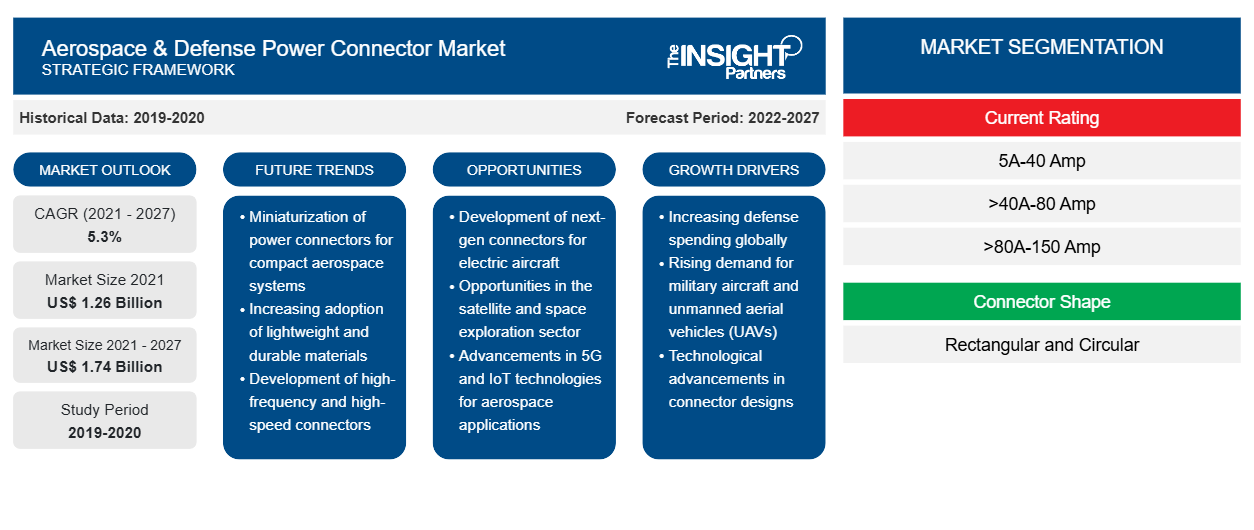

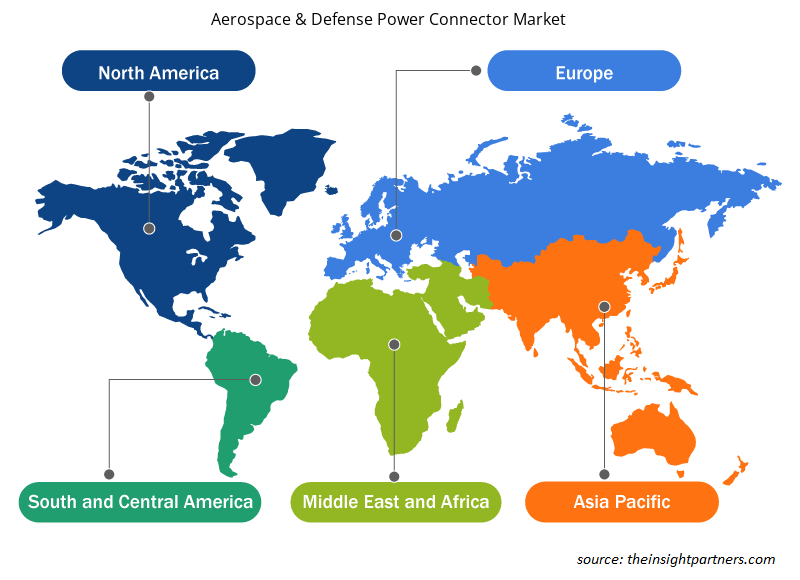

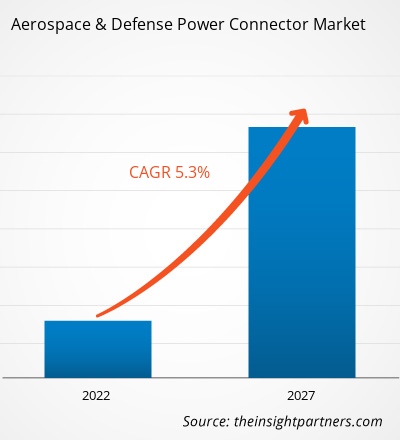

The Aerospace & defense power connector market is expected to grow from US$ 1,262.71 million in 2021 to US$ 1,737.78 million by 2027. The Aerospace & defense power connector market is expected to grow at a CAGR of 5.3% during the forecast period of 2021 to 2027.

