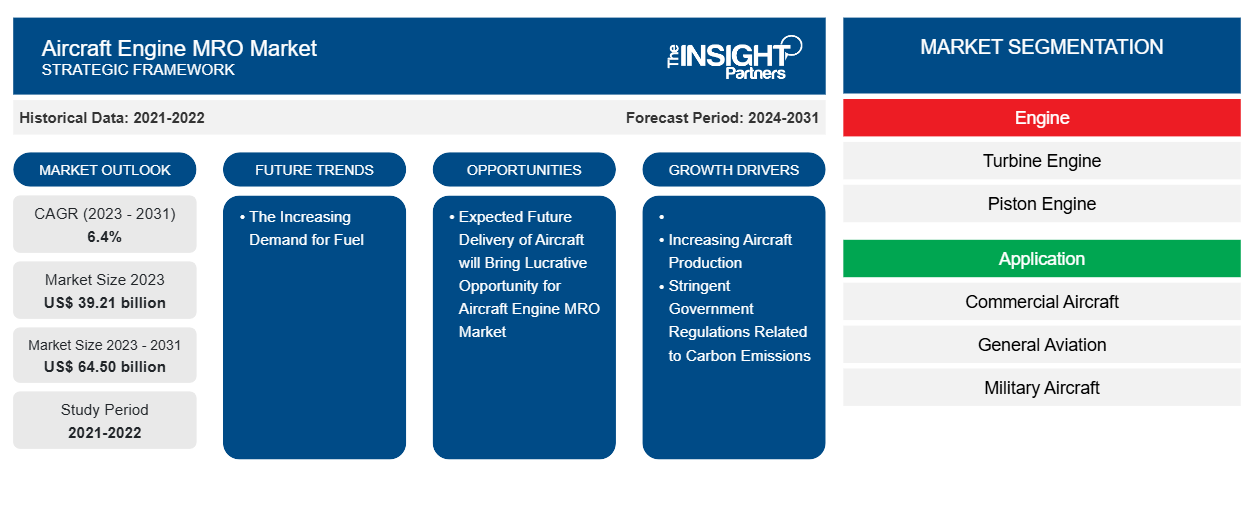

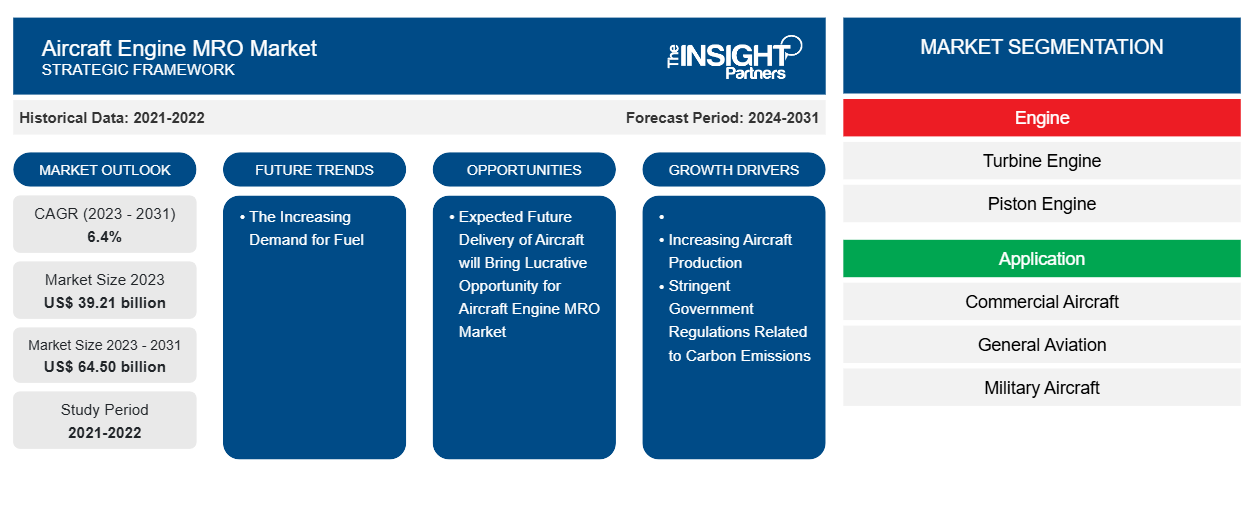

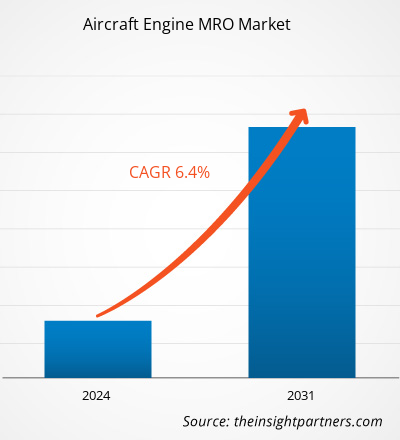

The Aircraft Engine MRO Market size is projected to reach US$ 64.50 billion by 2031 from US$ 39.21 billion in 2023. The market is expected to register a CAGR of 6.4% in 2023–2031. The increasing demand for fuel-efficient aircraft is likely to remain a key aircraft engine MRO market trend.

