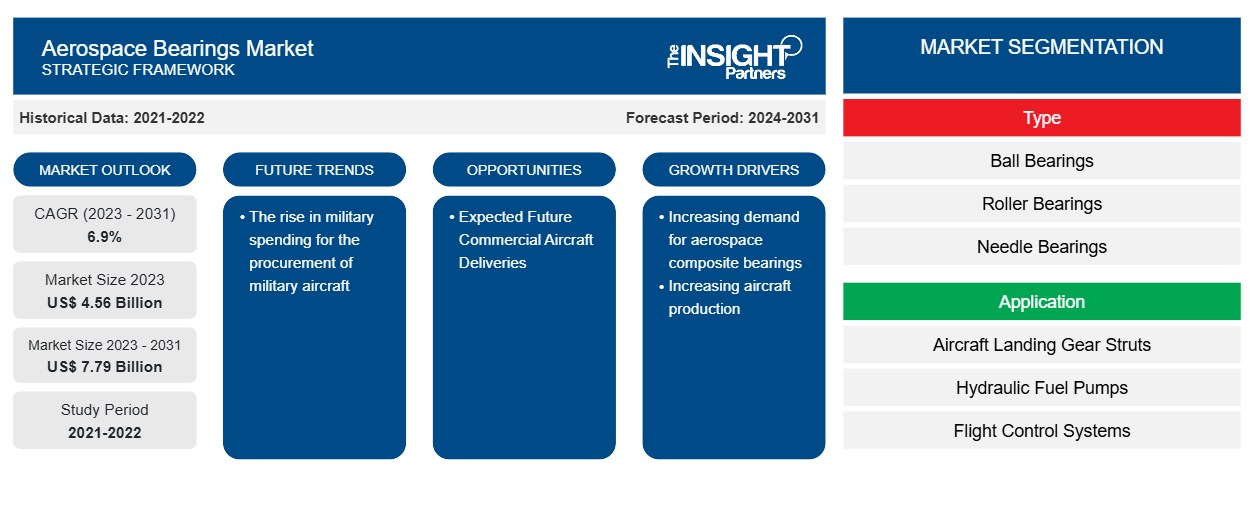

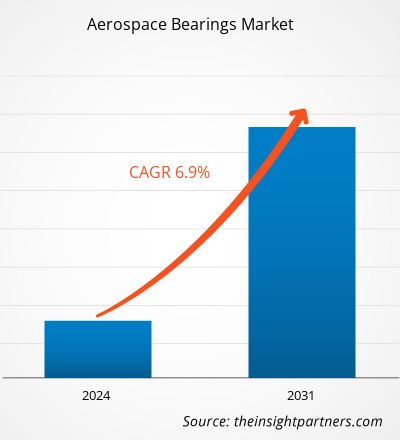

The aerospace bearings market size is projected to reach US$ 7.79 billion by 2031 from US$ 4.56 billion in 2023. The market is expected to register a CAGR of 6.9% during 2023–2031. The increasing global defense spending for procurement of military aircraft is likely to remain a key trend in the market.

Aerospace Bearings Market Analysis

The bearing manufacturers players include SKF Group; JTEKT Corporation; GGB; The Timken Company; RBC Bearings Inc.; NSK Ltd.; Schaeffler AG; NTN Corporation; Kaman Corporation; and other manufacturing players. The advancement in bearing technology is strengthening the demand for aerospace bearings. For instance, in September 2021, SKF launched a new line of spherical roller bearings in North America. Thus, such developments from the aerospace bearings manufacturers are driving the market outlook.

