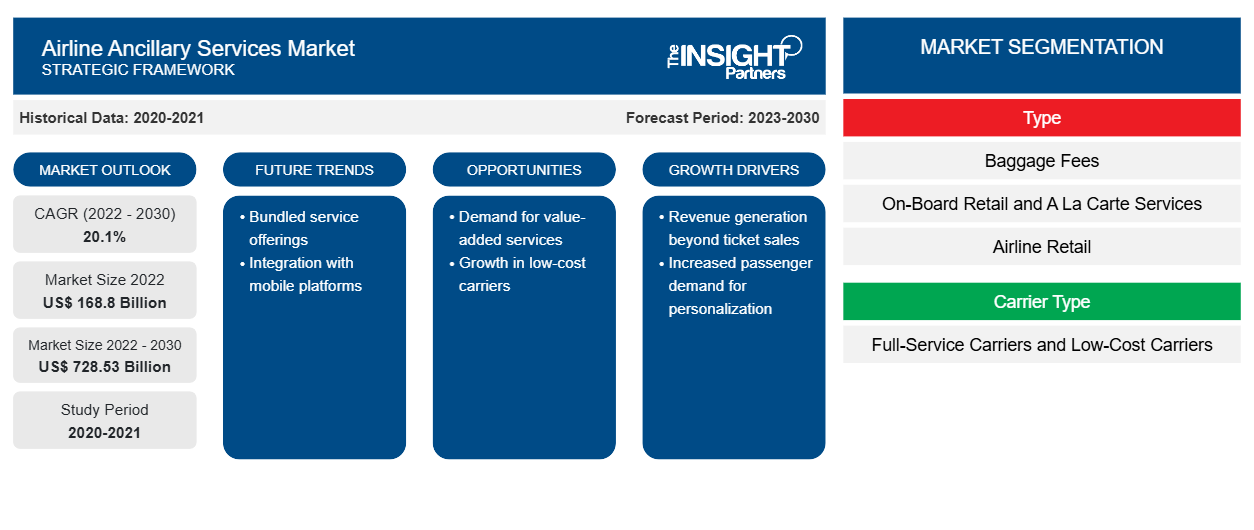

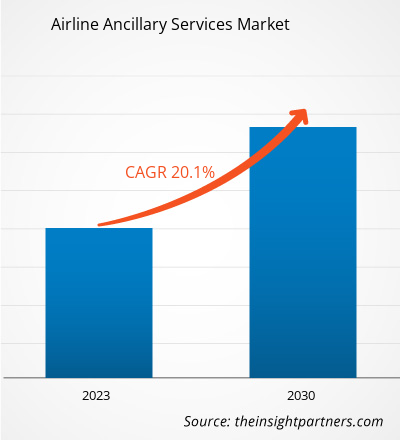

[Research Report] The airline ancillary services market size is projected to reach US$ 728.53 billion by 2030 from US$ 168.80 billion in 2022; the market is expected to record a CAGR of 20.1% from 2022 to 2030.

Analyst Perspective:

The key players operating in the airline ancillary services market are witnessing increased demand for services such as entertainment, Wi-Fi, and catering. The growing number of aviation passengers across the world significantly drives the airline ancillary services market. Ancillary revenues are critical to the airline business model; for instance, in developed markets such as North America and Europe, airline companies including Ryanair, Spirit, and Allegiance have recognized ancillary revenues contributing significantly to their total revenues. The trend was soon adopted by rapidly developing economies in Asia Pacific, where carriers such as Air Asia experienced that one-fifth of their revenue comes from ancillary services. Thus, this trend is anticipated to significantly influence airline carrier revenues, particularly in developing economies, which would further contribute to the airline ancillary services market growth.

Airline Ancillary Services Market Overview:

The airline ancillary services market is benefitted from the willingness of the passengers to pay for services that add value to their experience. Seat upgrades, pre-booking of seats, and baggage are a few of the popular ancillary services in demand. Several startups are entering the market to cater to these evolving needs. Further, low-cost carriers are gaining immense importance in the global aviation industry. The robust business models for ticketing, airport services, onboard services, and others facilitate low-cost carriers to attract passengers from all classes of society. The rising demand from passengers for additional services such as inflight food and beverages service, Wi-Fi, and retail is expected to offer several opportunities to startups. Apart from the aforementioned ancillary services, the in-flight entertainment (IFE) service is expected to impact the airline ancillary service industry substantially. As digitally cultured customers, particularly business travelers, anticipate their carriers to facilitate in-flight connectivity options. It was also found that most passengers on a short-haul route demand web access while onboarding to access their digital devices. Thus, the rising demand for IFE is expected to enhance ancillary revenues, positively influencing the airline ancillary services market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airline Ancillary Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airline Ancillary Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airline Ancillary Services Market Driver:

