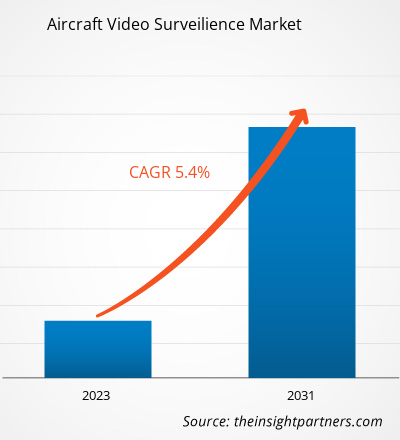

The aircraft video surveilience market size is projected to reach US$ 775.4 million by 2031 from US$ 508.0 million in 2023. The market is expected to register a CAGR of 5.4% in 2023–2031. Advent of connected cabins and rise in investment towards expansion of aircraft fleet are among the key trends driving the aircraft video surveilience market.

Aircraft Video Surveilience Market Analysis

The global aircraft video surveillance market is displaying an upward trend for the past couple of years and it is anticipated to reflect a similar trend during the forecast period. The growth of the aircraft video surveillance market is majorly attributed to significant investments in the aerospace industry. Over the past few decades, the aviation industry has grown immensely. The growth rate of technological transformation has been outstanding, which stimulated the demand for various products and services. There is an increased adoption of aircraft video surveillance solutions in commercial aircraft owing to rise in demand for in-flight safety and security systems. Increasing number of complaints against airlines and improving regulatory standards of safety have highlighted the importance of aircraft video surveillance solutions.

Aircraft Video Surveilience Market Overview

The aircraft video surveillance market ecosystem comprises the following stakeholders: component/raw material providers, video surveillance system integrators, aircraft manufacturers, and airline companies. Raw material/components providers supply small parts, such as screws, cables, cameras, control panel, a distribution unit, video recorder, mounting brackets, camera cores, and sensors, to form an aircraft video surveillance system. Raw material is procured through various vendors in the video surveillance system integrating facility for further processing. System integrators carry out various processes, such as designing, assembling, and production to transform raw material/components into the finished product. Video surveillance system providers have a specific set of solutions to offer—such as cockpit door surveillance systems, cabin surveillance systems, and environmental camera systems.

Companies such as Collins Aerospace, AD Aerospace, and Cabin Avionics are among the leading manufacturers who provide a wide range of video surveillance systems. Aircraft manufacturers procure video surveillance systems to install them in aircraft fleets such as wide body aircraft and narrow body aircraft. Aircraft manufacturers have a tie-up with video surveillance solution providers to procure a specific set of the system, meeting the specific security standards. With rising digitalization, the system developers are focusing on developing a connected cabin solution with an enhanced camera installation in passenger cabins. Airline companies are adopting the aftersales services to upgrade the existing fleet with new video surveillance solutions under retrofit development.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Video Surveilience Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Video Surveilience Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Video Surveilience Market Drivers and Opportunities

Rising Demand for Enhanced Security in Aircraft Applications

The commercial aircraft fleet has experienced tremendous changes in the past few years in terms of functions, equipment, and features. To improve safety and security for passengers and crew members, airline companies are adopting video surveillance systems. This would help them to improve the brand image in a competitive market. Further, post 9/11 terrorist attack, the importance of security and surveillance systems has increased, especially in commercial aircraft. The installation of advanced surveillance system at passenger cabins and cockpit doors has become an essential aspect for airline companies.

For instance, Air Canada also imposed new directives to improve security in aircraft, such as installation of reinforced doors for blocking the intruders from entering the cockpit and installation of cockpit locks with video surveillance to verify the crew members. The new systems are fully connected video surveillance systems, which improve cargo bay security, flight crew protection, and flight deck safety. New product developments and increased need for enhanced security are bolstering the aircraft video surveillance market growth.

