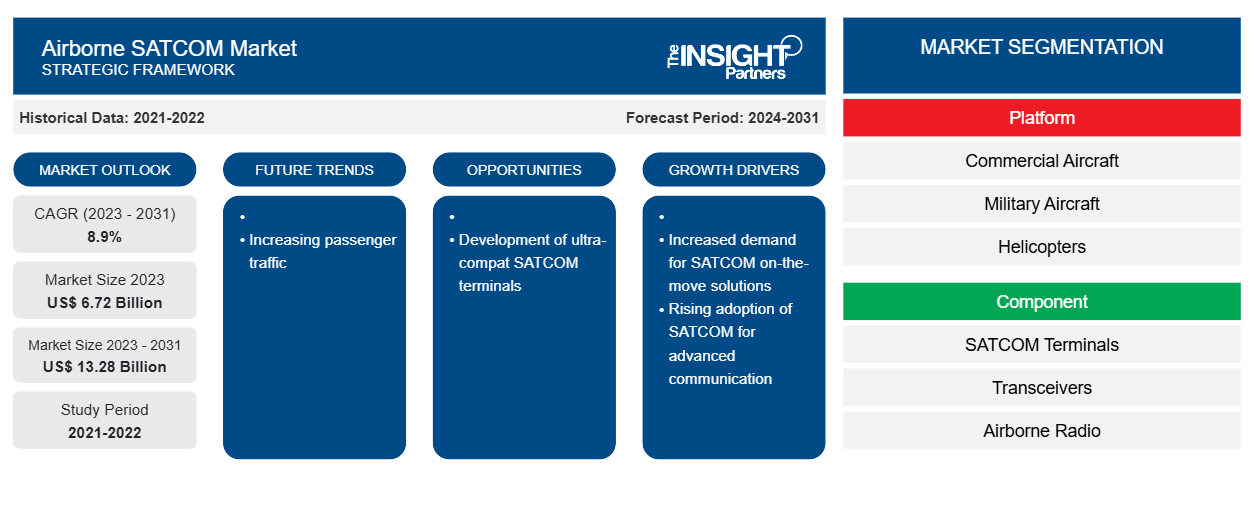

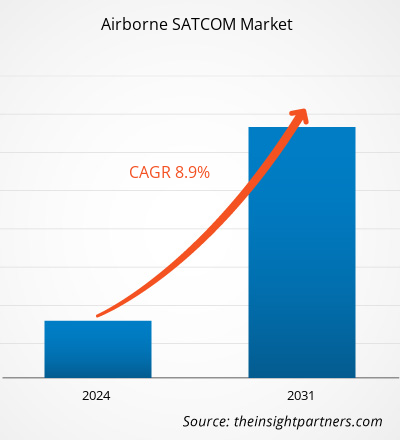

The airborne SATCOM market size is projected to reach US$ 13.28 billion by 2031 from US$ 6.72 billion in 2023. The market is expected to register a CAGR of 8.9% during 2023–2031. Increasing air passenger traffic is likely to remain a key trend in the market.

Airborne SATCOM Market Analysis

The airborne SATCOM players include Collins Aerospace; Honeywell International Inc.; General Dynamics Mission Systems, Inc.; L3Harris Technologies, Inc.; Viasat, Inc.; Astronics Corporation; and many more. The airborne SATCOM market has a large number of small players engaged in the business which holds a significant portion of the global market. The small players are also involved in R&D activities for developing the new technologies which are further strengthening the market size over the coming years. These organizations over the years have increased their investment in the development of new and advanced airborne SATCOM as per the growing customer needs with the help of government regulatory bodies. The government regulatory body helps the airborne SATCOM manufacturer by providing the contract to defense, airport, and government authorities.

Airborne SATCOM Market Overview

The major stakeholders in the global airborne SATCOM market ecosystem include raw material/component suppliers, airborne SATCOM manufacturers, government regulatory bodies, and end-users. The raw material /component providers are the crucial stakeholders in the ecosystem of the airborne SATCOM market. The major raw material used in SATCOM includes a transmitter, receiver, transceiver, antenna, airborne radio, modems & routers, high-power amplifiers, batteries, and other equipment. The timely supply of all these components is crucial for efficient operation across airborne SATCOM manufacturing plants. Thus, any operational impact on these component providers directly impacts the airborne SATCOM market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airborne SATCOM Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airborne SATCOM Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airborne SATCOM Market Drivers and Opportunities