The global aircraft manufacturing industry is experiencing substantial growth due to the increasing demand for commercial and military aircraft worldwide. The growing disposable incomes in developing countries and the presence of top players such as Boeing and Airbus are some of the factors that are driving the demand of these aircraft. In a global scenario, commercial airplanes are anticipated to maintain a continuous growth over the coming years, regardless of several challenges faced by the commercial airlines such as uncertain fuel prices and other regulatory changes in various countries. In addition to this, the growing investments in defense equipment across countries are expected to drive the demand for military aircraft during the forecast period of 2020 to 2027. The growing production of aircraft demand for integration of advanced equipment such as engine control, avionics, cabin system, and in-flight entertainment system, which requires power connectors in order to supply power to these systems. Power connectors are designed to meet the aerospace and defense standards. All these factors are anticipated to fuel the demand for power connectors in various geographies and offer future growth opportunities for Aerospace & Defense Power Connector market players operating in the global market.

The aircraft production industry is heavily dependent on manual labor despite robotic technology. In the wake of strong lockdown regulations imposed by several countries, the aircraft-manufacturing sector is experiencing a significantly lower number of labors in respective aircraft and component manufacturing facilities. Since the aircraft-manufacturing sector is majorly concentrated in North America and Europe, and the two regions are facing a tremendous challenge in maintaining its manufacturing pace with the outbreak. The European countries manufacture various aircraft components and defense equipment and vehicles. However, a majority of European countries are challenged continuously growing outbreak. The plane makers across the globe are witnessing a severe downfall in component procurement. The downfall in the production of aircraft components is a result of a labor shortage.