Aircraft Engine MRO Market Analysis

Airports worldwide have various types of engine MRO facilities. Commonly, the maintenance is done on the aircraft's airframe or the engine. Engine MRO services also include MRO of components nowadays. Depending on the service type, these services are provided at the airport and, sometimes, at off-airport facilities. Activities, such as routine inspections, regular troubleshooting, or day-to-day engine checks can be done when the aircraft is parked in the air terminal.

Aircraft Engine MRO Market Overview

One of the key applications of aircraft engine MRO is to ensure that all rotating stages of the engine are balanced and keep minimum vibration levels. This improves the engine's durability and fuel efficiency and restricts the amount of engine wear from vibration. By upgrading aircraft engines and components related to them, the need for advanced infrastructure and skilled labor for the aircraft engine MRO will also increase. The MRO requirement of engines varies based on the type and categories of engines. Older and smaller aircraft engines have times between overhauls (TBOs) of a maximum of 5,000 hours. Modern engines have more than 6,000 hours of TBOs. With more business aircraft flying less than 500 hours a year, the requirement of engine MRO service averages 12 years or more it.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Engine MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Engine MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Engine MRO Market Drivers and Opportunities

Stringent Government Regulations Related to Carbon Emissions

In 2021, the US government announced its aim for a 20% reduction in aircraft emissions by 2030. Several regulatory authorities are implementing strategies to reduce carbon emissions. For instance, in March 2022, the International Air Transport Association (IATA) estimated that more than 10 billion trips per year will be made by flights by 2050 and thus announced to achieve net-zero carbon emissions by 2050.

More than 60% of the countries worldwide have announced a net-zero carbon emission. Companies, such as Honeywell Aerospace, are also committed to achieving net-zero carbon emissions by 2035. In November 2021, Bell Textron Inc. announced that Bell 525 completed its first flight utilizing sustainable aviation fuel. Boeing and Airbus have recently announced that by 2030, their aircraft will fly 100% on SAF. The US and European governments are encouraged to produce SAFs. These factors are propelling the aircraft engine MRO market substantially.

Expected Future Delivery of Commercial Aircraft – An Opportunity in Aircraft Engine MRO Market

With the increase in air traffic and aircraft demand, air carriers are boosting their aircraft delivery. The demand for new airlines is not just coming from existing aircraft re-establishing their fleet but also from new low–cost aircraft entering the market. A repressed interest of leisure travelers being more cost-sensitive post-pandemic, decreased interest in business travel, and the adaptability of the minimal expense aircraft plan of action are surging the demand for MRO services. Moreover, according to the Boeing and Airbus forecasts, more than 40,800 commercial aircraft are expected to be delivered by the end of 2042 which further drives the deployment of new engines into those aircraft production. This will further increase the overall aircraft fleet globally and generate the demand for engine MRO as well as market vendors in the coming years.

Aircraft Engine MRO Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aircraft engine MRO market analysis are engine, application, and aircraft type.

Engine [Turbine Engine (Turboprop Engine, Turbofan Engine, Turboshaft Engine), Piston Engine], Application (Commercial Aircraft, General Aviation, Military Aircraft), Aircraft Type (Fixed Wing, Rotary Wing)

- Based on engine, the aircraft engine MRO market is segmented into turbine engines and piston engines. Also, turbine engines have been further segmented into turboprop engines, turbofan engines, and turboshaft engines. The turbine engine segment held a larger market share in 2023.

- Based on application, the market is segmented into commercial aircraft, general aviation, and military aircraft. The commercial aircraft segment held a larger market share in 2023.

- Based on aircraft type, the market is segmented into fixed-wing and rotary-wing. The fixed-wing segment held a larger market share in 2023.