Rising Preference of Air Travel by Middle-Income Passengers

As per the International Air Transport Association (IATA), the number of passengers traveling by air is expected to reach ~7.8 billion by 2036. The rapidly emerging middle-class segment can be associated with a rise in the number of air passengers in developing economies. In October 2021, world organizations such as United Nations World Tourism Organization (UNWTO) and the International Civil Aviation Organization partnered to support a resurgence in travel and tourism. In October 2020, UNWTO and IATA inked a Memorandum of Understanding to work together to support the resumption of global tourism. The main focus of this agreement was enhancing the confidence of the general public in air travel, which further helped increase air traffic. According to the United Nations, the growing number of middle-class travelers, especially in China and India, is the primary factor contributing to the growth of air travel and various ancillary services. As the world recovers from economic contractions, the demand for air travel increases. The rising air travel demand has resulted in the augmented production of s, which has considerably contributed to the demand for ancillary services such as in-flight Wi-Fi, excess luggage, food and beverages, and in-flight shopping. The increasing focus on offering enhanced services to flight passengers and the rising number of aviation passengers worldwide are driving the airline ancillary services market growth.

Airline Ancillary Services Market Segmental Analysis:

The airline ancillary services market, by type, is segmented into baggage fees, on-board retail & a la carte, airline retail, FFP mile sale, and others. The baggage fees segment held the largest market share in 2022. Baggage fees are additional charges imposed by airlines for checking in luggage or carrying extra baggage on a flight. These fees are separate from the base ticket price and vary based on factors such as the airline, destination, and baggage weight or size. Baggage fees have become a common practice in the airline industry, allowing airlines to generate extra revenue and offer more flexible fare options to passengers. Travelers can choose to pay for checked baggage or opt for lower base fares if they travel with only carry-on luggage. The implementation of baggage fees has been a significant aspect of the airline ancillary services market, providing airlines with a means to increase profitability and offering passengers choices in their travel experience.

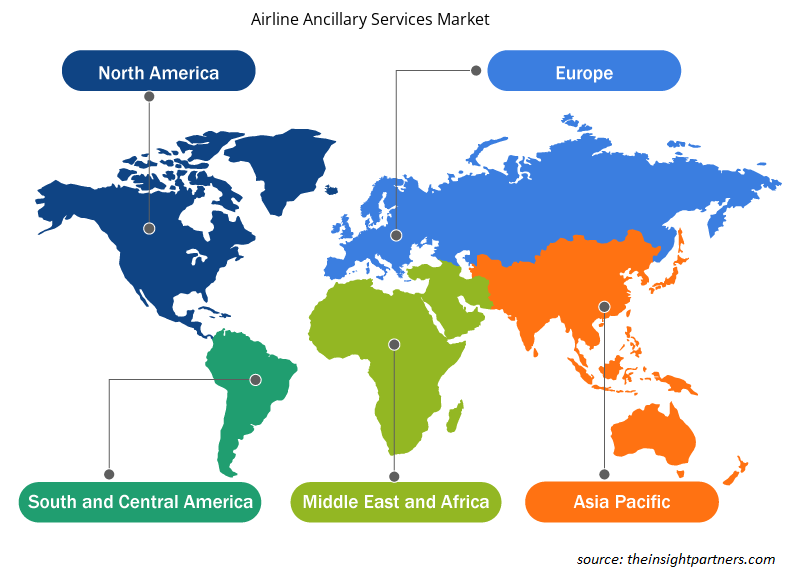

Airline Ancillary Services Market Regional Analysis:

The North America airline ancillary services size was US$ 64.70 million in 2022; the market is expected to register a CAGR of 20.6% during 2023–2030, reaching a value of US$ 289.34 million by 2030. The North America airline ancillary services market is segmented into the US, Canada, and Mexico. The US held the largest share of the North American airline ancillary services market in 2022. According to the data of the Bureau of Economic Analysis, the GDP of the US in the fourth quarter of FY2022 increased by ~2.6%; this growth in the GDP was primarily driven by strong business investment and consumer spending. The airline industry contributes significantly to the overall US economic growth. The rising consumer spending and business investment in the civil airline sector are expected to encourage the airline ancillary services market growth.

