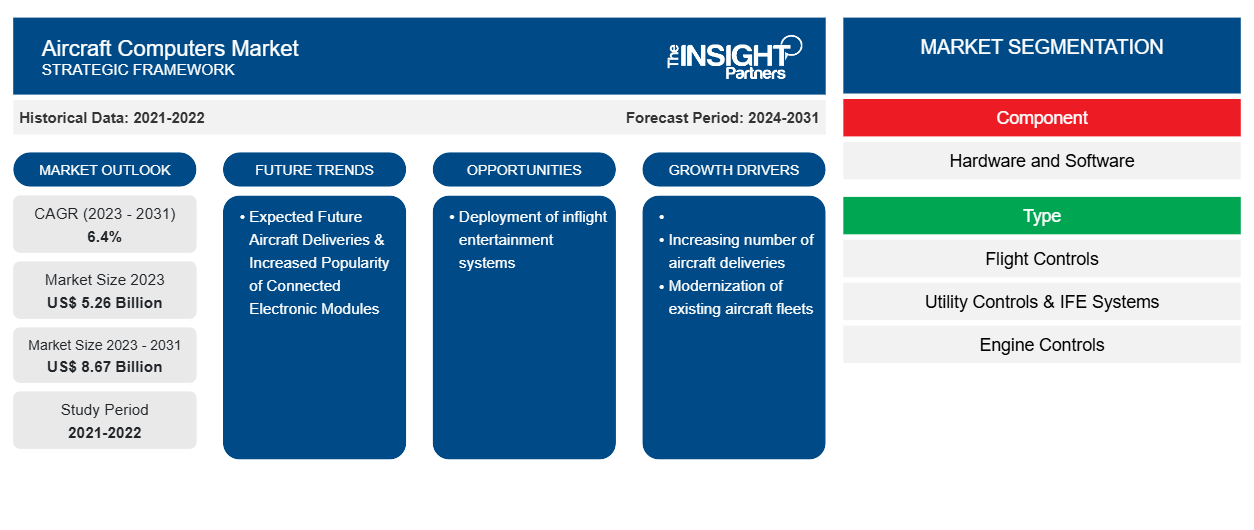

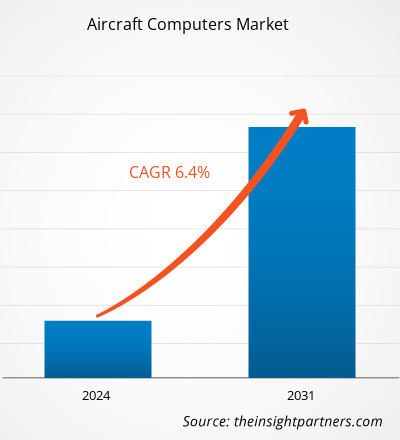

The aircraft computers market size is projected to reach US$ 8.67 billion by 2031 from US$ 5.26 billion in 2023. The market is expected to register a CAGR of 6.4% during 2023–2031. Deployment of inflight entertainment systems capabilities is likely to remain a key trend in the market.

Aircraft Computers Market Analysis

The aircraft computers market ecosystem is evolving. Its stakeholders are component suppliers, aircraft computer manufacturers, and end users. Major players occupy places in the second node of the market ecosystem. Component manufacturers provide different components such as actuators, sensors, and control systems to different product manufacturers who the utilize it to produce the final aircraft computer product, which is then supplied to aircraft manufacturers, MRO vendors, commercial airlines, military forces, and business jets or helicopter owners. Companies, such as BAE Systems Plc, Garmin Ltd., General Electric, General Dynamics Mission Systems, Honeywell International Inc., Lockheed Martin Corporation, Raytheon Technologies Corporation, SAAB AB, Safran, and Thales Group are among the leading manufacturers in the aircraft computers market. These companies are engaged in providing wide range of aircraft computers services to end-users, such as aircraft OEMs, commercial airliners, military forces, and general aviation owners and other customers respectively.