Increase in demand for SATCOM On-The-Move (OTM) Solutions

One of the most important applications of satellite communication technology is communications on the move (COTM), which provides crucial services to various businesses. COTM provides important applications for first responders, disaster recovery, emergency preparedness, remote access, and other applications to military and commercial end users. Moreover, moving aircraft such as commercial, government, and unmanned aerial vehicles (UAVs) equipped with a satellite dish capable of establishing and sustaining communications with a satellite network while the aircraft is in motion are referred to as COTM. Demand for satellite-based on-the-move communications (COTM) emerged as a new trend in defense and commercial aerial communication systems. COTM technologies have become significantly more effective due to the arrival of high-powered L-band satellites with low-gain antenna solutions designed originally for the security and defense industries. In November 2018, Get SAT announced the release of the UltraBlade L-Band antenna for on-the-go L-band airborne applications. Customers and operators, both commercial and military, want faster speeds and more competitive bandwidth pricing. Operators' networks are being constricted as different platforms require new antenna types or ways to purchase connectivity, leading to the development of advanced airborne on-the-move SATCOM solutions.

Development of Ultra-Compact SATCOM Terminals

UAVs with tactical, long-range capabilities are used to acquire and transmit real-time intelligence, surveillance, and reconnaissance (ISR) data to ground stations. Reliable, high-performance satellite communications ensure continuous broadband connectivity in beyond-line-of-sight (BLOS) activities. In recent years, there has been a significant increase in the demand for small aerial vehicles (UAVs) with high performance and throughput L-Band SATCOM terminals with a tiny footprint. For instance, Intellian announced in October 2021 that its new FB250 and Fleet One L-band terminals received Inmarsat type certification. The Intellian Fleet One terminal is a small, sturdy, and low-cost solution for simultaneous phone and data communication up to 150kbps. Further in January 2022, Inmarsat, the market leader in international mobile satellite communications, permitted ultra-intelligence and communications to use its new ultra-compact SATCOM terminal with the Inmarsat Global Xpress network. The new ultra-terminal is a frontrunner in size, weight, power, and higher performance standards to create a communications capability in the field of operations, facilitating mission-critical communication between soldiers in the field and command and control.

Airborne SATCOM Market Report Segmentation Analysis

Key segments that contributed to the derivation of the airborne SATCOM market analysis are platform, component, and application.

- Based on platform, the airborne SATCOM market is segmented into commercial aircraft, military aircraft, helicopters, and UAV. The commercial aircraft segment held a larger market share in 2023.

- Based on component, the airborne SATCOM market is segmented into SATCOM terminals, transceivers, airborne radio, modems & routers, SATCOM radomes, and others. The transceivers segment held a larger market share in 2023.

- Based on application, the airborne SATCOM market is segmented into defense and commercial. The commercial segment held a larger market share in 2023.

