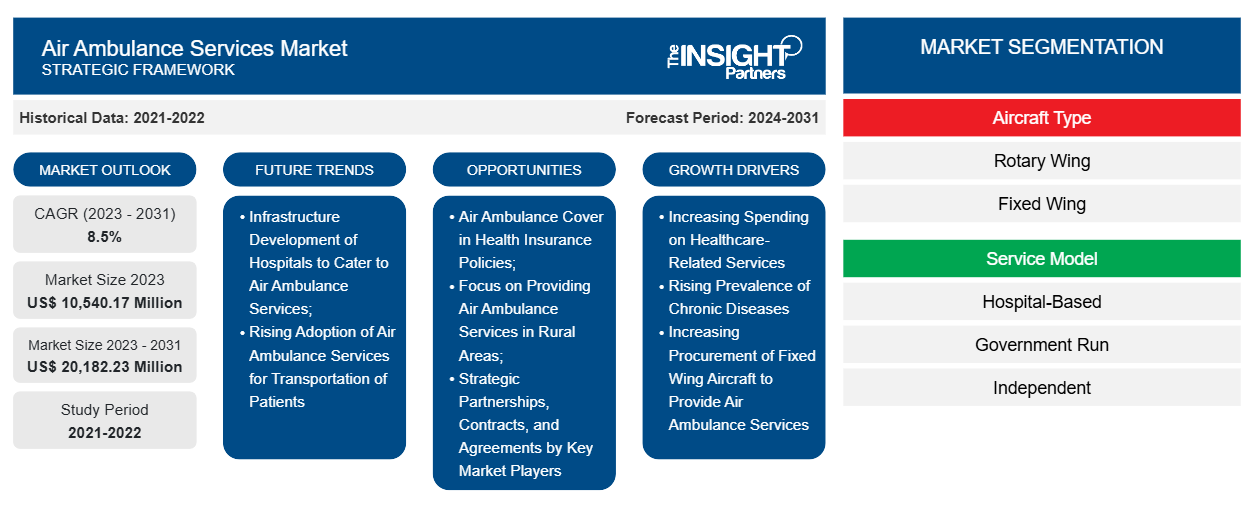

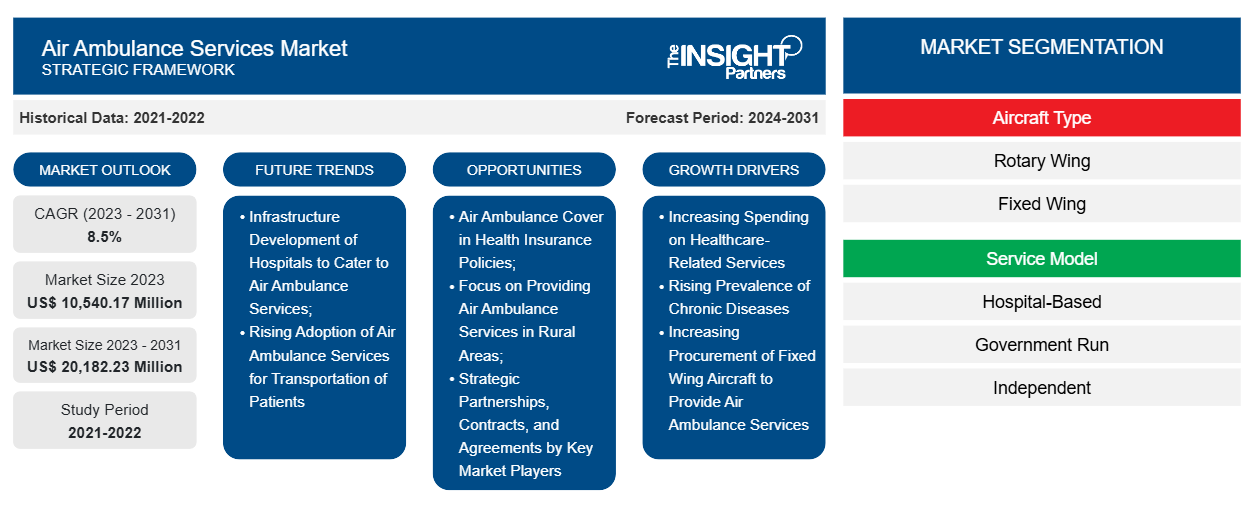

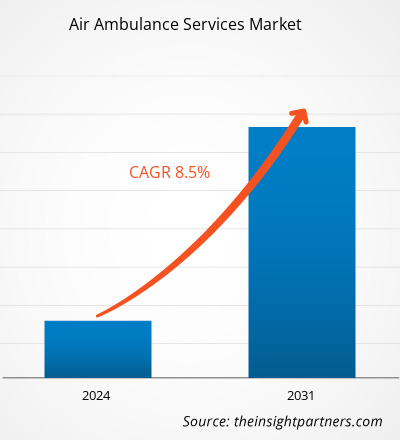

The air ambulance services market size is projected to reach US$ 20,182.23 million by 2031 from US$ 10,540.17 million in 2023. The market is expected to register a CAGR of 8.5% during 2023–2031. The increasing spending on healthcare-related services is likely to remain one of the key air ambulance services market trends.

Air Ambulance Services Market Analysis

The air ambulance services market is moderately fragmented, with the presence of a large number of players operating across different regions. The need for air ambulance services is mainly driven by higher demand during emergency medical cases wherein the patients are required to be transferred to another suitable location for their medical treatment. Various authorities across different regions have been taking initiatives to establish an air ambulance infrastructure across their respective locations. Several state governments across different countries have also been investing heavily in the construction of new helipads or runways to provide a better service for emergency medical needs. For instance, in July 2023, the state government of Maharashtra, India, announced its plans to establish 16 new helipads specifically for air ambulances on the Mumbai-Nagpur Samruddhi Expressway.

Air Ambulance Services Market Overview

Patient transport from one place to another requires significant care and coordination between patients, healthcare facilities, and transport service providers. The mode of transportation depends on the patient's medical condition and hospital location. Factors such as required medical equipment, distance, patient mobility, and cost of addressing. With proper communication and planning between transport teams, healthcare, and patients to be moved safely. Private equity companies control around two-thirds of both the fixed-wing and helicopter air ambulance markets worldwide. Air ambulance services have gained popularity for several purposes, including patient