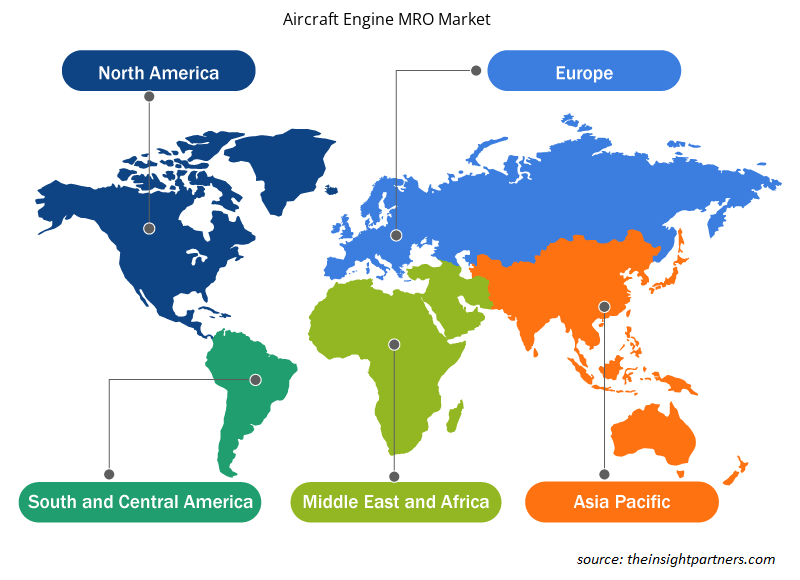

Aircraft Engine MRO Market Share Analysis by Geography

The geographic scope of the aircraft engine MRO market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

In 2023, Asia Pacific accounted for a major share of the global aircraft engine MRO market followed by North America and Europe. Asia's economy has been fueled by a diverse range of income levels and a fast-expanding middle class. This resulted in strong sales growth in the region's fast-growing economies, such as India and China. APAC is predicted to be the market with the most prospects for aircraft MRO service providers. The region contains several developing economies that are leading the way in a range of industries, such as aerospace, military & defense, and technology. Many growing economies in APAC are seeking regulatory investment to improve their technologies. This would eventually spur the development and use of new technologies for aircraft integration. Several airlines in APAC, such as Singapore Airlines and Malaysian Airlines, are developing their in-house maintenance capabilities. Pratt & Whitney, a US-based aerospace firm, added MRO capability for its PW100G-JM geared turbofan at its Eagle Services Asia plant in Singapore in 2019. Over the years, this plant has been overhauling Pratt & Whitney GTF engines. With the launch of the PW100G-JM engine, the facility is expected to see a significant increase in revenue from various aircraft operators who use the PW100G-JM. Additionally, the rising deployment of retrofitting technologies for improved aircraft and the burgeoning adoption of blockchain technology are among the major factors driving the growth of the aircraft engine MRO market. Also, the growth of the market in Asia Pacific is attributed to the increasing aircraft fleet owing to the rising passenger traffic; increasing spending on military aircraft propelled by growing defense budget; and the ongoing projects of the development of commercial, general aviation, and military aircraft.

Aircraft Engine MRO Market Regional Insights

Aircraft Engine MRO Market Regional Insights

The regional trends and factors influencing the Aircraft Engine MRO Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Engine MRO Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Engine MRO Market

Aircraft Engine MRO Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 39.21 billion |

| Market Size by 2031 | US$ 64.50 billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Engine

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

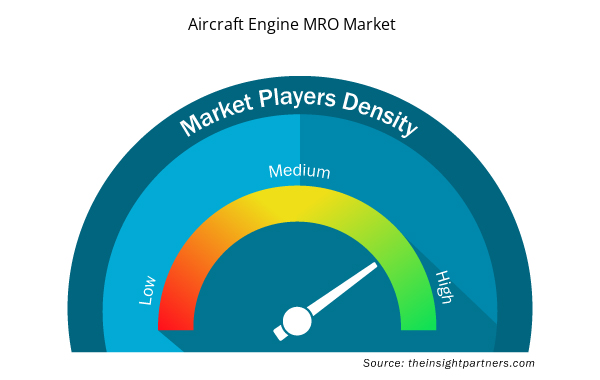

Aircraft Engine MRO Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Engine MRO Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Engine MRO Market are:

- Delta Airlines, Inc.

- GE Aviation

- CFM International

- Lufthansa Technik

- MTU Aero Engines AG

- SIA Engineering Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Engine MRO Market top key players overview

Aircraft Engine MRO Market News and Recent Developments

The aircraft engine MRO market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In April 2024, ITP Aero signed a contract with the Colombian Ministry of Defence for the Maintenance, Repair and Overhaul (MRO) of the T700 engines that power its Armed Forces’ fleet of Black Hawk helicopters. The contract will run until June 2026 and the MRO services for the engines will be carried out at ITP Aero’s facilities in Albacete (Spain). (Source: ITP Aero, Press Release)

- In November 2023, MTU Maintenance signed a five-year LEAP-1A maintenance, repair and overhaul (MRO) contract with SriLankan Airlines, building on the two companies’ existing relationship that has also covered V2500 engines and leasing support. The national carrier of Sri Lanka currently operates a fleet of 22 Airbus A330s and A320/A321 aircraft and carries out flights across South Asia, Europe, the Far East and the Middle East. (Source: MTU Maintenance, Newsletter)

Aircraft Engine MRO Market Report Coverage and Deliverables

The “Aircraft Engine MRO Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Aircraft Engine MRO Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Aircraft Engine MRO Market trends

- Detailed Porter’s Five Forces

- Aircraft Engine MRO Market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Aircraft Engine MRO Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Engine, Application, and Aircraft Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For