Airline Ancillary Services Market Key Player Analysis:

United Airlines Holdings Inc, American Airlines Group Inc, Delta Air Lines Inc, EasyJet Plc, Deutsche Lufthansa AG, Qantas Airways Ltd, Ryanair Holdings Plc, Southwest Airlines Co, The Emirates, and Air France KLM SA are among the major players in the airline ancillary services market.

Airline Ancillary Services Market Regional Insights

Airline Ancillary Services Market Regional Insights

The regional trends and factors influencing the Airline Ancillary Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Airline Ancillary Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Airline Ancillary Services Market

Airline Ancillary Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 168.8 Billion |

| Market Size by 2030 | US$ 728.53 Billion |

| Global CAGR (2022 - 2030) | 20.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

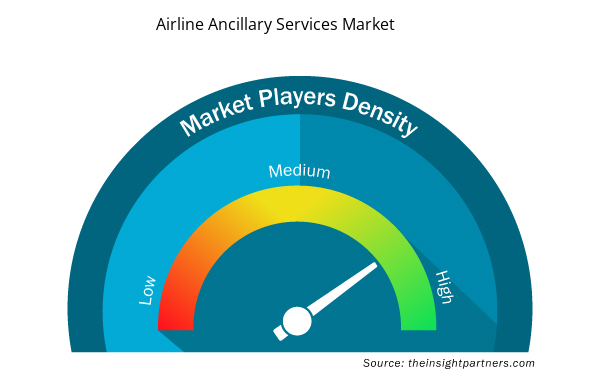

Airline Ancillary Services Market Players Density: Understanding Its Impact on Business Dynamics

The Airline Ancillary Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Airline Ancillary Services Market are:

- United Airlines Holdings Inc

- American Airlines Group Inc

- Delta Air Lines Inc

- EasyJet Plc

- Deutsche Lufthansa AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Airline Ancillary Services Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the airline ancillary services market. A few recent key airline ancillary services market developments are listed below:

- In February 2023, United Airlines recently announced its decision to allow families with small children to select adjacent seats at no additional cost. This customer-friendly move acknowledges the importance of providing families a seamless and comfortable travel experience, highlighting United's commitment to enhancing its ancillary offerings.

- In January 2023, Delta Air Lines' announced free Wi-Fi for passengers in the US, made possible through a partnership with T-Mobile. Starting February 1, the frequent flier program members of SkyMiles would enjoy complimentary Wi-Fi. This move, made as a significant step toward enhancing ancillary service offerings, demonstrates Delta's commitment to improving the inflight experience and adding value to its loyal customers.

- In July 2022, EasyJet took steps to improve the customer experience with a series of initiatives for the summer travel season. These include a dedicated customer hotline for families, extended customer service hours, "Helping Hands" at key airports, and the reintroduction of the Twilight Bag Drop service. The airline aims to provide additional support and convenience to passengers, showcasing its commitment to enhancing ancillary services.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Carrier Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the Global Airline Ancillary Services Market are United Airlines Holdings Inc, American Airlines Group Inc, Delta Air Lines Inc, EasyJet Plc, and Deutsche Lufthansa AG.

The rising preference for air travel by middle-income passengers, benefits of frequent flyer programs, and in-flight retail partnerships are the major factors that propel the Global Airline Ancillary Services Market.

Increasing deployment of in-flight wi-fi are impacting the Global Airline Ancillary Services, which is anticipated to play a significant role in the Global Airline Ancillary Services Market in the coming years.

The Global Airline Ancillary Services Market is expected to reach US$ 728.53 billion by 2030.

The incremental growth expected to be recorded for the Global Airline Ancillary Services Market during the forecast period is US$ 559.73 billion.

The Global Airline Ancillary Services Market was estimated to be US$ 168.80 billion in 2022 and is expected to grow at a CAGR of 20.1% during the forecast period 2023 - 2030.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Airline Ancillary Services Market

- United Airlines Holdings Inc

- American Airlines Group Inc

- Delta Air Lines Inc

- EasyJet Plc

- Deutsche Lufthansa AG

- Qantas Airways Ltd

- Ryanair Holdings Plc

- Southwest Airlines Co

- The Emirates

- Air France KLM SA

Get Free Sample For

Get Free Sample For