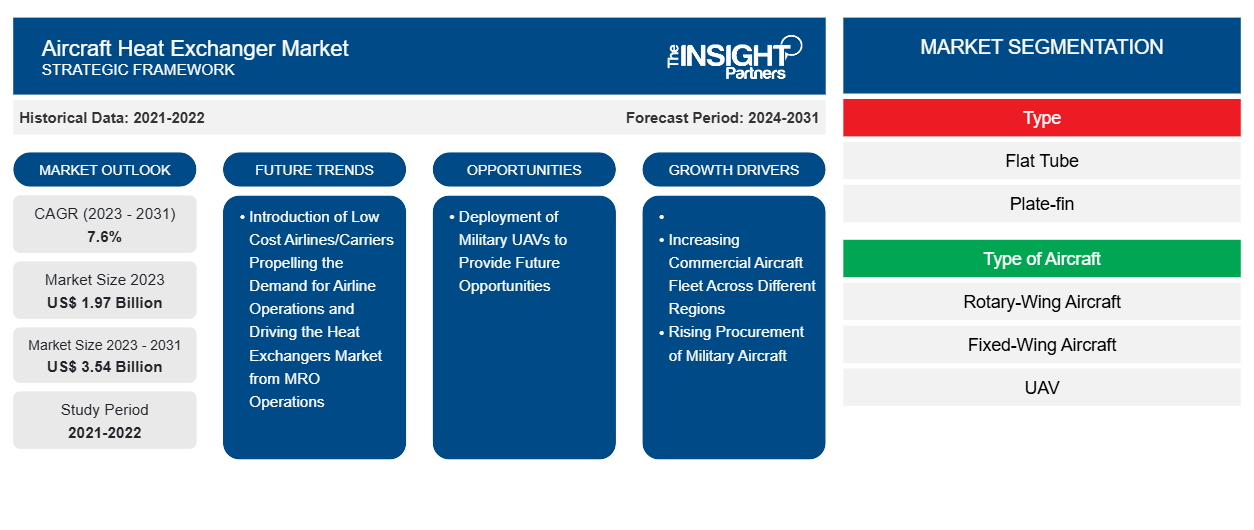

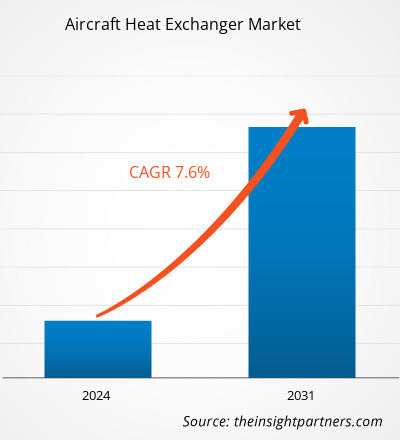

The Aircraft Heat Exchanger Market size is projected to reach US$ 3.54 billion by 2031 from US$ 1.97 billion in 2023. The market is expected to register a CAGR of 7.6% in 2023–2031. The global aircraft manufacturing industry is possessed with a large number of well-established companies across the globe wherein the bargaining power of buyers is estimated to grow to a high level in the coming years. Due to the presence of a large number of heat exchanger suppliers in the market, the aircraft manufacturers have several options to choose the best manufacturer which provide higher quality products, better customer service, and lower prices.

Aircraft Heat Exchanger Market Analysis

The demand for the aircraft heat exchanger is surging among the aircraft manufacturers and airlines. The designers of the aircraft heat exchanger are spending enormous amounts in the development of advanced technology such as additive manufacturing to ease the process of designing. This factor is attracting the customers of heat exchangers designers, manufacturers, and suppliers. The airlines procure the aircraft heat exchanger through OEMs. Also, aircraft manufacturers such as Boeing, and Airbus, among others, convince their customers to integrate new aircraft with advanced products. This also facilitates the aircraft heat exchanger market to surge.

Aircraft Heat Exchanger Market Overview

Aircraft heat exchanger market is likely to witness a robust growth in the coming years. The growth of market is attributed to soe of the below factors:

- Increasing Commercial Aircraft Fleet Across Different Regions

- Rising Procurement of Military Aircraft

- Emerging Need for Effective Cooling & Heating in Commercial Aircraft for Enhanced Aircraft Operations

These factors are likely to show significant impact in terms of positive growth of the aircraft heat exchanger market. The need for effective heat & cooling management is another major factor generating the demand for new installation of heat exchangers in the new aircraft and existing aircraft fleet of various commercial airlines. Further, the rising procurement and orders of military aircraft is another major factor catalyzing the adoption of heat exchangers for military aircraft as well.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Heat Exchanger Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Heat Exchanger Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Heat Exchanger Market Drivers and Opportunities

Increasing Commercial Aircraft Fleet Across Different Regions

The rising demand for new aircraft from the operating airlines across different regions is one of the major factors pushing the global aircraft fleet size worldwide. In 2023, the global commercial aircraft fleet size was around 27,385 aircraft that further reached to 28,398 commercial aircraft in 2024. Such rise in fleet has driven the demand for aircraft heat exchanger across different regions. Moreover, the upcoming deliveries as per the Airbus and Boeing data (i.e., more than 40,000 aircraft are expected to be delivered during 2023 to 2042) is also likely to drive the market for aircraft heat exchangers in the coming years as well.

Deployment of Military UAVs to Provide Future Opportunities

The rising number of UAV deployments across the armed forces of different countries is one of the major factors likely to generate new opportunities for new installations of heat exchangers in the UAV segment. Further, this is also supported by the rising military expenditure across different countries worldwide that are spending more expenses for the procurement of military UAVs. Such factors are likely to generate new opportunities for aircraft heat exchangers market in the coming years.