Aircraft Computers Market Overview

The growth of the aircraft computers market in North America is attributed to the presence of a large number of aircraft manufacturers, such as Boeing; Airbus; Lockheed Martin Corporation; Raytheon Technologies Corporation; General Dynamics Mission Systems, Inc.; and Northrop Grumman Corporation. The growing pipeline of upcoming aircraft deliveries, along with the presence of a large number of aircraft providers, is likely to favor the growth of the aircraft computers market in North America in the coming years. Escalating demand for aircraft computers in unmanned aerial vehicles (UAVs) is another factor supporting the market growth in this region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Computers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Computers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Computers Market Drivers and Opportunities

Modernization of Existing Aircraft Fleets

The modernization of existing fleets helps enhance their sustainability by reducing fuel consumption and carbon emission, thereby improving flight performance. The development of advanced electronics systems and computers is generating the need to replace the older electronics system in the aircraft models that are currently in use. Several countries are emphasizing the development and procurement of next-generation aircraft fleets to modernize and expand their fleets which is aiding the demand for advanced aircraft computer systems. For instance, in May 2021, Lufthansa Group modernized its fleet and purchased 10 highly efficient long-haul aircraft, with an aim to improve efficiency and reduce operating costs. In addition, in January 2022, the French Defense Procurement Agency received the sixth ATL2 Maritime Patrol Aircraft upgraded from standard 5 to standard 6. The aim of the above mentioned upgradation initiative was to develop new technologies and integrate them into tactical mission systems, sensor subsystems, and display consoles of existing aircraft, followed by restoring aircraft performance to peak levels. The upgradation of such advanced system emerges the need for technologically viable aircraft computer systems which is propelling the market growth over the forecast period.

Expected Future Aircraft Deliveries and Popularity of Connected Electronic Modules

Boeing has received ~300 orders for the new generation of the 777 family, and in April 2022, it pushed the delivery of its first 777X plane to 2025. In May 2021, Airbus, planned an average A320 Family production rate of 45 aircraft per month, to attain this production rate by the fourth quarter of 2021; Furthermore, it is likely to boost its production rate to 64 aircraft per month by the second quarter of 2023, 70 aircraft per month by the first quarter of 2024, and 75 aircraft per month by 2024. In May 2022, Qantas confirmed its order for 12 units of Airbus A350-1000 for its ultra-long-haul Project Sunrise initiative. Further, as per the Commercial Market Outlook 2021–2040, published by Boeing, it expects to deliver a total of 43,610 aircraft, including 2,390 regional jets, 32,660 single-aisle aircraft, 7,670 widebody aircraft, and 890 freighter deliveries, in the next 20 years. Thus, the pipeline of aircraft deliveries is likely to present potential growth opportunities for the aircraft computers market players during the forecast period. Such factors are likely to push the demand for aircraft computers in the coming years.

Aircraft Computers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aircraft computers market analysis are component, type, platform, and fit type.

- Based on component, the aircraft computers market is divided into hardware and software. The hardware segment held a larger market share in 2023.

- Based on type, the aircraft computers market is segmented into flight controls, utility controls & ife systems, engine controls, mission computers, and flight management computers. The flight controls segment held a larger market share in 2023.

- By platform, the market is segmented into fixed-wing aircraft, rotary-wing aircraft, and unmanned aerial vehicles. The fixed-wing aircraft segment held the largest share of the market in 2023.

- By fit type, the market is segmented into line fit and retrofit. The line fit segment held the largest share of the market in 2023.

