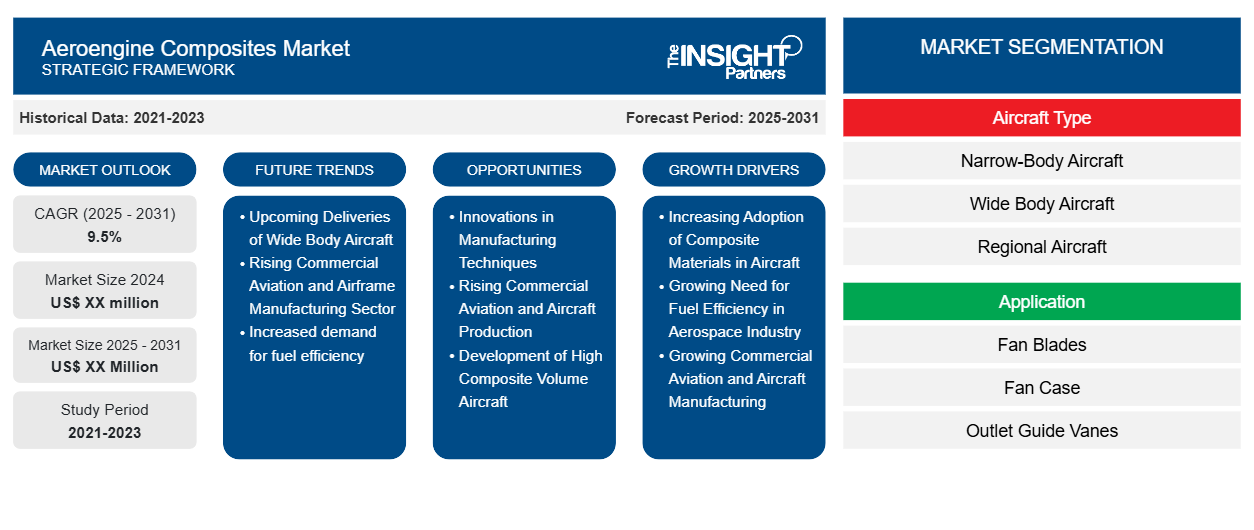

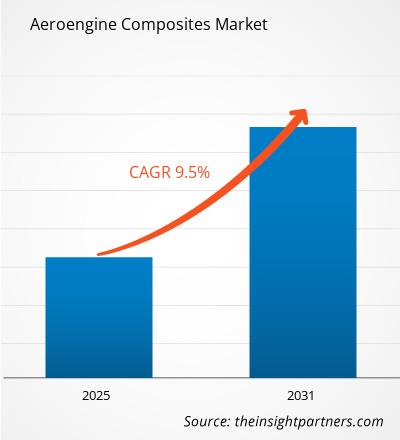

The Aeroengine Composites Market is expected to register a CAGR of 9.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Aircraft Type (Narrow-Body Aircraft, Wide Body Aircraft, Regional Aircraft, General Aviation, Helicopter, Military Aircraft, UAVs); Application (Fan Blades, Fan Case, Outlet Guide Vanes, Shrouds, Cowlings, Nacelles, Others); Composite Type [Polymer Matrix Composites (PMC), Ceramic Matrix Composites (CMC), Metal Matrix Composites (MMC)]. The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Aeroengine Composites Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Aeroengine Composites Market Segmentation

Aircraft Type

- Narrow-Body Aircraft

- Wide Body Aircraft

- Regional Aircraft

- General Aviation

- Helicopter

- Military Aircraft

- UAVs

Application

- Fan Blades

- Fan Case

- Outlet Guide Vanes

- Shrouds

- Cowlings

- Nacelles

- Others

Composite Type

- Polymer Matrix Composites

- Ceramic Matrix Composites

- Metal Matrix Composites

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aeroengine Composites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aeroengine Composites Market Growth Drivers

- Increasing Adoption of Composite Materials in Aircraft: The growing demand for lightweight and high-strength materials in aircraft manufacturing to reduce the overall weight and increase the operational efficiency of aircraft is one of the major factors propelling the growth of aeroengine composites market.

