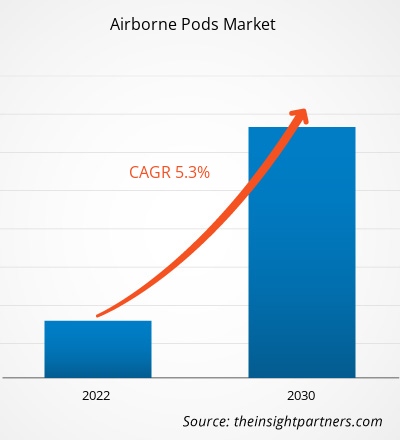

The Airborne Pods Market size is projected to reach US$ 4,287.47 million by 2030 from US$ 2,832.45 million in 2022. The market is expected to register a CAGR of 5.3% in 2022–2030. The changing geopolitical scenario worldwide boosts the requirement for strong defense countermeasure systems. Countermeasure systems are airborne defensive systems that help identify airborne threats. Air defense radar systems generate important data for fusion and correlation by leveraging inputs from other sensors and intelligence sources. This accelerates the development of a comprehensive and accurate air image, enabling precise threat assessments and target engagements. The tension across nations such as Russia–Ukraine, India–Pakistan, and Israel–Palestine is compelling their governments to strengthen their armed forces.

Airborne Pods Market Analysis

The armed forces across different countries are investing in procuring air defense systems such as surface-to-air missile systems, integrated air defense systems, naval defense systems, fighter aircraft, early warning systems, and border surveillance systems. Radar systems are fundamental components of comprehensive air defense systems. They enable armed forces to track, detect, and identify airborne threats such as aircraft, drones, and missiles. BAE Systems, General Dynamics Corporation, Honeywell International Inc., Israel Aerospace Industries Inc., Leonardo S.p.A, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, and Thales Group are a few companies focusing on developing defense countermeasure systems that include radar system, communication and surveillance system, and navigation devices. Thus, the increasing procurement and deployment of countermeasure systems is expected to fuel the growth of the airborne pods market during the forecast period.

Airborne Pods Market Overview

The growing unstable geopolitical scenarios worldwide are the major factors contributing to the rise in the application of airborne pods in military aircraft and helicopters. The growing government initiatives to strengthen the defense sector to combat modern warfare requirements are also leading to a surge in the application of airborne pods for improved aerial surveillance, detection, targeting, and countermeasure of airborne attacks. The competence to commence manned and unmanned missions and simultaneously integrate with a host of data-linked sensors among domains and terra-firma are a few of the major features of advanced combat aircraft. The advanced combat aircraft have high-end avionics, more competent thrust-vectoring engines, and an in-built super-cruise. Airborne pods have major applications in combat aircraft; they gather and collect information regarding the enemy's strength, activities, and actions. Airborne Intelligence, Surveillance and Reconnaissance (ISR) pods help offer highly confidential intelligence data to the Air Force defense bases. Targeting pods are leveraged by combat aircraft to detect and attack the targets traced on the ground. With the growing technological advancement, self-protection pods are also being utilized in combat aircraft, which allows the tracking of infrared and radio frequency of missile threats. Accordingly, it prepares the deployment of countermeasure and real-time threat recognition and defense systems.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airborne Pods Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airborne Pods Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airborne Pods Market Drivers and Opportunities

Increasing Procurement of Military Aircraft and Helicopters

The increasing procurement of military aircraft and helicopters for combating the growing instances of airborne attacks is boosting the market for airborne pods globally. The growing demand for advanced technologies to neutralize missile attacks along with enhancing the process of identification or locating the target area, and surveillance and detection of possible airborne threats is boosting the application of advanced airborne pods in military aircraft, jets, and helicopters. The government bodies of different countries are investing substantially in procuring high-end military aircraft, combat jets, and helicopters to tackle the growing airborne threats, which is also expanding the application scope of airborne pods and advanced sensors globally.