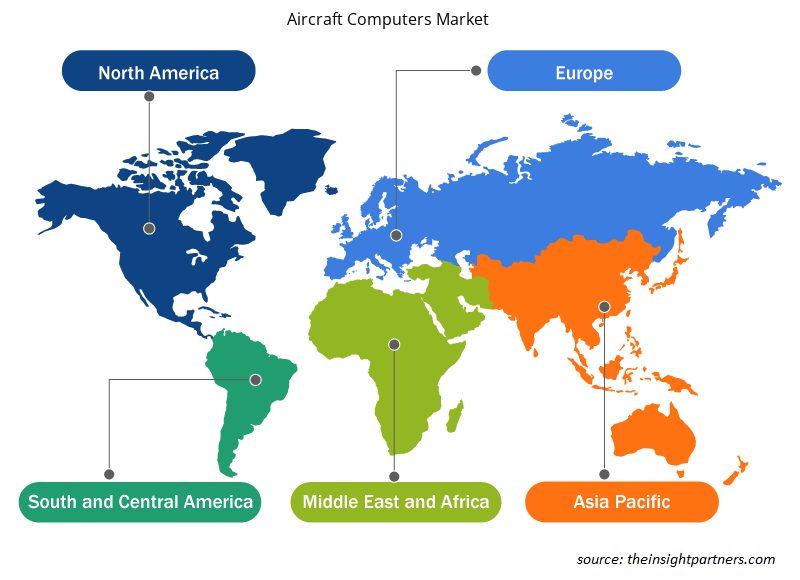

Aircraft Computers Market Share Analysis by Geography

The geographic scope of the aircraft computers market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific. Further, Asia Pacific is likely to become the most dominant market for aircraft computers in the coming years. APAC has had a strong import of advanced commercial aircraft since the past few years owing to an increase in international travelers from across the globe in countries such as India, China, Japan, and Taiwan. Owing to the increasing count of aircraft and airports, the demand for aircraft MRO services will soar during the forecast period. The region is expected to account for ~40% of the future airline production to suffice the aircraft demand. The increasing number of airports and rising regional flight transportation between Asian countries are encouraging the demand for aircraft computers and systems to perform safer operations. To fulfill these needs, new and existing players are developing new systems, which, in turn, is expected to drive the market growth across the Asia Pacific region in the coming years.

Aircraft Computers Market Regional Insights

The regional trends and factors influencing the Aircraft Computers Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Computers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Computers Market

Aircraft Computers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.26 Billion |

| Market Size by 2031 | US$ 8.67 Billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

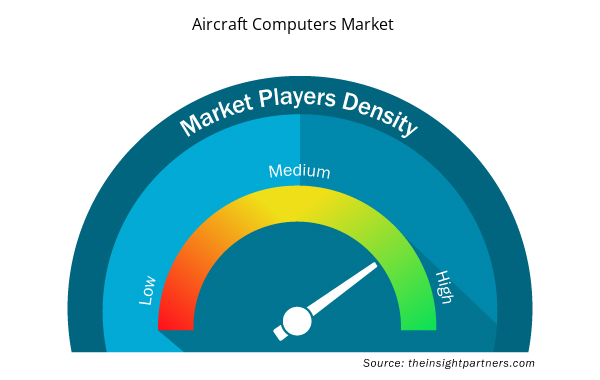

Aircraft Computers Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Computers Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Computers Market are:

- AAR CORP

- AeroRepair Corp.

- AEROSPACE MRO CO., LTD.

- Air Atlanta Aviaservices

- AMETEK Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Computers Market top key players overview

Aircraft Computers Market News and Recent Developments

The aircraft computers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aircraft computers market are listed below:

Universal Avionics (UA), an Elbit Systems company, has successfully completed initial flight tests of its NexGen, software-based interactive Flight Management System (i-FMS). The flight tests were conducted in Austria on a government-owned Bell 212 helicopter as part of a joint effort with Elbit to improve flight management and navigation capabilities for the customer. (Source: Universal Avionics, Press Release, Dec 2023)

- CMC Electronics today announced a multi-year contract with Swiss-based Pilatus Aircraft Ltd. for the purchase of its cutting-edge avionics solutions for the PC-21 Next Generation Trainer. (Source: CMC Electronics, Press Release, Aug 2023)

Aircraft Computers Market Report Coverage and Deliverables

The “Aircraft Computers Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Aircraft computers market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aircraft computers market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Aircraft computers market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aircraft computers market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Type, Platform, and Fit Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the aircraft computers market in 2023.

Increasing number of aircraft deliveries and modernization of existing aircraft fleets are some of the factors driving the growth for aircraft computers market.

Deployment of inflight entertainment systems is one of the major trends of the market.

BAE Systems Plc, Garmin Ltd, General Electric, General Dynamics Mission Systems Inc, Honeywell International Inc, Lockheed Martin Corporation, Raytheon Technologies Corporation, SAAB AB, Safran Group, and Thales SA are some of the key players profiled under the report.

The estimated value of the aircraft computers market by 2031 would be around US$ 8.67 billion.

The aircraft computers market is likely to register of 6.4% during 2023-2031.

Get Free Sample For

Get Free Sample For