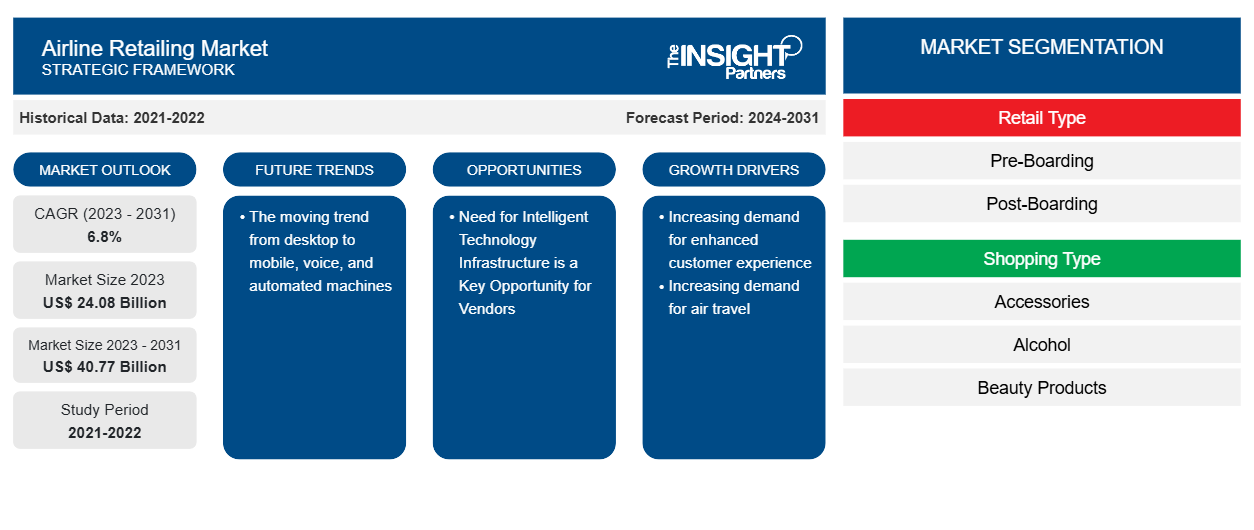

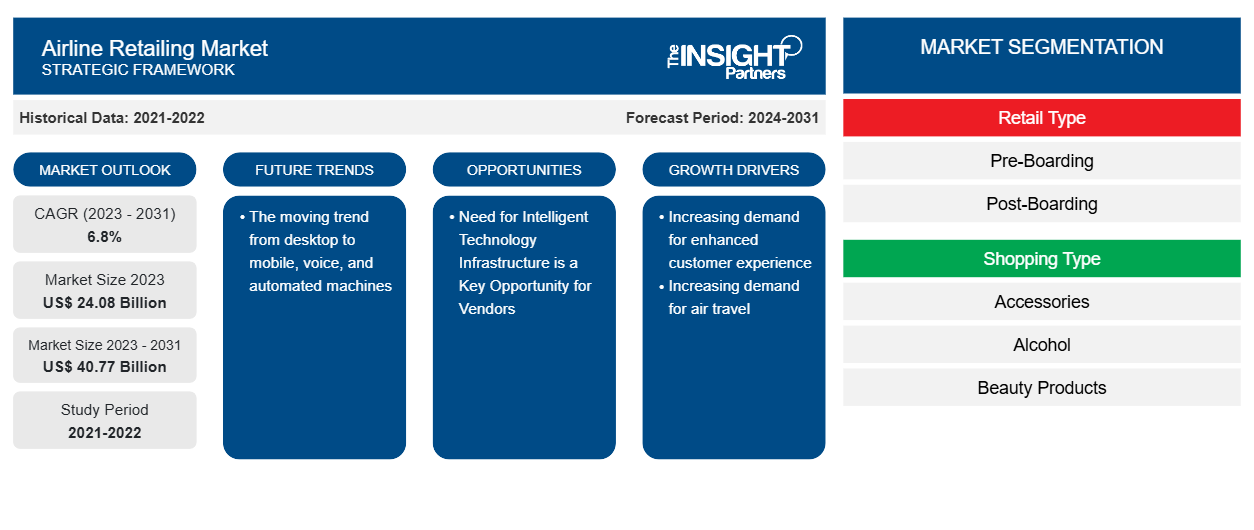

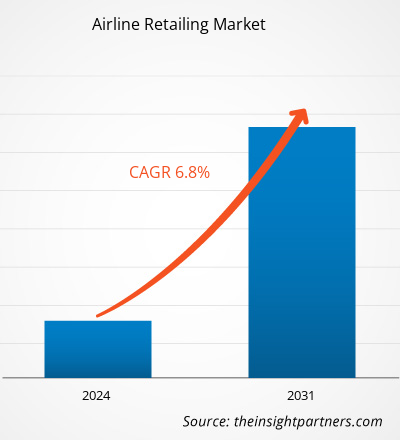

The airline retailing market size is projected to reach US$ 40.77 billion by 2031 from US$ 24.08 billion in 2023. The market is expected to register a CAGR of 6.8% during 2023–2031. The moving trend from desktop to mobile, voice, and automated machines is likely to remain a key trend in the market.

Airline Retailing Market Analysis

Retailing is driving a transformation in how travel is purchased. In the broader sphere, retailers have established advanced merchandising practices to better serve their clients. Also, airlines are discovering new forms of travel services to add value to their passengers’ and enhance profitability. Airline retail helps in boosting airline revenue along with enhancing the level of customer satisfaction. The airlines offer retailing services through two different modes i.e. pre-boarding and post-boarding. Some of the airline companies offer both modes, however, certain airlines offer one of the mentioned modes.

Airline Retailing Market Overview

Several airlines offer both pre-boarding retailing sales and post-boarding retailing sales in the current market scenario. The pre-boarding sales segment has dominated the market in recent years and is also anticipated to drive the airline retailing market in the forthcoming years. This is due to the fact that some airlines are terminating in-flight merchandising options from their entire fleet. This is resulting in increased emphasis on the pre-boarding segment. Various airlines have their in-house retailers with significant product lines. For example, Singapore Airline’s in-house retailer KrisShop Pte. Ltd. offers an extensive range of perfumes, bags, electronics, watches, and wine & spirits, among others. Similarly, British Airways High Life Shop is an in-house retailer of British Airways, which offers significantly large product lines. Various airlines with no in-house retailers collaborate with retailers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airline Retailing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airline Retailing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airline Retailing Market Drivers and Opportunities

Increasing Demand for Enhanced Customer Experience

The airline sector is a highly competitive market. The operational cost of airlines is very high, and the demand is subject to significant seasonal fluctuations. With the increasing number of airline companies, businesses are looking for alternatives that could help airlines to gain an edge in the competitive market. In order to gain an edge in the market, airline companies are highly focused on enhancing their services for high customer satisfaction.