- Growing Need for Fuel Efficiency in Aerospace Industry: The aerospace industry faces immense pressure to increase the efficiency of fuel and reduce the emissions produced due to escalating fuel costs and strict environmental laws. Aeroengine manufacturers are increasingly adopting composite materials that are lighter than metals, reducing the overall weight of the engine. Manufacturers can achieve performance and efficiency improvement using composites in fan blades and casings, resulting in a higher adoption of composite materials in aeroengine design. Advances in Composites Manufacturing Technologies: New developments in composite manufacturing, such as automated fiber placement (AFP) and resin transfer molding (RTM), make the production of high-quality composite components easier and more economical. Complex shapes and structures that were not feasible to achieve with traditional materials can now be achieved with the help of these new manufacturing techniques. The growing use of composites in aeroengines will be driven by improved manufacturing processes, enabling lighter, stronger, and more durable engine designs.

- Growing Commercial Aviation and Aircraft Manufacturing: The aeroengine composites market finds a key driver in the growth of the commercial aviation industry. Increasing air travel demand has led airlines to invest in new aircraft, expanding their fleets and enhancing operational efficiency. This increased aircraft manufacturing translates to an increased need for sophisticated aeroengine technologies such as lightweight composite materials. This trend towards older aircraft replacement with newer models that offer higher efficiency again increases the demand for composites in next-generation aeroengines.

- Demand for Fuel Efficiency: The growing demand for improving fuel efficiency by reducing the overall weight of the aircraft is another major factor supporting the growth of aeroengine composites market.

Aeroengine Composites Market Future Trends

- Upcoming Deliveries of Wide Body Aircraft: The upcoming deliveries of around 7,000 wide body commercial aircraft by the end of 2042 is further likely to drive the market for aeroengine composites market in the coming years.

- Rising Commercial Aviation and Airframe Manufacturing Sector: Growth in the commercial aviation market is a primary growth driver in the aeroengine composites market. With ever-increasing air travel demands, the airlines are continuously investing in new aircraft and increasing the fleet size as well as enhancing operational efficiency. Thus, the upsurge in aircraft manufacturing is directly linked with the rise in demand for advanced aeroengine technologies, such as lightweight composite materials. More demand for composite materials in future-generation aeroengines comes from the trend towards replacing older aircraft with more modern, efficient models.

- Increased demand for fuel efficiency: Due to increased fuel costs and the tightening of environmental regulations, the aerospace industry is always under pressure to improve fuel efficiency and reduce emissions. Aeroengine manufacturers are resorting to composite materials, which are lighter than traditional metals, in an effort to reduce the overall weight of engines. With the use of composites in fan blades and casings of engines, manufacturers can improve performance and efficiency, and therefore adopt more composite materials in aeroengine design. Advances in composite manufacturing technologies: Innovations in techniques for manufacturing composites - such as automated fiber placement (AFP) and resin transfer molding (RTM) - are making it less expensive and easier to produce very high-quality composite components. These innovations now allow the manufacturer to create intricate shapes and structures that were much more difficult to achieve with traditional materials. The use of composites in aeroengines will increase as processes become less labor-intensive.

Aeroengine Composites Market Opportunities

- Innovations in Manufacturing Techniques: The constant improvements in aircraft parts manufacturing techiques is one of the key trends pushing the aeroengine composites market growth.

- Rising Commercial Aviation and Aircraft Production: The growth of the commercial aviation sector is one of the major drivers for the aeroengine composites market. As air travel demand continues to rise, airlines are investing in new aircraft to expand their fleets and enhance operational efficiency. This increase in aircraft production directly correlates with the demand for advanced aeroengine technologies, including lightweight composite materials. The trend of replacing old aircraft with new, more efficient ones increases the demand for composite materials in next-generation aeroengines.

- Development of High Composite Volume Aircraft: The growing development of high composite volume aircraft such as B787 series is another major trend pushing the growth of aeroengine composites market. The B787 series of aircraft is comprises 80% composites by volume and by material composites account for around 50% of the aircraft series.

