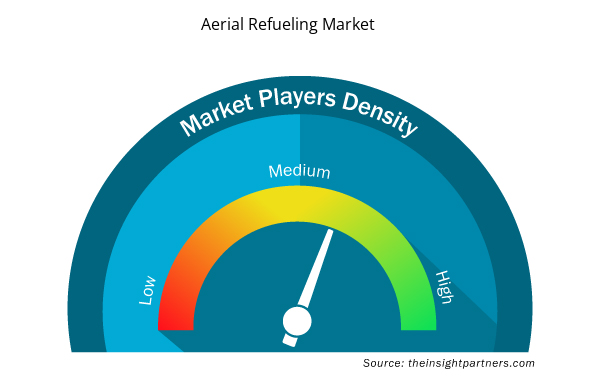

Aerial Refueling Market Players Density: Understanding Its Impact on Business Dynamics

The Aerial Refueling Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aerial Refueling Market are:

- Cobham Plc

- Safran

- Eaton

- GE Aviation

- Marshall Aerospace & Defense Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aerial Refueling Market top key players overview

Key Player Analysis:

“The aerial refueling market analysis” is carried out by identifying and evaluating key players in the market across different regions. L3Harris Technologies Inc, Raytheon Technologies Corporation, Curtiss-Wright Corporation, Honeywell International Inc, General Electric Company, Safran SA, BAE Systems Plc, Moog Inc, Meggitt Plc, and Garmin Ltd are among the prominent players profiled in the aerial refueling marketreport. In addition, Cobham Plc, Safran, Eaton, GE Aviation, and Marshall Aerospace & Defense Group are considered among the top market players owing to the diversified product portfolio offered.

Recent Developments:

The aerial refueling market report includes company positioning and concentration to evaluate the performance of competitors/players in the market. Inorganic and organic strategies such as product launches, mergers, and acquisitions are highly adopted by companies in the aerial refueling market. A few of such instances are mentioned below:

- In February 2021, Eaton bought the aerial refueling system unit of Cobham Plc in the US in a deal worth US$ 2.8 billion.

- In November 2023, Eaton announced that it had successfully conducted the testing of its newly designed actively stabilized drogue prototype, mainly focused on autonomous aerial refueling for next-generation fighter jets.

Thus, such factors have been catalyzing the aerial refueling market growth from the suppliers' perspective.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Aircraft Type, System Type, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Cobham Plc, Safran, Eaton, GE Aviation, and Marshall Aerospace & Defense Group are some of the key market players operating in the global aerial refueling market.

Deployment of refueling tanker UAVs into military forces is one of the major trends expected to drive the market in the coming years.

North America is expected to account for the largest share during the forecast period and it is likely to retain its dominance during the forecast period as well.

Increasing awareness for strengthening armed forces of different countries and rising military aircraft fleet are some of the key factors likely to generate new opportunities for market vendors during the forecast period.

Surge in global military expenditure and rising procurement of refueling tanker aircraft are contributing to the growth of aerial refueling market.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Aerial Refueling Market

- Cobham Plc

- Safran

- Eaton

- GE Aviation

- Marshall Aerospace & Defense Group

- Parker Hannifin Corporation

- Israel Aerospace Industries Ltd

- BAE Systems Plc

- Elbit Systems Ltd

- ARESIA

Get Free Sample For

Get Free Sample For