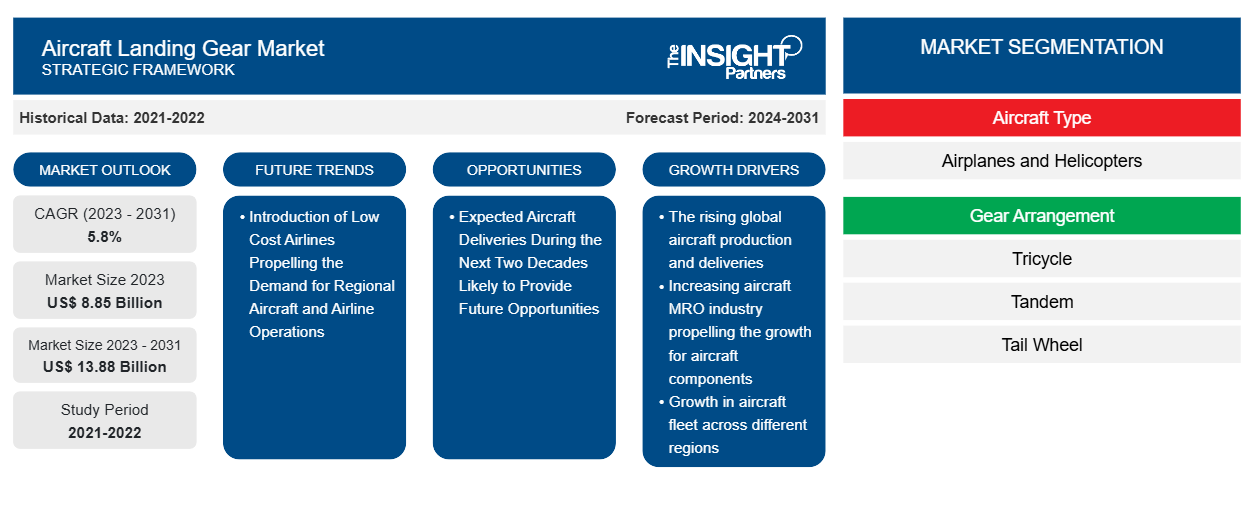

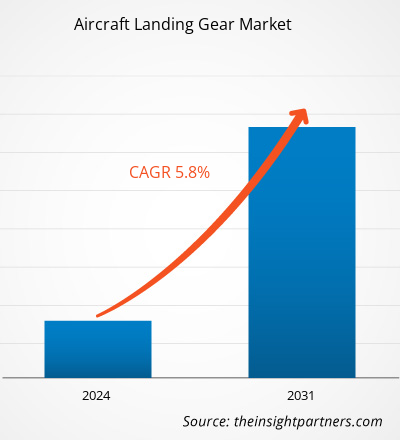

The Aircraft Landing Gear Market size is projected to reach US$ 13.88 billion by 2031 from US$ 8.85 billion in 2023. The market is expected to register a CAGR of 5.8% in 2023–2031.

One of the major trends in the aircraft landing gear market is the demand-driven from the aftermarket due to the constantly rising fleet of commercial and civil aircraft models worldwide. In general, the service life of the landing gear for commercial airplanes for overhaul is between 200 to 400 landing cycles depending upon the weight of the aircraft models. Further, the rise in several older aircraft that require C/D checks during maintenance is another major factor likely to drive the market for aircraft landing gear market from 2023 to 2031.

Aircraft Landing Gear Market Analysis

The aircraft landing gear market is growing at a normal growth rate after the significant negative impact during FY2020 due to the held civil aviation operations caused by the COVID-19 pandemic. However, the civil aviation sector resumed its operations after an indefinite period which also hampers the demand for landing gear MRO market as well. Further, the aircraft production has also started recovering from the suspended production facilities and has been witnessing positive revenue growth which is another major factor driving the growth for aircraft landing gear installations. Further, the rising air passenger traffic worldwide is one of the major secondary factors driving the aircraft landing gear market size from the retrofitting users.

Aircraft Landing Gear Market Overview

The aircraft landing gear market is likely to witness strong growth in the coming years. The growth of the aircraft landing gear market is due to some of the below key factors:

- The rising global aircraft production and deliveries

- Increasing aircraft MRO industry propelling the growth of aircraft components

- Growth in aircraft fleet across different regions

- Major backlogs of the major aircraft OEMs

These factors are likely to show a significant impact in terms of positive growth of the aircraft landing gear industry. Some of the other major factors likely to drive the aircraft landing gear market include factors such as the rising procurement of civil helicopters; the introduction of low-cost airlines/low-cost carriers (LCA/LCC) propelling the aircraft operations to cater to the rising global air passenger traffic & cargo operations; and an increasing number of contracts for military aircraft & helicopter procurement propelled by the rising global military expenditure.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Landing Gear Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Landing Gear Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Landing Gear Market Drivers and Opportunities

The Rising Global Aircraft Deliveries

The increasing number of aircraft deliveries is one of the major factors driving the growth of the landing gear market. For instance, one of the major aircraft giants ‘Airbus 2023, delivered around 735 commercial aircraft in 2023 and has witnessed a growth of 11% since 2022. Further, during the same period, Airbus also has secured more than 2315 commercial aircraft gross orders including the 1,835 units of the A320 series and 300 units of the A350 series of aircraft models. Similarly, another aircraft giant i.e. ‘Boeing’ in 2023, delivered 528 commercial aircraft globally compared to 480 units of aircraft in 2022. Such aircraft deliveries have majorly driven the aircraft landing gear market growth during FY 2023.

