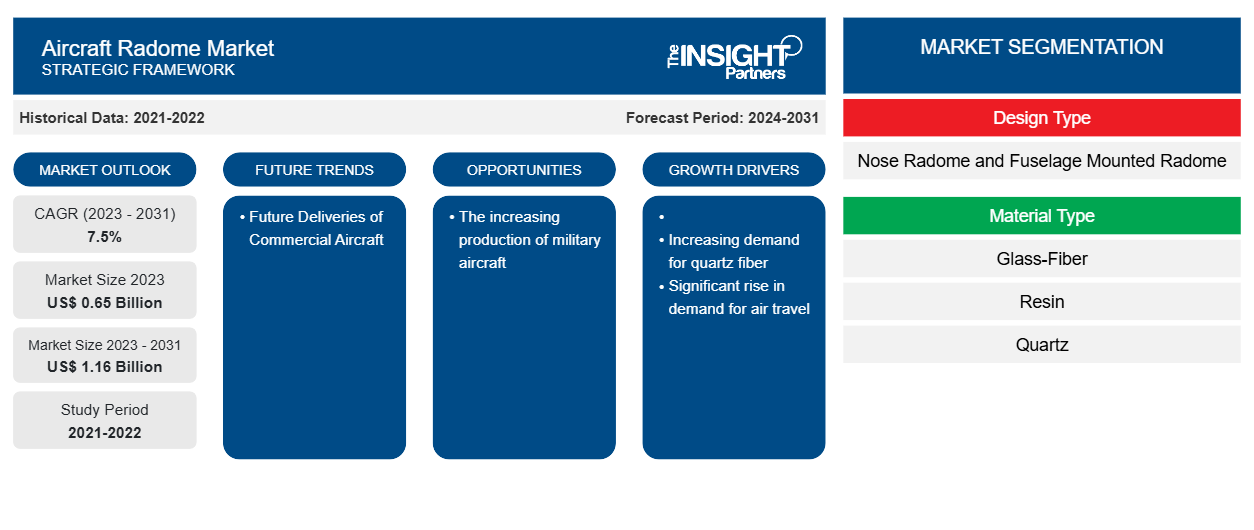

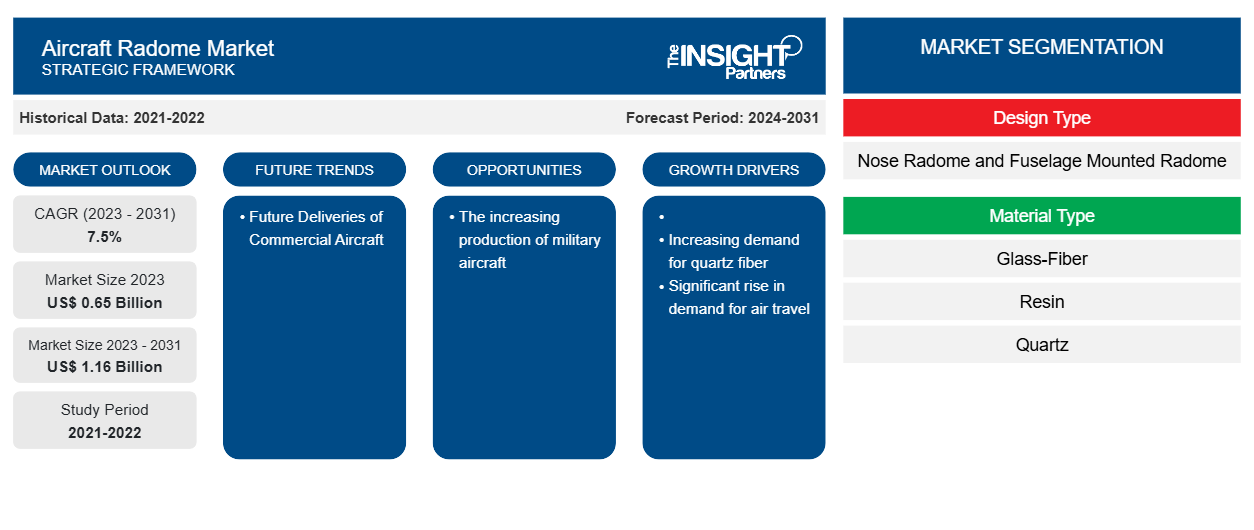

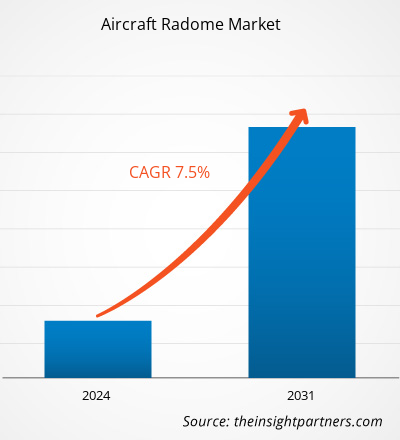

The Aircraft Radome Market size is projected to reach US$ 1.16 billion by 2031 from US$ 0.65 billion in 2023. The market is expected to register a CAGR of 7.5% in 2023–2031. The deployment of military aircraft in large numbers is generating new demand for aircraft radome systems. The aircraft radome manufacturing industry consists of large numbers of well-established and well recognized companies such as General Dynamics Corporation, Jenoptik, Airbus, Orbitall ATK and Parker Hannifin Corp among others. The existing radome manufacturers acquire most of the contracts from the major aircraft manufacturers, which limits the entrance for new companies to enter the industry. The capital investments involved in setting up a new aircraft component manufacturing company incurs huge costs, which is a major concern for the new entrants in the industry.

Aircraft Radome Market Analysis

The aircraft radome manufacturing industry consists of large numbers of well-established and well recognized companies such as General Dynamics Corporation, Jenoptik, Airbus, Orbitall ATK, and Meggitt PLC among others. The existing radome manufacturers acquire the most of the contracts from the major aircraft manufacturers, which limits the entrance for new companies to enter the industry. Owing to these, the threats to new entrants in the aircraft radome market, is all time low. The capital investments involved in setting up a new aircraft component manufacturing company incurs huge costs, which is a major concern for the new entrants in the industry.

Aircraft Radome Market Overview

The radome is a covered structural component of an aircraft, safeguarding the antenna from different environmental parameters, as well as external factors such as bird strike, lightning strike. At the same time, radome increases the stealthy feature of the aircraft. These are achieved by manufacturing the radome with high end composite materials and advanced technology. The maintenance of high end composites and advanced technology in order to increase the operational efficiency of the radome requires highly skilled engineering labor. The lack of skilled engineering labor in different parts of the world is limiting the aircraft manufacturers to adopt the technologically advanced radome, thus, inhibiting the growth of the market for aircraft radome over the period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Radome Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Radome Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Radome Market Drivers and Opportunities