Increasing Demand for Business or Commercial Aircrafts

The business aviation sector is experiencing a significant rise in aircraft demand with an increasing number of corporate passengers. Business aviation is becoming a new tool for corporate development and growth strategy for enterprises. According to Dassault Aviation, more than 17,000 business jets are offering services for customers across the world. The US holds two-thirds of the fleet, and countries—such as Russia, China, and India—are experiencing a double-digit growth rate from the past few years. The benefits of business aircraft—such as confidentiality of travel, security, multiple stopovers, flexibility in terms of arrival and departure time, and time-saving by reducing multiple security checks—are among major factors driving the business aviation sector. With the rising production of business jets, the demand for video surveillance solutions is also increasing. Video surveillance systems are being deployed in business aircraft to enhance situational awareness and record incidents for analysis. Further, the solution is offering security benefits to flight crew and passengers by mounting cameras into the cockpit door, aircraft exteriors, and cabins. Collins Aerospace offers cabin video systems and Meggitt PLC offers aircraft cameras. Such video surveillance solutions are enhancing the security level in aircraft.

Aircraft Video Surveilience Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aircraft video surveilience market analysis are system type, fit type, and aircraft type.

- Based on system type, the aircraft video surveilience market has been divided cockpit door surveillance system, cabin surveillance system, and environmental camera system. The less than 24 inches segment held a larger market share in 2023.

- Based on the fit type, the aircraft video surveilience market has been divided into retrofit and line fit. The transport line segment held a larger market share in 2023.

- On the basis of aircraft type, the market has been segmented into wide body aircraft and narrow body aircraft. The refined products segment dominated the market in 2023.

Aircraft Video Surveilience Market Share Analysis by Geography

The geographic scope of the aircraft video surveilience market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Europe has dominated the aircraft video surveilience market in 2023. The European region includes Germany, France, Italy, Russia, the UK, and the Rest of Europe. The aerospace industry in Europe is matured and is growing at a significant rate due to the presence of a large number of aircraft manufacturers, advanced video surveillance solution providers, and a skilled workforce. There is a tremendous demand for video surveillance systems in the region as aircraft manufacturing companies are well aware of newer technologies. For instance, Airbus is offering advanced security and surveillance system in its A320, A330, A350, and A380 series aircraft models. The video surveillance solutions facilitate the aircraft crew to secure the flight deck and also to maintain high safety standards on-board.

Aircraft Video Surveilience Market Regional Insights

The regional trends and factors influencing the Aircraft Video Surveilience Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Video Surveilience Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Video Surveilience Market

Aircraft Video Surveilience Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 508.0 million |

| Market Size by 2031 | US$ 775.4 million |

| Global CAGR (2023 - 2031) | 5.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By System Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

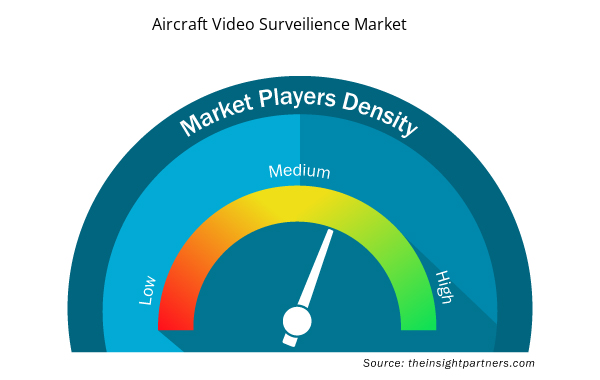

Aircraft Video Surveilience Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Video Surveilience Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Video Surveilience Market are:

- AD Aerospace Ltd

- Aerial View Systems Inc.

- Cabin Avionics Ltd

- Kappa Optronics GmbH

- Global Eagle Entertainment Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Video Surveilience Market top key players overview

Aircraft Video Surveilience Market News and Recent Developments

The aircraft video surveilience market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aircraft video surveilience market and strategies:

- In October 2022, Optimized Electrotech launched flagship surveilience system. This new product can be deployed in minimal supervision areas and also strengthened the product portfolio of the company.

- In November 2023, Signia Aerospace acquired Meeker Aviation and Airfilm Camera Systems. This acquisition strengthened the product portfolio of the company in aircraft video survilience market.

Aircraft Video Surveilience Market Report Coverage and Deliverables

The “Aircraft Video Surveilience Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

System Type , Fit Type , and Aircraft Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For