Advanced technology and customer intelligence are enabling new opportunities for improving customer experiences. The implementation of customer intelligence is enabling new opportunities for airline retail. The airline has a captive audience and extensive customer knowledge, enabled by digital applications, which can be stimulated with smart and entertaining in-flight retail opportunities utilizing emotional momentum. Most of the airlines are on the learning curve when it comes to retail opportunities. With the external recruits, who have experience in retail, airlines are improving their retail performance. Big data utilization is also impacting airline retail and is optimizing customer value and experiences. The introduction of advanced technologies and the increasing demand for enhanced customer experience are significantly driving the airline retail market.

The need for Intelligent Technology Infrastructure is a Key Opportunity for Vendors

To operate in a customer-centric environment, airlines are focusing on implementing intelligent retail solutions and are creating potential demand for intelligent technology infrastructure. The intelligent technology infrastructure combines artificial intelligence (AI), machine learning (ML), sophisticated operations-research (OR) models, and customer data to provide relevant insights. The customer data enables airlines to identify, analyze, and predict consumer behavior.

Intelligent technology also empowers departments to schedule synchronization, deploy schedules faster to increase revenue and reduce recommendation costs, monitor and analyze fares automatically, deliver persona-based, flight-plus-ancillary bundled offers, provide pricing recommendations that use multi-channel availability and are buffered from abrupt market changes, and provide personalized offers and services that are consistent across all channels.

Airline Retailing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the airline retailing market analysis are retailing type, shopping type, and carrier type.

- Based on retail type, the airline retailing market is segmented into pre-boarding and post-boarding. The pre-boarding segment held a larger market share in 2023.

- Based on shopping type, the airline retailing market is segmented into accessories, alcohol, beauty products, merchandise, and others. The merchandise segment held a larger market share in 2023.

- Based on carrier type, the airline retailing market is segmented into full service carrier and low cost carrier. The full-service carrier segment held a larger market share in 2023.

