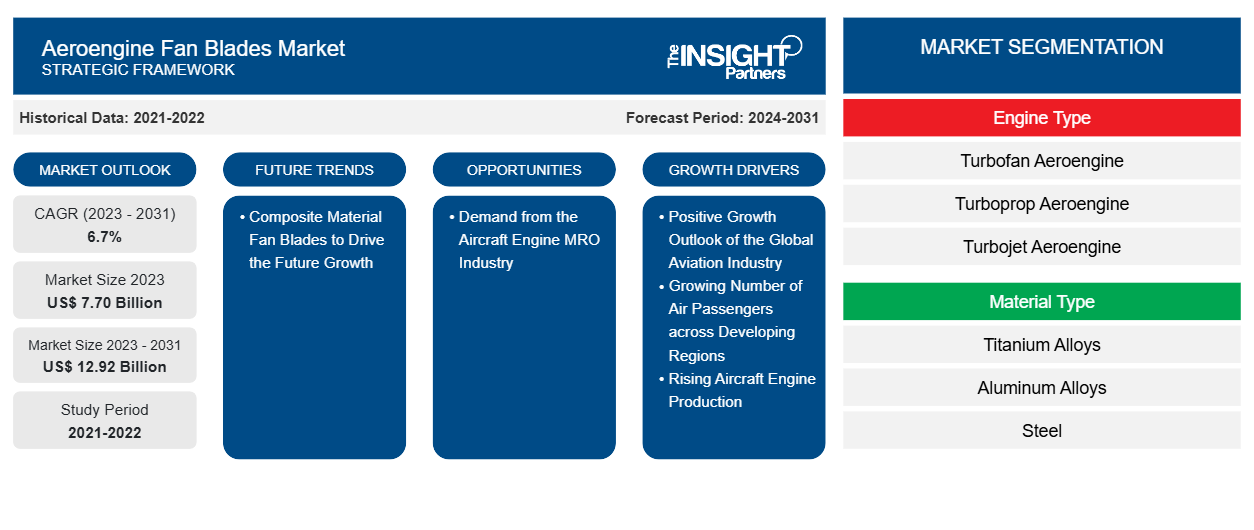

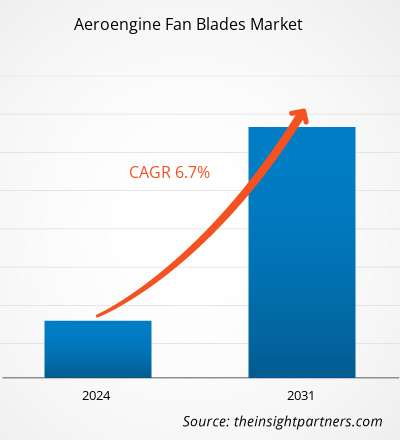

The aeroengine fan blades market size is projected to reach US$ 12.92 billion by 2031 from US$ 7.70 billion in 2023. The market is expected to register a CAGR of 6.7% in 2023–2031. The market growth and demand for aeroengine fan blades in various countries depends on the presence of aircraft manufacturing players, aeroengine manufacturers, aircraft component manufacturers, and maintenance, repair & overhaul service providers. Some of the key countries that are anticipated to drive the demand for aeroengine fan blades in the coming years include the US, the UK, France, Germany, Russia, China, Japan, Brazil, India, and Turkey among others.

Aeroengine Fan Blades Market Analysis

Below are some of the key points mentioned by some of the key opinion leaders operating in the aeroengine fan blades market:

- The key factors that are affecting the global aviation industry growth include air travel demand, regulatory changes, infrastructure developments, and technological advancements.

- The demand for low-cost travel is increasing at an impressive pace across geographies. The increasing popularity and demand for LCCs and ULCCs commercial aircraft is anticipated to offer ample future growth opportunities for aeroengine fan blade companies worldwide.

- The adoption of composite materials by key fan blade manufacturers such as GE Aviation, CFM International, and Rolls-Royce Plc coupled with ongoing research & development activities to improve the performance of various composite materials are expected to boost the growth of composite fan blades in the near future.

Aeroengine Fan Blades Market Overview

The aeroengine fan blade market ecosystem comprises of the above-mentioned stakeholders. These stakeholders include hardware/component suppliers; aeroengine fan blades manufacturers; maintenance, repair & overhaul (MRO) companies; aircraft engine manufacturers, and end users. The manufacturers constantly procure raw material from the suppliers in order to manufacture fan blades with an objective to meet the growing demands of the customers. The raw materials used in the production of fan blades include titanium, carbon fiber, and aluminum among others. Upon procuring raw materials, the aeroengine fan blades OEMs manufacture fan blades with high-performance and durability, thereby, meeting respective customer demands. Aeroengine fan blades as well as engine manufacturers include companies such as CFM International, GE Aviation, and Pratt & Whitney procure components from hardware/component providers and manufacture fan blades to use in their own engines as well supply them to other aircraft engine manufacturers and MROs. The end users include both commercial and military aircrafts. Aircraft MROs such as AAR Corporation and Lufthansa Technik provide maintenance, repair & overhaul services to these end users by providing fan blade repairing services. With the growing production rate of commercial and military aircrafts, the demand and replacement orders for fan blades is expected to increase at a steady rate over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aeroengine Fan Blades Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aeroengine Fan Blades Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aeroengine Fan Blades Market Drivers and Opportunities

Rising Aircraft Engine Production

The increasing aircraft engine production from the major engine manufacturers is propelling the need for aeroengine components including fan blades across different regions. This is further propelled by the demand generated for new aircraft production and expected future deliveries of more than 40,000 commercial aircraft by the end of 2042 (According to the Boeing and Airbus forecasts). Further, the need for new aeroengine fan blades is further, propelled by the rising deliveries of leap engines and turbofan engines by major engine manufacturers. For instance, in 2023, GE Aviation delivered around 1,570 leap engines to different customers worldwide. Further, GE Aviation has also aimed to deliver around 1,884-1,963 of the turbofan engines in 2024 along with generating a capacity to deliver around more than 2,000 leap engines annually by 2025. Such factors have been pushing the growth for aeroengine fan blades across different regions worldwide.