Increasing Number of Aircraft Worldwide

The increasing fleet of aircraft across different regions is one of the major factors supporting the growth of aircraft radome market globally. The demand for new commercial aircraft is on the rise; majority of the aircraft OEMs i.e., Airbus and Boeing have also been receiving large number of orders for different model of aircraft such as A320 series, B787 series, A330 series, and B737 series. These aircraft are some of the most widely used commercial aircraft models that acquire for the majority share in the worldwide aircraft fleet. This is also propelling the production of such aircraft models and thereby generating new demand for the installation of aircraft radomes across different regions.

Upcoming Deliveries of Aircraft is Likely to Generate Future Opportunities for Radome Manufacturers

The expected deliveries of commercial aircraft, military aircraft, and general aviation aircraft are likely to generate new opportunities for market vendors during the forecast period. The upcoming deliveries of more than 40,000 commercial aircraft in the next 20 years is likely to generate huge opportunities for aircraft radome market vendors in the coming years.

Further, the rising contracts for the procurement of military aircraft is another major factor likely to generate new opportunities for market vendors in the coming years. This is further supported by the increasing military expenditure across different countries around the world.

Aircraft Radome Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Aircraft Radome Market analysis are design type, material type, aircraft type, and geography.

- Based on design type, the Aircraft Radome Market has been segmented into nose radome and fuselage mounted radome. The nose radome segment held a larger market share in 2023.

- By material type, the market has been segmented into glass-fiber, resin, and quartz. The glass-fiber segment held the largest share of the market in 2023.

- In terms of aircraft type, the market has been segregated into civil and military. The civil segment dominated the market in 2023.