Expected Aircraft Deliveries During the Next Two Decades Likely to Provide Future Opportunities

The expected number of commercial aircraft deliveries in the next two decades is likely to witness strong growth. According to Airbus’ Global Market Forecast, more than 40,800 units of commercial aircraft during 2023 to 2042. Similarly, according to Boeing’s Commercial Market Forecast, more than 42,590 new commercial aircraft will be delivered from 2023 to 2042. Such growth in the production and deliveries of new commercial aircraft in the next two decades is likely to generate new opportunities for market vendors in the forecasted period of 2024 -2031 as well.

Aircraft Landing Gear Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Aircraft Landing Gear Market analysis are aircraft type, gear arrangement, type, end-user, and geography.

- Based on aircraft type, the Aircraft Landing Gear Market has been divided into airplanes and helicopters. The airplane segment held a larger market share in 2023.

- By gear arrangement, the market has been segmented into tricycle, tandem, and tail wheel. The tricycle segment held the largest share of the market in 2023.

- In terms of type, the market has been segregated into main landing gear and nose landing gear. The main landing gear segment dominated the market in 2023.

- In terms of end-users, the market has been segmented commercial and military. The commercial segment dominated the market in 2023.

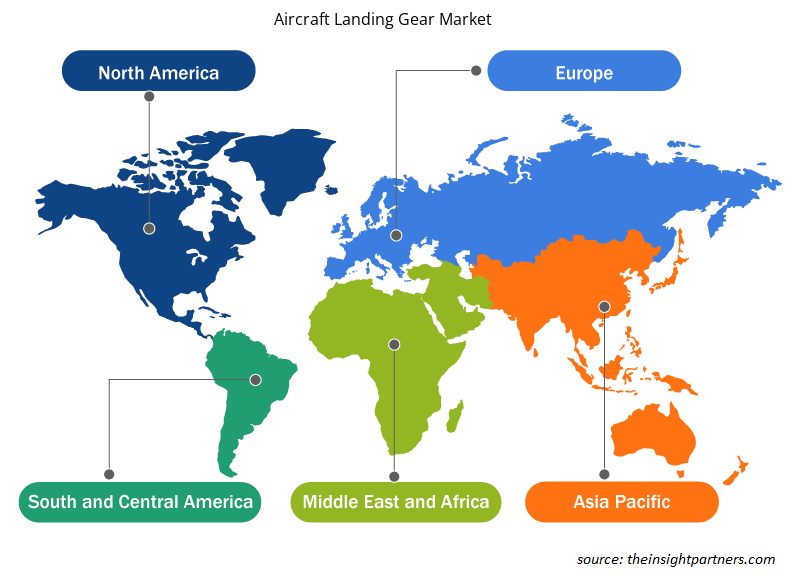

Aircraft Landing Gear Market Share Analysis by Geography

The geographic scope of the Aircraft Landing Gear Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Aircraft Landing Gear Market in 2023, whereas, the Asia Pacific region is likely to witness significant growth during the forecast period. The North American region includes the US, Canada, and Mexico. The US dominated the North American aircraft landing gear market in 2023. This is mainly due to the rising air passenger traffic and aircraft fleet size across the country. For instance, according to the Bureau of Transportation Statistics (BTS) analysis, in 2022, US airlines carried 194 million more passengers than in 2021, which was 30% year-to-year growth.

Aircraft Landing Gear Market News and Recent Developments

The Aircraft Landing Gear Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aircraft landing gear market and strategies:

- On October 2023, Safran Landing Systems signed a five-year contract with airline company Wizz Air to carry out the Maintenance, Repair, and Overhaul (MRO) operations on 57 aircraft of its A320 family fleet. (Source: Safran Group, Press Release/Company Website/Newsletter)

- In May 2022, Magellan Aerospace Corporation announced that it had reached a five-year agreement with Safran Landing Systems (“Safran”) to manufacture complex machined landing gear components. (Source: Magellan Aerospace Corporation, Press Release/Company Website/Newsletter)

Aircraft Landing Gear Market Regional Insights

The regional trends and factors influencing the Aircraft Landing Gear Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Landing Gear Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Landing Gear Market

Aircraft Landing Gear Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8.85 Billion |

| Market Size by 2031 | US$ 13.88 Billion |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Aircraft Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aircraft Landing Gear Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Landing Gear Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Landing Gear Market are:

- Safran

- Liebherr Group

- Hroux-Devtek Inc

- Collins Aerospace

- Triumph Group Inc

- Circor International Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Landing Gear Market top key players overview

Aircraft Landing Gear Market Report Coverage and Deliverables

The “Aircraft Landing Gear Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Semiconductor Metrology and Inspection Market

- Surgical Gowns Market

- Pressure Vessel Composite Materials Market

- Sleep Apnea Diagnostics Market

- 3D Mapping and Modelling Market

- Volumetric Video Market

- Electronic Data Interchange Market

- Military Rubber Tracks Market

- Greens Powder Market

- Saudi Arabia Drywall Panels Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Aircraft Type ; Gear Arrangement ; Type ; End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

- Safran

- Liebherr Group

- Héroux-Devtek Inc

- Collins Aerospace

- Triumph Group Inc

- Circor International Inc

- Sumitomo Precision Products Co Ltd

- GKN Aerospace Services Limited

- AAR Corp

- Magellan Aerospace Corporation

Get Free Sample For

Get Free Sample For