Aerospace Bearings Market Overview

The major stakeholders in the global aerospace bearings market ecosystem include raw material suppliers, aerospace bearing manufacturers, and end-users. The raw material supplier is the crucial stakeholder in the ecosystem of the aerospace bearings market. The major raw materials are steel, ceramics, plastics, and composite material primarily used to manufacture the bearings used in aircraft. The major raw material suppliers include TriStar Plastics Corp; Continental Steel & Tube; Johnson Bros. Metal Forming Co; All Metal Sales, Inc. Company; Morgan Advanced Materials; Kineco Limited; UNITECH GROUP; Hexcel Corporation; and other players. In October 2021, the ÉireComposites, a design, manufacturing, and testing company, signed a new multi-million-euro contract with Spirit AeroSystems to supply structural components for commercial airliners and business jets and assembly parts. In addition, in December 2020, Hexcel extended the long-term supplier contract with Safran to include advanced composite materials for a broader range of commercial aerospace applications, including engine nacelles and aircraft interiors. Thus, such growing initiatives from the raw material suppliers are strengthening the production of aircrafts which is propelling the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerospace Bearings Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerospace Bearings Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aerospace Bearings Market Drivers and Opportunities

Aircraft Production Driving the Market Growth

According to the company website data, Airbus delivered 611, 661, and 735 commercial aircraft deliveries in the years 2021, 2022, and 2023 respectively. Similarly, Boeing delivered around 340, 480, and 528 commerial aircraft in the years 2021, 2022, and 2023 respectively. This shows an increase in aircraft production and deliveries from the two of the major aircraft OEMs worldwide which is leading to generate new demand for aircraft components and sub-components including bearings for different aircraft applications.

The growing initiatives for expanding the production sites is augmenting the demand for components and equipment used in aircrafts which is further fueling the market growth. For instance, in May 2024, Bombardier inaugurated its new production US$ 500 million Global aircraft assembly center at Toronto Pearson, Canada. Such developments are driving the growth for aerospace bearings market globally.

Future Commercial and General Aircraft Deliveries

The rise in aircraft deliveries is anticipated to hold potential demand for line fit aerospace bearings, driving the market growth over the forecast period. For instance, in March 2022, Airbus reported consolidated financial results for its first quarter and forecasted strong growth in commercial aircraft demand driven by the A320 Family. The company plans to increase A320 family production rates to 75 aircraft a month in 2025. In addition, Boeing has received ~300 orders for the new generation of the 777 family, and in April 2022, it pushed the delivery of its first 777X plane to 2025. Boeing expects to produce 25,680 new single-aisle airplanes over that period with a market value of US$ 4.4 trillion, whereas Bombardier forecasts 22,000 business aircraft deliveries over the next 20 years. In 2024, Airbus projected the demand for more than 42,000 new passengers and freighter aircraft by 2042. Thus, the rise in number of aircraft deliveries, increases the aircraft production which further augments the demand for aerospace bearings, fueling the market growth over the forecast period.

Aerospace Bearings Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aerospace bearings market analysis are type, application, material, and aircraft type.

- Based on type, the aerospace bearings market is segmented into ball bearings, roller bearings, needle bearings, thrust bearings, and others. The ball bearing segment held a larger market share in 2023.

- Based on application, the aerospace bearings market is segmented into aircraft landing gear struts, hydraulic fuel pumps, flight control systems, and others. The flight control system segment held a larger market share in 2023.

- Based on material, the aerospace bearings market is segmented into stainless steel, fiber-reinforced composites, engineered plastics, and others. The stainless steel segment held a larger market share in 2023.

- Based on aircraft type, the aerospace bearings market is segmented into fixed wing and rotary wing. The fixed wing segment held a larger market share in 2023.