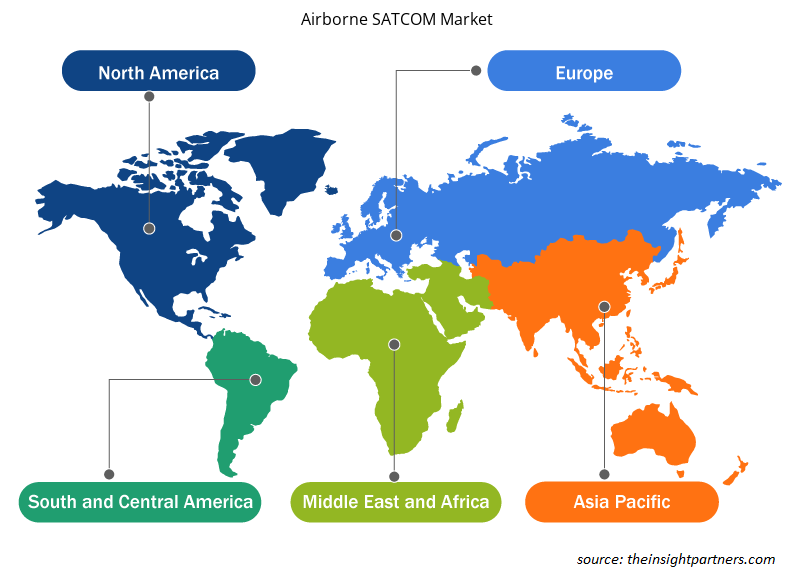

Airborne SATCOM Market Share Analysis by Geography

The geographic scope of the airborne SATCOM market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific has dominated the market in 2023 followed by North America and Europe regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. China is one of the largest countries in the Asia Pacific region that has largest population globally and is one of the largest manufacturing hubs in the world. China has facilities of Boeing, Airbus, COMAC, Pratt & Whitney, Changhe Aircraft Industries Corporation, Chongqing Helicopter Investment Corporation, Harbin Aircraft Industry Group, Yuneec International, Shenyang Aircraft Corporation, AVIC Aircraft Corporation, and Guizhou Aircraft Industry Corporation. The country has seen substantial growth in the manufacturing and production of aircraft, UAVs, helicopters, and other parts of aircraft along with a well-established aerospace manufacturing hub. For instance, by the end of 2021 COMAC announced that it has delivered around 66 china made aircraft across the country; also Airbus China announced that it has delivered around 142 commercial aircraft across the country during the same period.

Airborne SATCOM Market Regional Insights

The regional trends and factors influencing the Airborne SATCOM Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Airborne SATCOM Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Airborne SATCOM Market

Airborne SATCOM Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.72 Billion |

| Market Size by 2031 | US$ 13.28 Billion |

| Global CAGR (2023 - 2031) | 8.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

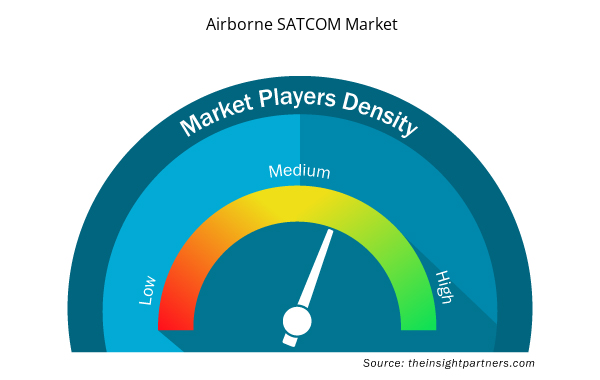

Airborne SATCOM Market Players Density: Understanding Its Impact on Business Dynamics

The Airborne SATCOM Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Airborne SATCOM Market are:

- ASELSAN A.

- Thales Group

- Collins Aerospace

- Cobham Limited

- Honeywell International Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Airborne SATCOM Market top key players overview

Airborne SATCOM Market News and Recent Developments

The airborne SATCOM market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the airborne SATCOM market are listed below:

- Astronics Corporation (Nasdaq: ATRO), a leading provider of advanced technologies for global aerospace, defense and other mission critical industries, launched today the Typhon T-400 Series system, which represents the next generation in Satellite Communications (SATCOM) connectivity technology. The Typhon T-400 Series is designed to seamlessly operate on any GEO-based Ku Satellite network, effectively addressing challenges associated with the high cost of equipping an aircraft with SATCOM connectivity. (Source: Astronics Corporation, Press Release, Mar 2024)

- Viasat Inc. (NASDAQ: VSAT), a global communications company, today announced that it has integrated a secure, flexible broadband Ku- and Ka-band airborne technology onto the Airbus C295 MSA aircraft for the Irish Air Corps (IAC), a division of the Irish Defence Forces focused on the Military Air Defence of Ireland airspace and supporting United Nations peacekeeping operations. Viasat and Airbus collaborated to integrate Viasat’s flexible dual-band broadband terminal, the GAT-5530, on the C295 MSA aircraft to provide enhanced capability to this multi-purpose military airborne platform. Airbus completed delivery of two C295 MSA aircraft to the Irish Defence Forces earlier this year. (Source: Viasat Inc., Press Release, Dec 2023)

Airborne SATCOM Market Report Coverage and Deliverables

The “Airborne SATCOM Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Airborne SATCOM market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Airborne SATCOM market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Airborne SATCOM market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the airborne SATCOM market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Platform, Component, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The rising adoption of satellite communication (SATCOM) technology to provide advanced communication solution and increase in demand for SATCOM On-The-Move (OTM) solutions are some of the factors driving the growth for airborne SATCOM market.

Asia Pacific region dominated the airborne SATCOM market in 2023.

Increasing air passenger traffic is one of the major trends of the market.

Collins Aerospace (Raytheon Technologies Corporation), Honeywell International Inc, General Dynamics Mission Systems Inc, L3Harris Technologies Inc, Viasat Inc, Astronics Corporation, ASELSAN AS, Thales Group, Cobham Limited, and Orbit Communications Systems Ltd are some of the key players profiled under the report.

The estimated value of the airborne SATCOM market by 2031 would be around US$ 13.27 billion.

The airborne SATCOM market is likely to register of 8.9% during 2023-2031.

Get Free Sample For

Get Free Sample For