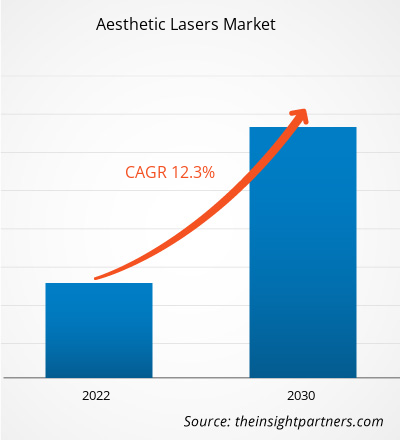

The aesthetic lasers market size was valued at US$ 3.58 billion in 2024 and is projected to reach US$ 8.24 billion by 2031. It is estimated to register a CAGR of 12.8% during 2025–2031. Technological advancements associated with medical aesthetic devices will likely remain a key trend in the market.

Aesthetic Lasers Market Analysis

The main drivers of the market are the growing acceptance of technologically sophisticated products and the increased awareness of aesthetic procedures. The number of noninvasive aesthetic procedures and the rise in skin conditions like warts, hemangiomas, and hyperpigmentation are driving up the size of the aesthetic laser market. Globally, the beauty industry has undergone significant transformation, leading to a surge in the need for aesthetic lasers for noninvasive procedures like body contouring, tattoo removal, skin tightening, scar removal, and fat reduction.

Aesthetic Lasers Market Overview

The need for aesthetic laser treatments is being driven by the increasing incidence of several conditions, including dermatitis, acne, pigmentation disorders, hair removal, and other skin abnormalities like warts, moles, skin tags, and acne scars. The American Academy of Dermatology Association reports that acne is the most predominant skin disorder in the United States, affecting approximately 50 million people annually. The rise in these conditions is driving up the demand for aesthetic laser treatment, specifically for the removal of acne scars. The demand for aesthetic laser devices is also being created by the beauty industry and evolving beauty standards, which is propelling the growth of the aesthetic laser market. Additionally, the need for anti-aging, toning, and skin rejuvenation treatments to mask the signs of aging is increasing due to the growing number of older adults prone to wrinkles and aging. The aesthetic lasers market is likely to grow because, according to The Aesthetic Society, 431,485 skin treatment (combination lasers) procedures were performed globally in 2021, bringing in US$ 171.45 million in revenue. In addition, there is a growing need for aesthetic medical lasers due to concerns about appearance, growing consumer awareness of skincare, and growing demand for beauty. The market is growing owing to the increasing demand for skin tightening, body sculpting, and laser treatments. Thus, the market for aesthetic lasers is expanding due to the previously mentioned factors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

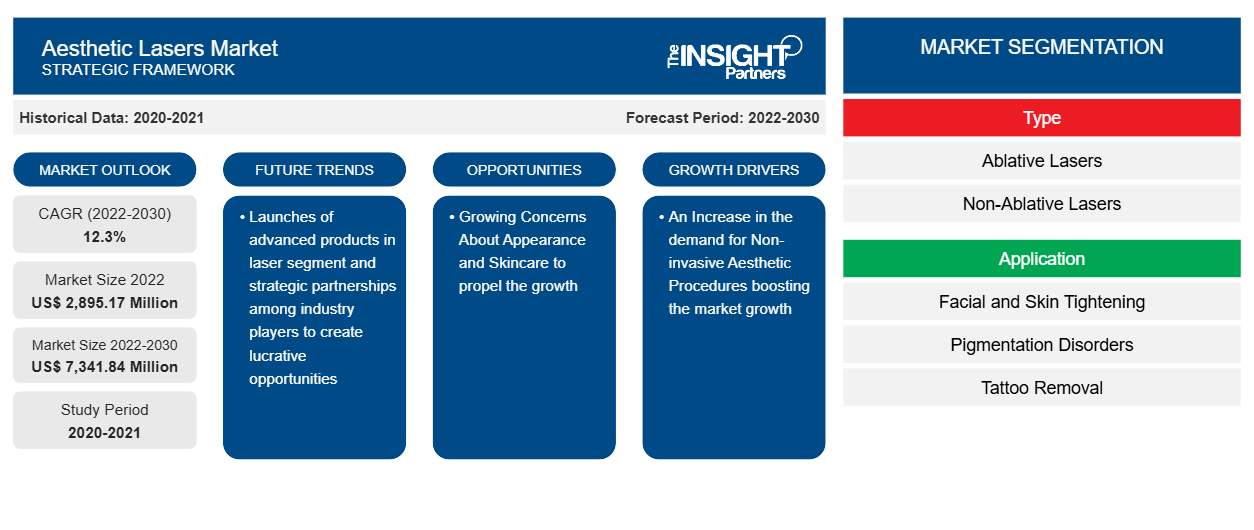

Aesthetic Lasers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aesthetic Lasers Market Drivers and Opportunities

Increase in Number of Non-Invasive Aesthetic Procedures Favors the Market Growth

The use of non-invasive aesthetic procedures has recently increased due to their excellent results and negligible side effects. Laser treatment is one non-invasive technique frequently used for hair removal, skin rejuvenation, hyperpigmentation, anti-aging, and other conditions. There are several advantages to using these non-invasive methods to improve skin quality. Improved skin tone and texture, fewer wrinkles and fine lines, less age spots and hyperpigmentation, and better overall skin health are some of the most popular advantages. The Aesthetic Society Report states that non-surgical procedures rose by 44% in 2021 over 2020.