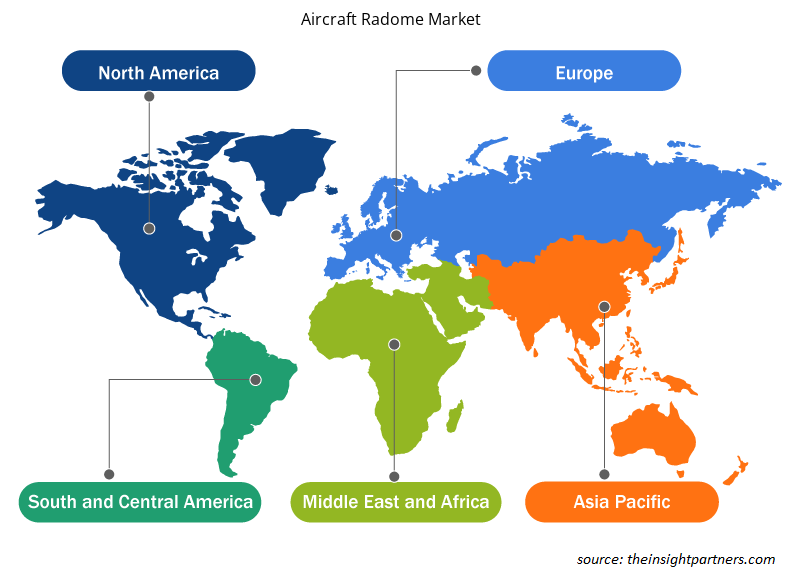

Aircraft Radome Market Share Analysis by Geography

The geographic scope of the Aircraft Radome Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific has dominated the Aircraft Radome Market in 2023, and it is likely to witness highest CAGR during the forecast period as well. The market for aircraft radome in the Asia Pacific region has been emerging mainly due to the rising procurement of civil and military aircraft across different countries. For instance, according to the Airbus forecasts, approximately 9,500 aircraft are expected to be delivered by the end of 2042 in the Asia Pacific region which is further expected to generate the demand for aircraft radomes across the Asia Pacific region in the coming years. Moreover, the rising air passenger traffic, rising disposable income, and introduction of low-cost carriers/airlines are some of the other factors supporting the procurement of new aircraft and thereby driving the market for aircraft radomes and other components as well in the Asia Pacific region.

Aircraft Radome Market Regional Insights

The regional trends and factors influencing the Aircraft Radome Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Radome Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Radome Market

Aircraft Radome Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 0.65 Billion |

| Market Size by 2031 | US$ 1.16 Billion |

| Global CAGR (2023 - 2031) | 7.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Design Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

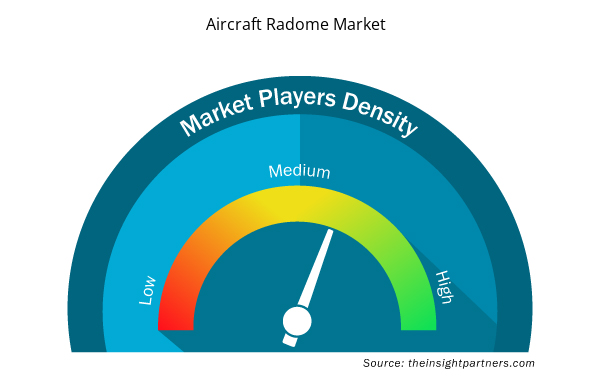

Aircraft Radome Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Radome Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Radome Market are:

- Airbus S.A.S

- General Dynamics Corporation

- Jenoptik AG

- Kitsap Composites

- Meggitt PLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Radome Market top key players overview

Aircraft Radome Market News and Recent Developments

The Aircraft Radome Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aircraft radome market and strategies:

- On August 2023, QinetiQ’s Airborne Technology Demonstrator (ATD) in partnership with BAE Systems, underpinned by the Long Term Partnering Agreement with the MOD, has conducted a flight test with the combat aircraft nose system (fast jet radome) installed onto the RJ100, paving the way to future radar and sensor integration capability. (Source: QinetiQ, Press Release/Company Website/Newsletter)

- On May 2021, General Dynamics Mission Systems delivered the 500th wideband nose radome to Lockheed Martin for installation aboard the US Air Force, US Navy, US Marine Corps and international military F-35 aircraft. (Source: General Dynamics Mission Systems, Press Release/Company Website/Newsletter)

Aircraft Radome Market Report Coverage and Deliverables

The “Aircraft Radome Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Design Type , Material Type , and Aircraft Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

Asia Pacific region dominated the aircraft radome market in 2023.

Increasing demand for quartz fiber and significant rise in demand for air travel are some of the factors driving the growth for aircraft radome market.

The increasing production of military aircraft is one of the major trends of the market.

Airbus SAS, General Dynamics Corporation, Jenoptik AG, Orbitall ATK, Saint Gobain, Starwin Industries, Vermont Composites Inc, Parker Hannifin Corpoation, Nordam Group, and Kitsap Composites are some of the key players profiled under the report.

The estimated value of the aircraft radome market by 2031 would be around US$ 1.16 billion.

The aircraft radome market is likely to register of 7.5% during 2023-2031.

Get Free Sample For

Get Free Sample For