Demand from the Aircraft Engine MRO Industry

The rising number of aircraft fleet worldwide is one of the major factors generating the need for engine MRO operations. Also, the engine MRO is the largest segment of the overall aircraft MRO industry that further drives the demand for aeroengine components MRO as well as fan blades market across the world. Several airlines have been taking initiatives to upgrade their respective fleet of aircraft across different regions which is further propelling the demand for the installation of new aircraft engines. This is further generating the need for installation of aeroengine fan blades worldwide. For instance, in January 2023, GE Aerospace & Cargolux announced that they have entered into a long-term support agreement for the GE9X powering Cargolux’s new fleet of Boeing 777-8 freighters. The agreement includes a multi-year GE TrueChoice service agreement as well as the order of two spare engines.

Aeroengine Fan Blades Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Aeroengine Fan Blades Market analysis are engine type, material type, and geography.

- Based on engine type, the aeroengine fan blades market has been categorized into turbofan aeroengine, turboprop aeroengine, and turbojet aeroengine. The turbofan aeroengine segment held a larger market share in 2023.

- By material type, the aeroengine fan blades market has been segmented into titanium alloys, aluminum alloys, steel, and composites. The titanium alloys segment held the largest share of the market in 2023.

Aeroengine Fan Blades Market Share Analysis by Geography

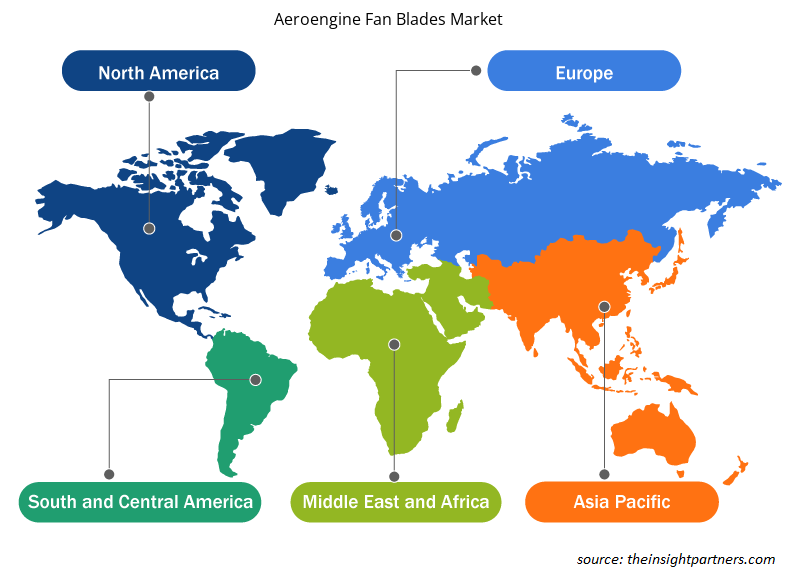

The geographic scope of the aeroengine fan blades market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the aeroengine fan blades market in 2023, whereas, Asia Pacific region is likely to witness a significant growth during the forecast period. Further, the demand for aeroengine fan blades in North America is majorly growing due to the presence of large number of aircraft engine manufacturers such as General Electric, Pratt & Whitney, Williams International, Honeywell International Inc, and CFM International. These companies constantly generate the demand for aeroengine components including fan blades in the North America region for aircraft engine applications.

Aeroengine Fan Blades Market Regional Insights

The regional trends and factors influencing the Aeroengine Fan Blades Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aeroengine Fan Blades Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aeroengine Fan Blades Market

Aeroengine Fan Blades Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7.70 Billion |

| Market Size by 2031 | US$ 12.92 Billion |

| Global CAGR (2023 - 2031) | 6.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Engine Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aeroengine Fan Blades Market Players Density: Understanding Its Impact on Business Dynamics

The Aeroengine Fan Blades Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aeroengine Fan Blades Market are:

- CFM International

- GE Aviation

- Pratt & Whitney

- Rolls-Royce Holdings plc

- Safran S.A

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aeroengine Fan Blades Market top key players overview

Aeroengine Fan Blades Market News and Recent Developments

The aeroengine fan blades market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aeroengine fan blades market and strategies:

- In May 2022, StandardAero signed an agreement to acquire EB Airfoils that engages into fan blade, compressor blade and vane MRO provider for the aero-engine and aero-engine derivative markets. (Source: StandardAero, Press Release/Company Website/Newsletter)

- In March 2021, Rolls-Royce announced that it has started the manufacturing of the world’s largest aero-engine, UltraFan, that aims to help redefine sustainable air travel for decades to come. (Source: Rolls-Royce Plc, Press Release/Company Website/Newsletter)

Aeroengine Fan Blades Market Report Coverage and Deliverables

The “Aeroengine Fan Blades Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Human Microbiome Market

- Medical and Research Grade Collagen Market

- Terahertz Technology Market

- Fishing Equipment Market

- Environmental Consulting Service Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Educational Furniture Market

- Aesthetic Medical Devices Market

- Authentication and Brand Protection Market

- Hydrogen Compressors Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Engine Type ; Material Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For