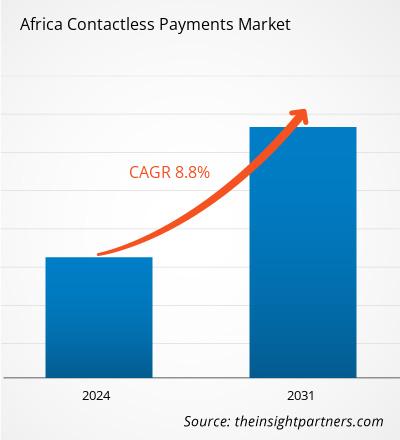

Africa contactless payments market size was valued at US$ 781.72 million in 2023 and is expected to reach US$ 1536.57 million by 2031, registering a CAGR of 8.8% during 2023–2031. Voice-based payments with voice match confirmation are likely to remain a key market trend.

Africa Contactless Payments Market Analysis

The Africa contactless payment market is driven by the increasing adoption of digital payment platforms and contactless payment technologies, the continuous innovation and advancement in payment security technologies and solutions; a surge in demand for faster, safer, and easier payment methods; and a rise in government initiatives and support for developing smart payment infrastructure and solutions. The integration of IoT and AI in contactless payment technology and the untapped potential of emerging markets and regions are expected to offer lucrative opportunities in the market in the coming years. The contactless payment market is fragmented and highly competitive, with the wide presence of several regional and global players.

Africa Contactless Payments Market Overview

Contactless payment is a secure and convenient payment method using a smartphone, debit card, or credit card that uses radio frequency identification (RFID) technology and near-field communication (NFC). This payment method works by tapping or waving the payment device over a point-of-sale (PoS) terminal that has contactless payment technology. The method provides several benefits, such as reduced transaction time and friction, as customers do not have to enter their PIN or handle cash at the checkout. Moreover, it improves customer experience and trust, owing to it being safe and encrypted to prevent fraudulent purchases. It offers flexibility for payment devices, as customers can use their NFC-enabled smartphone, wearable device, or contactless card to make payments. It also provides loyalty benefits, as a few contactless payment systems are integrated with loyalty programs that offer discounts and rewards to customers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Africa Contactless Payments Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Africa Contactless Payments Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Africa Contactless Payments Market Drivers and Opportunities

Increase in Government Initiatives to Promote Digital Payments

Several government bodies across Africa are promoting digital payments and financial technologies. They have implemented policies and initiatives to encourage the adoption of contactless payments. Africa has witnessed rapid technological advancements, such as the widespread availability of smartphones and mobile internet connectivity. These factors have facilitated the adoption of contactless payment solutions, particularly mobile wallets. Payment providers, financial institutions, and technology companies in the region have formed strategic partnerships and collaborations to enhance the adoption and acceptance of contactless payments.

South Africa Reserve Bank announced the launch of a faster payment service, PayShap, in March 2023. PayShap is a low-value, real-time retail payment platform/scheme aimed at deepening the financial inclusion of consumers and small businesses by making digital payments more convenient, thus reducing the reliance on cash. Key features launched include instant payments by enabling fund transfers from one bank account to another and using a proxy, such as a mobile number, to transfer funds to a recipient. The request-to-pay feature is in development and will be launched in 2024. PayShap supports the Vision 2025 goals of financial inclusion, innovation and competition, and cost-effectiveness. Thus, rising government initiatives to promote digital payments drive the Africa contactless payment market growth.

Technological Advancements in Contactless Payments

The process of holding a chipped card or smartphone directly against the reader provides extra security to contactless payments. NFC is used by smartphones that have enabled mobile wallets, such as ApplePay. Contactless payment enables faster transactions and increased customer satisfaction and loyalty, as well as the adoption of new payment technologies, such as NFC and others, facilitating machine-to-machine communication and IoT integration. Several cards are equipped with NFC technology that allows tapping or waving near a receptive card reader for contactless payment.

Mobile devices are weaved or tapped near an NFC-equipped card reader, similar to an NFC-enabled credit card. Also, the EMV (short for Europay, Mastercard, and Visa) chip is the physical antennae necessary for RFID/NFC contactless payments using credit cards. While all EMV chips are capable of NFC contactless payments, the ability to do such a transaction relies on the payee. If the PoS or farebox collecting the payment is not able to process NFC payments, the chip is then used by inserting the card into the reader. Thus, technological advancements in contactless payment are expected to provide lucrative opportunities for the contactless payment market.

Africa Contactless Payments Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Africa contactless payments market analysis are component, payment mode, and industry vertical.

