The Africa fuel dispenser market was valued at US$ 49.96 million in 2022 and is projected to reach US$ 64.23 million by 2030; it is expected to register a CAGR of 3.20% during 2022–2030.

Analyst Perspective:

The Africa fuel dispenser market was dominated by Nigeria and Egypt, with market shares of 34.60% and 20.19%, respectively, in 2022. Nigeria and Egypt's economies are among the top economies in the region. Nigeria's natural gas deposit was ~208.62 trillion cubic feet in 2022. The Nigerian government is heavily investing in compressed natural gas for adoption in the automotive and transportation sectors. Egypt has taken significant steps to convert automobiles to compressed natural gas (CNG). For example, in January 2021, the government of Egypt announced its plan to boost the number of automobiles powered by compressed natural gas. Egypt's natural gas output is considered to be self-sufficient.

Market Overview:

A fuel dispenser is essential gas station equipment, offering a safe and efficient way to pump gasoline, diesel, or other fuel types into automobiles. It properly measures and dispenses fuel, guaranteeing that consumers only pay for what they receive.

The surging demand for fuel in Africa, catalyzed by robust economic growth and growing urbanization, is poised to propel the Africa fuel dispenser market to new heights. As economies expand, there is a simultaneous surge in energy consumption across various sectors. Urbanization amplifies this demand, necessitating a sophisticated fuel distribution infrastructure. The increase in urban centers and hubs of economic activity intensifies the need for efficient transportation networks, thereby driving the growth of Africa fuel dispenser market. The increased reliance on automobiles and public transport in urban areas underscores the critical role that fuel dispensing systems play in meeting the escalating fuel requirements. Modernizing fuel retail infrastructure in numerous African nations represents a strategic shift poised to significantly impact and drive the Africa fuel dispenser market across the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Africa Fuel Dispenser Market: Strategic Insights

-

Market Size 2022

US$ 49.96 Million -

Market Size 2030

US$ 64.23 Million

Market Dynamics

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

Regional Overview

- Africa

Market Segmentation

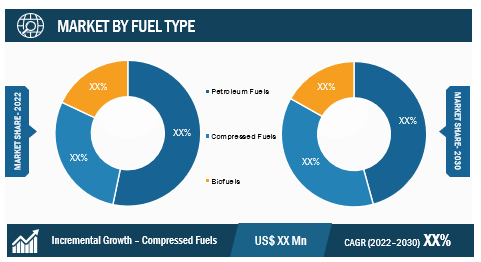

Fuel Type

Fuel Type

- Petroleum Fuels

- Compressed Fuels

- Biofuels

Dispenser System

Dispenser System

- Submersible

- Suction

End-users

End-users

- Automotive

- Industrial

- Aerospace and Defense

- Marine

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

The surging demand for fuel in Africa, catalyzed by robust economic growth and increased urbanization, is poised to propel the Africa fuel dispenser market to new heights. As economies expand, there is a proportional surge in energy consumption across various sectors. Urbanization amplifies this demand, necessitating a sophisticated fuel distribution infrastructure. The increase in urban centers and hubs of economic activity intensifies the need for efficient transportation networks, thereby driving the demand for fuel dispensers. The increased reliance on automobiles and public transport in urban areas highlights the critical role that fuel dispensing systems play in meeting the escalating fuel requirements. The table below shows the constant demand for fuel from South Africa throughout 2022. This trend is anticipated to offer promising growth opportunities for the Africa fuel dispenser market in the coming years.

January to December South Africa Fuel Sales Volume / Consumption (2022)