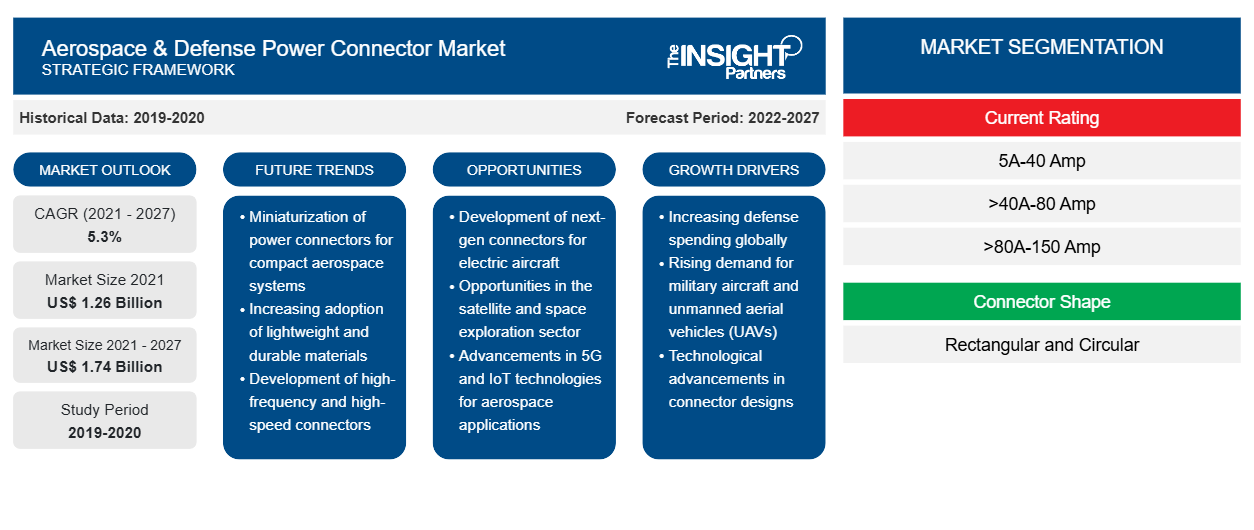

The market for aerospace & defense power connector has been segmented on the basis of current rating, connector shape, application, and geography. Based on current rating, the market has been segmented into 5Amps to 40Amps, >40Amps to 80Amps, >80Amps to 150Amps, >150Amps to 300Amps, >300Amps to 600Amps, >600 to 900Amps. 5Amps to 40Amps segment represented the largest share of the overall market throughout the forecast period. Based on the connector shape, the market has been segmented into rectangular and circular. Based on the application, the market is segmented into aerospace, military ground vehicles, body-worn equipment, and naval ships. The aerospace segment is further bifurcated into the engine control system, avionics, cabin equipment, and others. Geographically, the market is segmented into five major regions— North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South America (SAM).

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerospace & Defense Power Connector Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerospace & Defense Power Connector Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aerospace & Defense Power Connector Market Insights

Stimulating Demand for Soldier Modernization

The rising battlefield scenarios are demanding the militaries to equip the soldiers with advanced technologies. The militaries around the globe are highly focused on optimizing soldier protection with efficient body armor and personal protection. Various technologically advanced countries such as China and the US are swiftly modernizing its armed forces, also highly investing in research and development for advanced defense technology. They are also conducting research into a broad range of defense-related technology, such as Artificial Intelligence (AI), robotics, quantum information sciences, and biometrics. The government is highly inclined toward investing billions in military and defense equipment; for instance, as per Stockholm International Peace Research Institute (SIPRI), in 2019, global military expenditure rose to US$ 1917 billion, it includes expenditure on current military forces and activities, arms and equipment purchases, military construction, research and development, and command and support.

Current Rating -Based Market Insights

The market players operating in the aerospace & defense power connector market offer their products with different current ratings, in order to match the demands of customers. The power connectors have a wider range of applications, and every application demands for different connectors with varying amperage. The aerospace & defense power connector market has been analyzed on the basis of various current ratings, which include 5Amps to 40Amps, >40Amps to 80Amps, >80Amps to 150Amps, >150Amps to 300Amps, >300Amps to 600Amps, and >600Amps to 900Amps.

Connector Shape -Based Market Insights

When it comes to electrical devices, a consistent and reliable power supply is crucial. The selection of an appropriate power connector completely depends on the nature of the application and also on the customer’s specific requirements. Ranging from high-voltage versions and specific standards to design diversity, the power connectors portfolio offers a broad, practical selection for fulfilling user’s individual application objectives. There are wide range of rectangular and cylindrical products for the usage in high amperage, high power applications.

Application -Based Market Insights

The power connectors are used heavily on various applications across the aerospace sector and defense sector. The power connectors are essential components on aircraft, military ground vehicles, naval ships, and body-worn equipment. The presence of large numbers of aerospace and defense contractors across the globe allows the power connector market players to experience significant demand for their products, which catalyzes the aerospace & defense power connector market year-on-year.

Players operating in the Aerospace & defense power connector market focus on strategies, such as market initiatives, acquisitions, and product launches, to maintain their positions in the Aerospace & defense power connector market. A few developments by key players of the Aerospace & defense power connector market are:

In February 2020, AMETEK announced the completion of a significant hermetic connector production expansion, thereby reducing the lead time by around 35% for products that have been in short supply for over a year. Equipment, Facilities, and personnel at their Ohio and California sites have been increased.

In July 2020, Radiall expanded its EPX™ Series with the addition of the newer iEPX connector, a weight-optimized EPXB2 disconnect shell that features an integrated strain relief and a press-in EMI backshell and supports quicker, more cost-effective integration into aircraft systems.