Deployment of Airborne Pods in Unmanned Aerial Vehicles (UAVs)

The increasing application of unmanned aerial vehicles for various purposes, including weapon delivery, surveillance, and disruption, boosts the demand for airborne pods. Navigation, communication, and surveillance systems are crucial in detecting and tracking UAVs and providing early warning and situational awareness. The increasing adoption of UAVs requires advanced airborne pods with improved detection capabilities to counter the airborne or ground-based threats effectively. As the threat from UAVs becomes more evident, governments and defense organizations worldwide prioritize developing and acquiring communication and surveillance defense systems to counter this evolving threat.

Airborne Pods Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Airborne Pods Market analysis are aircraft type, pod type, senor technology, range, and geography.

- Based on aircraft type, the Airborne Pods Market has been segmented into combat aircraft, helicopters, UAVs, and others. The combat aircraft segment held a larger market share in 2022.

- By pod type, the market has been segmented into ISR, targeting, and countermeasure. The ISR segment held the largest share of the market in 2022.

- In terms of sensor technology, the market has been segregated into EO/IR, EW/EA, and IRCM. The EO/IR segment dominated the market in 2022.

- By range, the market has been segmented into short, long, and intermediate. The long range segment held the largest share of the market in 2022.

Airborne Pods Market Share Analysis by Geography

The geographic scope of the Airborne Pods Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Airborne Pods Market in 2022, and it is likely to retain its dominance during the forecast period as well. Moreover, in 2022, Europe accounted for the second largest share followed by Asia Pacific. Further, Asia Pacific is likely to surpass the European region by 2030. Europe is one of the leading regions across the globe in terms of developments in the defense sector. The rising geopolitical volatility among countries such as Ukraine and Russia driving the demand from the air force for strong and advanced sensors capable of aerial detection, identification, recognition, communication, and targeting. China, India, Australia, Japan, and South Korea are major markets for airborne pods in Asia Pacific. Growing focus on national security and increasing governmental initiatives toward boosting the development of the air force security infrastructure are a few factors boosting the demand for airborne pods in Asia Pacific.

Airborne Pods Market Regional Insights

The regional trends and factors influencing the Airborne Pods Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Airborne Pods Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Airborne Pods Market

Airborne Pods Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,832.45 Million |

| Market Size by 2030 | US$ 4,287.47 Million |

| Global CAGR (2022-2030) | 5.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Aircraft Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

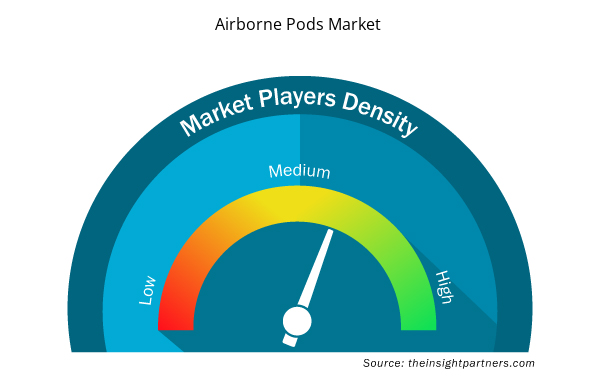

Airborne Pods Market Players Density: Understanding Its Impact on Business Dynamics

The Airborne Pods Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Airborne Pods Market are:

- BAE Systems Plc

- Advanced Technologies Group (ATGI)

- L3Harris Technologies Inc

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Airborne Pods Market top key players overview

Airborne Pods Market News and Recent Developments

The Airborne Pods Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for airborne pods market and strategies:

- In August 2023, Collins Aerospace, an RTX business, won a US$ 36 million contract from the US Air Force Research Laboratory to develop and demonstrate a platform-agnostic, Beyond-Line-Of-Sight satellite communications pod. (Source: Raytheon Technologies, Press Release/Company Website/Newsletter)

- On September 2022, Northrop Grumman Corporation’s LITENING advanced targeting pod successfully completed its first test flights on the US Navy’s F/A-18 Super Hornet. The Navy selected LITENING to replace the legacy targeting pods on the F/A-18 fleet. (Source: Northrop Grumman Corporation, Press Release/Company Website/Newsletter)

Airborne Pods Market Report Coverage and Deliverables

The “Airborne Pods Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Aircraft Type, Pod Type, Range and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For