- Based on component, the market is divided into hardware, software, and services. The hardware segment held the largest market share in 2023.

- In terms of payment mode, the market is categorized into smartphones, smart cards, PoS terminals, and others. The smartphones segment dominated the market in 2023.

- By industry vertical, the market is categorized into retail, hospitality, healthcare, transportation & logistics, media & entertainment, and others. The retail segment accounted for the largest market share in 2023.

Africa Contactless Payments Market Share Analysis by Country

- Africa contactless payments market is segmented into South Africa, Ethiopia, Egypt, Nigeria, and the Rest of Africa. Contactless payment is experiencing rapid adoption across Africa, particularly in Sub-Saharan Africa, where 144 mobile money providers are driving changes in consumer transaction behaviors. Leading players such as M-Pesa (offered by Safaricom), MoMo (by MTN), and Orange Money hold dominant market positions, according to Statista data. Telecommunication companies are at the forefront of this transformation, delivering mobile money solutions through a network of licensed agents. These services enable registered users to deposit funds into a virtual wallet, facilitating a wide range of financial transactions, including peer-to-peer (P2P) transfers, payments, and purchases.

Africa Contactless Payments Market Regional Insights

The regional trends and factors influencing the Africa Contactless Payments Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Africa Contactless Payments Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Africa Contactless Payments Market

Africa Contactless Payments Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 781.72 Million |

| Market Size by 2031 | US$ 1536.57 Million |

| Global CAGR (2023 - 2031) | 8.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Africa

|

| Market leaders and key company profiles |

Africa Contactless Payments Market Players Density: Understanding Its Impact on Business Dynamics

The Africa Contactless Payments Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Africa Contactless Payments Market are:

- Visa

- Mastercard

- IBA Group

- Giesecke + Devrient GmbH

- IDEMIA

- CityCard Technology Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Africa Contactless Payments Market top key players overview

Africa Contactless Payments Market News and Recent Developments

The Africa contactless payments market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Africa contactless payments market are listed below:

- IBA Group a.s. announced TapXphone is among the first 10 solutions globally to comply with the PCI MPoC Solution requirements. This means tapXphone meets the latest security standards for processing mobile payments on commercial off-the-shelf (COTS) devices. PCI MPoC Solution is a key certification within the MPoC security standard. Created by the PCI Council, it sets the compliance criteria and best practices that ensure tapXphone meets all necessary requirements, including secure development, proper maintenance, strict security standards, and ongoing system checks.

(Source: IBA Group a.s., Press Release, September 2024)

- Mastercard and AF Payments, Inc. (AFPI), the company behind Beep cards, announced a strategic partnership to enable contactless acceptance of Mastercard cards in the Metro Rail Transit Line 3 (MRT-3 Line) and buses for the first time in the Philippines. In support of the government's goal to accelerate the digitization of payments, and in line with the Bangko Sentral ng Pilipinas' Digital Payments Transformation Roadmap, the 'Mastercard-Beep EMV Contactless Acceptance in Transport Partnership' aims to broaden contactless acceptance in the Philippines. This initiative is expected to bring greater convenience to the consumer commuting experience, simplifying access and enabling travelers to tap in and tap out with their Mastercard card.

(Source: Mastercard, Press Release, February 2024)

Africa Contactless Payments Market Report Coverage and Deliverables

The "Africa Contactless Payments Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Africa contactless payments market size and forecast at regional, and country levels for all the key market segments covered under the scope

- Africa contactless payments market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Africa contactless payments market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Africa contactless payments market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Increase in government initiatives to promote digital payments and efficiency and cost effectiveness of contactless payments are the factors driving the Africa contactless payments market growth.

The Africa contactless payments market was estimated to be USD 781.72 million in 2023 and is expected to grow at a CAGR of 8.8%, during the forecast period 2024 - 2031.

The efficiency and cost effectiveness of contactless payments are the major future trends for the Africa contactless payments market.

The key players, holding majority shares, in Africa contactless payments market includes Mastercard, Ingenico, Idemia SA, VISA, and Giesecke+Devrient.

The hardware segment led the Africa contactless payments market with a significant share in 2023.

The Africa contactless payments market is expected to reach US$ 1,536.57 million by 2031.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Africa Contactless Payments Market

- Visa

- Mastercard

- IBA Group

- Giesecke + Devrient GmbH

- IDEMIA

- CityCard Technology Ltd

- EcoCash

- Ingenico

- Nedbank Ltd

- Sudo Africa, Inc.

Get Free Sample For

Get Free Sample For