transfer to hospitals, medical tourism, international patient care, and organ transplantation. Air ambulances ensure safe transportation of the organs for transplantation and enhance the success rates of organ transplantation surgeries. Several companies are adopting these air ambulance services across the world. For instance, in January 2024, ICATT India's Bengaluru base had 15 fixed-wing aircraft and 2 helicopters for international and domestic transfers. The company offers 1–2 domestic patient transfers per day and 3 international trips per week in India. The increasing adoption of air ambulance services for patient care and patient transfer from hospital to hospital created a massive demand for air ambulance services.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Air Ambulance Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Air Ambulance Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Air Ambulance Services Market Drivers and Opportunities

Increasing Procurement of Fixed Wing Aircraft to Provide Air Ambulance Services

Fixed-wing aircraft are used to transport patients at longer distances. The increase in government initiatives and programs to provide air ambulance services is the major driving factor for the market. For instance, in March 2024, the Maldives President launched air ambulance services in the country. The Ministry of Health in Maldives has launched a paper regarding the starting of the operation of air ambulance services in the Maldives. In November 2023, the government of Ontario added four more fixed-wing Pilatus PC-12 aircraft for Ornge's air ambulance services. The total fixed-wing aircraft order reached 12, worth over US$ 108 million. Air ambulance services include patient transfer, newborn baby transfer, pediatric emergency transportation services, bariatric patient operations, extracorporeal oxygenation operations, intra-aortic balloon pump operations, and over-water aeromedical transportation. Therefore, the increasing procurement of fixed-wing aircraft to provide air ambulance services drives the market growth.