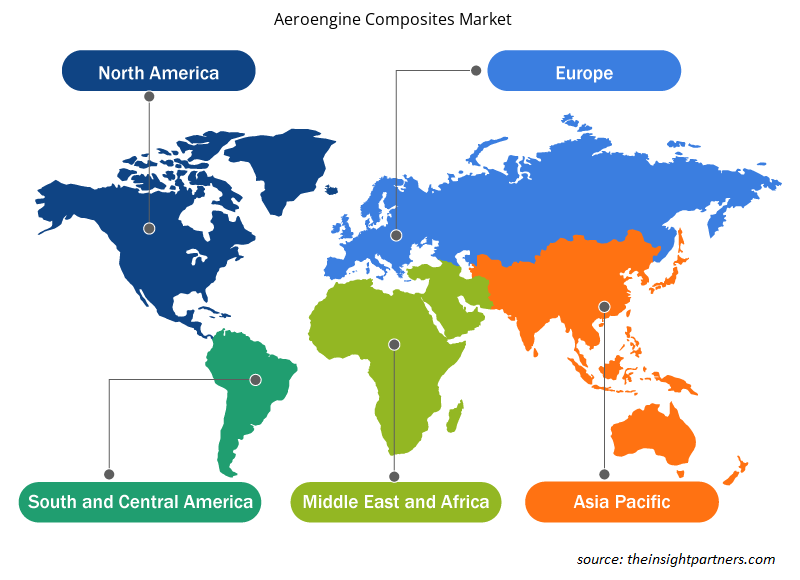

Aeroengine Composites Market Regional Insights

The regional trends and factors influencing the Aeroengine Composites Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aeroengine Composites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aeroengine Composites Market

Aeroengine Composites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 9.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Aircraft Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

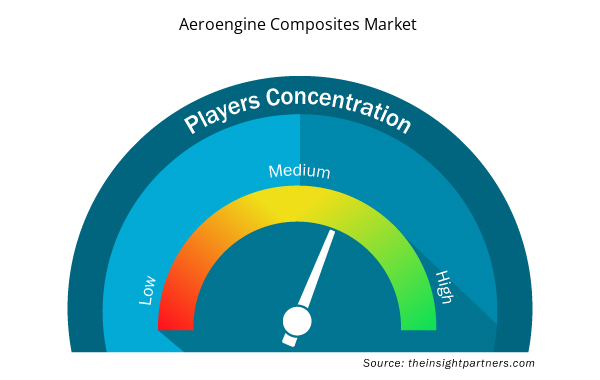

Aeroengine Composites Market Players Density: Understanding Its Impact on Business Dynamics

The Aeroengine Composites Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aeroengine Composites Market are:

- Albany International Corp

- FACC AG

- GE

- GKN Aerospace (Melrose Industries)

- Godrej Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aeroengine Composites Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Aeroengine Composites Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Aeroengine Composites Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Biopharmaceutical Contract Manufacturing Market

- Flexible Garden Hoses Market

- Real-Time Location Systems Market

- Sleep Apnea Diagnostics Market

- Vision Care Market

- Customer Care BPO Market

- Visualization and 3D Rendering Software Market

- Non-Emergency Medical Transportation Market

- Micro-Surgical Robot Market

- Railway Braking System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

The Aeroengine Composites Market is estimated to witness a CAGR of 9.5% from 2023 to 2031

Some of the major trends driving the aeroengine composites market are:

1. Innovations in Manufacturing Techniques

2. Development of High Composite Volume Aircraft

The major factors driving the aeroengine composites market are:

1. Increasing Adoption of Composite Materials in Aircraft

2. Demand for Fuel Efficiency

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies

1.Albany International Corp

2.FACC AG

3.GE

4.GKN Aerospace (Melrose Industries)

5.Godrej Group

6.Hexcel Corporation

7.Meggitt PLC.

8.Solvay

9.Triumph Group Inc.

10.ZOLTEK Corporation

Get Free Sample For

Get Free Sample For