Volume in Million Liters |

|||||

|

Product name |

Q1- January to March |

Q2 - April to June |

Q3 - July to September |

Q4 - October to December |

Grand Total |

|

Diesel (All grades) |

3231.73 |

3133.18 |

3243.82 |

3108.58 |

12717.32 |

|

Petrol (All grades) |

2341.86 |

2236.06 |

2215.98 |

2390.95 |

9184.86 |

|

Jet Fuel |

348.61 |

337.00 |

366.94 |

425.58 |

1478.14 |

|

Paraffin |

305.53 |

299.68 |

300.79 |

271.88 |

1177.89 |

|

Furnace Oil |

146.34 |

144.65 |

138.67 |

164.36 |

594.04 |

|

LPG |

90.98 |

86.75 |

68.72 |

76.92 |

323.38 |

|

Aviation Gasoline |

1.49 |

1.23 |

0.90 |

1.06 |

4.69 |

|

Grand Total |

6466.58 |

6238.57 |

6335.84 |

6439.36 |

25480.37 |

Simultaneously, the industrialization sweeping across the continent amplifies the necessity for a seamless and continuous fuel supply. Industries, essential components of economic development, demand a reliable energy source for manufacturing processes and transportation. This heightened industrial activity increases the need for strategically located fuel dispensers near industrial zones. The economic landscape of Africa is dynamically evolving, and this presents a strategic opportunity for stakeholders in the Africa fuel dispenser market. Investing in advanced technologies and expanding the fuel distribution network to accommodate the burgeoning demand align with the trajectory of economic development in the region. As the nexus between economic growth, urbanization, and industrialization propels the demand for fuel dispensers, proactive industry players stand to capitalize on this increasing Africa fuel dispenser market growth, fostering innovation, infrastructure development, and sustainable economic progress across Africa.

Segmental Analysis:

The Africa fuel dispenser market is characterized by a diverse range of fuel types, each catering to unique demands and regional preferences. The fuel types include petroleum fuels, compressed fuels, and biofuels. This segmentation reflects the continent’s dynamic energy landscape and the ongoing transition toward cleaner and more sustainable fuel options. Diesel fuel dispensers continue to play a crucial role in supporting the transportation, industrial, and agricultural sectors. The consistent demand for diesel underscores its significance in powering various vehicles and machinery. Fuel dispensers for gasoline remain essential for private and commercial vehicles. Despite the growing interest in alternative fuels, petrol maintains a significant market share, particularly in urban areas. The adoption of CNG as a cleaner alternative is gaining traction. Countries in Africa, such as Egypt, lead in CNG infrastructure development, with a growing number of CNG-powered vehicles and an expanding network of refueling stations. Ethanol-blended fuels are becoming increasingly popular, with biofuel dispensers accommodating the demand for cleaner alternatives. Initiatives such as Sunbird Bioenergy’s use of cassava feedstock in Zambia signify a growing interest in sustainable biofuels, which is boosting the growth of Africa fuel dispenser market share of Zambia.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The Africa fuel dispenser market was dominated by Nigeria and Egypt, with market shares of 34.60% and 20.19%, respectively, in 2022. Nigeria and Egypt’s economies are among the top economies in the region. In addition, the marine transportation industry in Nigeria is developing rapidly. Nigeria’s maritime trade has a direct connection to the country’s oil & gas industry. Nigeria, Africa’s largest oil producer, exports petroleum products, including crude oil, refined petroleum, and liquefied natural gas (LNG), via maritime channels. Nigeria is Africa’s largest ship-owning country, with 291 vessels totaling 7.94 million deadweight tons. Nigerian-owned vessels ranked 30th in vessel value, accounting for 0.56% of global fleet value. As a result, there is a rise in growth Africa fuel dispenser market share in the marine sector of Nigeria.

Apart from Nigeria and Egypt, Algeria and Kenya are a few notable African countries where the demand is growing. Algeria is Africa's largest crude oil and natural gas producer. Algeria has an estimated 159 trillion cubic feet of proven natural gas reserves at the start of 2023. Algeria produced more natural gas in 2021 compared to any previous year. Kenya is one of Africa's fastest-developing economies. In the third quarter of 2023, Kenya's GDP rose 5.9% yearly, compared to 4.3% growth in the same quarter of 2022. As the country’s demand for fuel grows, fuel consumption also increases continuously. Such increased fuel consumption increases the Africa fuel dispenser market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Key Player Analysis:

Tiger Pump; Ehad Fuel Equipment; FTI Group Ltd.; SAMD; Smartflow; Galileo Technologies SA; Eaglestar Energy Technology Co., Ltd.; Dover Fuelling Stations; Prowalco; and Gilbarco Veeder-Root are the prominent market participants in the Africa fuel dispenser market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Africa fuel dispenser market. The market initiative is a strategy adopted by Africa fuel dispenser market players to expand their footprint across the world and to meet the growing customer demand. The market players present mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by the key players are listed below:

Year |

News |

|

April 2022 |

Helmerich & Payne (H&P) invested US$ 33 million in Galileo Technologies, bolstering the company's unique technological platform aimed at decarbonizing the energy supply chain. |

Africa Fuel Dispenser Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 49.96 Million |

| Market Size by 2030 | US$ 64.23 Million |

| CAGR (2022 - 2030) | 3.20% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered |

Africa

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

What is the future trend for Africa fuel dispenser market?

Which country to dominate the Africa fuel dispenser market in the forecast period?

Who are the major vendors in the Africa fuel dispenser market?

What are market opportunities for the Africa fuel dispenser market?

What are reasons behind Africa fuel dispenser market growth?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For