Aerospace & Defense Power Connector Aerospace & Defense Power Connector Market Regional Insights

The regional trends and factors influencing the Aerospace & Defense Power Connector Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aerospace & Defense Power Connector Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aerospace & Defense Power Connector Market

Aerospace & Defense Power Connector Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.26 Billion |

| Market Size by 2027 | US$ 1.74 Billion |

| Global CAGR (2021 - 2027) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2027 |

| Segments Covered |

By Current Rating

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

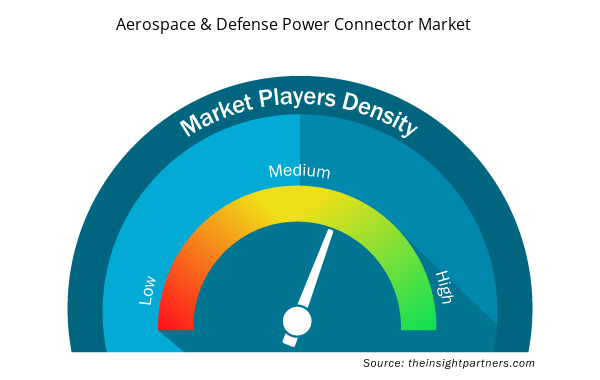

Aerospace & Defense Power Connector Market Players Density: Understanding Its Impact on Business Dynamics

The Aerospace & Defense Power Connector Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aerospace & Defense Power Connector Market are:

- AMETEK. Inc.

- Amphenol Corporation

- Arrow Electronics, Inc.

- Collins Aerospace (Raytheon Technologies Corporation)

- Eaton Corporation plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aerospace & Defense Power Connector Market top key players overview

Aerospace & Defense Power Connector Market – by Component

- 5Amps to 40Amps

- >40Amps to 80Amps

- >80Amps to 150Amps

- >150Amps to 300Amps

- >300Amps to 600Amps

- >600Amps to 900Amps

Aerospace & Defense Power Connector Market – by Connector Shape

- Rectangular

- Circular

Aerospace & Defense Power Connector Market – by Application

- Aerospace

- Military Ground Vehicle

- Body-worn Equipment

- Naval Ships

Aerospace & Defense Power Connector Market – by Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Russia

- UK

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- Japan

- Australia

- South Korea

- Rest of APAC

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- SAM

- Brazil

- Rest of SAM

Aerospace & Defense Power Connector Market – Company Profiles

- AMETEK. Inc.

- Amphenol Corporation

- Arrow Electronics, Inc.

- Collins Aerospace (Raytheon Technologies Corporation)

- Eaton Corporation plc

- Fischer Connectors SA

- ITT Corporation

- Molex, LLC

- Radiall

- TE Connectivity

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Influenza Vaccines Market

- Educational Furniture Market

- Intraoperative Neuromonitoring Market

- Military Rubber Tracks Market

- Artificial Intelligence in Defense Market

- Virtual Production Market

- Pressure Vessel Composite Materials Market

- Smart Mining Market

- Equipment Rental Software Market

- Environmental Consulting Service Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Current Rating ; Connector Shape ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The power connectors with current ratings ranging from 5Amps to 40Amps are the most prominent connector in the aerospace & defense power connector market. This is due to the fact that these power connectors are widely used across the aerospace industry and defense industry. Some of the application areas of power connectors with amperage ranging from 5Ams to 40Amps include commercial aircraft cabin systems and unmanned airborne systems. These connectors are capable of mating quickly and are able to provide superior durability and ensure proper connection via connector position assurance (CPA).

The North America region led the aerospace & defense power connector market in 2019. The demand for various military equipment is on the rise as governments across the North American region are increasingly focusing on military modernization owing to the increasing security concerns. The sustained and uncertainty complexity of the international security environment worldwide is expected to boost defense spending by the authorities in the region over the next five years.

The growing commercial aircraft demands for several equipment, which are equipped within the aircraft such as avionics systems and engine control and monitoring system that, operate at peak efficiency. In these equipment, power connectors play a crucial role as they are used to connect engine control units with the cables of the commercial aircraft electrical system, where they guarantee a consistent transmission of electric signals and power.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Aerospace & Defense Power Connector Market

- AMETEK. Inc.

- Amphenol Corporation

- Arrow Electronics, Inc.

- Collins Aerospace (Raytheon Technologies Corporation)

- Eaton Corporation plc

- Fischer Connectors SA

- ITT Corporation

- Molex, LLC

- Radiall

- TE Connectivity

Get Free Sample For

Get Free Sample For