Aircraft Heat Exchanger Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Aircraft Heat Exchanger Market analysis are type, type of aircraft, application, type of manufacturing, and geography.

- Based on type, the market has been categorized into flat tube and plate-fin. The plate-fin segment held a larger market share in 2023.

- By type of aircraft, the market has been segmented into fixed-wing aircraft, rotary-wing aircraft, and UAVs. The fixed-wing aircraft segment held the largest share of the market in 2023.

- In terms of application, the market has been segmented into engine and airframe. The engine segment dominated the market in 2023.

- In terms of type of manufacturing, the market has been segmented into conventional type and additive manufacturing type. The conventional type segment dominated the market in 2023.

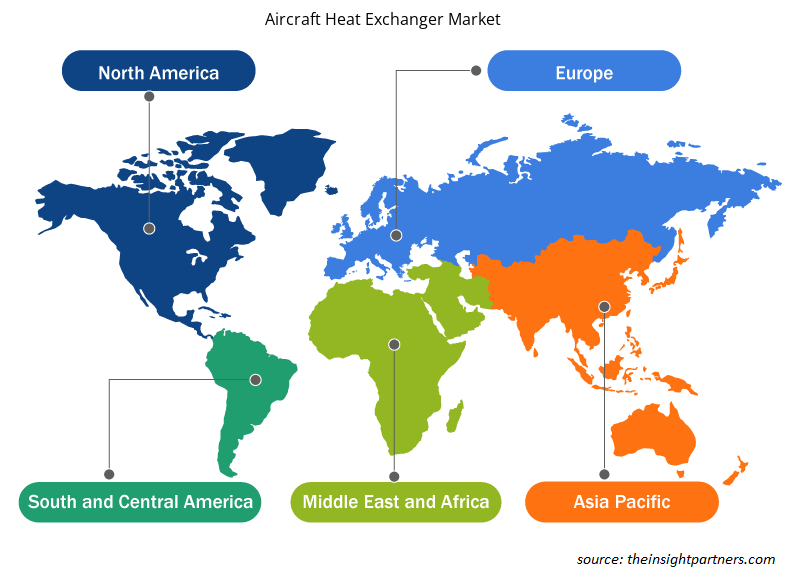

Aircraft Heat Exchanger Market Share Analysis by Geography

The geographic scope of the Aircraft Heat Exchanger Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Aircraft Heat Exchanger Market in 2023, whereas, Asia Pacific region is likely to witness a significant growth during the forecast period. The North American region includes the US, Canada, and Mexico. The US dominated the North American aircraft heat exchanger market in 2023. This is mainly due to the rising air passenger traffic and increasing aircraft fleet size across the country. Further, the future aircraft deliveries in the coming twenty years will also generate new opportunities for the market vendors in the North America region. For instance, according to the Airbus Global Market Forecast report, more than 6,970 commercial aircraft are expected to be delivered during 2023-2042. This will generate new demand for aircraft heat exchanger in the coming years.

Aircraft Heat Exchanger Market Regional Insights

The regional trends and factors influencing the Aircraft Heat Exchanger Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Heat Exchanger Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Heat Exchanger Market

Aircraft Heat Exchanger Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.97 Billion |

| Market Size by 2031 | US$ 3.54 Billion |

| Global CAGR (2023 - 2031) | 7.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

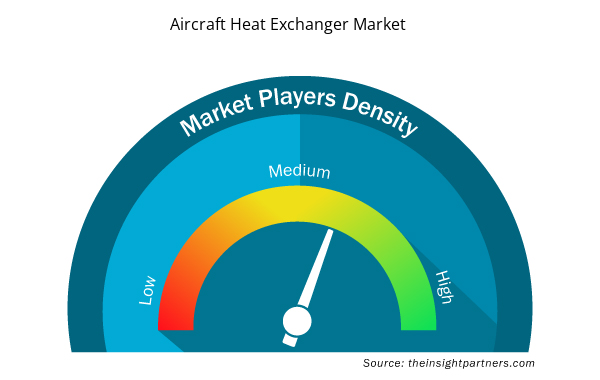

Aircraft Heat Exchanger Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Heat Exchanger Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Heat Exchanger Market are:

- Boyd Corporation

- Collins Aerospace

- Honeywell International Inc.

- Jamco Corporation

- Liebherr Group

- Meggitt PLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Heat Exchanger Market top key players overview

Aircraft Heat Exchanger Market News and Recent Developments

The Aircraft Heat Exchanger Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aircraft heat exchanger market and strategies:

- In June 2023, Safran Aero Boosters launched HIPEX, a new range of high-performance heat exchangers based on a revolutionary aerodynamic design, at the Paris Air Show. (Source: Safran Group, Press Release/Company Website/Newsletter)

- In May 2023, AMETEK MRO AEM, a leading provider of aviation maintenance, repair, and overhaul (MRO) services, has expanded heat exchanger capabilities at its Ramsgate facility in the UK. (Source: AMETEK, Press Release/Company Website/Newsletter)

Aircraft Heat Exchanger Market Report Coverage and Deliverables

The “Aircraft Heat Exchanger Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Single-Use Negative Pressure Wound Therapy Devices Market

- Cosmetic Bioactive Ingredients Market

- Organoids Market

- Skin Graft Market

- Electronic Signature Software Market

- Underwater Connector Market

- Nuclear Decommissioning Services Market

- Medical Audiometer Devices Market

- Space Situational Awareness (SSA) Market

- Personality Assessment Solution Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Type of Aircraft ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For