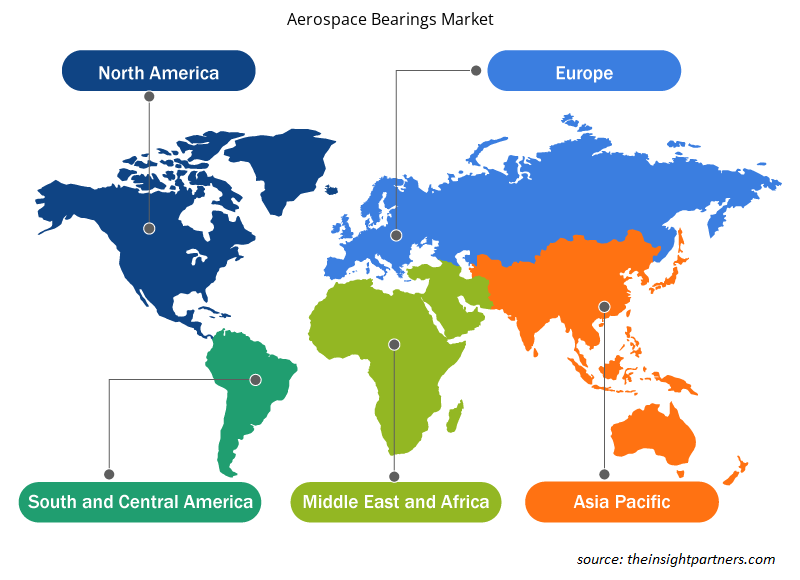

Aerospace Bearings Market Share Analysis by Geography

The geographic scope of the aerospace bearings market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific. Further, Asia Pacific is likely to witness highest CAGR in the coming years. One of the main factors likely to generatenew opportunities for market vendors in the Asia Pacific region includes the expected delivery of commercial and military aircraft across the region in the coming years. For instance, according to the Airbus’ forecasts more than 18,800 commercial aircraft are expected to be delivered in the Asia Pacific region by the end of 2042. Such factor is likely to generate new opportunities for aerospace bearings in the coming years.

Aerospace Bearings Market Regional Insights

The regional trends and factors influencing the Aerospace Bearings Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aerospace Bearings Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aerospace Bearings Market

Aerospace Bearings Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.56 Billion |

| Market Size by 2031 | US$ 7.79 Billion |

| Global CAGR (2023 - 2031) | 6.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

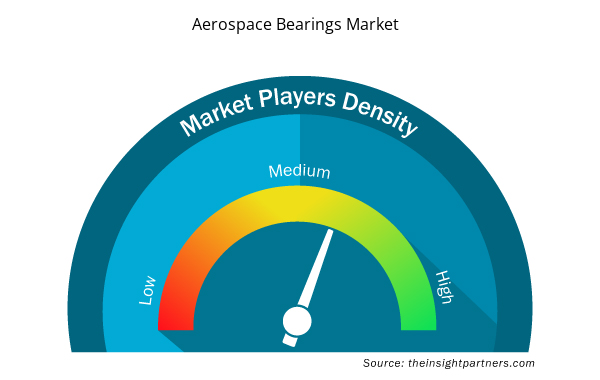

Aerospace Bearings Market Players Density: Understanding Its Impact on Business Dynamics

The Aerospace Bearings Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aerospace Bearings Market are:

- AST Bearings

- GGB

- JTEKT Corporation

- Accurate Bushing Company

- MinebeaMitsumi Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aerospace Bearings Market top key players overview

Aerospace Bearings Market News and Recent Developments

The aerospace bearings market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aerospace bearings market are listed below:

- Cablecraft Motion Controls (“Cablecraft”), a Torque Capital Group portfolio company, announced today that it has completed the purchase of Radial Bearing Corp. (“Radial”), a leading designer and manufacturer of rod ends and spherical bearings. Based in Danbury, Conn., Radial has a rich history of delivering engineered solutions in the aerospace, defense, and industrial markets. (Source: Cablecraft Motion Controls, Press Release, Feb 2024)

Schaeffler will provide long-term support for Rolls-Royce with the latest production technologies and manufacturing processes. The contract mainly covers production and development of engine rolling bearing systems for widebody aircraft and business jet market segment (Source: Schaeffler, Press Release, April 2022)

Aerospace Bearings Market Report Coverage and Deliverables

The “Aerospace Bearings Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Aerospace bearings market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aerospace bearings market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Aerospace bearings market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aerospace bearings market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Material, and Aircraft Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the aerospace bearings market in 2023.

Increasing demand for aerospace composite bearings and increasing aircraft production are some of the factors driving the growth for aerospace bearings market.

The rise in military spending for the procurement of military aircraft is one of the major trends of the market.

AST Bearings, GGB, JTEKT Corporation, Accurate Bushing Company, Minebeamitsumi Inc, NTN Bearing Corporation of America, RBC Bearings Incorporated, SKF Group, Regal Rexnord Corporation, and Barden Bearings are some of the key players profiled under the report.

The estimated value of the aerospace bearings market by 2031 would be around US$ 7.79 billion.

The aerospace bearings market is likely to register of 6.9% during 2023-2031.

Get Free Sample For

Get Free Sample For