Focus on Providing Air Ambulance Services in Rural Areas

Rural hospitals are struggling with several problems, including the shortage of physicians, the lack of medical appliances, and the absence of emergency medical services. Hence, various companies are taking initiatives to provide air ambulance services for rural communities across the globe. For instance, Air Methods, an air ambulance service provider based in Colorado, US, spends a significant amount on transferring patients from rural hospitals. Further, there has been an increase in government initiatives and funding for air ambulance services across rural areas. For instance, in June 2023, US government authorities launched the No Support Legislation Act to improve access to emergency air medical services for rural communities in America. This Americans Act uses data collected under the No Surprises Act to offer reimbursement rates for emergency air services for rural communities across the US. Air ambulances offer lifesaving services, especially for the many rural areas in Kansas. The rising focus on providing air ambulance services in rural areas across the globe is expected to create ample opportunity for air ambulance services market growth.

Air Ambulance Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the air ambulance services market analysis are aircraft type, service model, and end user.

- Based on aircraft type, the air ambulance services market is divided into rotary wing and fixed wing. The rotary wing segment held a larger market share in 2023.

- By service model, the market is segmented into hospital-based, government run, and independent. The hospital-based segment held the largest share of the market in 2023.

- In terms of end user, the market is bifurcated into domestic and international. The domestic segment dominated the market in 2023.

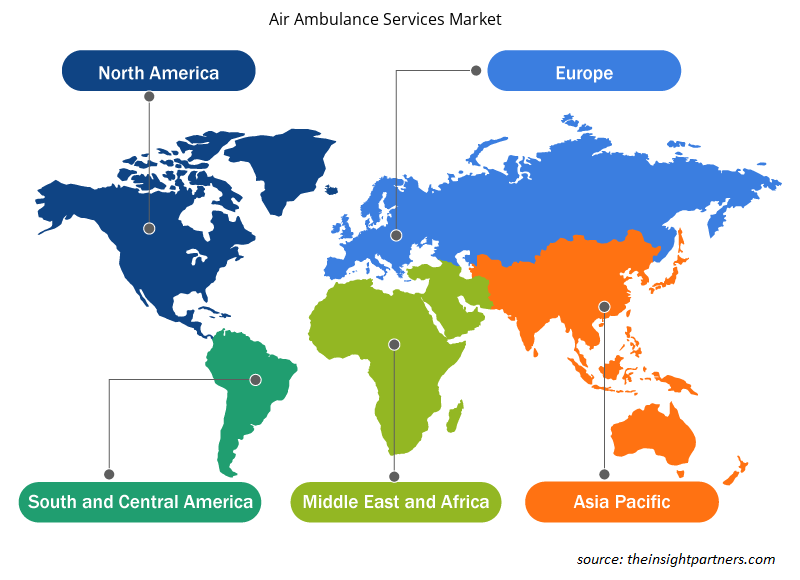

Air Ambulance Services Market Share Analysis by Geography

The geographic scope of the air ambulance services market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the air ambulance services market. The growing healthcare infrastructure in terms of building new multi-specialty hospitals and care centers, along with a rising focus on healthcare facilities such as emergency medical assistance services, is anticipated to boost the air ambulance services market growth in North America. The mounting prevalence of chronic diseases such as cardiovascular diseases, cancer, and stroke and the growing consumer preference for emergency medical services for improved and immediate medical attention are factors contributing to the dominance of the North America air ambulance services market. Asia Pacific is anticipated to register the highest CAGR in the coming years.

Air Ambulance Services Market News and Recent Developments

The air ambulance services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for air ambulance services:

- TrustAir Aviation and ARworks, two Hungarian companies, have jointly developed a unique and innovative VR training application for simulating the specific conditions of air medical transport. This ground-breaking application allows for the use and exploitation of VR technology and the benefits provided by artificial intelligence in a healthcare context that has not been utilized before.