Compared to surgical treatments, these non-invasive procedures have several advantages, including a quicker recovery period with a lower risk of complications, no scars or incisions, no hospital stay, and lower treatment costs. Thus, the market for aesthetic lasers is anticipated to grow shortly due to the advantages of non-invasive treatments, their positive outcomes, and the general public's growing awareness.

Opportunities Are Expected to Be Plenty When Product Development, Launches, and Other Strategic Partnerships Among Industry Players Increase

The growing demand for aesthetics from a large population worldwide has increased new product development, product launches, and approvals on a global scale, which has led to the healthcare industry's constant and notable development. Major market players also engage in research and development to guarantee innovation and the creation of effective products. Numerous events, including product launches and market approvals, have occurred recently and will probably generate many opportunities. For instance, in March 2023, Sentient launched two powerful non-laser aesthetic devices, Sculpt and Tixel, which increased the full service of providing aesthetic device platforms. Both non-invasive, non-laser devices offer safe, effective, and well-tolerated treatments for highly sought aesthetic indications

Aesthetic Lasers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aesthetic lasers market analysis are type, application, and end user.

- Based on type, the aesthetic lasers market is divided into ablative lasers, non-ablative lasers. The non-ablative lasers segment held the most significant market share in 2022.

- By application, the market is categorized into facial and skin tightening, pigmentation disorders, tattoo removal, scar treatment, hair removal, body sculpting and fat reduction, acne reduction, others. The facial and skin tightening segment held the major share of the market in 2023.

- By end user, the market is segmented into dermatology clinics, medical spas, beauty and wellness centers, others. The dermatology clinics segment held the major share of the market in 2023.

Aesthetic Lasers Market Share Analysis by Geography

The geographic scope of the aesthetic lasers market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

According to estimates, the US market with the most significant share belongs to aesthetic lasers. The market for aesthetic lasers is expanding due to several factors, including an increase in non-invasive cosmetic procedures and the regional introduction of new products. The market is predicted to grow in Canada due to variables like growing strategic investments from foreign companies, increased aesthetic clinics, and increased public awareness of aesthetics. Numerous factors, including the development of non-invasive medical aesthetic procedures and the exponential growth in aesthetic procedures, define the country's market growth.

Additionally, the number of non-invasive procedures has increased due to technological advancements. As per the International Society of Plastic Surgeons (ISAPS), there was a 19.9% global increase in non-surgical aesthetic procedures in 2021. Additionally, with over 827,000 IPL procedures performed in the US in 2020, Intense Pulsed Light (IPL) treatment ranks among the top 5 cosmetic minimally invasive procedures.

Aesthetic Lasers Market Regional Insights

The regional trends and factors influencing the Aesthetic Lasers Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aesthetic Lasers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Aesthetic Lasers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.58 Billion |

| Market Size by 2031 | US$ 8.24 Billion |

| Global CAGR (2025 - 2031) | 12.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aesthetic Lasers Market Players Density: Understanding Its Impact on Business Dynamics

The Aesthetic Lasers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Aesthetic Lasers Market top key players overview

Aesthetic Lasers Market News and Recent Developments

The aesthetic lasers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aesthetic lasers market are listed below:

- Reveal Lasers LLC, a subsidiary of Reveal Lasers LTD, is pleased to announce its recent acquisition of the AgeJET Advanced Plasma Skin Therapy device through a strategic merger with NEOconcepts LLC. This strategic acquisition marks an important milestone for Reveal Lasers LLC as it expands its presence in the rapidly growing market of plasma skin resurfacing. (Source: Reveal Lasers LLC, Press Release, January 2023)

- Cynosure announced that it launched the PicoSure Pro device, its latest upgrade to the PicoSure platform. (Source: Cynosure, News Letter, April 2022)

Aesthetic Lasers Market Report Coverage and Deliverables

The “Aesthetic Lasers Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Aesthetic lasers market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aesthetic lasers market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Aesthetic lasers market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aesthetic lasers market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the aesthetic lasers market in 2025?

What are the driving factors impacting the aesthetic lasers market?

What are the future trends of the aesthetic laser market?

What is the expected CAGR of the aesthetic laser market?

Which are the leading players operating in the aesthetic laser market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For