Airline Retailing Market Share Analysis by Geography

The geographic scope of the airline retailing market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific has dominated the market in 2023 followed by North America and Europe regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. China dominated the Asia Pacific airline retailing market in 2023. APAC includes some of the fastest growing world economies such as China and India. Along with that, Japan is the most technologically advanced country in the region giving an opportunity for the development of deployment of IoT/smart solution in the region. Also, emerging economies of Asia such as South Korea, Taiwan, Singapore, and others are experiencing a growth in their technological and smart trend thus, propelling the growth of various services. Furthermore, the developing economies in the APAC region have witnessed exponential growth in their economies in the last few years. This has also led to higher employment percentages, as well as higher disposable incomes with individuals. High disposable incomes has facilitated the middle class and the upper middle class population in the countries to avail for luxurious services such as airplane travel. There has been a marked increase in the number of passengers that travel through flight in these countries.

Airline Retailing Market Regional Insights

The regional trends and factors influencing the Airline Retailing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Airline Retailing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Airline Retailing Market

Airline Retailing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 24.08 Billion |

| Market Size by 2031 | US$ 40.77 Billion |

| Global CAGR (2023 - 2031) | 6.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Retail Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

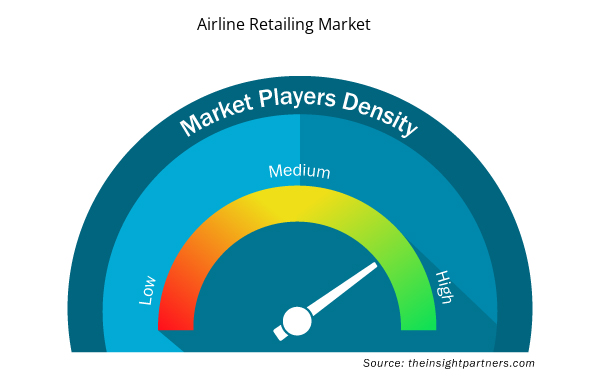

Airline Retailing Market Players Density: Understanding Its Impact on Business Dynamics

The Airline Retailing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Airline Retailing Market are:

- Air France/ KLM

- AirAsia Group Berhad

- British Airways Plc

- Deutsche Lufthansa AG

- Easy Jet PLC

- Korean Air Lines Co., Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Airline Retailing Market top key players overview

Airline Retailing Market News and Recent Developments

The airline retailing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the airline retailing market are listed below:

- British Airways’ Gatwick-based short-haul subsidiary, BA Euroflyer, has expanded the options available for customers to purchase in Euro Traveller (economy) and launched new seasonal menus in Club Europe (business class). The airline, working with its retail partner Tourvest, has expanded its onboard offering by introducing new options for customers to purchase during the flight. Customers were previously only able to pre-order fresh food, or purchase ambient snacks during their journey. New options for customers include fresh Tom Kerridge Chicken Coronation sandwiches and Sweet & Spicy Falafel wraps, which can be bought on board without pre-ordering. Customers can pair this with Jimmy’s Iced Coffee or Punchy soft drinks.. (Source: British Airways, Press Release, Apr 2023)

- Qatar Airways introduces new menu items onboard sourced from local organic farms in Qatar. The airline’s latest delicious additions available for passengers travelling from Doha until March 2024. (Source: Qatar Airways, Press Release, Nov 2023)

Airline Retailing Market Report Coverage and Deliverables

The “Airline Retailing Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Airline retailing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Airline retailing market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Airline retailing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the airline retailing market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Single-Use Negative Pressure Wound Therapy Devices Market

- Fish Protein Hydrolysate Market

- Wind Turbine Composites Market

- Integrated Platform Management System Market

- Gas Engine Market

- EMC Testing Market

- Carbon Fiber Market

- Adaptive Traffic Control System Market

- Asset Integrity Management Market

- Thermal Energy Storage Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Retail Type ; Shopping Type ; Carrier Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

Asia Pacific region dominated the airline retailing market in 2023.

Increasing demand for enhanced customer experience and increasing demand for air travel are some of the factors driving the growth for airline retailing market.

The moving trend from desktop to mobile, voice, and automated machines is one of the major trends of the market.

Air Asia Group, Air France – KLM SA, British Airways Plc, easyJet Plc, Korean Air Lines Co Ltd, Duetsche Lufthansa AG Qantas Airways Limited Singapore Airline Limited Thai Airways International Public Co Ltd, and The Emirates Group are some of the key players profiled under the report.

The estimated value of the airline retailing market by 2031 would be around US$ 40.77 billion.

Get Free Sample For

Get Free Sample For