- FAI rent-a-jet GmbH's Air Ambulance Division announced it has received Commercial Airline Medical Escort (CAME) accreditation from the European Aeromedical Institute (EURAMI) for its Dubai-based medical escort service. This follows FAI's accreditation as an approved EURAMI provider in early 2023. The CAME endorsement accredits aero-medical providers performing patient transfers, like FAI, to transport patients seated in the cabin or on a designated stretcher. FAI is the first private company in the GCC with EURAMI CAME accreditation and the only European fixed-wing operator to receive both the CAME accreditation and the EURAMI-approved provider accreditation in the GCC.

Air Ambulance Services Market Regional Insights

The regional trends and factors influencing the Air Ambulance Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Air Ambulance Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Air Ambulance Services Market

Air Ambulance Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 10,540.17 Million |

| Market Size by 2031 | US$ 20,182.23 Million |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Aircraft Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

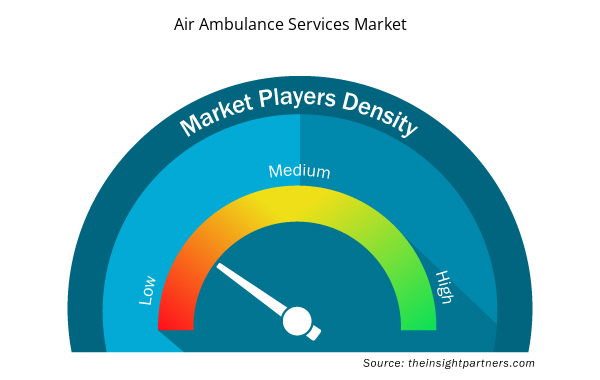

Air Ambulance Services Market Players Density: Understanding Its Impact on Business Dynamics

The Air Ambulance Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Air Ambulance Services Market are:

- Air Methods

- Aero-Dienst GmbH

- Airlec Air Espace

- Babcock International Group Plc

- Trust Air Aviation Ltd

- FAI Aviation Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Air Ambulance Services Market top key players overview

Air Ambulance Services Market Report Coverage and Deliverables

The "Air Ambulance Services Market Size and Forecast (2023–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increasing spending on healthcare-related services and the rising prevalence of chronic diseases are acting as major driver for air ambulance services.

Air Methods, Aero-Dienst GmbH, Airlec Air Espace, Babcock International Group Plc, Trust Air Aviation Ltd, FAI Aviation Group, IAS Medical, Medical Air Service, PHI Air Medical, and Quick Air Jet Charter GmbH are the key market players operating in the global air ambulance services market.

North America is one of the major regions in the air ambulance services market owing to mounting prevalence of chronic diseases.

Growing investment in healthcare industry and increasing prevalence of chronic diseases are acting as major drivers for the air ambulance services market.

Patient transport from one place to another requires significant care and coordination between patients, healthcare facilities, and transport service providers. The mode of transportation depends on the patient's medical condition and hospital location. Factors such as required medical equipment, distance, patient mobility, and cost of addressing. With proper communication and planning between transport teams, healthcare, and patients to be moved safely. Private equity companies control around two-thirds of both the fixed-wing and helicopter air ambulance markets worldwide. Air ambulance services have gained popularity for several purposes, including patient transfer to hospitals, medical tourism, international patient care, and organ transplantation. Air ambulances ensure safe transportation of the organs for transplantation and enhance the success rates of organ transplantation surgeries. Several companies are adopting these air ambulance services across the world.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Air Ambulance Services Market

- Air Methods

- Aero-Dienst GmbH

- Airlec Air Espace

- Babcock International Group Plc

- Trust Air Aviation Ltd

- FAI Aviation Group

- IAS Medical

- Medical Air Service

- PHI Air Medical

- Quick Air Jet Charter GmbH

Get Free Sample For

Get Free Sample For